We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Gilts and accrued interest in self-assessment 2024-5

kidwell25

Posts: 58 Forumite

in Cutting tax

I'm doing a self-assessment for the first time and just want to be sure I'm treating my gilts correctly. I didn't have any gilts prior to April 2024. I bought the following in the 24-25 tax year on these dates. I've included the accrued interest shown on the respective contract notes

Because of the timings, I didn't receive any coupon on the TR43 that year, and my coupons on the T26 and T26A only totalled £35.65. So in the section on interest from gilts, when I'm asked for the gross amount before tax, should that be MINUS £151.39?

| Date | Gilt | Accrued interest |

| 17/04/2024 | T26 | 2.96 |

| 19/08/2024 | T26A | 14.66 |

| 05/11/2024 | TR43 | 31.8 |

| 20/12/2024 | TR43 | 25.58 |

| 07/01/2025 | TR43 | 53.09 |

| 15/01/2025 | TR43 | 58.95 |

| Total | 187.04 |

Because of the timings, I didn't receive any coupon on the TR43 that year, and my coupons on the T26 and T26A only totalled £35.65. So in the section on interest from gilts, when I'm asked for the gross amount before tax, should that be MINUS £151.39?

0

Comments

-

No

Ignore TR43 until 2025/6 (just don't forget about it). You can offset the T26 and T26A figures in 2024/5.0 -

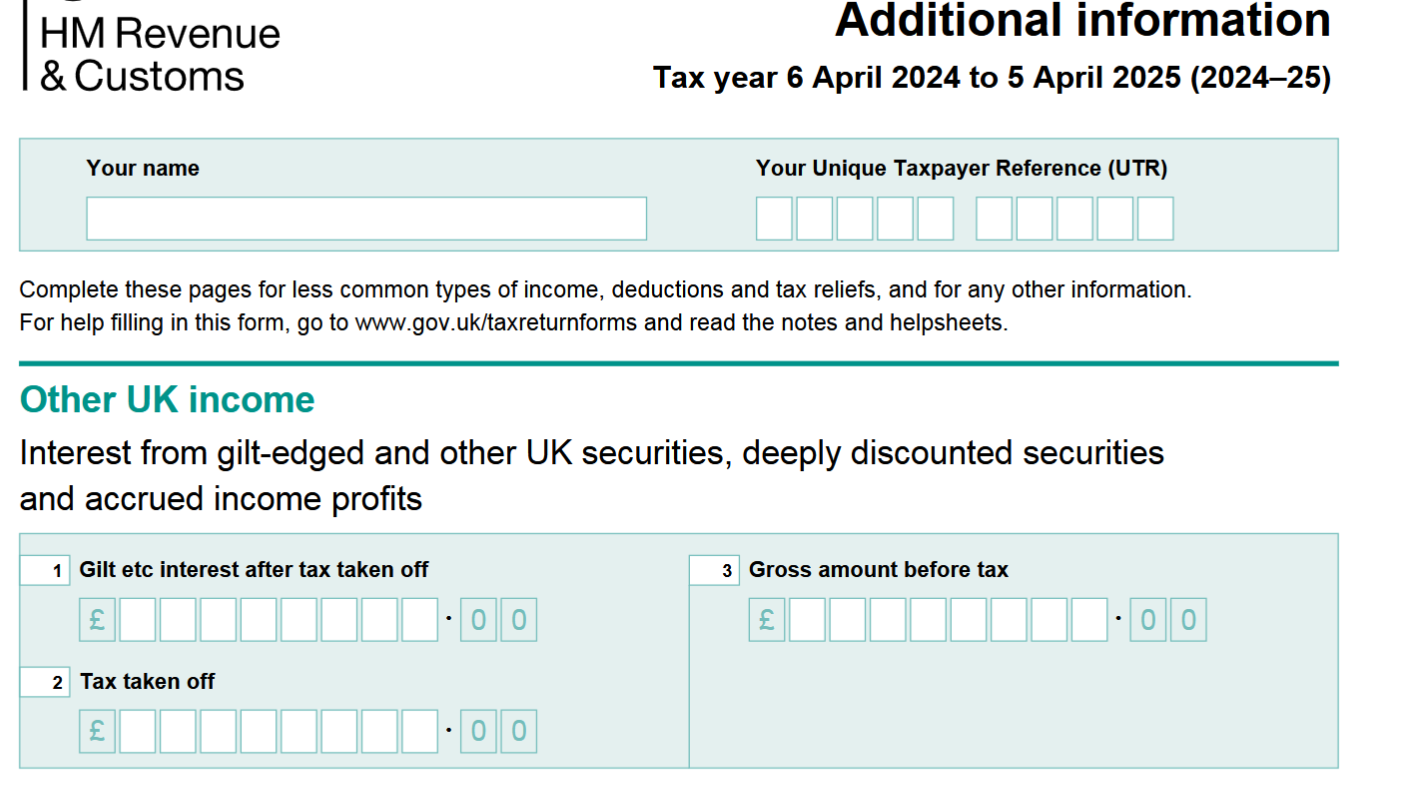

The accrued interest is deducted from the next coupon after purchase, and the tax year when that next interest payment (coupon) after purchase is paid determines which tax year is relevantThe first interest payment on TR43 after purchase is 22/4/2025 (and that applies to all 4 purchases). So the first taxable interest payment is the 22/4/2025 interest payment that falls in the 2025/2026 tax year. For 2024/2025 there is no interest from TR43 to include. In a year's time for 2025/2026 you will include the actual interest payments paid on 22/4/2025 and 22/10/2025 less the accrued interest on purchase of 169.42 (= 31.80 + 25.58 + 53.09 + 58.95).For T26 the first interest payment (coupon) after purchase was 30/7/2024. And the second and only other interest payment in the 2024/2025 tax year was on 30/1/2025. So you calculate the first interest payment less the accrued interest (2.96) plus the second interest payment as the relevant interest figure.For T26A the first interest payment after purchase was 22/10/2024 and that was the only interest payment in the 2024/2025 tax year. So you calculate the first interest payment less the accrued interest (14.66) as the relevant interest figure.In the Additional Information part of the tax return leave boxes 1 and 2 blank and fill in box 3 with the amounts above for T26 and T26A. Based on your figure for the total coupons paid on 30/7/2024, 30/1/2025 and 22/10/2024 of 35.65, it's 18.03 (= 35.65 - 2.96 - 14.66) that should be entered in box 3.

I came, I saw, I melted0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards