Your correction strategy?

Options

Comments

-

I'm retired and have a 75/25 asset allocation because I don't really need my portfolio for retirement income. I've stopped rebalancing to implement a "rising glide path" as I get older. So my strategy is to change absolutely nothing and continue to put any cash over my two year's worth of spending buffer into equities.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

-

I've just chucked a further £1K into my VLS60/40...on top of my £700 monthly payments. The price is lower than Jan /Feb when I started this journey. I'm £600 down on my £35K portfolio ..a few weeks back I was £1500 up....in it for the long term, well at least the next 10 years.0

-

Overall strategy here is to buy funds in sectors (and geographies) which have the potential for large gains, while at the same time staying reasonably diversified. This includes holding a significant amount of cash, which is also a great way to add some diversity as well as fulfilling multiple other functions. Without cash, the portfolio gets "gunked up". Cash lubricates!

Buying volatile funds is not a problem. The more volatile the better (within reason) since the gains are potentially larger when coming out of a dip.

When a correction comes along, my strategy is to buy whatever looks attractive to me at the lowest possible price, obviously. I try to hold enough cash so I can make at least 2 or 3 significant buys, each around 4-8% of my portfolio's total value. That gives me a few attempts to get a good price.

That's not how it worked out this time. I bought too soon (PCT on Tuesday), and only had enough for one buy. I had been close to selling one of the other funds (which has done well) prior to the dip, but the dip beat me to it.

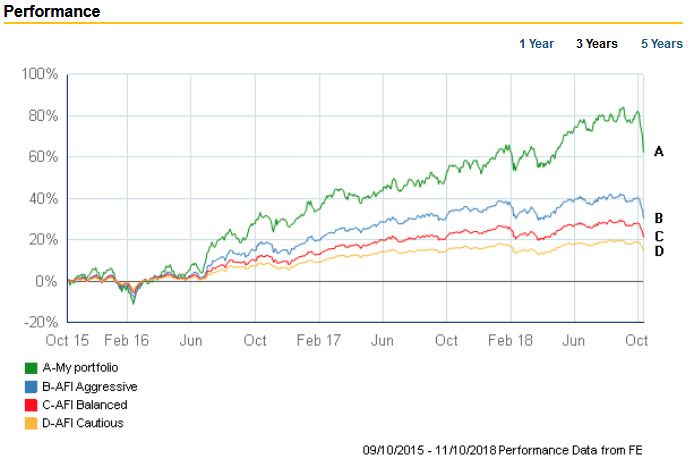

So I missed out a little this time, but not bothered since I have a long investing horizon, and the main component of my strategy is to remain invested/let gains compound over time. Rebalancing my portfolio via timed buys rather than by random has worked well for me so far. I've been doing it for nearly 3 years now so by no means is my strategy fully tested, but I think it looks like it could cope with a serious downrun, and still come out ahead (given a long enough "run up").

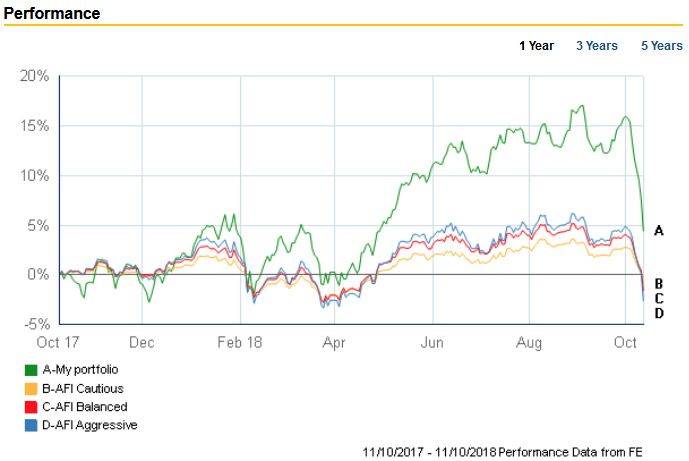

Here's my portfolio's performance over a year. The dip might look a bit scary, but put it into context, with a 3 year chart...

The dip might look a bit scary, but put it into context, with a 3 year chart...

Caveats: Not sure how accurately TN tracks my portfolio in terms of charting, but it should give a rough idea, and of course, the portfolio is a few months under 3y.0 -

I've just chucked a further £1K into my VLS60/40...on top of my £700 monthly payments. The price is lower than Jan /Feb when I started this journey. I'm £600 down on my £35K portfolio ..a few weeks back I was £1500 up....in it for the long term, well at least the next 10 years.

Sounds like you are in it for the medium term then in which case VLS60 is a good choice for that. Not sure what you are hoping VLS40 will do for you over 10 years. This might be a good chance to simplify to just VLS60?

Alex0 -

Let's assume, for the sake of this thread, that the current market wobble becomes a larger correction and let's assume you have some 'cash' waiting to be invested in the market. What is your strategy for investing and why? All in now (time in the markets)? Drip feed it in (cost averaging)?? Wait until an xx% pullback and then all in (buy low, sell high)??? Curious as to people's investment strategies at such a time!

What's your objective and what's your time frame?

There's many variables to the questions you are asking. One size may not fit all.0 -

Your portfolio graph looks solid.

Do you mind sharing your portfolio allocation details?

I am trying to create a diversified portfolio for my sipp.

I understand everyones goal and risk appetite is different.BrockStoker wrote: »Overall strategy here is to buy funds in sectors (and geographies) which have the potential for large gains, while at the same time staying reasonably diversified. This includes holding a significant amount of cash, which is also a great way to add some diversity as well as fulfilling multiple other functions. Without cash, the portfolio gets "gunked up". Cash lubricates!

Buying volatile funds is not a problem. The more volatile the better (within reason) since the gains are potentially larger when coming out of a dip.

When a correction comes along, my strategy is to buy whatever looks attractive to me at the lowest possible price, obviously. I try to hold enough cash so I can make at least 2 or 3 significant buys, each around 4-8% of my portfolio's total value. That gives me a few attempts to get a good price.

That's not how it worked out this time. I bought too soon (PCT on Tuesday), and only had enough for one buy. I had been close to selling one of the other funds (which has done well) prior to the dip, but the dip beat me to it.

So I missed out a little this time, but not bothered since I have a long investing horizon, and the main component of my strategy is to remain invested/let gains compound over time. Rebalancing my portfolio via timed buys rather than by random has worked well for me so far. I've been doing it for nearly 3 years now so by no means is my strategy fully tested, but I think it looks like it could cope with a serious downrun, and still come out ahead (given a long enough "run up").

Here's my portfolio's performance

Caveats: Not sure how accurately TN tracks my portfolio in terms of charting, but it should give a rough idea, and of course, the portfolio is a few months under 3y.0 -

bhavikbuzz wrote: »Your portfolio graph looks solid.

Do you mind sharing your portfolio allocation details?

I am trying to create a diversified portfolio for my sipp.

I understand everyones goal and risk appetite is different.

Currently:

19.5% Polar Capital Biotechnology R Inc

15.7% Polar Capital Technology Trust

15.5% Baillie Gifford Japanese Smaller Companies B Acc

11.5% Artemis Global Energy R Acc

7.9% Worldwide Healthcare

7.4% Schroder Recovery Fund Z Inc

6.5% Stewart Investors Indian Subcontinent A Acc

5.2% Guinness Asian Equity Income Fund X D

5.0% The Biotech Growth Trust PLC

4.2% A certain ETF which has done well for me but not included in my TN portfolio/the charts I posted in my previous posts

2.0% Cash

For comparison, TN tells me that the combined FE risk score for that portfolio (not including the ETF) is 119, which is comparable to the FTSE 100 index, but my portfolio leaves the FTSE 100 in the dust in terms of performance, at least in the short time I've had this strategy implemented.

I should also note that I take about 3% of my portfolio as income every year, which is another reason I always hold at least some cash, and usually around 10-15%.

Regarding "risk appetite", I don't see holding a portfolio like this over a long time horizon as risky, although the individual funds, if held in a different combination or alone might be. I don't think my strategy would work as well with significantly less risky funds.

What would be the point in trying to time the market for only a 3-4% gain? I'm usually looking for at least around a 10% boost initially, with hopefully plenty more gains to follow (if I picked right).

I should also say that the aim of this portfolio is to double my initial investment over the course of 5-10 years (then repeat), as well as provide me with some income, so it (and the constituent funds) need to be super-aggressive. My over all philosophy is that the best defense is a good offense, at least initially. At some point after a decade or two I will de-risk. In the mean time, I'm building a cash moat while the sun is shinning.0 -

Sounds like you are in it for the medium term then in which case VLS60 is a good choice for that. Not sure what you are hoping VLS40 will do for you over 10 years. This might be a good chance to simplify to just VLS60?

Alex

My current weighting is 73% VLS60 and 24% VLS40 and the rest in cash.I guess I'm cautious. I'm retired, early 50's with a decent pension, another one to come in seven years. The 10 year time frame is really just guide in my head not to touch any of it or lose sleep when there is a correction / crash. I accept I'm new at this but simply wanted my savings to work harder than a Santander 123 account etc over the next decade or so. .0 -

BrockStoker wrote: »Currently:

19.5% Polar Capital Biotechnology R Inc

15.7% Polar Capital Technology Trust

15.5% Baillie Gifford Japanese Smaller Companies B Acc

11.5% Artemis Global Energy R Acc

7.9% Worldwide Healthcare

7.4% Schroder Recovery Fund Z Inc

6.5% Stewart Investors Indian Subcontinent A Acc

5.2% Guinness Asian Equity Income Fund X D

5.0% The Biotech Growth Trust PLC

4.2% A certain ETF which has done well for me but not included in my TN portfolio/the charts I posted in my previous posts

2.0% Cash

For comparison, TN tells me that the combined FE risk score for that portfolio (not including the ETF) is 119, which is comparable to the FTSE 100 index, but my portfolio leaves the FTSE 100 in the dust in terms of performance, at least in the short time I've had this strategy implemented.

I should also note that I take about 3% of my portfolio as income every year, which is another reason I always hold at least some cash, and usually around 10-15%.

Regarding "risk appetite", I don't see holding a portfolio like this over a long time horizon as risky, although the individual funds, if held in a different combination or alone might be. I don't think my strategy would work as well with significantly less risky funds.

What would be the point in trying to time the market for only a 3-4% gain? I'm usually looking for at least around a 10% boost initially, with hopefully plenty more gains to follow (if I picked right).

I should also say that the aim of this portfolio is to double my initial investment over the course of 5-10 years (then repeat), as well as provide me with some income, so it (and the constituent funds) need to be super-aggressive. My over all philosophy is that the best defense is a good offense, at least initially. At some point after a decade or two I will de-risk. In the mean time, I'm building a cash moat while the sun is shinning.

Do you fancy joining the GBIO https://forums.moneysavingexpert.com/showthread.php?t=5719517 normally it would be a bit late to join but recent events have moved the goal posts a bit.0 -

BrockStoker wrote: »Currently:

19.5% Polar Capital Biotechnology R Inc

15.7% Polar Capital Technology Trust

15.5% Baillie Gifford Japanese Smaller Companies B Acc

11.5% Artemis Global Energy R Acc

7.9% Worldwide Healthcare

7.4% Schroder Recovery Fund Z Inc

6.5% Stewart Investors Indian Subcontinent A Acc

5.2% Guinness Asian Equity Income Fund X D

5.0% The Biotech Growth Trust PLC

4.2% A certain ETF which has done well for me but not included in my TN portfolio/the charts I posted in my previous posts

2.0% Cash

Wow....that's pretty high octane tbh......strap yourself in!......;)0

This discussion has been closed.

Categories

- All Categories

- 343.2K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608.1K Mortgages, Homes & Bills

- 173.1K Life & Family

- 247.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards