We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Option ARM timebomb set to explode....

Comments

-

Its a big forum, I wouldnt discount someone from 'people relations' stumbling across here to see what currently ires the mob0

-

let's just hope that the Cheif Economists at the Fed and Bank of England are reading this forum - mbga9pgf seems to be so much ahead of the game. do you think that they know about this?

Perhaps if they had been reading Housepricecrash.co.uk back in 2005 we wouldnt be in such of a mess.

By the way, the I before E except after C doesnt work with the word Chief. Learn to spell reprobate!0 -

Perhaps if they had been reading Housepricecrash.co.uk back in 2005 we wouldnt be in such of a mess.

By the way, the I before E except after C doesnt work with the word Chief. Learn to spell reprobate!

lol - why did in not know you'd be quoting HPC.co.uk as the economic Bible.

it's obviously the place that university students should reside.

excellent reply re the spelling mistake - good comeback big man.0 -

Perhaps if they had been reading Housepricecrash.co.uk back in 2005 we wouldnt be in such of a mess.

By the way, the I before E except after C doesnt work with the word Chief. Learn to spell reprobate!

Either way, buy/sell or rent,an internet forum is the last place i'd take meaningful advice from.

Saying that my moby contract is up this week,some top retention threads in the moby section.Official MR B fan club,dont go............................0 -

when buying a house the price is the biggest factor. interest rate on the mortgage comes a lowly 2nd in comparison for how it affects the buyer in majority of the cases in my opinion.

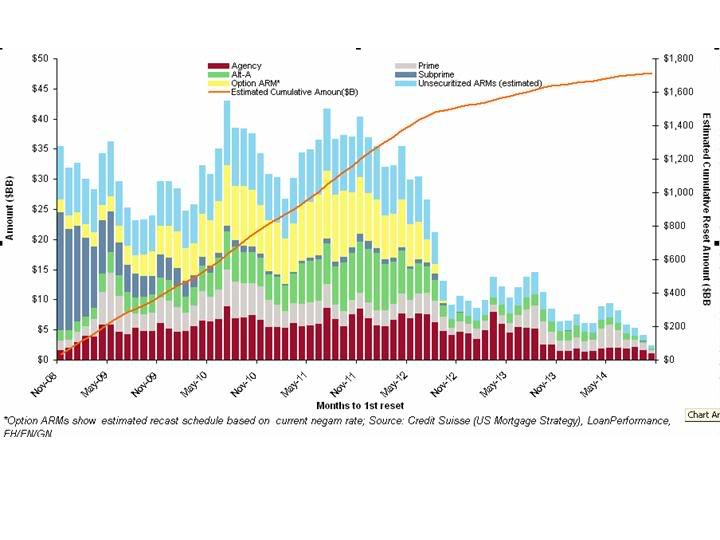

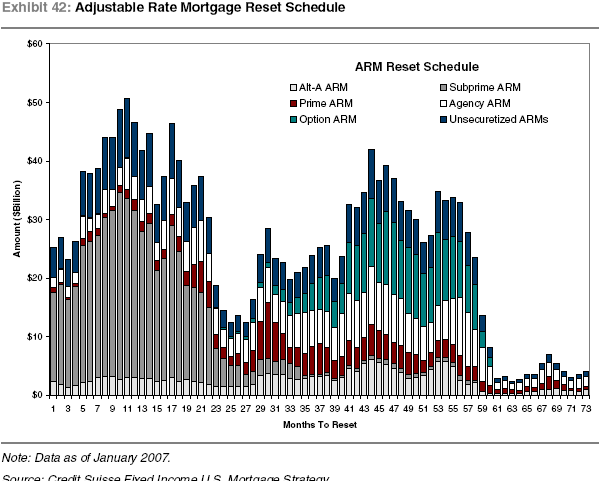

wrt ARMs the biggest risk is the payment shock that comes if they are on teaser rates as most of the option ARMs seem to have been on teaser rates of 1% for upto 5y. the could reset anywhere between 6m to 5y during the mortgage term. these resets could take the monthly payment 3 times the prev amount even if the interest rate remained the same during the period of the mortgage.

even if the base rate went to ZERO even in that scenario they will still get a payment shock of up to 3 times their initial payment depending on the circumstances of how the mortgage was setup and paid as they would have to repay the principal which kept growing during the period of teaser rates. this situation will be worse than interest only mortgages.

these ARMs had additional margin rates (rates above base rate) from 2.7 - 3% and above the various base rates (LIBOR, Treasuries, cost of financing for the bank, COFI, COSI, CODI etc etc), they could also have ceiling rates both for lower and upper limits, upper ceiling could be upto 18% based on which state the ARM was issued in.

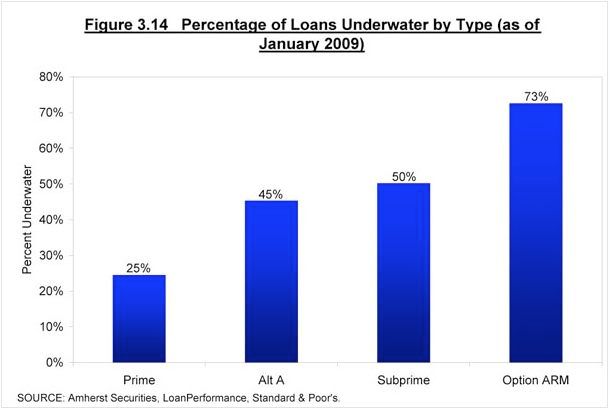

majority of the ARMs have not reached their reset points yet. BUT majority are already in default!!!!

most important - majority are already in negative equity. this will have a big impact on foreclosure rates.

there is no way many of these no doc or min doc mortgages can withstand a payment shock. many mortgages were issued in an idiotic manner to idiots who took on massively unaffordable loans by living in LaLa land by idiotic bankers. people earning 14,000$ a year were getting mortgages for 750,000$ :eek:

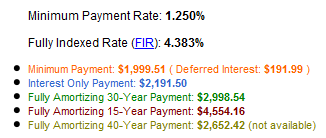

some interesting visuals and links to answer some of your questions. see how payment shock occurs as explained in one of the links below.

see latest interest rate trends on these option ARMs . thats the interest rate which excludes the teaser rates and payment shock by the way.

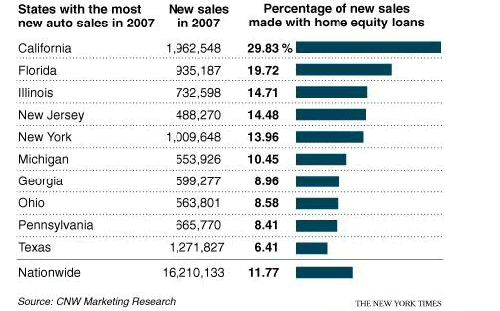

see what other sectors of the economy suffers as MEWing takes a hit. see prev trends of mewing

btw california and florida are where the biggest falls in prices have occurred. so the foreclosures will keep rising as more people get sttuck in negative equity with nonrecourse usa homeloans and consequentyly will have a bigger inclination to hand in the keys.

http://www.dailykos.com/storyonly/2009/6/1/737325/-Subprime-meltdown-over;-now-comes-the-bad-part see more on this link.

Barclays has forecast the payment shock amounts the customers would have to bear even if interest rates stay the same in future which is unlikely as the only way is up now. if (more a question of when i think) interest rates go up the shock will be much worse.

an example of payment shock below. for a couple making 100k who bought a house for 600k, please note the fully amortizing payment and minimum payment differ by 30%. it could be worse depending on what the customers margin rate above index rate was set as and also if it was set as the banks cost of borrowing in present climate which will be grossly different from base rate of the govt.

read more on option ARM for dummies. see examples of how reset payments occur.

i know it is cut pasting but it is a reasoned opinion all the same . bubblesmoney :hello:0

. bubblesmoney :hello:0 -

Yea its the combination of everything that will be devastating if it actually hits.

Cali has 11% unemployment and bank stress tests were for a worst case of 10%

The FSA tested Barclays but how can they account for the American situation

mark to model might mean all this is written off silently, Im not sure at what point it has to matter if everover 3.2 million Americans hold credit cards issued by Barclays for a number of partners, including US Airways. 0

0 -

sabretoothtigger wrote: »Yea its the combination of everything that will be devastating if it actually hits.

Cali has 11% unemployment and bank stress tests were for a worst case of 10%

The FSA tested Barclays but how can they account for the American situation

mark to model might mean all this is written off silently, Im not sure at what point it has to matter if ever

Any losses will only matter in 2 instances:

- When/if they hit the bank's balance sheet (if the debts have been securitised then any losses may not hit the bank)

- If the FSA decides they matter. The FSA could demand a higher or lower level of reserves to be held against credit card lending compared to current rules for example.0 -

To show I am not biased, another article on this

With all the, you know what, the garden needs trimming.

With all the, you know what, the garden needs trimming.

Interesting that 58% are concentrated in California.

http://www.bloomberg.com/apps/news?pid=20601109&sid=aQ_ZgC75Zfyw'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

To show I am not biased, another article on this

With all the, you know what, the garden needs trimming.

With all the, you know what, the garden needs trimming.

Interesting that 58% are concentrated in California.

http://www.bloomberg.com/apps/news?pid=20601109&sid=aQ_ZgC75Zfyw

What would be really bad news is if rates were rising just as those resets come in.......oh hang on a min....0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards