We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Salary Sacrifice??

Comments

-

James thanks for checking that, i have not spoken to my employer as i am on holiday, but I am guessing that as they offer ss, it is my choice what way to do it, maintain net extra pension or same pension extra net.

Would you know as what point the reduced NIC effect state or second pension? I know the extra money should/will out way the loss, but i would just like to understand how much etc loss/gain type thing

cheers0 -

It affects it immediately if you're not a higher rate tax payer. The S2P contribution is on the money eliminated so the earnings-related additional state pension is reduced.

For higher rate tax payers there's no effect on S2P until their pay after reduction falls into the standard rate bracket. That's because higher rate is now the same or pretty much the same as the upper accrual point for S2P contributions, above which no extra S2P money is added. They still get the basic rate addition.0 -

Hi James sorry to be really dumb, but have i got this right. So given my example

NIC pre salary sacafice - 1571.35

NIC after salary sacrafice - 1418.31

Difference of - 153.04

So thats 153.04 less going towards s2p? Does this include employers NIC

but because I am doing salary sacafiec I am getting 191.03 going towards private pensoin which is 37.99 more. lol I am probally way off am I

cheers

jimmy0 -

I've just sacrificed £7500 bonus, majority was at hrt.

Saved £2873 in tax and company have enhanced my contribution by 10% from NI savings.

So I got £8250 invested in pension for a net outlay of roughly £4627 I get a return of 70 odd percent on day one, probably slightly higher due to NI savings I also make.

And I get to take it all out 100% free of tax at retirement.

Seems like a fairly good move for me.0 -

Saved £2873 in tax and company have enhanced my contribution by 10% from NI savings.

You do realise that your company pays 12.8% NI (13.8% from April)? Rather than being 'revenue neutral' to your employers, they're making a saving here.

Only 25% of your pension fund (currently) may be withdrawn tax free. The rest will be taxed at your marginal rate.And I get to take it all out 100% free of tax at retirement.Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

Paul_Herring wrote: »You do realise that your company pays 12.8% NI (13.8% from April)? Rather than being 'revenue neutral' to your employers, they're making a saving here.

Only 25% of your pension fund (currently) may be withdrawn tax free. The rest will be taxed at your marginal rate.

Point 1 - correct, they use savings to provide better flex benefits for us, I am not going to quibble about the 1 or 2 percent

Point 2 - I am funding for tax free cash through top up, whilst the maximum I can get is 25% of value of db benefits, the top up means all my contribution can effectively be taken as cash (tax free).0 -

Also can someone tell me how to quote people when you only want a sentence or two and not the whole thing thanks.

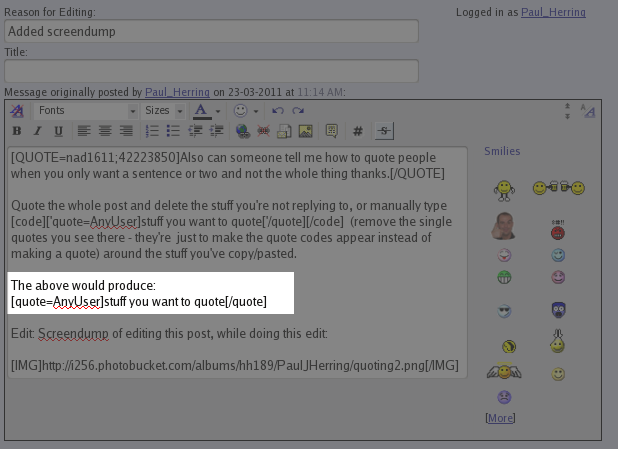

Quote the whole post and delete the stuff you're not replying to, or manually type['quote=AnyUser]stuff you want to quote['/quote]

(remove the single quotes you see there - they're just to make the quote codes appear instead of making a quote) around the stuff you've copy/pasted.

The above would produce:AnyUser wrote:stuff you want to quote

Edit: Screendump of editing this post, while doing this edit: Conjugating the verb 'to be":

Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

claretmatt; just to take up a couple of points you raised or anyone who can answer them;

• If you are in receipt of child tax credit and/or working tax credit should find out how this will be affected. A lower salary may mean more working tax credit but this would be offset by less child tax credit due to lower childcare costs.

• Pension -lower earnings may affect state pension benefit due to lower contribution levels.

Why would Child Tax Credit be affected?

If one already has enough qualifying years then would I'm guessing it won't make any difference to the State Pension?

Does anyone know if there will be a cap to the amount of Contributions annually an employee can make.

Also can someone tell me how to quote people when you only want a sentence or two and not the whole thing thanks.0 -

i have a salary sacrifice scheme with my employer who will match my contributions up to 90% (currently 10%)

i also have an old pension from a previous employer

question - should i cash the old pension in (if i can) and use it to live on for a while, meantime uping my salary sacrifice to 90% which my employer will match?0 -

i have a salary sacrifice scheme with my employer who will match my contributions up to 90% (currently 10%)

i also have an old pension from a previous employer

question - should i cash the old pension in (if i can) and use it to live on for a while, meantime uping my salary sacrifice to 90% which my employer will match?

I'd be very surprised if they would match your 90% with their own 90%. They would almost be doubling their salary costs.

It probably refers just to your 90% that they will be paying across, not adding on their own matching 90% on top.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards