We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

£100K homes return to London

Comments

-

The main problem that this part of Muswell Hill has is that it's a bit of a hike to the Underground. The nearest is at East Finchley, which is around 20 mins away on foot. The shops on Muswell Hill Broadway are very good. Buses are plentiful, too.

Ally Pally is round the corner if you like green spaces, and there are nice woods around, not too far away.

Overall, it's quite trendy, and up-and-coming, too.No reliance should be placed on the above! Absolutely none, do you hear?0 -

From all the esate agents and bankers who I talk to 50% drop in London is realistic even conservative.

I guess time will tell. I think 50% average drops for some types of property in some boroughs are quite possible but for London-wide average prices to drop by 50% or more, surely it would take much more than a lack of available lending and strict criteria? I’d have thought it would mean that average Londoners were unable to meet repayments on existing mortgages and were being forced into selling. Sure, there have been job losses, and more will surely come, but I don’t see any widespread evidence of forced selling. Unless the market is flooded with property (and not just crappy BTL places) people are desperate to sell, and which few want to buy, I don’t see average London prices dropping lower than 30%.

I’d love to be proved wrong though as it would mean I could up my sights for when I try to clamber up the next rung of the ladder at some point next year.0 -

30% from peak to trough is looking like a conservative estimate, given that we are around 20% down with prices dropping nearly 2% a month and estimated drop for this year of say 10% from respected pundits.No reliance should be placed on the above! Absolutely none, do you hear?0

-

Unless you think prices will bottom in 2010 which many do. The faster you fall the quicker you hit the floor0

-

30% from peak to trough is looking like a conservative estimate, given that we are around 20% down with prices dropping nearly 2% a month and estimated drop for this year of say 10% from respected pundits.

Couldnt agree more, good informative post.

So it all depends on how long they will keep dropping.

If you do the math with these percentages we will be looking at 50% falls by about 2011-2012.

I personaly cant see things improving before then.

Oh and Pierce Brosnan definately does live near to that 150K flat some of the year. As I said I have friends who have been living there for years. They often see him many times a year when he is in London this is his house. They also said one of the spice girls used to have a house near and some other celebs. One of the Ninja`s in Batman Begins lives that area, he has been in many films but I have forgoten his name.0 -

Quote:

Originally Posted by ad9898

As soon as it catches on, and I believe there are still huge amounts of people in denial, this statement above will ensure huge deflation in the market, and it can't come soon enough, the sellers in denial are just dragging this whole thing out much longer than it needs to be. There are only so many mugs about who will buy at todays prices, and these mugs are getting scarcer by the day. It's time to wake up and smell the coffee, 2007 has gone, 2006 has gone, in most areas 2005 has also gone. We are now well entrenched in 2004 prices in a large amount of areas, and it won't be long before this too has gone.

The great unwind is gathering pace.

Forget 2004, this is going to be the worst depression for 100yrs.

When interest rates shoot back up, house sellers could only dream about 2004 prices.

As this 150K flat in good location proves.0 -

So what will happen in real terms ??

0

0 -

It will mean (assume 2k fall per month, which is what we've had so far continues) soon we will see 50% fall from the top.

But by then unemployment will be higher and the market always overshoots too. So could be more.0 -

With another one and a half million due to join the dole and unable to afford their mortgages,prices can only go one way for the next two years at least.

http://forums.moneysavingexpert.com/...&postcount=209

The government haven`t got a clue what to do next.

Anything as bad as this,has never happened before.

Property prices rose for the past eight years,there`s no reason they can`t fall for eight years.

There will be one or two false dawns but the trend is all the way down for the next year or two.

I did this to use up a lot of room, so the next page wont have to scroll

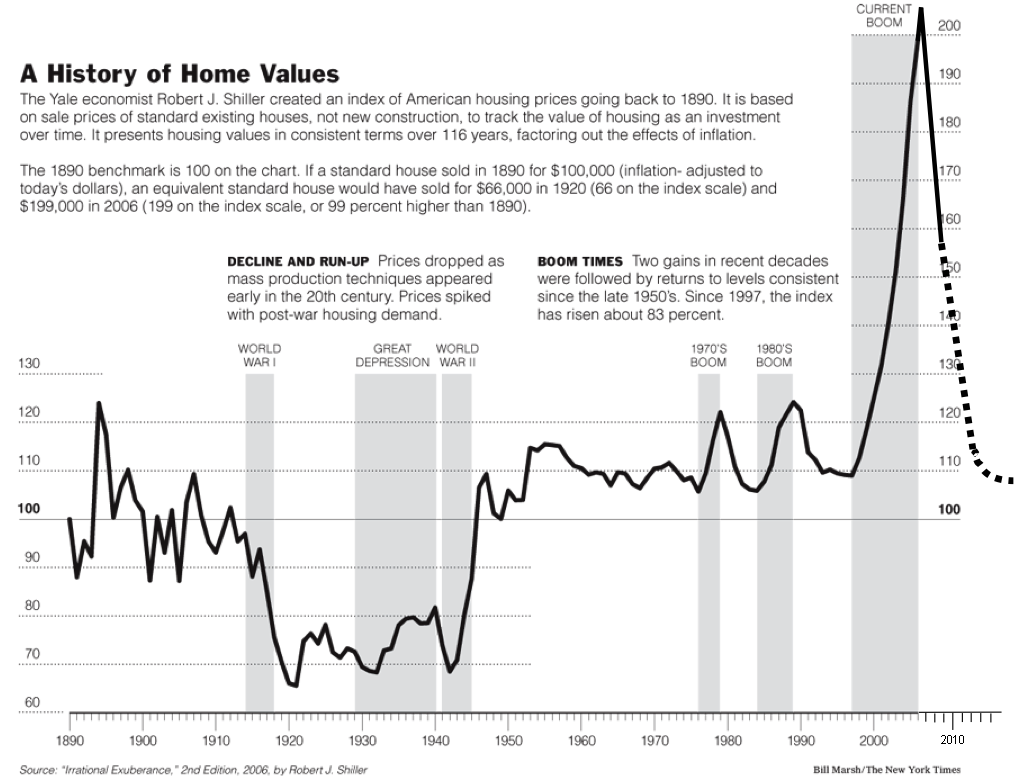

This graph says it all adjusted for inflation back to 1890.

It is the US market so we are about a yr ahead of them. http://www.youtube.com/watch?v=ca_aOvZPh-g

http://www.youtube.com/watch?v=ca_aOvZPh-g

Originally Posted by bubblesmoney

a picture can say it in an instant when sometimes a thousand words might not do enough justice.

here is a picture of past house price crashes in usa. probably the uk ones might not be much different. 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards