We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

if the goverment wont put anymore money into lloyds/hbos what does that mean forsaver

the_root_of_all_evil

Posts: 172 Forumite

i saw on the news today that the goverment may not put anymore money into hbos.

does that mean they would let it go under if it came to the crunch?

and how does that effect savers, and aslo savers at Birmingham midshires and intelligent finance and the like which all part of that group.

is it time to move savings?

does that mean they would let it go under if it came to the crunch?

and how does that effect savers, and aslo savers at Birmingham midshires and intelligent finance and the like which all part of that group.

is it time to move savings?

0

Comments

-

Liquidity is when you look at your investment portfolio and **** your pants0

Liquidity is when you look at your investment portfolio and **** your pants0 -

It's part of Lloyds now, so it's unlikely to 'go under' - Govt. would nationalise if need be.0

-

I think depositors would only lose money if the government literally couldn't afford to bail the bank out further. So the real question is, could the UK government go bust?i saw on the news today that the goverment may not put anymore money into hbos.

does that mean they would let it go under if it came to the crunch?

If the answer to that is yes, then yes, in theory you could lose your money. As to whether the 5th richest country in the world could go bust - I really don't know.

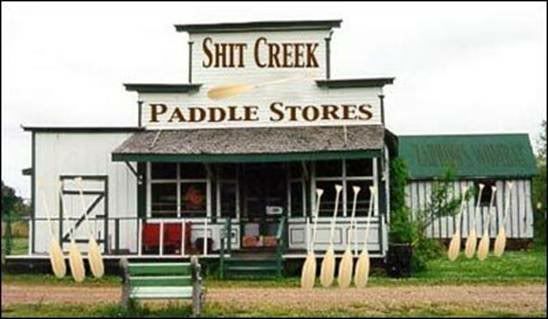

I might buy one of Stavros' paddles just in case though

:-)0 -

Its the people with shares in this bank that can lose everything, savers should be fine as the Government seemed to have indicated with other troubled savings institutions.0

-

the_root_of_all_evil wrote: »i saw on the news today that the goverment may not put anymore money into hbos.

does that mean they would let it go under if it came to the crunch?

and how does that effect savers, and aslo savers at Birmingham midshires and intelligent finance and the like which all part of that group.

is it time to move savings?

I'm sure the bank would be nationalised if need be - some chap on Moneybox (R4) was saying this is getting closer (I don't think he was talking about Lloyds specifically).

If they were allowed to slide away then savers would have the first 50K of their savings returned to them via the FSCS.

So if you have more than 50K savings with them it would be a good idea to move some of it to a different bank. This advice applies regardless of which bank you're with. You need to be careful about savings with apparently different banks/institutions as they are often owned by the same organisation so the 50K applies to the whole organisation. There is not a simple list of who these are although I think there is an attempt at one on the Savings pages of this website. As I don't have 50K savings this isn't something I pay much attention to.

If you have less than 50K savings then just chill. Although I'm sure you can find better interest rates elsewhere, which would be a much better reason for moving them.

EDIT: I think I'm right in saying that when Lloyds bought HBOS they retained their separate 50K limits. I'm not certain of that. I've got three quid in an old Websaver account. They're welcome to it if it will help them, the fools.0 -

@freddysmith Which does make sense since people with shares should known of the risks beforehand.0

-

EDIT: I think I'm right in saying that when Lloyds bought HBOS they retained their separate 50K limits. I'm not certain of that. I've got three quid in an old Websaver account. They're welcome to it if it will help them, the fools.

True, you are fully protected for up to £50k in Lloyds and a further £50k in HBOS.0 -

True, you are fully protected for up to £50k in Lloyds and a further £50k in HBOS.

As long as the FSCS and the government don't go bust. In which case we're all %^%"ed.

:-)0 -

I reckon Halifax etc is about as safe for depositors as it goes at the mo -

NR may be little bit safer - the next stage, if required, will be more bale and then, if required ,nationalisation. For sure, it won't be allowed too fold waving goodbye to taxpayers' £17Bills.

I know we lose track of the value of these numbers and fail to realise how big they are, but £11bill loss? Actually 'only' £1.6 Bill more than expected.

Gov't could fund that from a small increase on fuel duty...

Slap a few pence on ciggies, put windfall tax on BP/Shell for last years excessive profits from oil price bubble....

Its media, keeping themselves in jobs.. 'running the world' - only one letter and a few months from.... 'ruining the world'.0 -

Thats true, but we're talking about *one* company making that big a loss. Add onto that the fact that we were previously relying on The City to provide 20% of *all* tax revenue and you can understand why the amount of debt the government is now taking on is absolutely rocketing...I know we lose track of the value of these numbers and fail to realise how big they are, but £11bill loss? Actually 'only' £1.6 Bill more than expected.

Gov't could fund that from a small increase on fuel duty...

Best Regards

S0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.8K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards