We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Annuities - why all the hate?

Comments

-

MarzipanCrumble said:I have a SIPP (approx 250k untouched) and am 74; I have a higher tax income ...

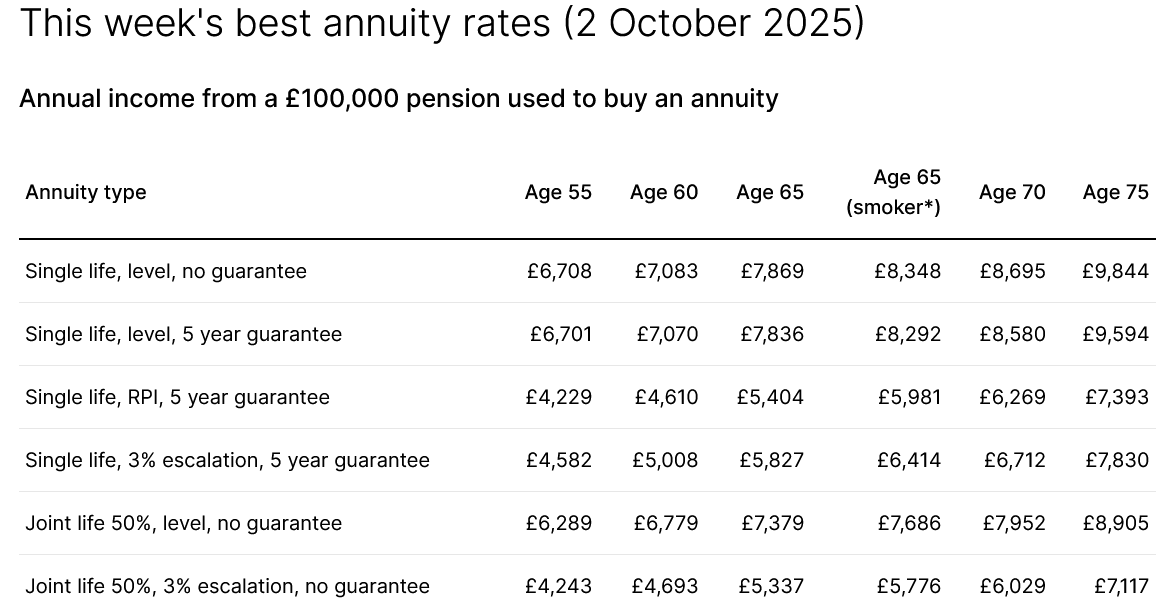

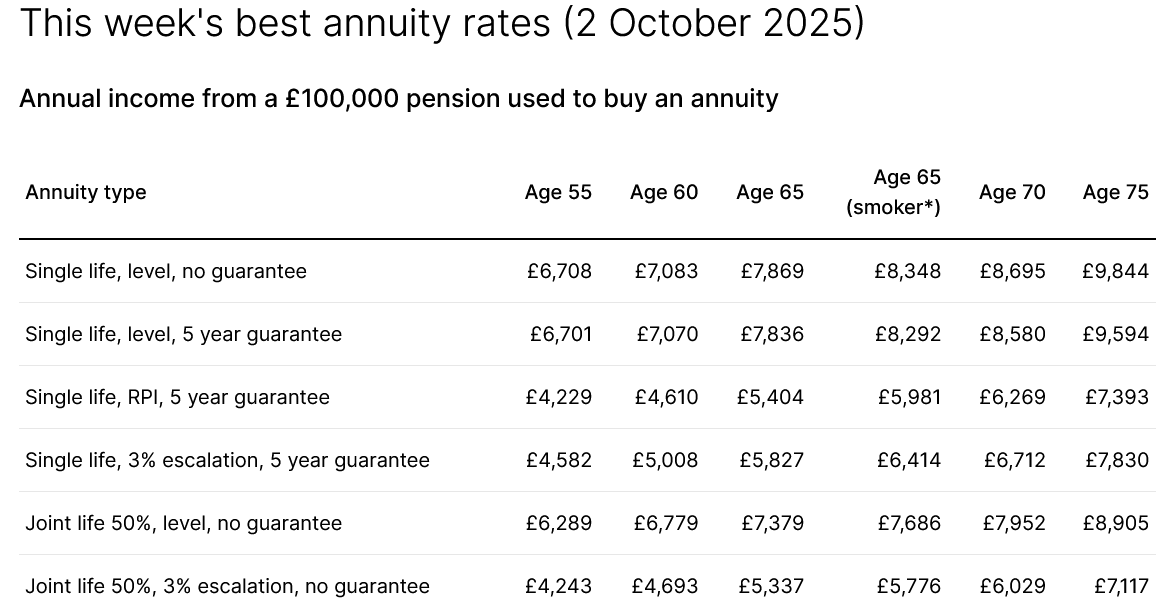

So..... I am thinking of converting my SIPP to an annuity. I am way into IHT territory. I would gift (surplus to income) the proceeds to my offspring. I keep records already proving I have surplus to income capacity.Assuming you's qualify the 25% TFLS, that would give you £62.5k cash-in-hand and £187.5k for the annuity.Here's the current HL best buy table: Using the Age 75 column, £187.5k would buy you a level annuity with no guarantee of circa £18.5k pa gross, £11.1k pa after 40% tax.If you'd rather have an RPI link, you'd get £13.9k pa gross, £8.3k pa net of tax.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

Using the Age 75 column, £187.5k would buy you a level annuity with no guarantee of circa £18.5k pa gross, £11.1k pa after 40% tax.If you'd rather have an RPI link, you'd get £13.9k pa gross, £8.3k pa net of tax.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

That sounds a good plan.MarzipanCrumble said:I have a SIPP (approx 250k untouched) and am 74; I have a higher tax income from my DB and widow pensions, one of which is an annuity bought 2009 by husband, 50% spouse survial income (me) and 4% inflation rise pa. Very, very grateful for that. It pays roughly 9k pa now. Originally it paid about 11k pa until OH died 2011.

So..... I am thinking of converting my SIPP to an annuity. I am way into IHT territory. I would gift (surplus to income) the proceeds to my offspring. I keep records already proving I have surplus to income capacity.

I am really not interested in the stress or research to maximise a SIPP via drawdown and checking its subsequent growth.

I really see this as a solution to bringing SIPPs into IHT territory in that if I need the income I can stop giving to offspring.

One thing I would suggest, in addition to the records that you keep, is to write an IHT GIFT from surplus income letter to your offspring detailing the arrangement and keep a copy in your files. If you do a google search you will find good template examples. I picked up this tip from a recent seminar I attended on estate planning.1 -

Although I would not assume that this surplus income route will last for ever. Maybe even only until November 26th .....Fermion said:

That sounds a good plan.MarzipanCrumble said:I have a SIPP (approx 250k untouched) and am 74; I have a higher tax income from my DB and widow pensions, one of which is an annuity bought 2009 by husband, 50% spouse survial income (me) and 4% inflation rise pa. Very, very grateful for that. It pays roughly 9k pa now. Originally it paid about 11k pa until OH died 2011.

So..... I am thinking of converting my SIPP to an annuity. I am way into IHT territory. I would gift (surplus to income) the proceeds to my offspring. I keep records already proving I have surplus to income capacity.

I am really not interested in the stress or research to maximise a SIPP via drawdown and checking its subsequent growth.

I really see this as a solution to bringing SIPPs into IHT territory in that if I need the income I can stop giving to offspring.

One think I would suggest, in addition to the records that you keep, is to write an IHT GIFT from surplus income letter to your offspring detailing the arrangement and keep a copy in your files. If you do a google search you will find good template examples. I picked up this tip from a recent seminar I attended on estate planning.1 -

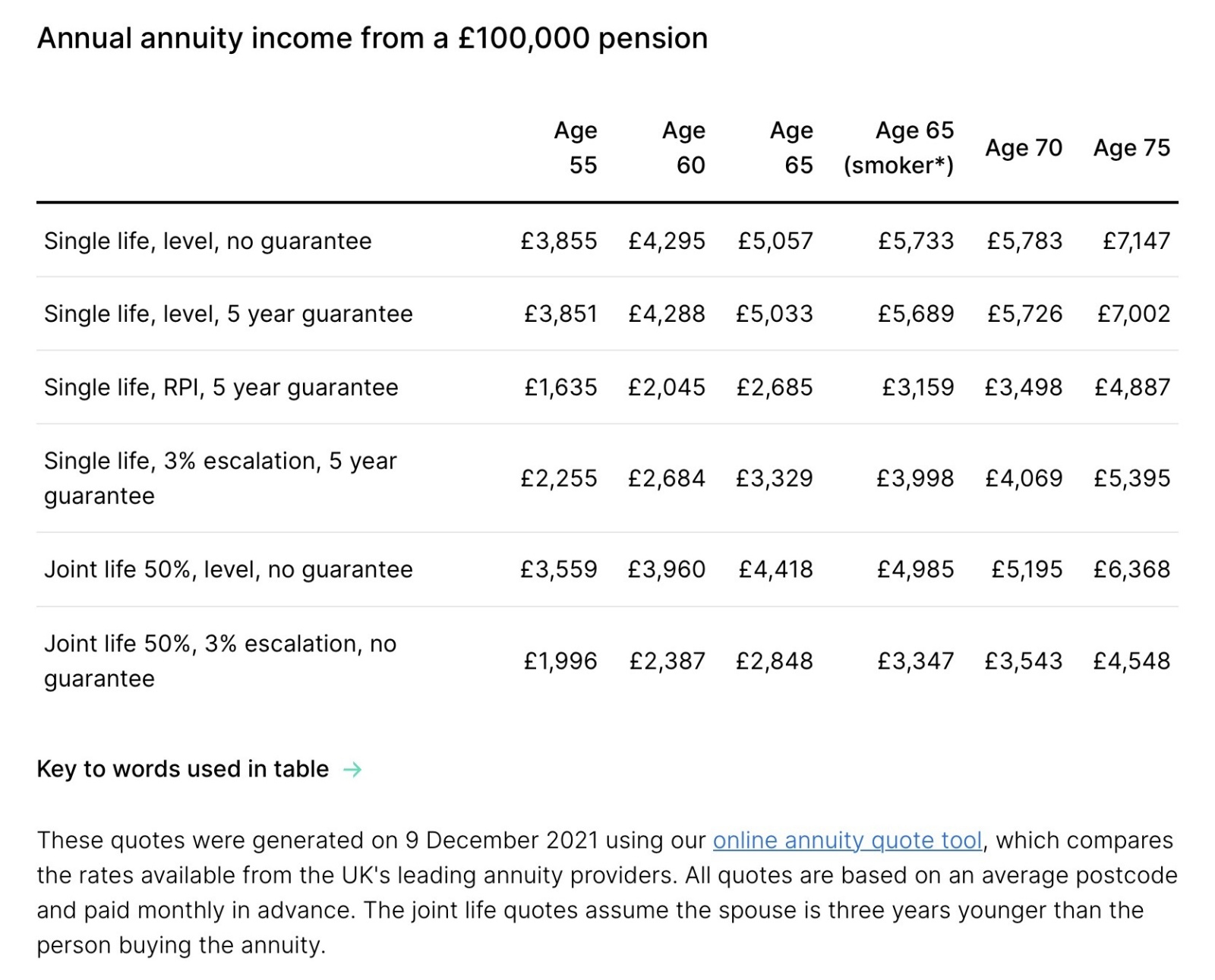

Compare those with these from December 2021!QrizB said:MarzipanCrumble said:I have a SIPP (approx 250k untouched) and am 74; I have a higher tax income ...

So..... I am thinking of converting my SIPP to an annuity. I am way into IHT territory. I would gift (surplus to income) the proceeds to my offspring. I keep records already proving I have surplus to income capacity.Assuming you's qualify the 25% TFLS, that would give you £62.5k cash-in-hand and £187.5k for the annuity.Here's the current HL best buy table: Using the Age 75 column, £187.5k would buy you a level annuity with no guarantee of circa £18.5k pa gross, £11.1k pa after 40% tax.If you'd rather have an RPI link, you'd get £13.9k pa gross, £8.3k pa net of tax.

Using the Age 75 column, £187.5k would buy you a level annuity with no guarantee of circa £18.5k pa gross, £11.1k pa after 40% tax.If you'd rather have an RPI link, you'd get £13.9k pa gross, £8.3k pa net of tax.

1 -

Picking up from the recent annuity IHT discussion, along with "gifts from excess income", I think it's also important to consider a guarantee period and the market value to any beneficiaries. Dying early without a guarantee period would be a way for an annuity to destroy an inheritance.And so we beat on, boats against the current, borne back ceaselessly into the past.0

-

As a side question, can surplus income also include if you choose to draw down your pension and have spare money left over from that each year?0

-

"As a side question, can surplus income also include if you choose to draw down your pension and have spare money left over from that each year?"

I believe (but cannot remember the reference) gifts from drawdown can only be Gifts From Income if the drawdown and giving are part of an ongoing regular pattern. Drawing down a large one-off lump sum and giving it all away wont work.

The question as to whether giving away all spare income at the end of the year counts as a regular pattern is as far as I know the only GFI question that has ever gone to the courts. In this case the judge ruled that although the amounts varied it did meet the criterion as he could see no legal reason why it shouldn't.

0 -

This is my understanding too. You have to be doing things regularly and that might be your annuity payments or the same amount every month from a SIPP. Of course the large single gift option above the annual gift allowance is also available and will become part of the 7 year IHT taper. Excess income gifts cannot be made from your capital, but I think SIPP drawdown counts as income in this case and there is no distinction made in annuity payments for how much is interest and how much return of capital, but that's just my reading for the HMRC manual.Linton said:

"As a side question, can surplus income also include if you choose to draw down your pension and have spare money left over from that each year?"

I believe (but cannot remember the reference) gifts from drawdown can only be Gifts From Income if the drawdown and giving are part of an ongoing regular pattern. Drawing down a large one-off lump sum and giving it all away wont work.

The question as to whether giving away all spare income at the end of the year counts as a regular pattern is as far as I know the only GFI question that has ever gone to the courts. In this case the judge ruled that although the amounts varied it did meet the criterion as he could see no legal reason why it shouldn't.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

So, Mrs Arty and I start drawing down £100k each every year. We can demonstrate that this is not an excessive amount relative to what we have earned through work in the past. We only spend half that, and decide we'll give the other half to our kids every year from then on. Naturally, this will all be carefully documented as gifts out of surplus income.

Sounds like we are either good here, or the makings of a test case for HMRC should we kick the bucket early...1 -

This is an interesting view.artyboy said:So, Mrs Arty and I start drawing down £100k each every year. We can demonstrate that this is not an excessive amount relative to what we have earned through work in the past. We only spend half that, and decide we'll give the other half to our kids every year from then on. Naturally, this will all be carefully documented as gifts out of surplus income.

Sounds like we are either good here, or the makings of a test case for HMRC should we kick the bucket early...

Just imagine a person used a million pounds that they had lying around to buy a purchased life annuity, maybe a 3 or 5 year term, maybe a one year term and has no need need for that considerable income, completely surplus income.

I'm guessing that person could just vent that 1M + very efficiently from a potential IHT point of view.

With April 2027 and SIPP/IHT rules changing approaching, HMRC will be looking to close any spill doors or probably change stuff a year later after people have set in place systems to work around and just add to that view that planning is more luck than skill.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards