We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Your payment habits now to appear on credit files

Comments

-

A credit card account is what’s called rolling credit. If you’re making purchases between the statement dates and the due dates, your balance will never be zero, no matter when Experian get to see it.God damnit now I will never get a new credit card... I always pay off in full!! But at the moment the payment sometimes doesn't make it by experian's cut off so looks like I am leaving a balance... with this system I can't fool them!

For a long time now, the reports from CallCredit have shown your balance history. But, you couldn’t infer how much was being spent versus how much was being repaid. I can understand the justification for seeing a record of minimum payments. That would be a simple mark against each month a minimum payment is made. What I can’t understand is why, to the nearest pound, do they need to share the amount repaid each month.

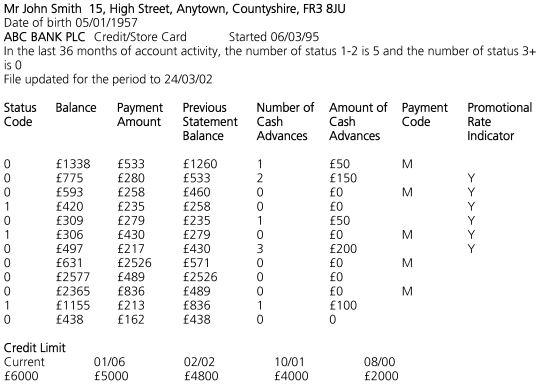

Example of account management details from Experian’s sample credit report.

Way too much information?古池や蛙飛込む水の音0 -

well, I got called from one of my credit card companys to let me know I can withdraw 10% of my credit limit per day lmfao

Hmmm , do you really think they give a monkeys if people are using their card to take money out ? i think not, they actively encourage you to do so as lets not forget, cc companies are not our best mates, they are there to make money and us withdrawing cash is a nice little earner for them, to some then it might make someones credit file look even more ripe for the picking if they take cash out often, likewise if you pay all your balances in full each month its likely you will be turned down as it will cost them money to service your account,

so based on that im none the wiser

sorry, other than to think its all a load of bollox, remember the credit ref agencies are also out to make money from us, so we cant win reallyDmp Mutual Support thread member No 820 -

-

They probably only make money out of the credit [strike]guesses[/strike] scores they sell. They must only be breaking even (or possibly making a loss?) on the £2 statutory reports by post...especially if you've been a rate-tart or stoozer for a period of time. For example, my credit report runs to 20+ pages now....remember the credit ref agencies are also out to make money from us, so we cant win really

The new format was on my last postal Equifax report, but NOT on the Experian one.Im a member of both equifax and experian and I cant see what you mean ?

There's lots of information on the new format on both the Experian & Equifax sites.0 -

yorkie1980 wrote: »with a further 28% admitting to having done so very occasionally.

Sorry, I seem to be having trouble with the English language today, does "very occasionally" mean "very often", or "once in a while"?

At first I thought it was the former, but now I'm starting to think they mean the latter. If that's true, this quote doesn't seem so shocking after all.You're spelling is effecting me so much. Im trying not to be phased by it but your all making me loose my mind on mass!! My head is loosing it's hair. I'm going to take myself off the electoral role like I should of done ages ago and move to the Caribean. I already brought my plane ticket, all be it a refundable 1.0 -

once in a while.

Edit: As you say, I dont see what it would be something to be concerned about. If it was happening every month then it might be concerning.0 -

Not worried, next they will have a copy of your Tesco shopping list published on Experian, they need to worry about their own financial status before they go all analytical on Joe consumer.

Indeed Mr P, I use the tesco clubcard because the points are brilliant and keep me in wine, but not too happy about them knowing exactly what I buy. It's a bit too invasive for my liking!! :eek:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards