We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

FinancialBliss: My mortgage free journey…

Comments

-

Do see my thread and some "interesting" things I found when reviewing building and contents insurance around September last year. We're now with DirectLine who don't appear on any of the comparison sites of course.

Good luck

Hi Stuart,

Will certainly have a look. Our home insurance is due next month (12th) so, I think I'll start getting online quotes. Could you point me to a rough page location?

FB.Mortgage and debt free. Building up savings...0 -

financialbliss wrote: »Hi Stuart,

Will certainly have a look. Our home insurance is due next month (12th) so, I think I'll start getting online quotes. Could you point me to a rough page location?

FB.

Very informative reading. Thanks Stuart. If my memory serves me correctly I think it was about page 6.0 -

FB and Mumto5

Sorry I was a bit rushed posting before, but yes it is page 6 #113 et seq.

http://forums.moneysavingexpert.com/showthread.html?t=944413&page=6

Basically I was very surprised at the differences in the actual policies which thankfully you can download in PDF format from many before buying the insurance. In fact because of this variation I won't go near insurance where I can't see the policy first.

HTH and good luck0 -

FB and Mumto5

Sorry I was a bit rushed posting before, but yes it is page 6 #113 et seq.

http://forums.moneysavingexpert.com/showthread.html?t=944413&page=6

Hi Stuart,

Thanks very much for that link - I'll take a look in the next few days.

FB.Mortgage and debt free. Building up savings...0 -

OK, we've come to the point in my diary (again) where I've fell a bit behind on a few things I should be doing. Quick update first, mainly just numbers...

Kaupthing Edge / ING Direct. Our KE savings account has now been migrated to ING Direct. The ING Direct savings rate is 4% including a 2% bonus rate for 6 months. Very kind of them to migrate the account as it's got exactly £0.00 in it. Didn't bother closing it as this had to be done by an 0845 or 0870 number - can't quite remember which. Guess that should ING become market leaders again, we can quickly apply funding. Note: ING aren't well renowned for best buy savings rates.

Tesco Internet Saver. Originally opened the account on 26th November 2008. Finally got the card reader ans was able to set up Mrs Bliss as a payee last week, ie will now be able to get funds back out of this account. Good news indeed, as we'll need to tap into these to finance the ensuite. Savings rate has dropped to 2.5% but we've got a 1.5% bonus until December, making 4% currently. I reported this as 5.1% last week, but they had just dropped the account by 1.1% :eek:

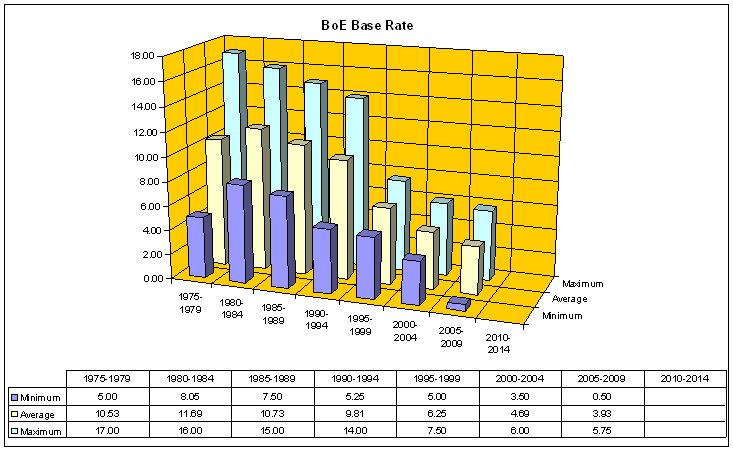

Bank of England base rate. I keep a list of base rates and update them as and when they change. I took a look at the Bank of England base rate history the other day:

http://www.bankofengland.co.uk/mfsd/iadb/Repo.asp?Travel=NIxIRx

and decided to do some analysis on the rates, just because I could. :rolleyes: I've backdated my own data to 1975 from the BoE site and then in five year blocks analysed the minimum, maximum and average base rate as below:

It's only in recent years, it's dropped so low. I'm now wondering that if the economy starts to recover in 2010 or 2011, will the base rate rise as quickly as it dropped over the last 6 months?

...and while you study the above numbers, I'm off to catch up on paperwork, receipts and bills, balancing bank statements etc. May end up starting the home insurance too, so I could be quiet for a few days. Perhaps a good thing? :rotfl:

FB.Mortgage and debt free. Building up savings...0 -

FB

The rates are interesting (you didn't go back to C17th??) having browsed them before, but of course mortgage rates were typically higher as trackers etc are recent products.

I would concur on the expectation of rising rates in future; we bought in 1994 at 8% mortgage rate, had standard quote of repayments at 10% and asked for repayment data with mortgage rates of 13% as this was "typical" for the previous decade or two.

It may very much pay to be on SVR or other non-tied products presently so you can choose to jump into fixed/capped (do the latter still exist?) quickly.

I had thought inflation and interest rates would rise from Spring 2010, but Mervyn King tells us inflation will be below 2% over next two years, so he won't need to raise interest rates will he?

Do you trust the BoE committee to be able to predict the future based on their prediction of the crash? (I know, past performance..... :rotfl:)

Good luck crunching all that data and reviewing those policy clauses.0 -

Hi there I'm another long time lurker.

I too have my mortgage with the Nationwide and have just noticed on my fixed rate paperwork (5.63% another 4 yrs left on it ) that if you cancel your direct debit or fall 3 months behind in your payments the Nationwide can remove your deal and put you on the SVR (3%) for being so naughty.

) that if you cancel your direct debit or fall 3 months behind in your payments the Nationwide can remove your deal and put you on the SVR (3%) for being so naughty.

bad glitterball, bad, bad, bad 0

0 -

glitterball wrote: »Hi there I'm another long time lurker.

I too have my mortgage with the Nationwide and have just noticed on my fixed rate paperwork (5.63% another 4 yrs left on it ) that if you cancel your direct debit or fall 3 months behind in your payments the Nationwide can remove your deal and put you on the SVR (3%) for being so naughty.

) that if you cancel your direct debit or fall 3 months behind in your payments the Nationwide can remove your deal and put you on the SVR (3%) for being so naughty.

bad glitterball, bad, bad, bad

I'd check the wording glitterball - does it say WILL remove or CAN remove? I expect it's at their discretion so they wouldn't impose this. Also, be aware it would look very bad on your credit record.

How much would it cost you to get out of the deal? Anyway, make as much OP's as you can to reduce the interest - ouch, that's got to hurt :eek:

Hijack over FB A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort Mortgage Balance = £0

Mortgage Balance = £0  "Do what others won't early in life so you can do what others can't later in life"0

"Do what others won't early in life so you can do what others can't later in life"0 -

Just a quick hi - on lunch at present.

Felt lousey in recent days - in bed before 10pm - man flu / cold / sore throat etc. Any regular readers will note from some of my "late" postings that pre-10pm is the middle of the afternoon for me! As a result, I've achieved very little in the way of bills / paperwork sorting.

Bathroom suite arrived yesterday, but without taps. Ensuite getting ripped out this Saturday. Had to put back the new suite installation with the plumber, as there is no taps in stock at present.

FB.Mortgage and debt free. Building up savings...0 -

hi

yeah, a new bathroom is very rewarding, but it can be daunting too. when i did mine (it was only replacing basin and toilet commode) i had to go back to retailer to replace the commode more than a few times because they came cracked inside the package. good luck with your new bath paradise.:whistle: 2009 MFW No 275

2009 MFW No 275

Mortgage started Jan 2006/ 95,000

Current in May 2009/ 37,947

MF Target before Sep 2010:rolleyes:0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards