We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Nationwide swoops on battered rivals

Comments

-

The clue to why they could both be seeing large losses in their mortgage business is their location.

They are both regional societies based in the Manchester area and both provided BTL mortgages. Many of those city centre apartments currently left empty may have been bought with their money.:eek:0 -

Read on.. http://www.nationwide.co.uk/mediacentre/PressRelease_this.asp?ID=1261

Further down it says (at 30th June 2008) Derbyshire had 'mortgages' of £5.418bn and Cheshire £3.814 bn - but that they had total assets as stated above. The balance consisted of 'liquid assets' of £1.553 bn and £1.065 bn respectively - and 'Fixed and other assets' (branch network?) of £122m and £66m.

Also note that Nationwide is soooo big that it claims

A total capital ratio reduction of 0.16% (of £9.5 bn) is £152m. But that ignores the capital additions from these acquisitions. I can't see where Nationwide's 'capital' of £9.5bn is made up from their figures - they give 'reserves' for example of £6.008bn???Nationwide has a strong and high quality balance sheet with total assets of £179 billion and total capital of £9.5 billion as at 4 April 2008. Following the two transactions, the Core Tier 1 capital ratio will reduce by 34 basis points (bp), Total Tier 1 by 21 bp and Total Capital ratio by 16 bp. Nationwide expects to recover these reductions in the current financial year as a result of retained trading profits.

But, if the 'Relative Size' metric (assets) was taken as a measure of 'capital' (is it? isn't it?) then the addition of 4.0% and 2.8% would imply that the absolute capital increased by 6.8%. The 'total capital ratio' is estimated to fall (from '12.4%') by '16bp' - hence to '12.24%'. This implies the newly added capital will be of the order of

(1.068% x [0.1224/ 0.1240] - 1) x £9.5bn or £515m

This is an 'upper' estimate naturally, since D&C must have less capital to assets ratio than NW. Assuming they had two thirds of NWs ratio the calculation above would suggest they were worth £298m. If one half, £196m, one third £90m. Forgive my niaveity but I just down see their capital ratios being even as low as a half of Nationwide's ratio, bearing in mind the following

Nationwide so has a Loan to deposit ratio of 117% - i.e it uses borrowed money to finance its lending - whereas the stricken societies L2R is 92% and 93% - less than their deposits - albeit marginally

Finally D&C have stated 'reserves' of £247m and £180m (4.1% and 3% of Nationwide's) respectively This alone suggests their capital strength is comparable to Natonwide's - even though it isn't - apparently

And I just noticed that Nationwide's own figures aren't quite as up to date as the others (4 April compared to 30 June) if that makes any difference? I suppose it just means that NW would be that much bigger again........under construction.... COVID is a [discontinued] scam0 -

You jump pretty quickly from "the facts" to a speculative judgement.martinman3 wrote: »they know that it is going to wipe out all their reserves in the years to come.

Nationwide also talks about the excellent prospects for the businesses in the medium term.0 -

baby_boomer wrote: »You jump pretty quickly from "the facts" to a speculative judgement.

Nationwide also talks about the excellent prospects for the businesses in the medium term.

It is the boards of the Derbyshire and Cheshire that know it not me.

If the prospects for the businesses in the medium term are so "excellent" why do you think that they ran to the Nationwide for help ? :rotfl:0 -

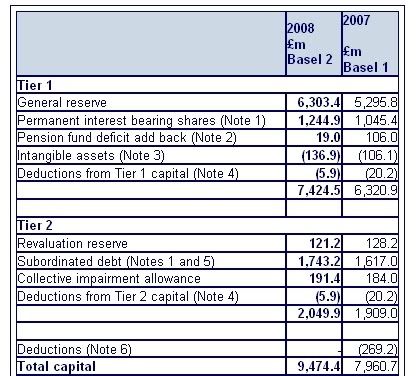

Regarding Milarky's question, the capital consists of the following (per Nationwide's results announcement):

Regarding martinman's comments, the size of the non-standard assets per se are meaningless. Cheshire and Derbyshire could each have £1bn of sub-prime, near-prime or commercial loans, and it wouldn't be a problem if it was all sub-50% LTV. But if it is mainly >80% LTV, then it would be a major problem.

Mortgages aren't risky simply because they are sub-prime. They are risky if the borrower doesn't pay and the security is inadequate.0 -

martinman3 wrote: »If the prospects for the businesses in the medium term are so "excellent" why do you think that they ran to the Nationwide for help ? :rotfl:

Many will believe that they were guided to Nationwide by the FSA as opposed to running unaided to Nationwide. 0

0 -

I agree.

The FSA is just keen to maintain financial confidence for as long as possible - other considerations (truth, justice etc. ) are secondary.

The boards of the Derbyshire and Cheshire have been told to dance to the FSA/Nationwide tune and so one thing they will do is to get as many write-downs as they can into those first six-month figures to justify the £0 "price" tag.

The FSA, by denying a vote or even a meeting, at Derbyshire / Cheshire, ensures that there can be no proper scrutiny of these interim figures.

You said that future losses would wipe out their reserves. The Derbyshire & Cheshire boards didn't say this.martinman3 wrote: »It is the boards of the Derbyshire and Cheshire that know it not me.0 -

baby_boomer wrote: »You said that future losses would wipe out their reserves. The Derbyshire & Cheshire boards didn't say this.

Maybe I should have written that their future losses have the potential to wipe out their reserves. Personally, I don't think they will need to look very hard to find any write-downs to put in their figures.

All of this is speculation, only the boards involved know the possible deficit in the final salary pension scheme or the arrears and repossession rates for those near-prime/sub-prime mortgages. I am assuming that the commercial loans mentioned are BTLs, only they know how many are high LTV on new-build apartments, in arrears and initially overvalued by the developers.

Some people on this thread seem a little over-optimistic about the finances of these two societies. If their finances were not so bad don't you think that they would have stayed independent ?

If the board members vote for meger and leave shortly after they get redundancy pay offs and their final salary pension scheme is secure.

If they continue on to possible financial disaster they get nothing and the fate of their pension is uncertain.

Which would you have chosen ? :rolleyes:0 -

But why are things like pension deficits going to be a surprise? Surely a deficit now would have been a deficit last year. Why didnt the boards flag this up then? Also, what is a mutual society doing getting into sub-prime loans and lending high LTV on speculative city centre apartments? Chasing profits isnt meant to be what the mutual sector is about. Theyve run their BSocs into the ground.martinman3 wrote: »Maybe I should have written that their future losses have the potential to wipe out their reserves. Personally, I don't think they will need to look very hard to find any write-downs to put in their figures.

All of this is speculation, only the boards involved know the possible deficit in the final salary pension scheme or the arrears and repossession rates for those near-prime/sub-prime mortgages. I am assuming that the commercial loans mentioned are BTLs, only they know how many are high LTV on new-build apartments, in arrears and initially overvalued by the developers.illegitimi non carborundum0 -

Pension scheme deficits change from valuation to valuation, depending on the assumptions about investment returns and mortality. It's impossible to guess what the next valuation will bring. And they are typically only done every 3 years.

The Telegraph today (or maybe yesterday) printed a correction to their previous story which had stated that Derbyshire had bought sub-prime loans from GMAC. In fact they were apparently prime.

The argument for building societies going into "different" forms of activity, to make profits, is that they can then give their members a better deal by charging a lower interest margin between mortgages and savings.

And arguably building societies exist to enable people to buy homes. Just because the individuals need a high LTV, and want to buy a city centre apartment, doesn't necessarily negate that.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards