We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Charging Order? The myth

Comments

-

Thank you for taking the time to reply.

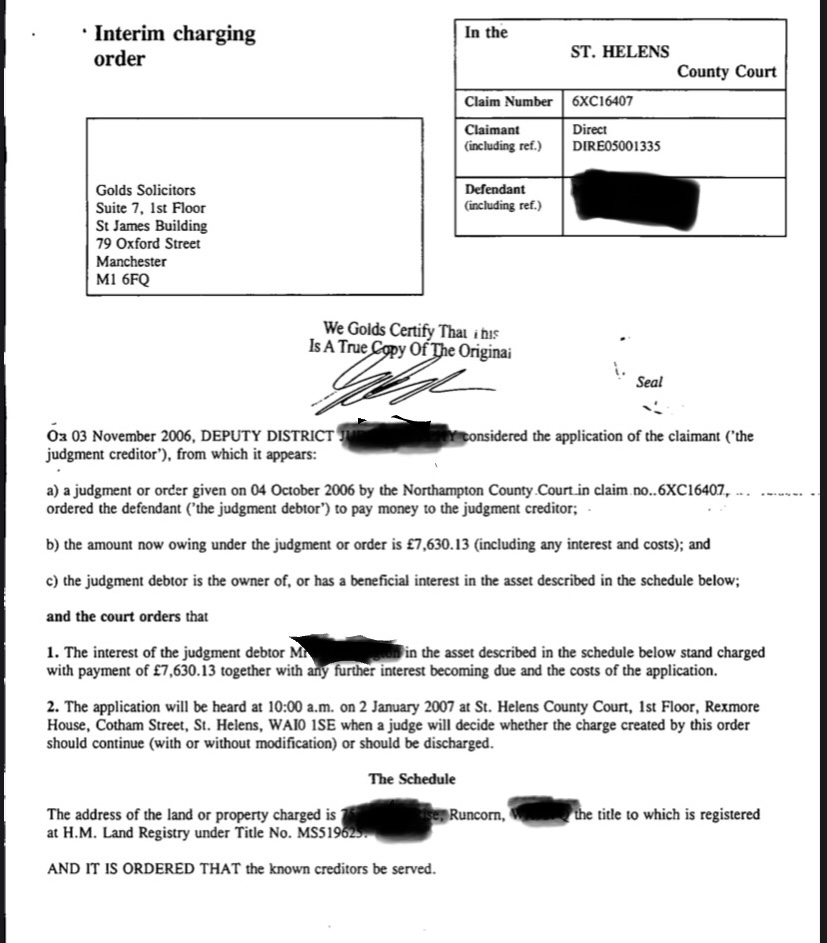

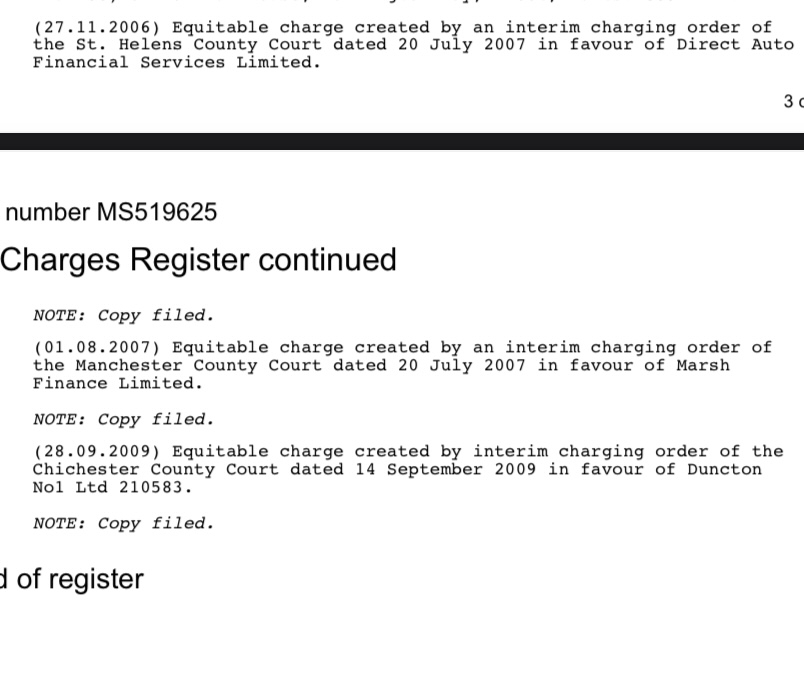

Land Registry said the charge was put on the property in 2006 with a standard form K. They have nothing to say a final charging order was made. I did contact the solicitor who was acting on behalf of the creditor and the court who put the charge on but they had no information on this with it being so long ago. 0

0 -

Kellie

Can I just ask you to clarify how many Charging Orders are against your other half and also what is actually registered on your deeds in realtion to them? If the Charging Orders are only "Interim" and have only been protected by a Form K restriction, there may be some light in your sale being able to proceed? (You can obtain a copy of your deeds from the Land Registry website for £3 if you don't have a copy)1 -

As far as I can see it’s three. They all seem to start with the same thing.

0

0 -

Leading on from our solicitor saying all our K worded restrictions have to be paid before completion, I thought I would share some of the things I have been told whilst trying to obtain redemption/settlement figures. One company offered a reduced settlement figure, they claim its a final charging order (single debt, joint mortgage). Another said they cannot accept a reduced offer because its a final charging order (again single debt, joint mortgage). So we're not sure who's telling the truth!

Also, I sympathise with the last poster. Our charges are all around 2005/6 and the courts have no records of them as they are "too old"1 -

Kellie

Unfortunately, the solicitor for the creditor has registered the correct info on your deeds (equitable charges) but I was asking in case they had registered a Form K as some Solicitors , occassionaly, do for CO's against sole owners. So its not good news but I would start to make plans to go back to Court if this sale falls through as you'rre always going to have this problem when selling?

1 -

Any creditor can accept what they want to settle a debt as they can then remove the Restriction using an RX form (but you should ensure a "full and final" settlement of the debt is signed). Whoever, told you they couldn't accept a reduced settlement because ifts a Final CO is talking nonsense (but you were, most likely, talking to a debt collection employee not an actual solicitor?)KathrynConfused said:Leading on from our solicitor saying all our K worded restrictions have to be paid before completion, I thought I would share some of the things I have been told whilst trying to obtain redemption/settlement figures. One company offered a reduced settlement figure, they claim its a final charging order (single debt, joint mortgage). Another said they cannot accept a reduced offer because its a final charging order (again single debt, joint mortgage). So we're not sure who's telling the truth!

Also, I sympathise with the last poster. Our charges are all around 2005/6 and the courts have no records of them as they are "too old"

As with Kellie above, its scandalous that records aren't kept in the day an age of computer storage and, I'm hopeful, the MOJ will offer some guidance on this (when they eventually reply!)0 -

Thank you for your advice. I think court will be the only option here.0

-

Kellie

No problem and please update the board if you do down that route as there are loads of customers on here in the same boat!1 -

Any information I come across I will share.

Hopefully, this will be helpful to everyone else in the future.0 -

Thank you again. Yes, I interestingly both companies who said that that they could and could not accept a reduced settlement are debt collection agencies. I plan to put my offer in writing to them and if they refuse based on the 'final charging order' argument then our solicitor can take over. At the moment, I only have only been advised that verbally.

With regards to the courts, I did ask about applying to get the restrictions removed and was told they could not do that as they don't have the original record and they both told me to go back to the creditor. Its madness.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards