We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The inevitable pre-budget speculation on pensions

Comments

-

Is it most people though?NoMore said:The point of the 2% increase in income tax and 2% decrease in ni is that for most people it will make little (none?)difference to their take home

According to ONS, around 30 million are in pay-rolled employment:

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/october2025

Some of those will not pay Employee's NI.

Also according to ONS, population of the country is a little under 70 million:

https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2024

30 million is a minority of 70 million.

1 -

RogerPensionGuy said:

With the current blackhole, economic outlook/GDP/age demographics etc and having in place a sensible headroom for the following few budgets, pulling a fair few levers looks very likely to me.Cobbler_tone said:Today I have read about a 2p increase on IC and 2p reduction on NI. Reducing or scrapping NI relief on salary sacrifice. Reducing the TFLS to £100k. Extending the freeze on tax bands.

They may not do any of them but at the same time could do all of them. If they did I think some posters on here would go into meltdown. Being close to retirement could mean a case of damage limitation but I’m sure they’ll be an impact somewhere but hopefully not enough to change my plans.

Only one item comes to mind that they won't pull on, state pension tripple lock.

We will see on the 26th.Shame, it’s breaking the economy, and quite frankly society.0 -

Exactly. The govt wants to reduce the cost to the state of pensioners, and since they cannot/will not tackle the triple lock (let alone the universal pension) they are generating more tax revenue from them. It seems perfectly logical, even though it will cost me.NoMore said:The point of the 2% increase in income tax and 2% decrease in ni is that for most people it will make little (none?)difference to their take home but people who pay income tax and little to no ni it will make a difference. Pension income being a big one.1 -

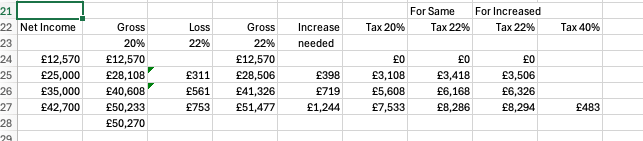

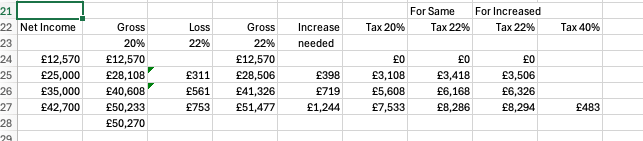

A further twist in the rumour mill. So it sounds likeukdw said:Re the latest speculation relating to increasing -the basic rate of income tax from 20% to 22%.If no other allowances change - then thinking about this from people taking a range of net pensions.2% doesn't sound that much - but it is a 10% increase. If my calculations are correct, then for someone currently on £25k net - they will lose £311 in extra tax if they don't increase their level of drawdown. To get back to £25k they would need to increase drawdown by £398 gross (from £28,108 to £28,506).At the other end of the 20% scale. Someone currently on £42.7k net - would lose £753 if they leave their gross at £50,233. To get that £753 back - they would need to push their gross up into the 40% band - by £1,244 I think (from £50,233 to £51,477).What are you going to do if it happens - the choices seem to be:1. Leave current gross drawdown level as is, pay more tax and get less income.2. Increase drawdown to get the same income back and pay even more tax.3. Lower drawdown amounts - to pay the same or less tax, and accept an even lower income.I will probably just leave my drawdown untouched and accept the extra tax hit and income loss.

If my calculations are correct, then for someone currently on £25k net - they will lose £311 in extra tax if they don't increase their level of drawdown. To get back to £25k they would need to increase drawdown by £398 gross (from £28,108 to £28,506).At the other end of the 20% scale. Someone currently on £42.7k net - would lose £753 if they leave their gross at £50,233. To get that £753 back - they would need to push their gross up into the 40% band - by £1,244 I think (from £50,233 to £51,477).What are you going to do if it happens - the choices seem to be:1. Leave current gross drawdown level as is, pay more tax and get less income.2. Increase drawdown to get the same income back and pay even more tax.3. Lower drawdown amounts - to pay the same or less tax, and accept an even lower income.I will probably just leave my drawdown untouched and accept the extra tax hit and income loss.

20% band up to 22%.

8% NI band down to 6%.

40% tax band up to 42%,

60% tax band up to 64%, (I think)

45% tax band up to 47%.

2% NI band left as is.

Total gain - mainly from pensioners & landlords and top third of earners - about £6bn according to my newspaper.

So my previous calculation may need to be tweaked a bit as people going into the 40% band to offset the £751 loss will now be going into the 42% band - so will need a bigger increase.

I presume the changes won't go into effect until 6/4/26.

I wonder if is worth maximising the 40% band for the rest of the current tax year - if it is going up to 42% (and maybe even higher in later years).

Also makes me wonder whether the IHT rate might go to 42% too.0 -

Don't forget that they.might close salary sacrifice for pension contributions as well!0

-

ukdw said:

A further twist in the rumour mill. So it sounds likeukdw said:Re the latest speculation relating to increasing -the basic rate of income tax from 20% to 22%.If no other allowances change - then thinking about this from people taking a range of net pensions.2% doesn't sound that much - but it is a 10% increase. If my calculations are correct, then for someone currently on £25k net - they will lose £311 in extra tax if they don't increase their level of drawdown. To get back to £25k they would need to increase drawdown by £398 gross (from £28,108 to £28,506).At the other end of the 20% scale. Someone currently on £42.7k net - would lose £753 if they leave their gross at £50,233. To get that £753 back - they would need to push their gross up into the 40% band - by £1,244 I think (from £50,233 to £51,477).What are you going to do if it happens - the choices seem to be:1. Leave current gross drawdown level as is, pay more tax and get less income.2. Increase drawdown to get the same income back and pay even more tax.3. Lower drawdown amounts - to pay the same or less tax, and accept an even lower income.I will probably just leave my drawdown untouched and accept the extra tax hit and income loss.

If my calculations are correct, then for someone currently on £25k net - they will lose £311 in extra tax if they don't increase their level of drawdown. To get back to £25k they would need to increase drawdown by £398 gross (from £28,108 to £28,506).At the other end of the 20% scale. Someone currently on £42.7k net - would lose £753 if they leave their gross at £50,233. To get that £753 back - they would need to push their gross up into the 40% band - by £1,244 I think (from £50,233 to £51,477).What are you going to do if it happens - the choices seem to be:1. Leave current gross drawdown level as is, pay more tax and get less income.2. Increase drawdown to get the same income back and pay even more tax.3. Lower drawdown amounts - to pay the same or less tax, and accept an even lower income.I will probably just leave my drawdown untouched and accept the extra tax hit and income loss.

20% band up to 22%.

8% NI band down to 6%.

40% tax band up to 42%,

60% tax band up to 64%, (I think)

45% tax band up to 47%.

2% NI band left as is.

Total gain - mainly from pensioners & landlords and top third of earners - about £6bn according to my newspaper.

So my previous calculation may need to be tweaked a bit as people going into the 40% band to offset the £751 loss will now be going into the 42% band - so will need a bigger increase.

I presume the changes won't go into effect until 6/4/26.

I wonder if is worth maximising the 40% band for the rest of the current tax year - if it is going up to 42% (and maybe even higher in later years).

Also makes me wonder whether the IHT rate might go to 42% too.That looks highly unlikely to me; as this is a massive change to income tax.

Such change would raise more than £6bn I would have thought?

Almost looks like the Scottish rates!0 -

If the bands increase it wouldn’t make sense not to tackle reducing relief paying into a pension. The obvious thing that would happen is people just paying extra into their pensions, as opposed to paying the tax. Granted, they’d still get taxed extra on the remainder and when getting it out. If there are work arounds people will quickly work them out.JoeCrystal said:Don't forget that they.might close salary sacrifice for pension contributions as well!0 -

Increasing IT by 2% and reducing NI by the same amount makes no sense to me and I am confident no such thing will happen.

I am also confident that there will be no changes to pension saving incentives.0 -

Suppose if you repeat a mantra often enough some people will start to believe it.BlackKnightMonty said:RogerPensionGuy said:

With the current blackhole, economic outlook/GDP/age demographics etc and having in place a sensible headroom for the following few budgets, pulling a fair few levers looks very likely to me.Cobbler_tone said:Today I have read about a 2p increase on IC and 2p reduction on NI. Reducing or scrapping NI relief on salary sacrifice. Reducing the TFLS to £100k. Extending the freeze on tax bands.

They may not do any of them but at the same time could do all of them. If they did I think some posters on here would go into meltdown. Being close to retirement could mean a case of damage limitation but I’m sure they’ll be an impact somewhere but hopefully not enough to change my plans.

Only one item comes to mind that they won't pull on, state pension tripple lock.

We will see on the 26th.Shame, it’s breaking the economy, and quite frankly society.0 -

The tax and NI jiggle, if it happens, would mean that Labour can claim that they are sticking to their promise not to increase taxes for 'working people'. Pensioners - including those who still work, but who are exempt NI - were never made any such promises.westv said:Increasing IT by 2% and reducing NI by the same amount makes no sense to me and I am confident no such thing will happen.

I am also confident that there will be no changes to pension saving incentives.2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards