We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Spring Bounces - "tHey never sustain"

Comments

-

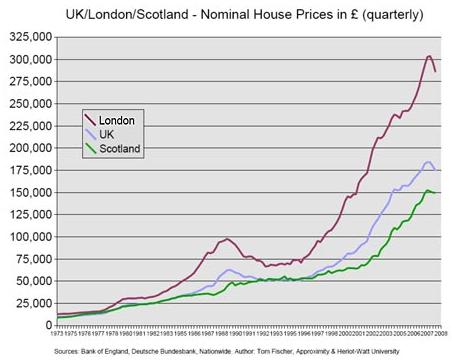

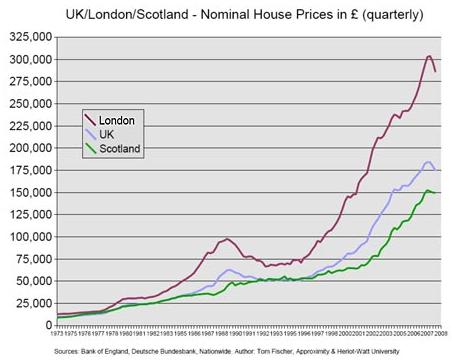

As we got that beat going the graph doesnt mean a lot until you look at house prices graphs since 1970. Anyone care to revise their statements?

Please remember other opinions are available.0

Please remember other opinions are available.0 -

swearing in code is against the rules of this site.. Retract the personal abuse also.

What's the view like on that horse?This is a system account and does not represent a real person. To contact the Forum Team email forumteam@moneysavingexpert.com0 -

As we got that beat going the graph doesnt mean a lot until you look at house prices graphs since 1970. Anyone care to revise their statements?

I had a look and noticed that Moneywatch predicted average house prices to be £300k by 2011

http://money-watch.co.uk/484/average-house-price

The graph seems to stop at the end of 2007.

I notice that one of the sources is an author from Nationwide, their graphs seem to indicate that house prices are at the long term real house price growth trend

Interesting, the site seems to portray a very one sided VI point of view

http://money-watch.co.uk/38/struggling-to-get-on-the-property-ladderLike many people, I’m getting more and more distressed about my chances of getting onto the property ladder. To give those reading this outside of the UK a bit of perspective, average house prices in the UK are now around £180,000, at the time of writing that’s $330,000 USD or $435,000 AUD. I’m a little bit luckier in that I live a town where the average is a just £130,000, but the National Housing Association reports (opens PDF document) that since 1997 house prices have risen by 125%, whereas average earnings rose by just 18%.

I’m sure I’m not alone in the somewhat selfish hope that the property market will collapse - however, we are seeing more and more reports saying that the housing market is slowing down, that house price rises are cooling, yet this still does not seem to make owning a house on a salary such as mine any more likely. Even those with two incomes to rely on are finding it difficult.

The government will this week announce plans to start a new scheme of shared home ownership. In the plan, the buyer would have to raise as little as half the cost of home, the rest of the property being owned by either the government or banks. The scheme has already been used to help key-workers (such as doctors and teachers) get affordable housing, and it sounds like it could be a useful development in getting people onto the property ladder, but it will still leave new buyers well behind the rest of the home-owning population when they come to move up the property ladder.:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

-

OK so is this is called teh Spring Bounce in House Prices?

Facts and Statistics going back to the 1970s will prove that Spring Bounces "never sustain" - they are always just a blip, an abhorrent aberration, a foolish falsehood, a temporary transition.

can you back up this statement with the Facts and Statistics that you say will prove this?0 -

-

Dervish has PMed me with the full set of stats and they are correct and complete. Obviously they cannot be published on a site such as this, but jsut take my word for it, they are pukka.

Dervish has never posted any facts and figures in any of her posts. talking of which i've never seen one of your posts with any facts and figures to back up your argument - just urban myths :T0 -

Don't start again. You know deep down that I speak the truth, and in time you will learn to accept it.Dervish has never posted any facts and figures in any of her posts. talking of which i've never seen one of your posts with any facts and figures to back up your argument - just urban myths :T0 -

Previous speculative bubbles in what markets and when, specifically? Can you show us an example? The house price curve doesn't seem to fit to me. The dip in the 1990s wasn't simply caused by a sell-off of UK property. Therefore it doesn't fit the theory. I see no reason why it would fit on the way down either. The graph is a meme. It's bogus.johnycoldears wrote: »By the way it is the life cycle of any bubble, and not specifically property ,drawn up from data on previous speculative bubbles0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards