We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Big dip for gold?

Comments

-

As this chart in GBP shows, we have trended back up to prices 5 weeks ago, but still a good 70 pound an ounce off the highs of ten weeks back. Buying opportunities are still here.

Check this, and other time period charts in GBP here,

http://goldprice.org/gold-price-uk.html Now, we are away again this weekend, at a seaside resort somewhere near you perhaps.

Now, we are away again this weekend, at a seaside resort somewhere near you perhaps.

So behave, and talk nice to each other, or you won't get a stick of rock brought back for you..0 -

I sold some of my gold shares today as they had done well.

Gold price did drop today as dollar grew in worth but not greatly, its hard to say the direction but I would be impressed or slightly surprised if it just never really came down a proper amount, as some have borrowed money to buy gold , etc

Replaced it with bhp and a tiny bit of some other gold miner

usa credit rated 13th - http://img121.imageshack.us/img121/7025/credratingspage3701014.png0 -

How scared people are is a factor, but the main driver of gold price is all the printy printy from 1945 onwards.

1945?

I think not.

Will 2010 be synonymous with 1980 for the price of gold?In case you hadn't already worked it out - the entire global financial system is predicated on the assumption that you're an idiot:cool:0 -

1945?

Will 2010 be synonymous with 1980 for the price of gold?

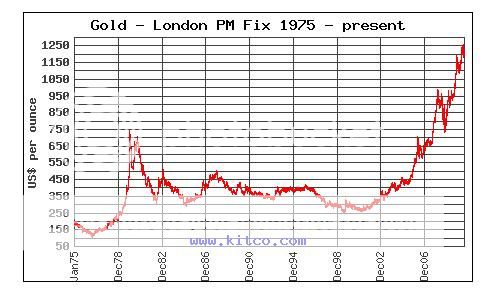

Those who bought gold at the peak of the last bubble (left, approx. average of $700/oz) had to wait roughly 20 years before the price of gold recovered.

The current trend (right peak, approx. $1200/oz) looks like an even bigger bubble to me. But I could be wrong, and miss out on this great opportunity.

JamesU0 -

You are wrong on that point because that graph isnt considering inflation, the 1980 price hasnt been exceeded yet as far I can remember its along the lines of $2700

Just in the uk the worth of sterling has more then halved since 1986 so prices cannot be compared directly. When gold was low in 2000 it really was dirt cheap comparatively I just wish I'd had more of a clue but no one says these things at the time.

Buffet bought some silver thats all the high street guy had to go on really

silver rather then gold because it has a use no doubt

The flat graph showing londom pm fix is just showing the usa gold standard, the 30's devaluation in usa and then in 1971 nixon broke the standard.

Also the UK had fixed exchange rates with the usa so price would have not differed massively either.

However they did gradually devalue the pound (via the exchange rate with the reserve currency, the dollar) from 1945 onwards and so the gold price in sterling would have risen at those points not been flat. London pm fix states a price in dollars I think

The last chart JamesU gives looks parabolic. Might work out best to wait for it to go vertical for a month or so then sell gold not for cash but other assets otherwise its more risky whether you will lose value looks like an even bigger bubble to me

looks like an even bigger bubble to me

Its exponential looks like, when it bursts the price will really fall bad.

The main difference between 1980 and now is the interest rates, dollar returns were about 15% back then and government bonds also gave a massive yield so gold being as useless as it is, did not compare well and lost the battle.

Gilts have been in a bull market for 30 years, they have never had a higher value or a lower return. Before the gold bubble is the gilt bubble

even pre '71 with fixed currency worth it was giving 4% return or almost twice now 0

0 -

Jonbvn,

you miss the info in your graph. Knock out the 1980 spike and you have a fairly nothing track in gold price from late '79 to '05. In your graph it is in the high 300USD for most of that period.

I can remember stories of people moving to Welsh valleys in Snowdonia, remote Scottish Glens, and catching ferries to Eire. Media hype yes, but when USSR invaded Afghanistan people flipped, it was the height of the cold war you know, fear hit the price.

Printy printy after 1945 was OK so long as high value manufactured goods put wealth in the economy, and therefore the printed paper.

As under 25% of UK GDP in 2009 was from manufacturing, and over 50% in 1979, you can spot the reason for the difference in the value of paper over that time. Only gold protects what you have.

http://research.stlouisfed.org/fred2/series/M1SL

From 1960 to 1985, +400 Billion.

From 2009 to 2010, +400 Billion.

Fiat chickens are coming home to roost.0 -

James U,

Using the BOE inflation calculator +current RPI, you find that gold should be between 725GBP, and 1240GBP today. So at an LBMA fix of 788GBP today, it is in the range of the inflation adjusted high and low price in 1980.

There was a low price in 1980 of 216GBP you know, as well as a high of 370GBP, the point being emphasised in this here thread, is that there are highs, as well as lows, in gold price!!!

Today is still a good day to buy.

Trust me, I'm bonkers.

References:

http://www.bankofengland.co.uk/education/inflation/calculator/flash/index.htm

http://www.statistics.gov.uk/CCI/nugget.asp?ID=19

http://www.lbma.org.uk/pages/?page_id=53&title=gold_fixings0 -

I can remember stories of people moving to Welsh valleys in Snowdonia, remote Scottish Glens, and catching ferries to Eire. Media hype yes, but when USSR invaded Afghanistan people flipped, it was the height of the cold war you know, fear hit the price.

I'm struggling to see why that would have had a huge impact on the price of gold. The notable thing about 1980 as far as the effect on gold prices was that inflation in the US nearly reached 15% before falling back.0 -

I'm struggling to see why that would have had a huge impact on the price of gold. The notable thing about 1980 as far as the effect on gold prices was that inflation in the US nearly reached 15% before falling back.

It was an unusual aspect of what was going on at that time.

Yes, inflation was high, and many of the issues that are being faced up to today are also similar.

But we do not have the spectre of nuclear, or world war, to worry about.

Difference at the time was, no new developing economies to challenge the established western order.

Other difference now, is that the west has abandoned any attempt to stay as a manufacturing top dog, and produce wealth.

The developing nations have not got larger growth figures in GDP than the west, because of an expanding financial services sector have they?

How can anything be safer than gold in the here and now.0 -

I can remember Ronald and Gorbachev basically saving the world by talking and the USSR retreat from Afghanistan which was incredible at the time

Some good data to backup your arguments.you find that gold should be between 725GBP, and 1240GBP today. So at an LBMA fix of 788GBP today, it is in the range of the inflation adjusted high and low price in 1980.

I took the gold numbers and adjusted them for inflation each year between 1981 and 1998, then averaged that and got a price of 448 sterling for the uk or roughly $724

Since we cant know future inflation we cant say the price either but I think its more then half way to a peak, I wouldnt assume 1980 prices inflation adjusted will be it exactly.

It was mostly the economic situation though the Iran revolution had a knock on effect, I think a previous peak could be exceeded

https://spreadsheets.google.com/ccc?key=0Andpq23WHOjAdFkxRzBjd3RlcEZvRjN6UUJiN0l2dnc&hl=en#gid=00

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards