9.01% fixed rate 5 year high yield bond - too good to be true?

Options

Comments

-

Peter Lines

"Been with a couple of years, good, professional, good contact, personnel touch will ring and inform you of any new products you may or may not want to take up.

Personnel or personal ?

And also "will ring you an inform you of any new products" can be read as "once you've highlighted yourself as the sort of person who will hand over money to the likes of us, we will pester you relentlessly and milk you dry of every last penny we can"(Although I could be wrong, I often am.)0 -

There should be a forum rule that as soon as someone asks "is this too good to be true" the automatic answer is YES.

I heard the other day of some 'building society' that has an account that you can put £3000 into over the course of a year in monthly chunks, and they pay you ten times the current BoE base rate on whatever is deposited within their terms.

To get it you first need to open what they call a "current account" and apparently one of their range of such accounts also pays ten times the base rate on the first £2500 of deposit. There is some small print for that too. The interest rate on both accounts is variable.

I assume with some banks paying a tenth of the base rate and these so called 'Flex' accounts allegedly paying ten times the base rate, that this rumour is too good to be true. Nobody pays 99 times more than their competition unless they are scamming you or they have some outrageous small print like you have to sacrifice your first-born and pledge them your soul. I should look elsewhere, right?0 -

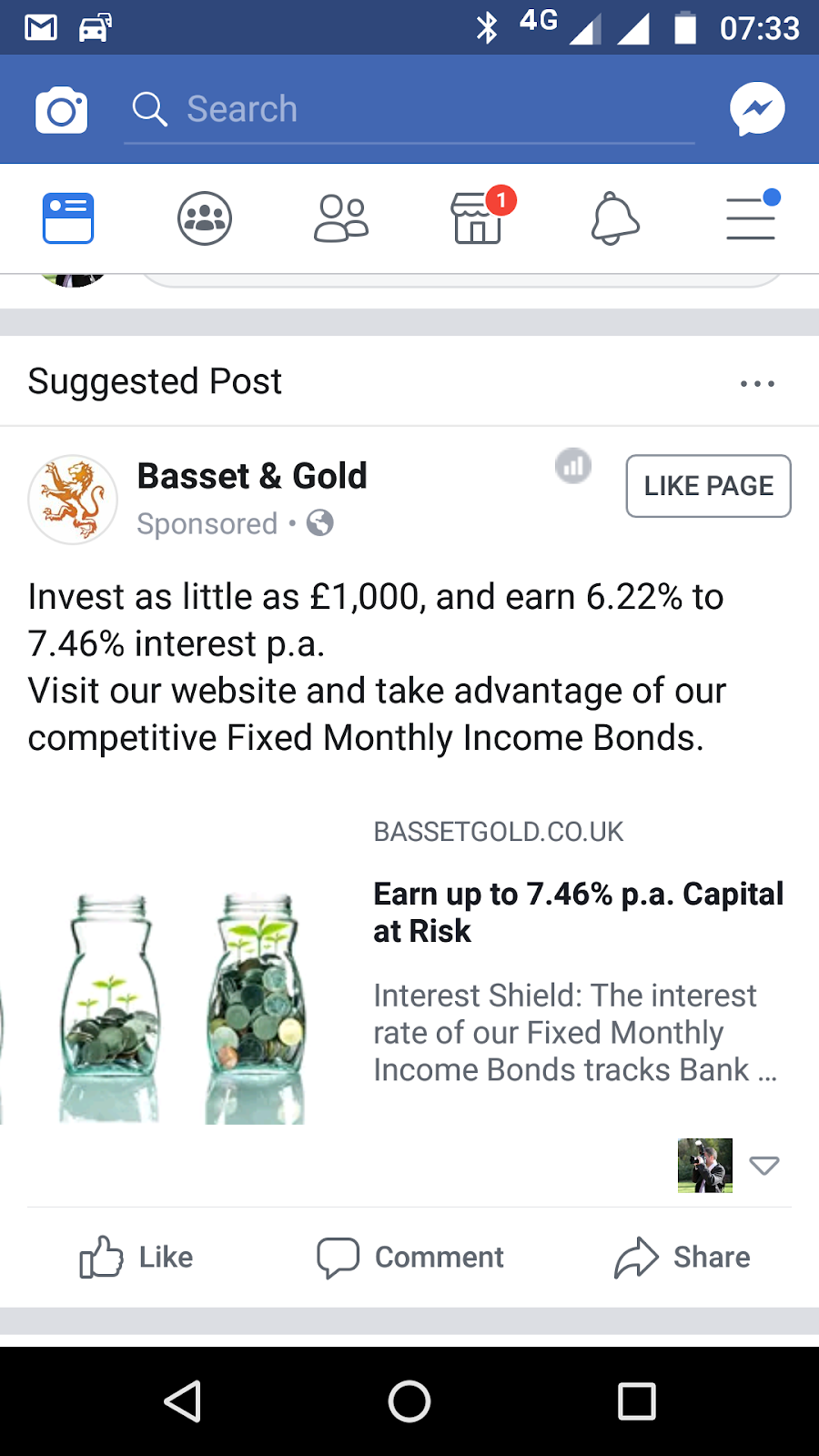

They seem to be varying the interest rate for different products, it does mention Capital at Risk but as per the OP it seems that people ignore/miss that bit as all the comments and messages downplay any risk!Without a doubt too good to be true.

https://damn-lies-and-statistics.blogspot.com/2018/04/basset-gold-bond-review-too-good-true.htmlRemember the saying: if it looks too good to be true it almost certainly is.0 -

Very broadly, you can look at the yield and consider that close to the expected failure rate. So, a 1 in 10 chance of losing all your money.

The expected failure rate is in my opinion considerably higher than that.

I can name three examples of this type of bond that have collapsed with total losses to investors. I can name none that returned interest and capital to all investors and then exited without further investment. If anyone can name 27 unregulated ultra-high-risk minibonds that were promoted to the public, and successfully exited returning all monies due to investors and then closed without further investment (thus generating a failure rate of 1 in 10), I will give them a fiver.

Note that I am specifically talking about unregulated minibonds offered to the public. P2P loans, bonds listed on a recognised exchange, and bonds that weren't marketed to the general public don't count.

The yield has nothing to do with the expected failure rate whatsoever. 8-10% appears to be the sweet spot for attracting investors who are blase about the risks of investing in an unregulated ultra-high-risk minibond. Lower than 8% and they don't leave the regulated arena. Higher than 10% and they start asking questions.longleggedhair wrote: »Company only established in July last year. Don't touch it with somebody else's barge pole!

Actually Basset & Gold was effectively established in August 2015 when a formerly dormant company known as Bladegold Limited was taken over by the current directors and renamed.0 -

Malthusian wrote: »Actually Basset & Gold was effectively established in August 2015 when a formerly dormant company known as Bladegold Limited was taken over by the current directors and renamed.

The underlying company is B&G Finance Ltd. I suspect that the name including the word Gold is being used to convey more of a sense of authenticity and respectability by association with the shiny metal.

This quote on their website though is complete garbage

"We ensure that your investments are aligned with our interests"

Their interests are making money from you, not quite sure how that helps your investment.

One of their other products is called a Cash Bond and claimed to be "A great savings rate with easy access to your cash" yet the capital is still at risk and there is zero mention of that in the website details.Remember the saying: if it looks too good to be true it almost certainly is.0 -

There is some more info about B&G here

https://www.leaprate.com/forex/executives/former-ads-securities-exec-jamieson-blake-joins-specialty-lender-basset-and-gold/

Strangely the B&G website makes no mention of the job titles of the people mentioned and doesn't give surnames on the page but the page above says:

Basset and Gold is controlled by UK-Israeli attorney and businesswoman Dina Benzaquen. Although she is listed in the staff on their page there is no indication she runs the company.

They obviously are doing pretty well from all the money they're taking in from selling these bonds, the staff are all going to Ascot expenses paid with free bar!

https://www.linkedin.com/feed/update/urn:li:activity:6410827176010145792/Remember the saying: if it looks too good to be true it almost certainly is.0 -

With these high risk mini bonds it's important to understand if their business model is valid and able to fund the promised returns.

Unfortunately it is also the part they tend to gloss over.

On their web site they state:Basset & Gold provides financing for online marketplace lenders and direct debt facilities. This means that we mostly provide facility loans directly to platforms, who then in turn provide online loans through their websites.

Sounds suspiciously like handing money over to Funding Circle who only aim for (and don't guarantee) 7.2% on a Balanced Lending model. Where is the rest coming from?0 -

Basset and Gold is controlled by UK-Israeli attorney and businesswoman Dina Benzaquen. Although she is listed in the staff on their page there is no indication she runs the company.

Curious. Companies House says that Basset & Gold is controlled by Hadar Swersky (also an Israeli) as of April 2018.

According to the last accounts, the investment consists entirely of loans to River Bloom Limited, a company domiciled in Cyprus. As to what River Bloom Limited do with the money, who knows. Even Basset & Gold's own auditors haven't been allowed to view River Bloom's accounts. (See the "emphasis of matter" on page 7.)0 -

Providing institutional debt or equity finance to the operators of P2P platforms or into direct lending opportunities funds is not the same as being a retail customer of a P2P site and signing up to the 'balanced' basket of loans for which a guide rate of 7.2% is suggested.they state:

Sounds suspiciously like handing money over to Funding Circle who only aim for (and don't guarantee) 7.2% on a Balanced Lending model. Where is the rest coming from?

Much as my ord or pref shares or bonds with Lloyds don't pay the same as the 0.35% on one of my savings accounts with them.0

This discussion has been closed.

Categories

- All Categories

- 343.3K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608.1K Mortgages, Homes & Bills

- 173.1K Life & Family

- 248K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards