We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

House prices rises over time

Comments

-

I got the feeling House prices won't reach 2007 levels for about a decade. Be a bit like Japan did with its housing bubble previously. They too wee meant to be small islands over crowded with rapidly risssing prices till that crashed and never really recovered.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

I got the feeling House prices won't reach 2007 levels for about a decade. Be a bit like Japan did with its housing bubble previously. They too wee meant to be small islands over crowded with rapidly risssing prices till that crashed and never really recovered.

Yes I read about Japan too. They had a similar house price bubble to the one the UK has just had back in the 1980's. Like Britain, they cut their interest rates after the crash to almost zero but even so, house prices are still lower now than they were then. It couldn't happen here could it?0 -

So you knowingly ripped them off? Lovely...!

As for your idea that lenders only lend 80%, or whatever, of a property's value due to anticipated price falls I'd like to see a link on that - I believe it's to provide a cushion for when some people can't make repayments.

Anyway, are you waiting until prices fall to a level that seems right before buying again? It's a risky game if you miss the bottom and whilst it's maybe OK when investing in the stock market I think for most of us taking that sort of risk with property is too big a risk. You sold in 2006 but prices peaked a year or 2 later, fell then recovered to 2007 levels at the moment. If they fall a lot more then you do well but if not and then when the Tories have sorted us all out (;)) they recover nicely you might not be feeling so comfortable. Not saying you will lose but you're playing a risky game.

As for your idea that lenders only lend 80%, or whatever, of a property's value due to anticipated price falls I'd like to see a link on that - I believe it's to provide a cushion for when some people can't make repayments.

Are you really that naive? Banks don't give a damn about people who can't make repayments, they are only interested in getting their money back.

Actually I did give them a good deal as I wanted rid of the house knowing that the high prices of the time couldn't continue. As you can imagine, with several hundred thousand pounds invested, I do keep a close eye on the property market and I can assure you that house prices are around 10% below 2007 values and falling every month. If I thought different I would be buying now. I am not (unless I can get somewhere 30% below 2007 prices) and I would urge anybody else not to either as you stand to lose a lot if you do. Playing the property game is all about timing, get out at the right time but hold your nerve whilst others lose theirs when buying.0 -

And completely ignore all social change and the numerous other factors?des_cartes wrote: »If you know what the house was worth in year x, find out what people earned in year x and compare the two. Then apply the same ratio to the house now. For example if the house cost 10k in 1980 and average wages were 3k then if average wages today are 30k then the house is worth 100k. Beware though, some people will try to convince you the house is worth 200k purely because before 2007 you coulkd borrow 6 times your income to buy a house. Those days have now gone so you now have to base the value of the house on what people can now borrow which is around 3 times your income.0

-

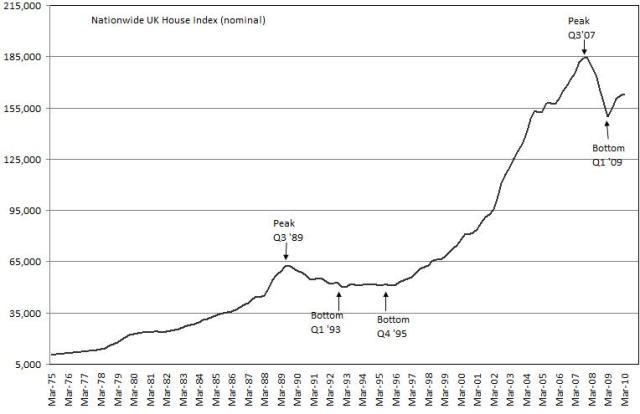

We've all seen this graph of "real" house prices on hpc and elsewhere.

But there seems to be ongoing confusion from some people who expect actual house prices to behave in the same way.

The fact is that historically in previous cycles, nominal prices (ie, what you actually pay for a house, not an imaginary figure adjusted against RPI) have never fallen anything like real prices have.

The falls achieved in this crash were far larger (and faster) than the falls achieved in the previous crash. And you can clearly see that nominal falls prior to that were almost non-existant compared to the 'real' price falls.

But of course, 'real' price falls do nothing to help potential buyers unless wages also increase.

Otherwise, all that happens is houses get more expensive AND so does everything else relative to wages.

So with regards to the OP, take a look at the nominal house prices graph above, and calculate the percentage difference between the average house price then and today, then apply it to the property you're looking at. It won't be precise, but it will be a good starting point.

And for des_cartes and the other scaremongerers, take a look at the same graph and realise that any significant further falls in nominal terms would be completely without precedent in UK housing. You've had your crash. Any further correction is likely to be mostly in real terms, which neither particularly hurts existing homeowners or particularly helps potential FTB's, until wages start to rise as well.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Des_cartes - sorry, I overestimated you. You see if I fail to make repayments then my debt increases and the longer this goes on for the less comfortable this gets for the lender but as long as there is a cushion then at least the property can be sold to pay off the debt. My point is that the idea that lenders only lend up to 80% of the property value due to expected property price falls is just wrong.0

-

The formula is [original price]x(1+x)^n where x equals the annual price increase in % terms (so 5% is 0.05) and n is the number of years.

Thus, a 7% annual price rise over 15 years would be (1+0.07)^15= 2.76 making a house worth £100,000 today worth £276,000 in 15 years time.0 -

If you know how much a house cost in year x, is there anyway you can tell how much it should be now assuming that it's value rose/fell at the same rate as average prices. I.e. a website that will calculate this?

Go to Land Registry, put in a search then do the following calculation

Current Month Price / Historic Month Price

e.g. £156,789 / £123,456 = House prices have risen on average by 1.269 x the amount (or a 26.9% increase) over that period.

Take your known bought price e.g. £96,543 and then multiply with the increase rate i.e £96,543 * 1.269 = £122,513

Remember that this is a rough average and may not reflect the actual property and type you are interested in.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

why dont you post the chart that shows average houseprices in ounces of gold? No arguing with that chart, unless you dont understand anything about currency or what has happened to sterling that is. We have had a major crash in terms of other currencies.

what happened to you being 100% sure that gold was a bubble and due an imminent crash?

How many gold bullion bars do you have in your wallet / bank account?:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

I got the feeling House prices won't reach 2007 levels for about a decade.

Some local areas are already above the 2007 levels.Be a bit like Japan

Japan again :rolleyes:

Why not do a search in the MSE forums for previous discussions and explanations how the Japanese market is different to the UK Market for many reasons? Doesn't fit with your requiremnts though does it?:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards