We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FinancialBliss: My mortgage free journey…

Comments

-

Hi FB, you must be thrilled - good luck in 2012. Looks like this is going to be a big year for you.

Best wishes Tilly x2004 £387k 29 years - MF March 2033:eek:

2011 £309k 10 years - MF March 2021.

Achieved Goal: 28/08/15 :j0 -

My plan to start off 2012 with an overpayment on 31st December back-fired as it also cleared on the 31st, which is no bad thing.

Have had to re-state my MFW-2011 final figures, plus it effects the mortgage interest, so I'll post a final 2011 statement here now:

Opening Balance: 33,304.75

Overpayments in Blue.

Interest in Red.

Balance in Green.

Month: Payment (Std / OP) / Interest (day) / Net reduction / Balance

January: 1,000.00 (929.33 / 70.67) / 131.57 (4.24) / 868.43 / 32,436.32

February: 1,000.00 (929.33 / 70.67) / 115.64 (4.13) / 884.52 / 31,551.96

March: 1,000.00 (929.33 / 70.67) / 124.43 (4.01) / 875.57 / 30,676.39

April: 887.41 (887.41 / 0.00) / 61.27 (2.04) / 826.14 / 29,850.25

May: 887.41 (887.41 / 0.00) / 61.62 (1.99) / 825.79 / 29,024.46

June: 887.41 (887.41 / 0.00) / 57.87 (1.93) / 829.54 / 28,194.92

July: 887.41 (887.41 / 0.00) / 58.04 (1.87) / 829.37 / 27,365.55

August: 887.41 (887.41 / 0.00) / 56.28 (1.82) / 831.13 / 26,534.42

September: 887.41 (887.41 / 0.00) / 52.76 (1.76) / 834.65 / 25,699.77

October: 887.41 (887.41 / 0.00) / 52.75 (1.70) / 834.66 / 24,865.11

November: 887.41 (887.41 / 0.00) / 49.33 (1.64) / 838.08 / 24,027.03

December: 903.81 (887.41 / 16.40) / 49.19 (1.59) / 854.62 / 23,172.41

Totals: Payment / Interest / Net reduction.

Minimum: 887.41 / 49.19 / 825.79

Maximum: 1,000.00 / 131.57 / 884.36

Average: 916.92 / 72.56 / 844.36

Grand Total: 11,003.09 / 870.75 / 10,132.34

Balance outstanding: 23,172.41

Ring-fenced mortgage savings: 2,460.00

Net mortgage: £20,712.41

Nationwide normally send out an annual mortgage statement in the second or third week in January, which I'm expecting to match to the £23,172.41 figure.

I have also updated the 2011 objectives and post #1, which shows a summary of the aims for each year and the outcomes of each set of objectives.

FB.Mortgage and debt free. Building up savings...0 -

Well, it's finally here. The year I'm hoping to be mortgage free. Is still by no means a walk in the park and things could still go seriously pear shaped. Hopefully I'll get comfortable with the credit card stoozing, as it's this that's allowing me to make big overpayments at present.

Without further waffle, here's my current list of aims for 2012.-=oOo=-[STRIKE]

1. MFW 2012 - Overpay by £10,400.[/STRIKE]

[STRIKE]2. Log the monthly mortgage interest.[/STRIKE]

[STRIKE]3. Become mortgage free BEFORE 12/12/12.[/STRIKE]

4. Cycle commute into work.

5. Update draft SOA and publish.

[STRIKE]6. Create a MSE Avatar.[/STRIKE]

7. Balance current and credit accounts.-=oOo=-

1. MFW 2012 - Overpay by £10,400.

I've joined these challenges in the past as a little bit of motivation on the side. There's no getting away from the overpayments in 2012 in that if I don't manage somewhere in the region of £10,400, then we don't stand a chance of being mortgage free in 2012.

#29 - Overpay by £10,400.00.

Month: Ideal Pay / Ideal Total / Ideal % / Actual Pay / Actual Total (Diff) / Actual %

January: 866.67 / 866.67 / 8.33% / 862.59 / 862.59 (-4.08) / 8.29%

February: 866.67 / 1,733.33 / 16.67% / 1,202.59 / 2,065.18 (+331.85) / 19.86%

March: 866.67 / 2,600.00 / 25.00% / 1,112.59 / 3,177.77 (+577.77) / 30.56%

April: 866.67 / 3,466.67 / 33.33% / 1,112.59 / 4,290.36 (+823.69) / 41.25%

May: 866.67 / 4,333.33 / 41.67% / 1,112.59 / 5,402.95 (+1,069.62) / 51.95%

June: 866.67 / 5,200.00 / 50.00% / 1,212.59 / 6,615.54 (+1,415.54) / 63.61%

July: 866.67 / 6,066.67 / 58.33% / 1,362.59 / 7,978.13 (+1,911.44) / 76.71%

August: 866.67 / 6,933.33 / 66.67% / 1,533.09 / 9,511.22 (+2,577.89) / 91.45%

September: 866.67 / 7,800.00 / 75.00% / 3,564.94 / 13,076.16 (+5,276.16) / 125.73%

Total overpaid: £13,076.16-=oOo=-

2. Log the monthly mortgage interest.

Logging the monthly and daily interest allows me to understand my mortgage product better and thus plan ahead in payment and overpayment terms. Continue to log the mortgage interest as per previous years, until the point in the year I become mortgage free.

Opening Balance: 23,172.41

Overpayments in Blue.

Interest in Red.

Balance in Green.

Month: Payment (Std / OP) / Interest (day) / Net reduction / Balance

January: 900.00 (887.41 / 12.59) / 47.36 (1.53) / 852.64 / 22,319.77

February: 900.00 (887.41 / 12.59) / 41.14 (1.47) / 858.86 / 21,460.91

March: 900.00 (887.41 / 12.59) / 43.71 (1.41) / 856.29 / 20,604.62

April: 900.00 (887.41 / 12.59) / 40.56 (1.35) / 859.44 / 19,745.18

May: 900.00 (887.41 / 12.59) / 40.07 (1.29) / 859.93 / 18,885.25

June: 900.00 (887.41 / 12.59) / 37.02 (1.23) / 862.98 / 18,022.27

July: 900.00 (887.41 / 12.59) / 36.42 (1.17) / 863.58 / 17,158.69

August: 900.00 (887.41 / 12.59) / 34.58 (1.12) / 865.42 / 16,293.27

September: 900.00 (887.41 / 12.59) / 31.70 (1.06) / 868.30 / 15,424.97

Totals: Payment / Interest / Net reduction.

Minimum: 900.00 / 31.70 / 852.64

Maximum: 900.00 / 47.36 / 868.30

Average: 900.00 / 39.17 / 860.83

Grand Total: 8,100.00 / 352.56 / 7,747.44

Balance outstanding: 15,424.97

Ring-fenced mortgage savings: 15,500.00

Net mortgage: :j:j:j £0.00 - Could clear using ring fenced savings :j:j:j

Credit card stoozing information:

Tesco CC @ 0% : 5,025.00

Nationwide CC @ 0% : 6,449.82

NatWest CC @ 0% : 2,372.00

Total CC debt: 13,846.82-=oOo=-

3. Become mortgage free BEFORE 12/12/12.

Despite liking the 12/12/12 date, it's going to be financially beneficial if I can become mortgage free before 12/12/12. I have a date in mind, but don't want to put further pressure on myself by committing to it. Any date before 12/12/12 counts as a success here.-=oOo=-

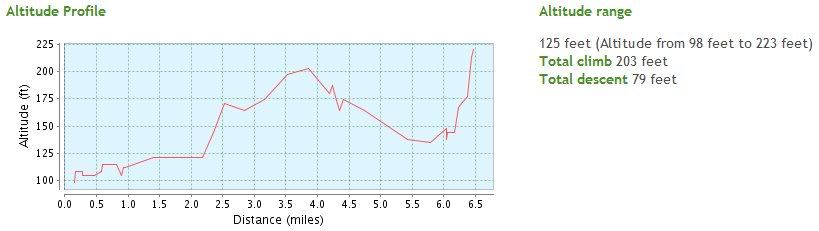

4. Cycle commute into work.

This isn't something I've just conjured up on New Year's Eve or today. I've been pondering over this for some time and (on paper) looks like a very sensible option.

Of the list of objectives, this could actually be the most difficult - probably in the initial motivation, so in the spirit of (20)12 and my 12/12/12 target, I've broke this down into (originally a dozen), but now a baker's dozen, ie 13 sub-challenges:- [STRIKE]4.01 : Cycle into work at least 12 times.[/STRIKE]

- [STRIKE]4.02 : Cycle into work at least once per month in 2012[/STRIKE]

- [STRIKE]4.03 : Cycle into work on 12 consecutive working days[/STRIKE]

- 4.04 : Reduce my commuting spend to 1/12 of previous spending

- [STRIKE]4.05 : Commute with an average speed of 12mph or more on commute into work[/STRIKE] Achieved: 14Mar - 12.4mph

- [STRIKE]4.06 : Commute with an average speed of 12mph or more on commute from work[/STRIKE] Achieved: 15Feb - 14.4mph

- [STRIKE]4.07 : Cycle more than 1,212 (two twelve's) commuting miles in 2012[/STRIKE] Achieved: 14Aug

- [STRIKE]4,07A : Cycle more than 2,012 commuting miles in 2012 - inspired by mortgage reduction novice - post #1855[/STRIKE]

- [STRIKE]4.08 : Commute for more than 12 x 12, ie 144 hours into / from work[/STRIKE]

- 4.09 : Cycle more than 52 (weeks) * 12, ie 624 recreational miles

- [STRIKE]4.10 : Included in the 624 recreational miles, cycle 12 recreational routes of 12 miles or more[/STRIKE]

- [STRIKE]4.11 : Attain a maximum commuting speed between two and three twelve’s, ie 24 to 36 mph[/STRIKE] Achieved - Maximum speed 34.0 mph - 29Mar

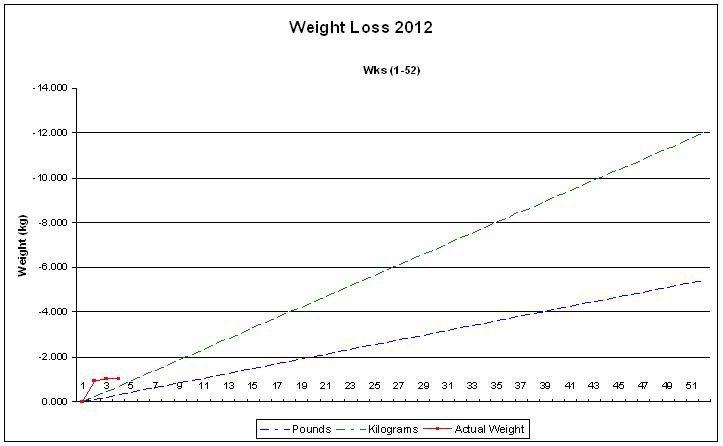

- [STRIKE]4.12 : Loose 12 pounds or more in weight[/STRIKE]

- [STRIKE]4.13 : Do a longer recreational cycle route of 3 x twelve's - 12 + 12 + 12, ie 36 miles[/STRIKE]

Cycle commute stats:

Summary:

https://docs.google.com/spreadsheet/ccc?key=0AnhcWfGMRVgddFpTWDZIbnRTSnFDMlhKTHJhQS1aR1E#gid=0

Detail:

https://docs.google.com/spreadsheet/ccc?key=0AnhcWfGMRVgddGNmWGhidkNhWFZBLUZkeUNKeE5qM2c#gid=0

Bit of background on the cycle commute:

Home: 98.172 ft / 29.923 metres

Work: 223.821 ft / 68.221 metres

Difference: 125.649 ft / 38.298 metres

4.10 Cycle 12 recreational routes...

1. 22/01/12 - 15.67 miles / 1h 32m / 10.1 mph

2. 10/03/12 - 24.83 miles / 2h 37m / 9.4 mph (avg) / 36.5 mph (max)

3. 10/06/12 - 41.89 miles / 4h 05m / 10.4 mph (avg) / 26.1 mph (max)

4. 12/06/12 - 22.82 miles / 2h 06m / 10.8 mph (avg) / 22.7 mph (max)

5. 01/08/12 - 24.06 miles / 2h 25m / 9.9 mph (avg) / 23.5 mph (max)

6. 18/08/12 - 55.73 miles / 5h 21m / 10.4 mph (avg) / 36.8 mph (max)

7. 26/08/12 - 13.08 miles / 2h 08m / 6.1 mph (avg) / 28.6 mph (max)

8. 28/08/12 - 13.27 miles / 1h 32m / 8.5 mph (avg) / 22.1 mph max)

9. 02/09/12 - 16.29 miles / 1h 19m / 12.3 mph (avg) / 32.6 mph (max)

10. 05/09/12 - 18.53 miles / 1h 55m / 9.6 mph (avg) / 26.7 mph (max)

11. 13/10/12 - 20.56 miles / 2h 04m / 10.4 mph (avg) / 25.6 mph (max)

12. 29/12/12 - 38.72 miles / 3h 55m / 9.8 mph (avg) / 31.2 mph (max)

13. 31/12/12 - 16.04 miles / 1h 11m / 13.4 mph (avg) / 33.1 mph (max)

4.12 Loose 12 pounds or more in weight

Weight loss graph: -=oOo=-5. Update draft SOA and publish.

-=oOo=-5. Update draft SOA and publish.

Have "messed" around with a SOA in the past, but never published one. Review or start again from scratch with the aim of finally getting a SOA out in 2012.-=oOo=-

6. Create a MSE Avatar.

A little item of fun - create a MSE avatar for myself. Don't know much about this at present, eg do they need to be of a certain size etc, but aim to do this in 2012 as it's something I've wanted to do for a while.-=oOo=-

7. Balance current and credit accounts.

This objective is for better money management. Balance the current accounts within 7 days of the statement dates and balance the credit card account(s) by the payment due date.-=oOo=-

With 2012 being such a big year for me, I'm intending to review these monthly and updating this post.

FB.Mortgage and debt free. Building up savings...0 -

Thought the mortgage payment would have reached the mortgage account today, but I'm wondering if it's due to the payment being taken on a Sunday and today being a bank holiday.

Still, the savings transfers were applied, so that takes us to £19,865, ie sub £20k taking into account the ring fenced mortgage savings.

Once the mortgage has cleared, the net mortgage balance should be around £18,980, give or take depending on mortgage interest.

Plan for the first quarter of 2012 at least is pay £1,750 per month to the mortgage. This consists of:

Standard mortgage payment: 887.41

Mortgage overpayment: 12.59

This tops the mortgage payments up to a round £900.00 per month.

I'm then doing 2 x £425 savings transfers into tax free ISAs at a better rate than the mortgage.

887.41 + 12.59 + 425.00 + 425.00 gives £1,750.00 per month.

So, 1,750 x 12 gives 21,000 which taking into account I'll get some interest charged to the mortgage, just about clears the mortgage by the December payment.

That's the plan so far. Should there be any major deviations from this, I'll post here as per usual.

FB.Mortgage and debt free. Building up savings...0 -

Hi FB

Just to say how well you are doing and I'm excited for you that this is the year for you :j:j:j

How is Mrs FB feeling now that the MF date is fast approaching?

Having caught up with the last couple of pages of your thread this morning I'm feeling totally ashamed of myself in terms of how you manage your money with becoming MF as well as providing for Mrs FB and the Blissings on your wage compared to myself - who does not have a partner and children to worry about when it comes to finances. I feel like I've taken my eye off the ball whereby I'm making monthly OP's of a mimimum of £500 and not doing much else and spending too much on other things. The fact that I've had to borrow £4958 from my parents to pay off an unexpected tax demand and that I've repaid them £1848 already just since September tells me that I'm doing something very wrong as I suspect that £1848 would not have gone to make extra OP's!

Regards

ATTMFW Start Date 1.4.08. Updated 23.1.18. MFW date 1.8.18

Original Mortgage o/s £187,643 / £71,904 (-115,739)

Repay o/s £92,661 / now £55,900 (-36,761)

Int Only o/s £94,982, now £16,004 (-78,978)

Total daily interest £1 [a) £0.77 b)£0.23

Total OP's:2018 target £TBC YTD £1,9950 -

Also congratulations from me you have done really well its been a long haul (remember original MFi3) but you are so close now I am sure you will get there. Well done from me and good luck for 2012.Save £12k in 25 No 49

PB Win 21 £225, 22 £275, 23 £900, 24 £750 Balance Dec 25 £32.7K

Plan to move to Denmark for FIRE by Autumn 2025 “May your decisions reflect your hopes not your fears”

New diary aiming for fire https://forums.moneysavingexpert.com/discussion/6414795/mortgage-free-now-aiming-for-fire#latest0 -

abouttimetoo wrote: »Hi FB

Just to say how well you are doing and I'm excited for you that this is the year for you :j:j:j

How is Mrs FB feeling now that the MF date is fast approaching?

Hi ATT / TallGirl and a happy new year to you both!

Mrs Bliss - Bit of a love hate thing going on here. Has mentioned in the past of the (worry of) large amounts of income I'm throwing at the mortgage, but pretty much leaves me to it, so I've a free reign on what goes.

Not quite sure she knows I'm aiming for a 12/12/12 landing, but I do mention frequently that I'm aiming to be mortgage free in 2012. For the current strategy, where I'm putting overpayments into savings instead of the mortgage, but growing credit card debt at 0%, this could be a high risk, but I could pretty much clear the CC (at the expense of the mortgage). Just takes a bit of management.

In terms of the relationship, I manage the finances, pretty much get the final say on any large purchase etc, while Mrs Bliss does the school runs, does the shopping, washing ironing etc - ie the usual stay at home mum stuff. Works for us at present and I'm very fortunate to be able to support the family.

ATT - Don't beat yourself up about lack of overpayments / money management. I'm not always as good as I may appear in my online persona, but at least you're aware of mortgage overpayments and the huge benefits they're giving you.

I've had conversations in the past where people have asked why are you overpaying your mortgage - get the money spent etc, so now I don't bother. Much better to mention / voice any queries here on the MFW board.

@TallGirl - I dropped into your new diary earlier today, but didn't manage to find the time to post a reply - one for later.

FB.Mortgage and debt free. Building up savings...0 -

Can't sleep. Things going around in my head. Been awake since just after 5am...:mad:

Decided to get up and check a few things, one of which was the mortgage.

January payment has finally cleared today, showing a balance of £22,278.57. With ring fenced mortgage savings too (£3,310), that's a mortgage balance of :

£18,968.57

Pleased with that at just 4 days into the year. Signature, graphs, post #1 etc, you know the drill by now to be updated this evening.

FB.Mortgage and debt free. Building up savings...0 -

Hi FB, sorry to hear that you have things whizzing through your mind and it is frustrating. However, once you have sorted things through, no doubt you will be back to sleeping longer. Your energy and determination is superb to read and you are so close to achieving one of your major goals now.

Good luck and I hope your replanning helps your zzzzzzzz.

Best wishes Tilly2004 £387k 29 years - MF March 2033:eek:

2011 £309k 10 years - MF March 2021.

Achieved Goal: 28/08/15 :j0 -

Hi FB, just wanted to say what inspiration you and the rest of MFW have been to me. :beer::A We have now got our mortgage down to from £70,000.00 to £3,148.90, which feels like nothing.

No longer Diary of a Confused MFW.Mortgage [strike]£70,000[/strike] £1:j

MF date [strike]31/08/2021[/strike] 6th February 2012:A0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards