We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Anyone got any thoughts about the base rate

TheMoneySpider

Posts: 370 Forumite

We are deciding whether to go onto a fixed rate or a variable when we renew our mortgage deal.. The fixed will be more expensive in the short term but once the base rate goes back up to 1.5% I think we'll be worse off. It's a three year deal so if the base rate stays low for the next 18 months we'll probably lose out overall....it's just a fixed rate looks pretty tempting with the rate at rock bottom.

What is everyone financial crystal ball telling them?

What is everyone financial crystal ball telling them?

0

Comments

-

What rates have you been offered?

It's all a guess but once interest rates start to rise, I think they'll go up pretty much as quickly as they went down. Where they'll settle is anyone's guess.

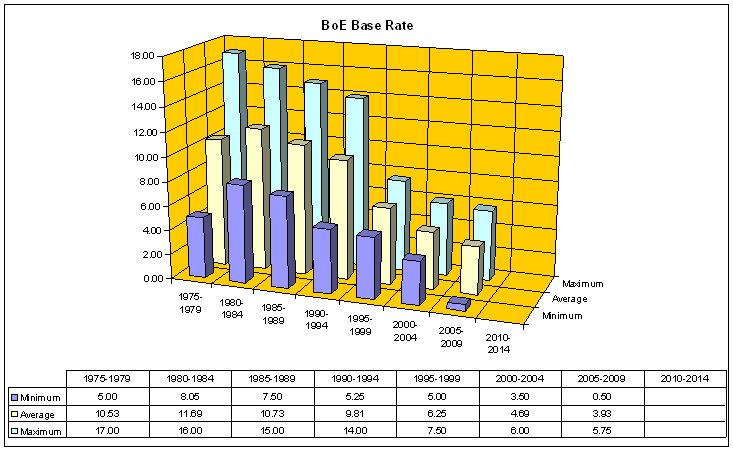

http://www.mortgages.co.uk/interest-rates/interest-rate-history.html0 -

Ed-Zed

I agree it is all crystal ball, lenders are already pushing up rates and BoE will have to start raising rates once inflation kicks in as they need to keep it close to 2.4% (I think). Watching the financial information closely may help, but, like trying to spot the "bottom" in the market, gauging the precise best rate & time to fix is easier to do in hindsight. Consider whether you can tolerate interest rates of 5, 7, 9% then decide when to trigger and jump into a fixed rate.0 -

My crystal ball says fix, but it sounds like you either haven't been offered a great deal, or you are currently on a great deal (tracker?)

We are about to fix, which will interestingly be below our current SVR. For us, we only lose out if the BOE rate goes down (highly unlikely!) However we will probably hold the offer for 6 months to lengthen the deal as we are opting for a 2 year product (lowest rate & fees.) I am well aware it may be awful when we come off it!0 -

Do these fixed rate deals offer flexibilty in overpaying ?

This is after all the MFW board and the OP feature might influence a decision as to which product should be chosenSpace available for rent0 -

next month i reckon they will go up 1/4% cos of the last minutes from the interest rate people0

-

Make your decision based on your ability to afford any potential increase - any additional cost on a fixed rate is surely the cost of "insuring" the risks of rises in the period.RosieTiger - Highest £242,000 Feb 2004 :mad:

Lightbulb Dec 2008 £146,000 by March 2026:eek:

MFi3T2 and T3 No 28 - Dec 2009 Start Balance £117,000

Current Position-Fully off set by savings since March 20130 -

Lunar_Eclipse wrote: »My crystal ball says fix, but it sounds like you either haven't been offered a great deal, or you are currently on a great deal (tracker?)

We are about to fix, which will interestingly be below our current SVR. For us, we only lose out if the BOE rate goes down (highly unlikely!) However we will probably hold the offer for 6 months to lengthen the deal as we are opting for a 2 year product (lowest rate & fees.) I am well aware it may be awful when we come off it!

We've fixed on a 2.99% for 2 years, like you, well aware where things could be but plan to overpay by as much as possible during that time as we expect to pay considerably more when we come off.

LM :jMFWin3T2 No 20 - aim £94.9K to £65K:j

:jMFWin3T2 No 20 - aim £94.9K to £65K:j

0 -

I too am obsessing about this at the mo. 2 of our mortgages are on deals fixed to base rate, the 3rd is linked to mortgage rate which, barring the last cut, has dropped along with base rate. Am hoping experts are right that base rate will stay the same till 2nd 1/4 next year but if I did not have redemption penalties now I would fix for 3 years.

We have a BTL @ 1.24% above base till end of year. Goodness knows what will happen then. Problem is (ok, 'problem' is stretching it a bit, plenty people would be happy with it) we will only owe around 40k by then, so the arrangement fees will have a disproportionate effect.

The 2 mortgages on our own house are at 0.99% above base till Oct 2010 (70k) and 0.25% discount on mortgage rate till July 2012, so although rates are great at the mo they will soon start to rise. Combined they represent about 60% of value so with 40% equity we should be ok to move to a better deal when they end, assuming prices are stabilising.

What I would really like is to lump all 3 together into one debt and have a great fixed rate but complete flexibility & offset facility :rolleyes:. Realistically we'll probably go for SVR for BTL, and aim to pay off asap. Complicated because although interest is supposedly calculated daily that only seems to apply to adding interest - lump sum overpayments, and regular monthly overpayments are only credited at the end of the year. (Beware anyone with C&G mortgages - this appears to be the case generally). So, best to stick in a savings account & pay off in December.A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

If the recession is going to get worse and more jobs are going to be lost, then inflation won't start coming back up.

At the moment people don't seem to be spending even though they are not actually any worse off - most of them - and so at some point these good intentions might just break and then we could have inflation.0 -

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards