We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Nominal vs Real House Price Cycles

HAMISH_MCTAVISH

Posts: 28,592 Forumite

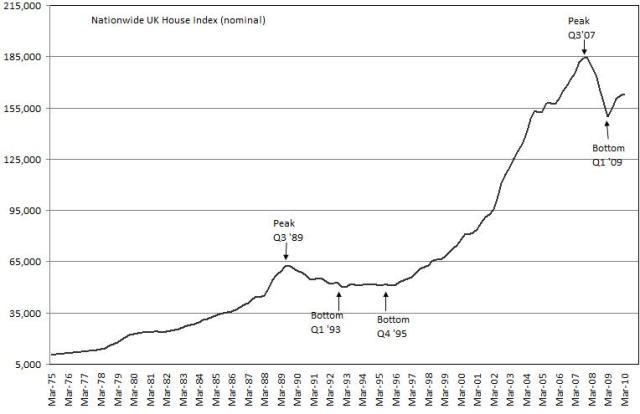

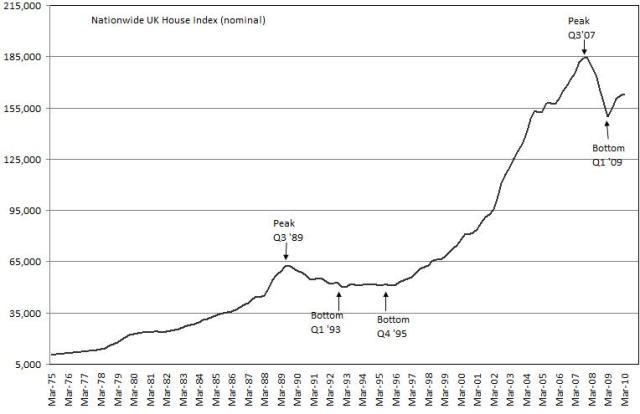

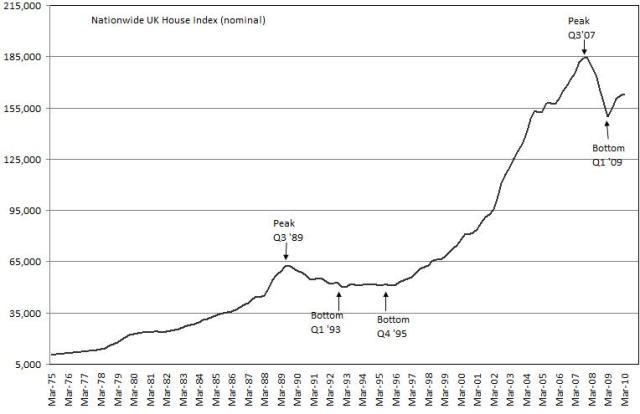

We've all seen this graph of "real" house prices on hpc and elsewhere.

But there seems to be ongoing confusion from some people who expect actual house prices to behave in the same way.

The fact is that historically in previous cycles, nominal prices (ie, what you actually pay for a house, not a figure adjusted against RPI) have never fallen anything like real prices have.

The falls achieved in this crash were far larger (and faster) than the falls achieved in the previous crash. And you can clearly see that nominal falls prior to that were almost non-existant compared to the 'real' price falls.

But of course, 'real' price falls do nothing to help potential buyers unless wages also increase. Otherwise, all that happens is houses get more expensive AND so does everything else relative to wages.

The Office for Budgetary Responsibility has now forecast what they expect to happen with house prices and inflation for the next term of Parliament.

So actual house prices are expected to make significant gains, and indeed, the historical evidence after previous crashes firmly supports that outlook. But now 'real' house prices are also not expected to fall, as the outlook for inflation is far lower than in previous crashes.

And given the lacklustre outlook for wage growth, it is also unlikely many people will be seeing an improvement in the house price to wage ratio, unless any of our resident posters are also expecting average wages to increase by 5.9 per cent this year, 1.6 per cent next year, 3.9 per cent in 2012 then 4.5 per cent in each of the two following years, and all on top of the 10% that would have been needed last year.....

So now that the crash is over (minor fluctuations still possible, seasonal, etc), and the forecasts for both real, nominal, and versus wages growth are swinging against you, the question for the housing bears would be what credible argument do you have left?

But there seems to be ongoing confusion from some people who expect actual house prices to behave in the same way.

The fact is that historically in previous cycles, nominal prices (ie, what you actually pay for a house, not a figure adjusted against RPI) have never fallen anything like real prices have.

The falls achieved in this crash were far larger (and faster) than the falls achieved in the previous crash. And you can clearly see that nominal falls prior to that were almost non-existant compared to the 'real' price falls.

But of course, 'real' price falls do nothing to help potential buyers unless wages also increase. Otherwise, all that happens is houses get more expensive AND so does everything else relative to wages.

The Office for Budgetary Responsibility has now forecast what they expect to happen with house prices and inflation for the next term of Parliament.

The OBR reckons house prices will rise by 5.9 per cent this year, 1.6 per cent next year, 3.9 per cent in 2012 then 4.5 per cent in each of the two following years. Assuming the same rate for the final two years may suggest the forecasters have no view on whether the rate will be rising or falling by then, but they are certain there will be no double dip. Indeed, not only will there be no fall, there will no decline in real terms in any year – not even in 2011, because general inflation is forecast to dip to 1.6 per cent then too.

If the OBR is right, prices will be 22 per cent higher in 2014 than they are today – which would be a 33 per cent increase from spring 2009 and take values firmly back above their 2007 pre-crunch peak.

So actual house prices are expected to make significant gains, and indeed, the historical evidence after previous crashes firmly supports that outlook. But now 'real' house prices are also not expected to fall, as the outlook for inflation is far lower than in previous crashes.

And given the lacklustre outlook for wage growth, it is also unlikely many people will be seeing an improvement in the house price to wage ratio, unless any of our resident posters are also expecting average wages to increase by 5.9 per cent this year, 1.6 per cent next year, 3.9 per cent in 2012 then 4.5 per cent in each of the two following years, and all on top of the 10% that would have been needed last year.....

So now that the crash is over (minor fluctuations still possible, seasonal, etc), and the forecasts for both real, nominal, and versus wages growth are swinging against you, the question for the housing bears would be what credible argument do you have left?

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”

0

Comments

-

:rotfl:HAMISH_MCTAVISH wrote: »

So now that the crash is over (minor fluctuations still possible, seasonal, etc), and the forecasts for both real, nominal, and versus wages growth are swinging against you, the question for the housing bears would be what credible argument do you have left?

The housing bubble is still there and starting to collapse again. We all know house prices are extremely overinflated due to irresponsible lending, securitisation, too low interest rates and mass fraud.

The bubble can't be maintained for ever and apart from 0.5% interest rates now there is nothing left supporting them.

The chart below shows the false dawn in when people thing bubbles have finished deflating. However the real crash is still to come, this is backed up with the recent falls and more downward preasures coming from the coming budget.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

The housing bubble is still there and starting to collapse again. We all know house prices are extremely overinflated due to irresponsible lending, securitisation, too low interest rates and mass fraud.

Wrong again, Brit.

The decrease in prices of around 23% during the crash was bigger in percentage terms than any crash in UK history.

Prices have since recovered rapidly and are now back to long term trend.

Irresponsible lending, securitisation and "mass fraud" may have played a very, very small part in rising prices, but have virtually disappeared in the last few years as UK banks adopted some of the toughest and strictest lending standards seen in decades, whilst prices rose significantly anyway.The bubble can't be maintained for ever and apart from 0.5% interest rates now there is nothing left supporting them.

The chart below shows the false dawn in when people thing bubbles have finished deflating. However the real crash is still to come, this is backed up with the recent falls and more downward preasures coming from the coming budget.

One of the bears favourite economists, Roger Bootle of Capital Economics, predicts that base rates will stay below 1% for the next 5 years.

The BoE have already stated the new neutrality point for interest rates is somewhere around 3%, versus the previous neutrality point of 5.5% to 6% for the last decade. So the next decade will likely see interest rates at just half the level of the last decade.

There is no "real crash" still to come. It's over. No matter how often you repost that bubble graph, which was never designed to apply to illiquid housing markets anyway.

Now, perhaps you can show us on the nominal (actual) house price graph below, where any of the previous crashes have fallen by the levels you predict are coming.

Oh, and while you're at it, perhaps you can show us where the "property stagnates for years at the bottom" remark is justified by the 1970's crash or the 1980's crash. As far as I can see, it only happened in one crash in the last four crashes..... “The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

HAMISH_MCTAVISH wrote: »Wrong again, Brit.

The decrease in prices of around 23% during the crash was bigger in percentage terms than any crash in UK history.

Thats simply because we have the biggest housing bubble in history. Hence we have big scope for falls back to normal levels.HAMISH_MCTAVISH wrote: »Prices have since recovered rapidly and are now back to long term trend.

Irresponsible lending, securitisation and "mass fraud" may have played a very, very small part in rising prices, but have virtually disappeared in the last few years as UK banks adopted some of the toughest and strictest lending standards seen in decades, whilst prices rose significantly anyway.

Thats because the people buying were foriegn investors, tax payer funded schemes and family funding. Hence transaction numbersmassively down.

Government schemes have had their budget removed. Other currencies are getting weaker reducing foriegn purchases.HAMISH_MCTAVISH wrote: »

There is no "real crash" still to come. It's over. No matter how often you repost that bubble graph, which was never designed to apply to illiquid housing markets anyway.

All the bad debt is there, all the fallout, you just can't magic away. Prices will continue to fall from here.HAMISH_MCTAVISH wrote: »Now, perhaps you can show us on the nominal (actual) house price graph below, where any of the previous crashes have fallen by the levels you predict are coming.

Oh, and while you're at it, perhaps you can show us where the "property stagnates for years at the bottom" remark is justified by the 1970's crash or the 1980's crash. As far as I can see, it only happened in one crash in the last four crashes.....

Be patient and you will see it with this one like the last.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

Like some many other people you are only reading the part of the OBR report which catched the headlines.

There is a large caveat that the OBR projections are as matters stand today. All the numbers will be recrunched after the budget changes are announced.0 -

Yet another mcTavish thread but the same old nonsense. Life must be rather dull in Aberdeen0

-

Yet another Doctor Gloom post without a single constructive thing to add to the debate.

No surprise there then.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

You need to get out more. You'll feel much better if you do. Go on, give it a go.

Is that constructive enough for you?0 -

HAMISH_MCTAVISH wrote: »Yet another Doctor Gloom post without a single constructive thing to add to the debate.

No surprise there then.

Hamish give us substance rather than a sound bite, then we can respect your posts a little more.:exclamatiScams - Shared Equity, Shared Ownership, Newbuy, Firstbuy and Help to Buy.

Save our Savers

0 -

Hamish give us substance rather than a sound bite, then we can respect your posts a little more.

Coming from the person who is ridiculed more for being wrong than any other poster on this site, that's laughable.

Your use of trite and wholly innacurate hpc soundbites as signatures is legendary.“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Thats simply because we have the biggest housing bubble in history. Hence we have big scope for falls back to normal levels.

Absolute nonsense.

Prices in parts of China are currently 88 times average earnings.

Prices in Japan before their crash reached a million US$ per square metre in some areas.

Prices in Australia fell a few percent from the old peak, before rebounding and setting new record high prices, up 20% in the last year in some markets...... And all on significantly higher interest rates and with much higher income multiples than the UK.

Whereas our prices today are exactly on long term trend, below the long term percentage of income used to pay mortgage costs, and only marginally above the long term price to income multiple.Thats because the people buying were foriegn investors, tax payer funded schemes and family funding. Hence transaction numbersmassively down.

More nonsense.

Foreign investors were probably less than 1% of sales last year. Government schemes another percent or two. BOMAD have been active, but thats only as a result of the mortgage rationing requiring absurd deposits.

And transaction numbers, whilst down from peak, are still a million or so house sales a year and currently rising.Government schemes have had their budget removed. Other currencies are getting weaker reducing foriegn purchases.

Woop de doo. That may impact a couple of percent of sales volume.All the bad debt is there, all the fallout, you just can't magic away. Prices will continue to fall from here.

Deleveraging is ongoing, the bad debt has mostly been written off by now, and prices are rising, not falling.Be patient and you will see it with this one like the last.

Is that as guaranteed as 50% off by Xmas 2009? :rotfl:“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards