We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Iceland nationalises Glitnir bank

Comments

-

Debt_Free_Chick wrote: »Technically, yes. I understand that once B&B failed the FSA test for a bank, then a claim on the FSCS was automatically triggered - but then the Government stepped in. I understand that no money will flow out of the FSCS unless B&B's loan book fails to recoup sufficient to repay the loan and even then, the other banks will have to put money IN to the FSCS.

It rather sounds as though the Government has done a deal that bypasses the FSCS - but the end result is the same with any ultimate cost to be met by the (remainder of the) banking industry.

We agree and I think my point was that the FSCS will be "no worse off" due to B&B and in the same position as it would have been, had the claim not been made.

and I think my point was that the FSCS will be "no worse off" due to B&B and in the same position as it would have been, had the claim not been made.

All correct. Up until last year, the only claims agains the FSCS were the failures of small credit unions.

Unlike the US sytem the FSCS is not 'pre-funded' so any claims would have to be paid out of contributions from all the other banks and building societies. In this case the government has decided that would take too long so has sold the book the Santander and lent the money B&B needs to fill the gap via the FSCS, charging all the banks and building societies the interest on that loan for now.

Regardless of the claim that the tax payer doesn't lose in this situation, all those members of building societies will now find their reserves go down and building societies will have to charge higher rates on loans or offer less rates on savings accounts to make up the difference. So individuals end up losing in the end again as a result of greed and a flawed business model used by B&B to grow its business since demutualisation.

R.Smile , it makes people wonder what you have been up to.0

, it makes people wonder what you have been up to.0 -

...there appears to be contradictary statements re the e mail from the FSCS...

...."as Kaupthing bank hf is not a UK firm it does not come under the direct control of the FSA..."

..."were Kaupthing bank hf to be declare insovent.............the FSCS would pay the remainder" ( re £35k limit).

This implies that the FSCS would pay the £35 compensation even though Kaupthing bank hf is not registered with the FSA..?....Have I got this right??....thanks ed0 -

formulaonefan wrote: »I would like to be prepared and help others in the process. If you don't want to post anything constructive then don't waste our time! What a loser and idiot!

This forum is seething with dangerous banking shills. Have you encountered Generali yet? He's another one of the cranks, completely consumed by his delusions.

To Generali and others, every fear and every worry is a "conspiracy theory" !

How ignorant these people are. They live in complete denial of the horrific train wreck they have created.

The system of international finance is irretrievably broken. This year alone, fourteen banks have gone under in the USA, and many more are in various stages of collapse around the globe. Countless failures are yet to come.

No amount of BandAid bailouts can patch up this mess. The time has come to put the whole wretched industry into federal bankruptcy reorganisation.

And then the criminal investigations of the industry should begin. The architects of this mess belong behind bars."If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

-- Thomas Jefferson0 -

...there appears to be contradictary statements re the e mail from the FSCS...

...."as Kaupthing bank hf is not a UK firm it does not come under the direct control of the FSA..."

..."were Kaupthing bank hf to be declare insovent.............the FSCS would pay the remainder" ( re £35k limit).

This implies that the FSCS would pay the £35 compensation even though Kaupthing bank hf is not registered with the FSA..?....Have I got this right??....thanks ed

I.E. FSCS, under the passport scheme, would cover any balance between the Icelandic €20000 compensation limit and the UK £35000 limit per depositor.

Kaupthing Bank hf is an authorised bank in Iceland and is a member of the Icelandic Depositor Guarantee Fund. Its UK operations are authorised by the FSA, and it pays a levy to the FSCS. However, as Kaupthing Bank hf is not a UK firm it does not come under the direct control of the FSA.

Were Kaupthing Bank hf to be declared insolvent, the Icelandic fund would pay compensation up to its limit of €20,000. If a depositor’s loss were higher than this, the FSCS would pay the remainder up to our limits, as outlined above.0 -

...there appears to be contradictary statements re the e mail from the FSCS...

...."as Kaupthing bank hf is not a UK firm it does not come under the direct control of the FSA..."

..."were Kaupthing bank hf to be declare insovent.............the FSCS would pay the remainder" ( re £35k limit).

This implies that the FSCS would pay the £35 compensation even though Kaupthing bank hf is not registered with the FSA..?....Have I got this right??....thanks ed

I have no answer, I am afraid.

I tuned in to Sky News this afternoon to watch the much vaunted interview of Jonathan Clark, Director of Claims at the FSCS.

I have never listened to such a pathetic creature. It sounded like he was being managed through his earpiece. That's my best explanation for his stuttering and for the long pauses in his speech - he was following aural instructions.

From what little Clark did say, it appears that the FSCS is now admitting what the realists have suspected for years - the FSCS compensation kitty is all but empty. The FSCS has no cash to pay out on anything other than the tiniest bank failures.

Clark defended this by claiming there are remedial plans afoot. Over the next three years. he said the coffers will be swelled through larger premiums levied on the banksters.

However, as it stands today, the FSCS is no good to man nor beast.

And that was from the goon who oversees the claims."If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

-- Thomas Jefferson0 -

I am a great fan of history. The Times 3/11/2005SORTING out the mess left by the collapse of BCCI is taking nearly as long as the brief 19-year life of the world’s most notorious bank. Agha Hasan Abedi, a charming Pakistani banker and mystic, set up his brainchild in 1972, with the aid of sympathetic Gulf backers who wanted an alternative to Western banks.

By the time that the Bank of England finally pulled the plug in 1991, BCCI had become the political standard bearer for Third World banking, the favoured choice of many British Asians and wealthy Arab depositors, and a global money laundry for drug-smugglers, earning the soubriquet Bank of Crooks and Cocaine International.

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article585992.ece0 -

SouthCoast wrote: »I am a great fan of history. The Times 3/11/2005

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article585992.ece

That brings back memories.

I phoned the FSCS when the US-owned Providian Bank did a conjuring trick with our money in 2002.

I said to the lady, "how soon could we be compensated?".. Her surprisingly candid reply was "Don't hold your breath. We still haven't paid out to BCCI's depositors and that bank failed in 1991!""If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

-- Thomas Jefferson0 -

And more on the historical theme.

Football and Finance.Maxwell was also well known as the chairman of Oxford United Football Club, saving them from bankruptcy and leading them into the top flight of English football, winning the League Cup in 1986. Oxford United were to pay a heavy price for his involvement in club affairs when Maxwell's questionable business dealings came into the public domain. Maxwell bought into Derby County F.C. in 1987. He also attempted to buy Manchester United in 1984, but refused to pay the price that the owner Martin Edwards had put on the club.

http://en.wikipedia.org/wiki/Robert_Maxwell0 -

Of course to the forum's bankster-shills like "Generali", that's just another a "conspiracy theory"!SouthCoast wrote: »By the time that the Bank of England finally pulled the plug in 1991, BCCI had become..a global money laundry for drug-smugglers, earning the soubriquet Bank of Crooks and Cocaine International.

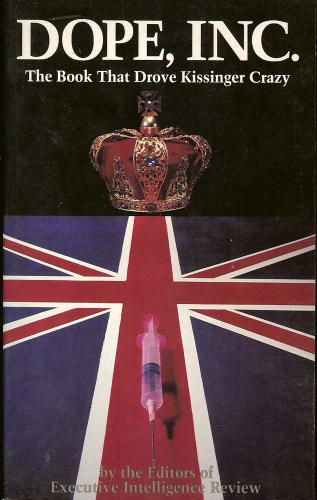

Dope, Inc. is an interesting book that details the City of London's role as the world's leading laundromat for the drug trade,

The book was last printed in the 90s, so it's getting a bit old, but it fingers some very senior figures in British banking.

Dope, Inc has been scanned for free viewing on Google Books, iirc."If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

-- Thomas Jefferson0 -

Tried for the last 15 minutes to log in but Kaupthing won't alow it - yes, I'm concerned. Anyone else experiencing the same ?Passionate about interior design, architecture, old buildings, new spaces.

Love decorating.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards