We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Interest rate retreat?

Sceptic001

Posts: 1,111 Forumite

So Egg pulls its 3.25% instant access account, West Brom BS pulls its 1 year fixed 3.9% account and Bucks BS cuts its Regular Saver rate (twice!!!). All of these were market leaders.

Is this just a coincidence, or does it mark the beginning of a retreat in rates for savers?

Is this just a coincidence, or does it mark the beginning of a retreat in rates for savers?

0

Comments

-

As the credit crunch eases, savings rates will ease, and will lose some of their premium to base rate.0

-

On the other hand, Principality have increased the rate on their 3-year fixed rate account to 4.55%, and the Yorkshire is launching an even higher rate bond.

I would think that to a certain extent the rates are changing according to how desperate the banks and building societies are for cash. West Brom have been offering market-leading rates for several weeks now, so perhaps they simply don't need much more money."The trouble with quotations on the Internet is that you never know whether they are genuine" - Charles Dickens0 -

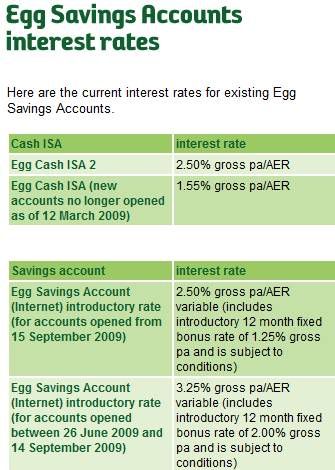

Going back to the Egg account, I seem to recall (but can't find it in writing) that for accounts opened prior to today the 2% bonus was fixed for 12 months and as it's only the bonus rate that's been reduced, the 3.25% (total) still applies to those accounts for the 12 months. At least, that's my understanding. Nick.0

-

Going back to the Egg account, I seem to recall (but can't find it in writing) that for accounts opened prior to today the 2% bonus was fixed for 12 months and as it's only the bonus rate that's been reduced, the 3.25% (total) still applies to those accounts for the 12 months. At least, that's my understanding. Nick.

I have it in writing from Egg...

"This consists of the Egg standard interest rate of 1.25% AER gross per annum variable and a fixed bonus interest rate of 2% AER gross per annum."0 -

The rates for Egg's Savings Accounts are clearly shown on their website:I seem to recall (but can't find it in writing) that for accounts opened prior to today the 2% bonus was fixed for 12 months and as it's only the bonus rate that's been reduced, the 3.25% (total) still applies to those accounts for the 12 months. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards