We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

6 CCA letters ready to go-- few questions, then our progress

Comments

-

I left mine to Egg blank (crossed PO), they have not - thus far - had an issue with it. Albeit this is a SAR rather than a CCA if that makes the slightest bit of difference.Starting Debt: ~£20,000 01/01/2009. DFD: 20/11/2009 :j

Do something amazing. GIVE BLOOD.0 -

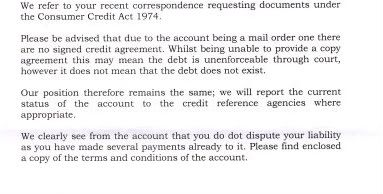

right we got our first reply today from Robinson way re: Next card

saying this

whats the next step, if it's unenforceable as they say it might be do we stop paying??0 -

Just because it is unenforceable doesn't, as they say, mean the debt doesn't exist. You spent it, you pay it back (my opinion). All it means is they cannot pursue you through the courts nor report it to CRAs.

I'm sure someone will correct me if I am wrong!Starting Debt: ~£20,000 01/01/2009. DFD: 20/11/2009 :j

Do something amazing. GIVE BLOOD.0 -

The debt is unenforceable. That's its legal status. If Rob Way want to show otherwise they must take court action and win their argument. I think that's unlikely.

You could send a'12+2' letter - Fermi has one as post 8 of this thread

You could also refer them to the OFT instructions to Mackenzie Hall earlier this year, reminding them that this is a 'disputed debt' and that they must now cease 'collection activity' - both terms defined by the ruling.

You can even continue to pay them if you want to but you may consider this one now to be of lower priority than enforceable debts!0 -

As above, you do owe the money and morally you should pay up. But it does buy you time to deal with other debts.

After 6 years, the debt will become statute barred if you no longer deal with it, whilst still a valid debt you owe, it reduces the powers of DCAs further.Although no trees were harmed during the creation of this post, a large number of electrons were greatly inconvenienced.

There are two ways of constructing a software design: One way is to make it so simple that there are obviously no deficiencies, and the other way is to make it so complicated that there are no obvious deficiencies0 -

The debt is unenforceable. That's its legal status. If Rob Way want to show otherwise they must take court action and win their argument. I think that's unlikely.

You could send a'12+2' letter - Fermi has one as post 8 of this thread

You could also refer them to the OFT instructions to Mackenzie Hall earlier this year, reminding them that this is a 'disputed debt' and that they must now cease 'collection activity' - both terms defined by the ruling.

You can even continue to pay them if you want to but you may consider this one now to be of lower priority than enforceable debts!

already got one of those addressed up ready to post tomorrow,

yeah i know morally i should pay up, but i've been moral most my life and it's got me nowhere,if it makes me a bad man if i stop paying them so be it, i won't lose any sleep over them anymore0 -

right the 19th is here and i've had no response at all from

lowell finacial -- barclay card

Capquest x 2 --Halifax credit cards

Mackensie hall-- Studio account

and the store card with lowell, they said they were attempting to get the cca from the original crediter, this hasn't turned up

so what's the next step0 -

You should let them know, by way of a 12+2 letter or similar, that you are aware of the Consumer Credit Act and that the account is at present unenforceable.

You then could walk away - they have six years from the last acknowledgement to try court action.

Or you could offer a low 'full & final settlement'.

I've just noticed my prediction in post #6 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards