We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Tax Return Query

vixen1500

Posts: 655 Forumite

in Cutting tax

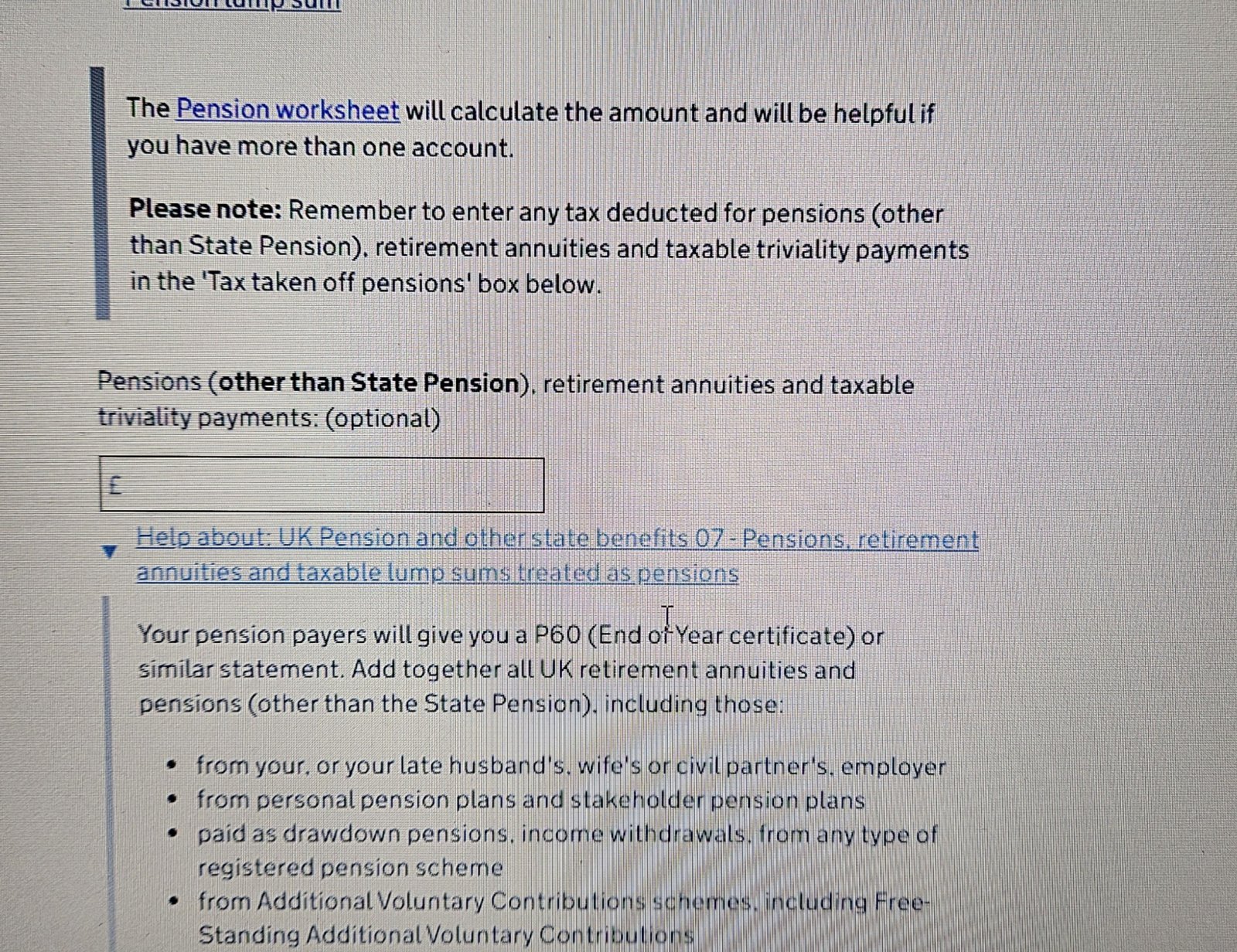

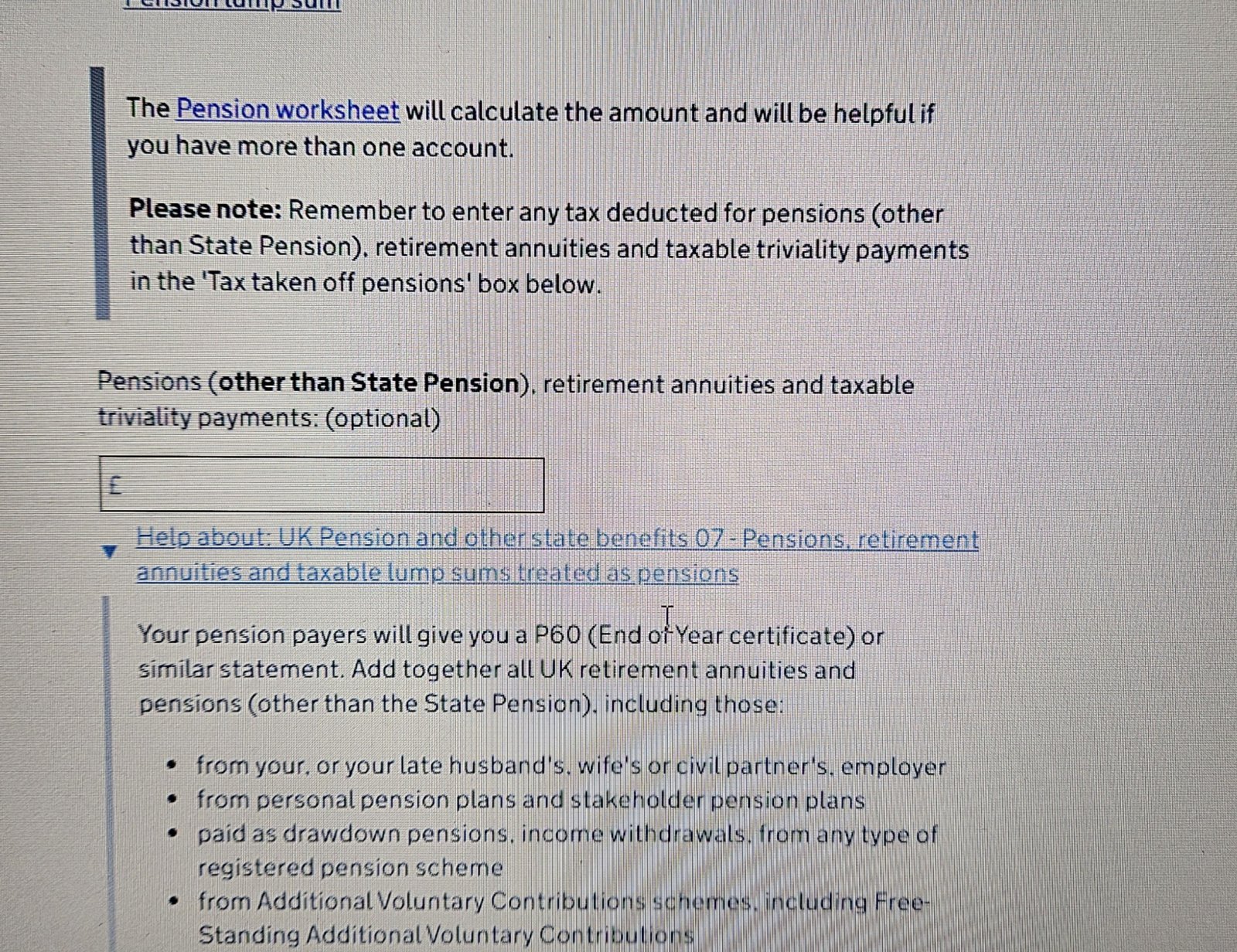

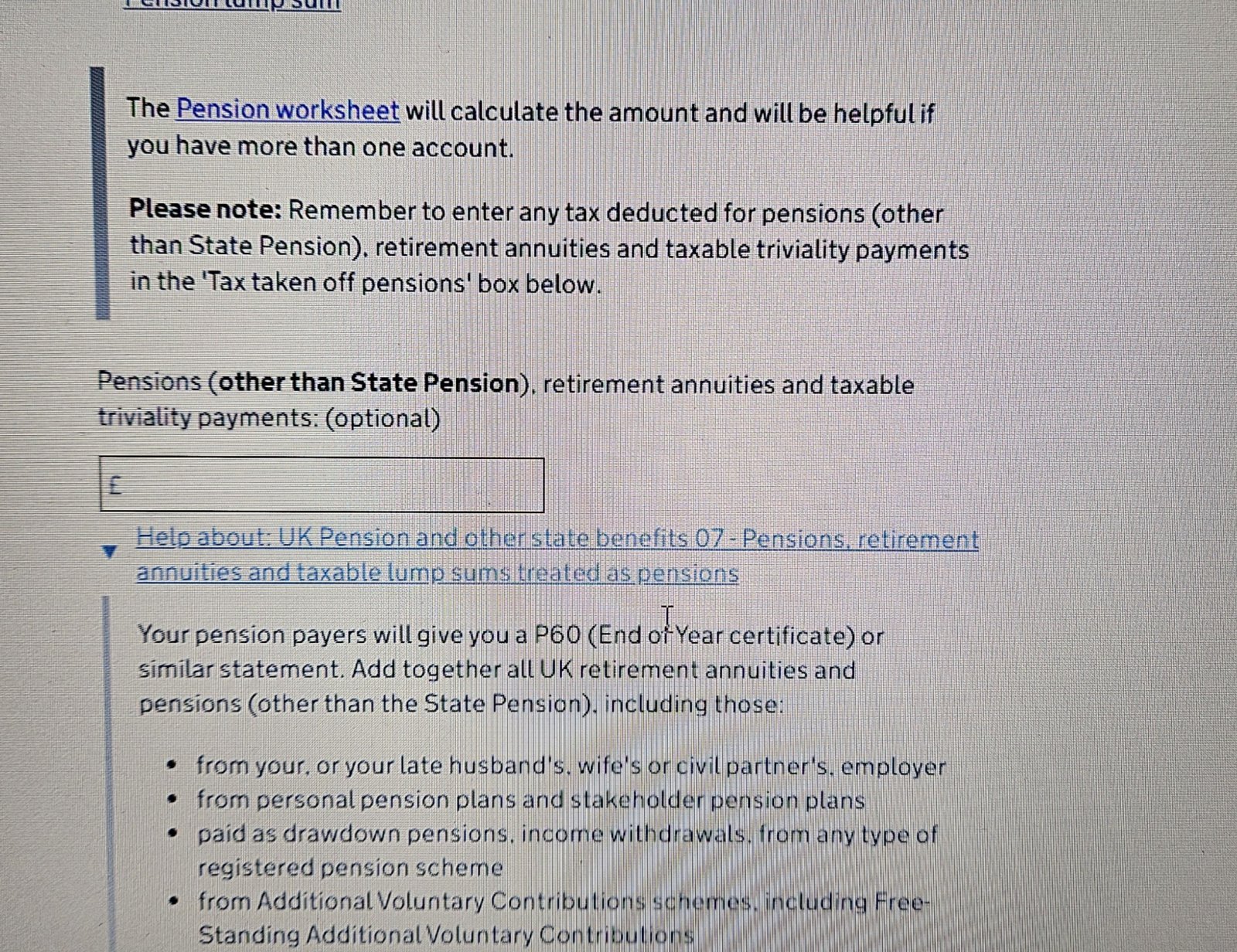

Still trying to complete my tax return and confused by why some questions are marked as optional.

I assume I should enter total received from my SIPP (but uncertain whether this figure should include the tax free part) plus pension from employer.

But as it says it is optional, can I just leave it blank? Though if I do wont this alter the amount of tax due?

I assume I should enter total received from my SIPP (but uncertain whether this figure should include the tax free part) plus pension from employer.

But as it says it is optional, can I just leave it blank? Though if I do wont this alter the amount of tax due?

Typically confused and asking for advice

0

Comments

-

Presumably it’s optional so that people who haven’t received any other pensions don’t have to fill it in.Credit card 1700

Overdraft 210

2026 EF 100/3000

All I want is a weather forecast saying there'll be more weather.0 -

They are optional as HMRC cannot possibly know which section applies to each person.vixen1500 said:Still trying to complete my tax return and confused by why some questions are marked as optional.

I assume I should enter total received from my SIPP (but uncertain whether this figure should include the tax free part) plus pension from employer.

But as it says it is optional, can I just leave it blank? Though if I do wont this alter the amount of tax due?

They aren't optional in the sense you can pick and choose which to complete. If you had taxable pension income in that tax year then you need to declare that.

It is unclear precisely what you mean by the "tax free part" but if you a tax free lump sum or pension commencement lump sum then no you wouldn't need to include that in that part of the return. However if you mean part of your taxable pension income which didn't have tax deducted then yes, you would still have to declare that.2 -

You should have a P60 from your pension company showing the gross amount paid and the tax deducted for the year.vixen1500 said:Many thanks. The tax free part I am referring to is my SIPP withdrawal £4,000 25% tax free = £3,000.

Not sure which figure I should add to my pension from employer (this I assume needs to gross figure?)

Then below I put in tax taken off.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards