We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Graph in 10 years time

Comments

-

The trouble with keep putting it off is it usually never happens.:rolleyes: You end up missing the boat and get left behind.

Besides, does it really matter what it's worth on paper? If you intend on making it your home and don't intend to sell for many years, it's value is not important. In 10 years time it will ALWAYS be worth at least 3 times what you paid for it, and history proves that.:money:

Another thing to ponder on...........do you really want to put your life on hold while trying to grab the best bargain? You may never grab it, and just think of all those missed years you'll never recoup enjoying a wonderful homelife in YOUR OWN home!

I know someone who wasted all their childrens' early years by refusing to buy a camcorder until the prices had shot down. By the time they did buy one their childrens' childhood had gone and had never been captured on film!:mad:

But the difference with camcorders and homes are that homes do increase in value eventually, and you'll always be chasing a dream if you're mug enough to believe all the doom-mongers on here!

According to some of the Doomers property was going to drop 50% by LAST summer!!!:rotfl: :rotfl: :rotfl: SOME property (only some) has dropped by an average 12%. Some properties have dropped by just 5%; a few awful hard-to-sell properties have dropped by 25%; and some properties haven't dropped at all!

HUGE drops just haven't happened! And they're not going to.:D0 -

pickledpink wrote: »The trouble with keep putting it off is it usually never happens.:rolleyes: You end up missing the boat and get left behind.

Besides, does it really matter what it's worth on paper? If you intend on making it your home and don't intend to sell for many years, it's value is not important. In 10 years time it will ALWAYS be worth at least 3 times what you paid for it, and history proves that.:money:

Another thing to ponder on...........do you really want to put your life on hold while trying to grab the best bargain? You may never grab it, and just think of all those missed years you'll never recoup enjoying a wonderful homelife in YOUR OWN home!

I know someone who wasted all their childrens' early years by refusing to buy a camcorder until the prices had shot down. By the time they did buy one their childrens' childhood had gone and had never been captured on film!:mad:

But the difference with camcorders and homes are that homes do increase in value eventually, and you'll always be chasing a dream if you're mug enough to believe all the doom-mongers on here!

According to some of the Doomers property was going to drop 50% by LAST summer!!!:rotfl: :rotfl: :rotfl: SOME property (only some) has dropped by an average 12%. Some properties have dropped by just 5%; a few awful hard-to-sell properties have dropped by 25%; and some properties haven't dropped at all!

HUGE drops just haven't happened! And they're not going to.:D

What a load of donkey droppings.

In mosts things, everyone misses that boat. Eg did you buy a new laptop a year ago? If you didn't, you definitely missed the boat on cheap electronics. Did you buy into the market after the dotcom crash? The list goes on.

Just remember, we are at the start of the recession, it takes time for the bad to filter through.0 -

If you are buying a house you want to live in and make your home it can be very difficult to find one you really like, it's not like popping down to comet to buy a TV. Its better to pay a couple of thousand more than you might have done to get the house you really like rather than the rock bottom price for one that you are not as that happy with. If you are looking to make money then it’s obviously better to buy at the bottom.0

-

If you are buying a house you want to live in and make your home it can be very difficult to find one you really like, it's not like popping down to comet to buy a TV. Its better to pay a couple of thousand more than you might have done to get the house you really like rather than the rock bottom price for one that you are not as that happy with. If you are looking to make money then it’s obviously better to buy at the bottom.

Spot on.

Buying at the bottom will invariably mean that there are less choice available.

Great if youfind your ideal home in your ideal area for a bargain price.

You may find that some find the gargain basement property is just not quite ideal when more choices come to the market when it starts rising again:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

With another one and a half million due to join the dole and unable to afford their mortgages,prices can only go one way for the next two years at least.

http://forums.moneysavingexpert.com/...&postcount=209

The government haven`t got a clue what to do next.

Anything as bad as this,has never happened before.

Property prices rose for the past eight years,there`s no reason they can`t fall for eight years.

There will be one or two false dawns but the trend is all the way down for the next year or two.

I did this to use up a lot of room, so the next page wont have to scroll

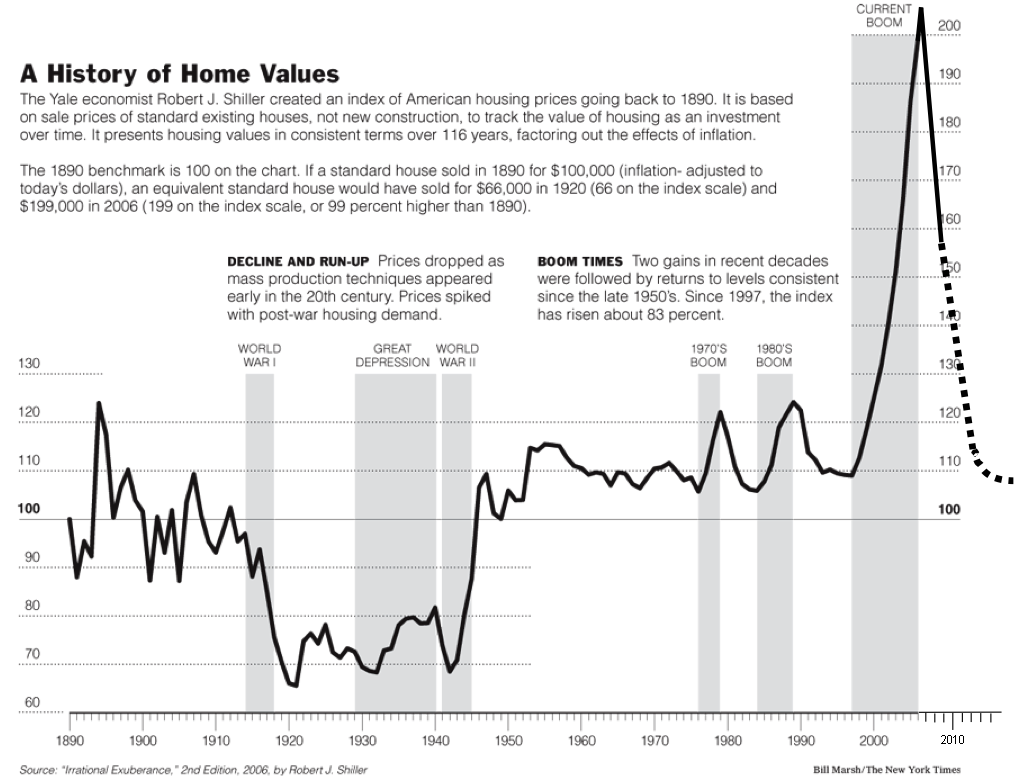

This graph says it all adjusted for inflation back to 1890.

It is the US market so we are about a yr ahead of them. http://www.youtube.com/watch?v=ca_aOvZPh-g

http://www.youtube.com/watch?v=ca_aOvZPh-g

Originally Posted by bubblesmoney

a picture can say it in an instant when sometimes a thousand words might not do enough justice.

here is a picture of past house price crashes in usa. probably the uk ones might not be much different. 0

0 -

If you spend a extra couple of grand on a nice home it ten years it won't worry you money isnt everything0

-

we're going to buy a house at the end of this year when we are married. not so bothered whether we've hit the bottom, we are happy enough that we will probably be saving by then maybe 20% on the peak, hopefully more. We've both got stable jobs and don't care really if we manage to squeeze every last drop of discount out of the market. We'll have a nice house and 2 cats and will be all loved up and happy, I can't wait.

(only thing i am worried about is interest rates might be rising again by then so our mortgage might be more expensive than we are looking at now, poopy)0 -

Not a lot different to the interest on the loan that would have also needed paying.IveSeenTheLight wrote: »It would, depending on the timeframe, it could be quite a bit of rent paid between the two 0

0 -

With so little property on the market if I wanted to move I don't think I could find a house I'd want anyway. It can be very hard to find a house you like so you could easily regret turning one down for a few thousand.0

-

For all those 'same price' comments, I think the key point here is that someone buying after 10% on the way up knows prices are back on their way up. Someone buying ont he way down merely hopes there is only another 10% to go.novazombie wrote: »I would prefer to buy 10% on the way up than 10% before the bottom.

One is almost risk free, one is quite the opposite.

Of course, if you can get a bigger discount on the way down that will sway it a bit. But don't fool yourself - lots of people believe 'oh, I got it for 10% below market value' in the same way that 90% of people believe they are a better than average driver.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards