We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is Gordon Brown an economic illiterate?

Comments

-

I don't understand what you mean - what has following Ken Clark's fiscal policies got to do with the measure used for inflation targeting?

Nice attempt to move the goalposts there, but Nosht's original claim wasn't restricted to fiscal policy:

Not to mention that there were fiscal changes too, eg introducing university tuition fees.I you remember the first thing G.B. did was to do nothing :eek: , he just continued with Ken Clark's economic policies for about 3 years, claimed the credit then started changing/messing things.

Interesting article. Rather out of date though, as in the two years since it could be argued that the BOE's actions (still following their 2% CPI target) have served us rather well.

Oh and BTW, the RPIX/CPI change was made in December 2003, by which time the housing boom was already well underway.0 -

Degenerate wrote: »Nice attempt to move the goalposts there, but Nosht's original claim wasn't restricted to fiscal policy:

Not to mention that there were fiscal changes too, eg introducing university tuition fees.

I didn't mean to address the post to you, that's why I deleted it.

'Economic policy' is a bit of a broad brush term isn't it. Weren't top up fees introduced in 2006?.0 -

'Economic policy' is a bit of a broad brush term isn't it. Weren't top up fees introduced in 2006?.

Yes, but that was after the original £1000 a year fees were introduced in 1998, a decision announced just weeks after Labour's election victory in 1997. Prior to that, higher education was completely free. There was even a maintenance grant, although that had been progressively chipped away to almost nothing by the previous Tory administration.0 -

Degenerate wrote: »And they changed once in 13 years, and that was to implement a generally accepted international standard, not on Brown's whim.

Actually it changed from RPIX to CPI. RPI was never used, because the base rate feeds directly into it via mortgage costs. RPI goes up -> bank raises rates to try to get it down -> mortgage costs rise -> RPI goes up even more. RPIX is RPI excluding housing costs, so Brown didn't change that aspect at all.

CPI is a generally accepted standard for measuring inflation, comparable in methodology to the measures used in other advanced economies around the world (otherwise known as the harmonised index of consumer prices or HICP). CPI does tend to produce a lower figure than RPIX, but the target was dropped from 2.5% to 2% at the same time to compensate for this.

The ONS has estimated the rate of HICP going back to 1987. It has never actually been above 3% since September 1992 and has fallen steadily lower ever since. Labour did not create low inflation, they capitalised on it to appear economically competent.0 -

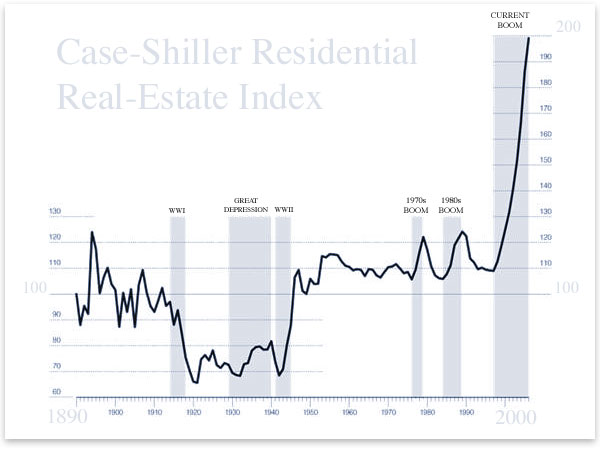

Whatever your opinion is on whether the UK housing boom was a bubble, you have to wonder what the Federal Reserve were thinking during the American housing boom:

No bubble here folks! :eek:0 -

It's an inflation adjusted chart that shows the average house price in terms of percentage increase/decrease compared to the 1890 benchmark, so the value on Y-axis would never be zero unless house prices were zero.0

-

The ONS has estimated the rate of HICP going back to 1987. It has never actually been above 3% since September 1992 and has fallen steadily lower ever since. Labour did not create low inflation, they capitalised on it to appear economically competent.

You talk as if low inflation was something that could simply be achieved and then forgotten about. Keeping it low through a decade of steady economic growth was a considerable achievment for the BOE MPC. Handing it over to them was Brown's decision, and one that he made right at the start. (Returning to my original point that he did not just continue previous Tory economic policy.)0 -

Degenerate wrote: »You talk as if low inflation was something that could simply be achieved and then forgotten about. Keeping it low through a decade of steady economic growth was a considerable achievment for the BOE MPC. Handing it over to them was Brown's decision, and one that he made right at the start. (Returning to my original point that he did not just continue previous Tory economic policy.)

Low inflation has been maintained by a relatively benign economic backdrop, stable oil prices and Chinese imports. Brown handed control of the base rate to the MPC for political gain and because there was no political capital in not giving it. It was Browns / Darlingsdecision to lower rates to 0.5% so it is hardly independent.

HPI has not been controlled by the MPC and it would have been prudent for GB to have made this a consideration when rates are set however he would then not have been able to spend all that extra tax revenue that was raised on borrowed money.

Inflation plunged after 1992 when the £ left the ERM. Joining the ERM, which Labour favoured and Maggie Thatcher didn't was the main cause of the recession in the early 1990's. The effect of being part of the Eurozone is the same as the ERM and if we were in it, as Labour and the Lib Dems favour, the current recession would be far more severe than at present.

You are right that Brown did not continue Tory economic policy. He borrowed and spent more, has created rather than solved long term economic problems and did everything for his own political advantage.

It is not the failure to regulate that is the cause of the banking crisis but the fault of the economic policy of this government;

http://www.telegraph.co.uk/finance/financetopics/financialcrisis/3363215/Labour-to-blame-for-banking-crisis-new-report-claims.html

"although the banking sector had to take some blame, Labour policies that led to excessive money supply growth, excessive borrowing and the assumption that "boom and bust had ended" were the chief reasons for the crisis"0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards