We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Should I Balance Transfer??

geordie_ben

Posts: 3,118 Forumite

in Credit cards

I have £4901.11 on a Halifax Credit Card (£9000 limit) at 5.2% and I pay £500 a month off this and if all goes to plan this will be paid off by June 2010

I also have a Virgin Credit Card (£3000 limit) with a zero balance. Virgin are offering existing customers a promotion to balance transfer until June 2010 at 0% with a 5% handling fee.

Is it worth me doing?

Am I right in thinking its better to pay a one of 5% fee than pay 5.2% every month? Even if I cant transfer the full balance?

Would it be worth me trying to increase the limit on my Virgin Card first?

Any help would be great

I also have a Virgin Credit Card (£3000 limit) with a zero balance. Virgin are offering existing customers a promotion to balance transfer until June 2010 at 0% with a 5% handling fee.

Is it worth me doing?

Am I right in thinking its better to pay a one of 5% fee than pay 5.2% every month? Even if I cant transfer the full balance?

Would it be worth me trying to increase the limit on my Virgin Card first?

Any help would be great

0

Comments

-

Hi,

IT wont be 5.2 a month.I believe the monthly rate is 5.2 divided by 12.0 -

geordie_ben wrote: »I have £4901.11 on a Halifax Credit Card (£9000 limit) at 5.2% and I pay £500 a month off this and if all goes to plan this will be paid off by June 2010

I also have a Virgin Credit Card (£3000 limit) with a zero balance. Virgin are offering existing customers a promotion to balance transfer until June 2010 at 0% with a 5% handling fee.

Is it worth me doing?

Am I right in thinking its better to pay a one of 5% fee than pay 5.2% every month? Even if I cant transfer the full balance?

Would it be worth me trying to increase the limit on my Virgin Card first?

Any help would be great

Did you mean you are paying off £50 a month rather than £500? Only two things are infinite, the universe and human stupidity, and I'm not sure about the former.

Only two things are infinite, the universe and human stupidity, and I'm not sure about the former.

--Albert Einstein--0 -

Nope, £500 was not a typo, I pay Five Hundred Pounds a month off my debt

0

0 -

You could calculate how much total interest you will pay till July 2010 and compare it with the 5% fee and see which works out cheaper.I am not very good at maths but my gut instinct tells me it wont be much different !0

-

No it's not better for you, assuming the Halifax is a life of balance offer.

If you actually pay the balance off by June 2010, it's better to stay with Halifax because although your annual interest is 5.2%, you will be paying that monthly on a declining balance, i.e. 0.43333% per month x £5000 = £22 per month at first reducing to 0.43333% per month x £500 = £2.20 in the last month. By comparison you'd have paid £250 up front for the balance transfer.

If you don't manage to pay it off in time it's even better value to stay with the Halifax life of balance rate as you'll be paying 20% or whatever when your 0% rate ends.0 -

Thanks Sdooley, I've been trying to do the sums to work it out.

And my money will defs be paid off by June next year if everything goes to plan 0

0 -

-

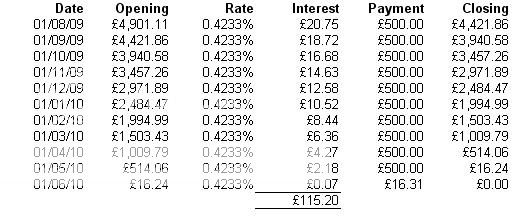

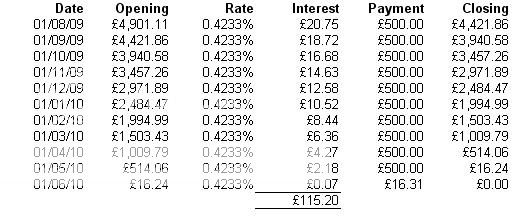

If you leave it as it is, you'll pay Halifax £115.20 in interest (0.4233% is monthly equivalent of 5.2% APR - see the rate converter on the stoozing site).

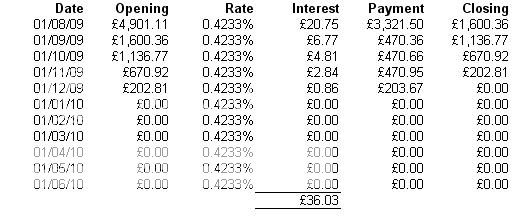

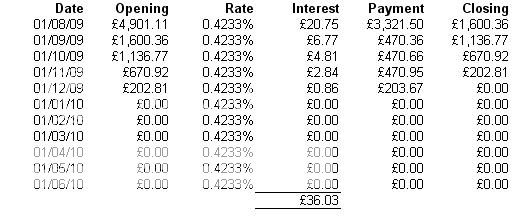

If you transfer £2850 (95% of £3000 limit), pay the minimum on the Virgin card until the Halifax is clear and pay the rest of your £500 to Halifax, you'll pay Halifax £36.03 in interest

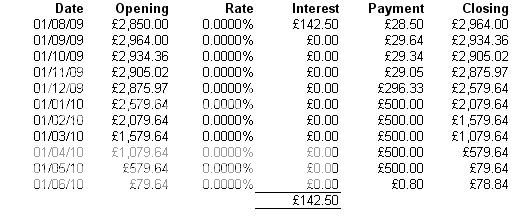

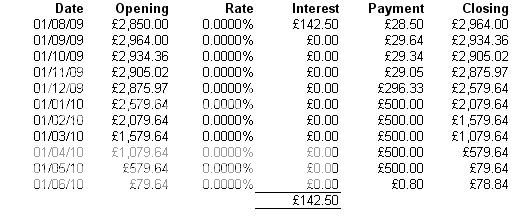

But the snag is that you'll have paid £142.50 fee to Virgin!

So no, best to keep it as you are, or ask MBNA to reduce their fee below 2.7% "A child of five could understand this. Fetch me a child of five." - Groucho Marx0

"A child of five could understand this. Fetch me a child of five." - Groucho Marx0 -

Canny, how did you work the interest out??

If you've put this in excel can you copy and paste the formula please 0

0 -

If you leave it as it is, you'll pay Halifax £115.20 in interest (0.4233% is monthly equivalent of 5.2% APR - see the rate converter on the stoozing site).

If you transfer £2850 (95% of £3000 limit), pay the minimum on the Virgin card until the Halifax is clear and pay the rest of your £500 to Halifax, you'll pay Halifax £36.03 in interest

But the snag is that you'll have paid £142.50 fee to Virgin!

So no, best to keep it as you are, or ask MBNA to reduce their fee below 2.7%

Wow ! I am impressed !0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards