We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Help clearing credit card debt please

Comments

-

First ov all hubby applied for the plus card and was declined, He also applied for virgin and was declined both requests were for £3500 bt

He was then contacted by halifax and pre-approved for the 0% 9 month interest card, we have the paperwork here waiting to be signed and returned but I wanted to double check that this is the best thing to do as I would have hated it if we made a bad decision without getting advice and ended up in 9 months time either owing the same amount or moreRunning total for swagbucks - £270 since Jan

Running total for superpoints - :D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

0 -

A lot of these pre approved offers are no such thing. When you look a little closer it tends to say something like "pre approved to apply".dragonfly02 wrote: »First ov all hubby applied for the plus card and was declined, He also applied for virgin and was declined both requests were for £3500 bt

He was then contacted by halifax and pre-approved for the 0% 9 month interest card, we have the paperwork here waiting to be signed and returned but I wanted to double check that this is the best thing to do as I would have hated it if we made a bad decision without getting advice and ended up in 9 months time either owing the same amount or more0 -

The exact paperwork reads

Dear Mr Dragonfly

following our recent telephone conversation, You'll be delighted to know that your application has been approved for the HALIFAX CREDIT CARD with an estimated credit limit of £2600*.

The other thing is that this card states- 0% for 9 months on balance transfers made within the first 90 days**(3% balance transfer fee applies)Running total for swagbucks - £270 since Jan

Running total for superpoints - :D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

0 -

Ok so having looked at our monthly repayments for each scenario we cannot see the benefit, We believe we can stretch to £200 per month payment

Current card £3500 18.9%apr, paying £200 per month would be paid off in around 21 months

New halifax card £2600 0% for 9 months would be paid off in about 20 months if we transfered what's left from the original card when enough credit is paid off

Obviously the amount of saving in interest is £400 but the repayment time would work out almost the same.Running total for swagbucks - £270 since Jan

Running total for superpoints - :D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D:D

0 -

dragonfly02 wrote: »Ok so having looked at our monthly repayments for each scenario we cannot see the benefit, We believe we can stretch to £200 per month payment

Current card £3500 18.9%apr, paying £200 per month would be paid off in around 21 months

New halifax card £2600 0% for 9 months would be paid off in about 20 months if we transfered what's left from the original card when enough credit is paid off

Obviously the amount of saving in interest is £400 but the repayment time would work out almost the same.

You pay less, it's as simple as that.

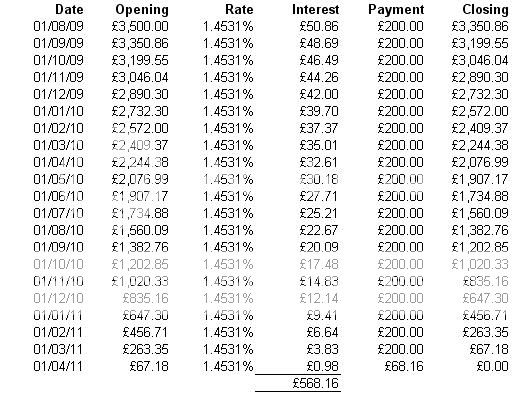

If you leave it as is, you'll pay £568.16 in interest @ 18.9% APR:

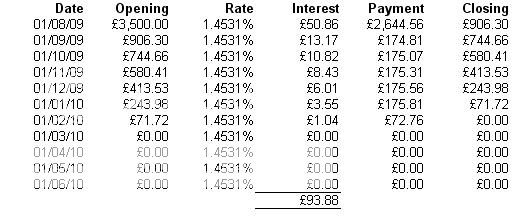

Assuming you move £2470 to the Halifax card (95% of your estimated limit - it could be more but you won't know until you apply) make the minimum payments to your Halifax card while paying the rest of the money to your current card, you'll pay it £93.88 in interest:

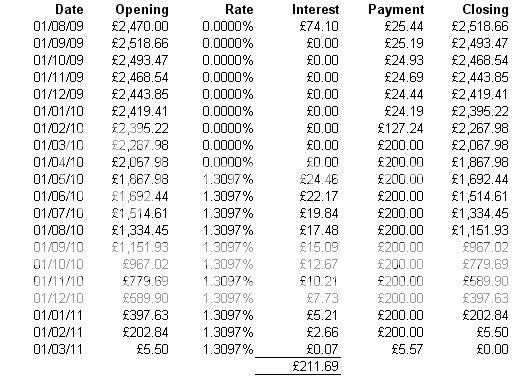

And assuming the Halifax card changes to their standard 16.9% APR and you switch the full £200 to it from February onwards, you'll pay £211.69 in interest:

So I make that £305.57 interest versus £568.16 - so you'll save £262.59 just by taking Halifax up on the offer their throwing at you No brainer in my book

No brainer in my book  "A child of five could understand this. Fetch me a child of five." - Groucho Marx0

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

cannyjock - you are the man!

2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards