We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Pensions Planning: The NUMBER

Comments

-

My target figure is only 13K. I'm single, no children. And I've lived on less than that in the past.

Food 2K

Non-food stuff 1K

Repairs, decoration and appliances 1K

Council tax 1.5K (1 bed flat)

Flat service charges 3.5K (allowing for possible higher charges of a retirement flat)

Other bills 1.5K

Entertainment 1.5K

Contingency 1K

No car

Holidays only if there's enough left over

9 -

Mrs FingersCrossed, will you manage financially if you survive your husband, I know this is something we have had to plan for.2

-

tichtich said:I think she said their joint retirement income was going to be £29K, so their personal allowance will be already used up. In that case 75% of the tax uplift will go back to the tax man. What the tax man giveth the tax man taketh away.

The total income is not equally shared and the poster has unused personal allowance now and will still have to a lesser extent upon retirement.1 -

Amateurretiree - As long as Mr Fingerscrossed doesn't die in the next 2 years I should be ok. If the worst happened I agree the widows pension of around £6,000 pa isn't enough to live off but I could get a part time job and / or dip into premium bonds or downsize to something more manageable (which I might choose to do anyway, but not straight away as I would be in shock for a while).

After my state pension kicks in in 2023 I will have around £6k defined benefit widows pension on top of the state pension, which with my small £700 pa I estimate will take my total annual income to around or over £15k after tax. That would be enough for me.

tichtich, triplea35 is right. As I have 2 years until state pension I could invest up to £2880 pa to get the £720 tax relief. Over the 2 years that would give me an additional £7200 to dip into as I don't earn enough to pay tax. And as triplea said even once I receive my pension of around £10k I would have spare personal allowance that would (I think) allow me to continue paying into the SIPP, though I might prefer then to just save in Premium Bonds as it might be less complicated and less of a worry.

Also I don't know if I would get the tax relief uplift once I'm receiving state pension if I'm no longer self employed? Do you know, triplea35? That's not something I've looked into.

As a fan of THE NUMBER THREAD, our NUMBER IS £22,000 a year = FREEDOM

Amended 2019 - new NUMBER is approx £27k pa nett (touch wood)

Amended 2021 - new NUMBER is approx £29k pa nett - heading that way...fingers crossed!3 -

I stand corrected, and I'm glad to hear you're beating the tax man.MrsFingersCrossed said:

tichtich, triplea35 is right. As I have 2 years until state pension I could invest up to £2880 pa to get the £720 tax relief. Over the 2 years that would give me an additional £7200 to dip into as I don't earn enough to pay tax. And as triplea said even once I receive my pension of around £10k I would have spare personal allowance that would (I think) allow me to continue paying into the SIPP, though I might prefer then to just save in Premium Bonds as it might be less complicated and less of a worry.

2 -

I had read on here (just after I opened it) that a Nest pension was an expensive option. I chose it because it is simple and they say suitable for small earning self employed but I am not that pleased with how it takes ages to add the tax relief so I can't easily tell whether it is growing or not.

Unfortunately the delay in getting the tax relief is not down to Nest. Tax relief is usually received between six and ten weeks after making personal contributions depending on when the contribution is made. Same with all the platforms I have used.3 -

Dear Mrsfingerscrossed. I'm not often on here in the evening but fingers crossed all good. Sending you as much love as the airwaves allow xMrsFingersCrossed said:Amateurretiree - As long as Mr Fingerscrossed doesn't die in the next 2 years I should be ok. If the worst happened I agree the widows pension of around £6,000 pa isn't enough to live off but I could get a part time job and / or dip into premium bonds or downsize to something more manageable (which I might choose to do anyway, but not straight away as I would be in shock for a while).

After my state pension kicks in in 2023 I will have around £6k defined benefit widows pension on top of the state pension, which with my small £700 pa I estimate will take my total annual income to around or over £15k after tax. That would be enough for me.

tichtich, triplea35 is right. As I have 2 years until state pension I could invest up to £2880 pa to get the £720 tax relief. Over the 2 years that would give me an additional £7200 to dip into as I don't earn enough to pay tax. And as triplea said even once I receive my pension of around £10k I would have spare personal allowance that would (I think) allow me to continue paying into the SIPP, though I might prefer then to just save in Premium Bonds as it might be less complicated and less of a worry.

Also I don't know if I would get the tax relief uplift once I'm receiving state pension if I'm no longer self employed? Do you know, triplea35? That's not something I've looked into.I have borrowed from my future self

The banks are not our friends3 -

Also I don't know if I would get the tax relief uplift once I'm receiving state pension if I'm no longer self employed? Do you know, triplea35? That's not something I've looked into.

Yes even without any earned income, and in receipt of any pension including State pension you can still pay in the £2880 per year and receive the tax uplift until you reach age 75.3 -

True, but my comment was in relation to Council Tax which is set by your local council not central government. Although central government decisions to take an axe to the level of funding they provide for local govt / services has driven a lot of the increases over recent years.cfw1994 said:

Well....there are MANY areas with 'safe seats' that mean a non-insignificant portion of the population feel there is no accountability....AlanP_2 said:

How can you get more accountability than the ability to "sack" the Board every 4 years through local elections?SouthCoastBoy said:Yes I am very concerned about inflation, all the money pumped into the economy recently will I think result inflation over the next few years. I'm not convinced cpi is an accurate indication of my inflation number. Council tax increases are horrendous, no accountability, not based on whether you can pay and nothing discretionary about it. Mine is around 2200 a year for a band d property.

In some ways the govt need inflation to go higher to help inflate the massive govt debt away

You may not agree with the decisions they make but it's hard to argue there is no accountability.

& walking, watching endless films or binging series, gardening, not to mention brewing & drinking (I told you not to mention brewing & drinking!)....& now meeting up with pals in parks....& soon in beer gardens (etc)....Terron said:

What absence? There is always reading.DairyQueen said:In the absence of any fun things to do during a winter lockdown OH delayed his retirement until the end of this year, although I suspect he will go sooner now we have the new home, lockdown is lifting, and the weather warmer.

Surprising really that central gov't can axe spend their Minsters and Departments don't have control over rather than the ones they do. Makes you wonder whether they went for the easy option and hence moved the "complaints" to local councillors inboxes than theirs but perhaps there was a real justification (that has never been articulated).0 -

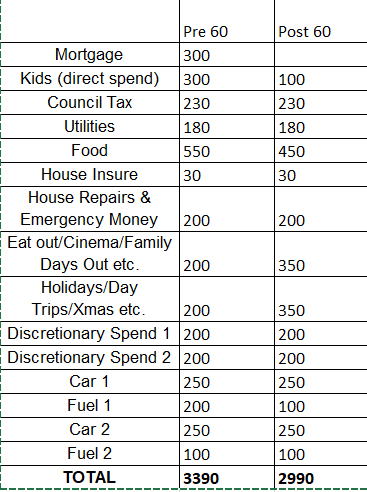

Been over my number and recently updated monthly figures below, so aiming for £3400 pre 60 and £3000 post 60 after mortgage paid off and kids through uni. Aiming to exit as soon as I can

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards