We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How to query vat payment on a second hand item from usa

cerddoriaeth

Posts: 3 Newbie

in Cutting tax

Hi,

I've just been charged full vat on a second hand item I ordered from the USA. Cost $300 approx. This would have been zero VAT if I'd bought it here in the UK, does any one know the rate I should pay for this? And if I've been charged wrongly, how do I reclaim?

Thanks in advance!

I've just been charged full vat on a second hand item I ordered from the USA. Cost $300 approx. This would have been zero VAT if I'd bought it here in the UK, does any one know the rate I should pay for this? And if I've been charged wrongly, how do I reclaim?

Thanks in advance!

0

Comments

-

What exactly have you been charged and by whom? Don't confuse import duty with VAT.0

-

Second hand goods aren't exempt from VAT. There are exceptions for certain things but even if bought in Britain they can attract VAT under the 'margin scheme.'cerddoriaeth said:Hi,

I've just been charged full vat on a second hand item I ordered from the USA. Cost $300 approx. This would have been zero VAT if I'd bought it here in the UK, does any one know the rate I should pay for this? And if I've been charged wrongly, how do I reclaim?

Thanks in advance!0 -

Thanks for the replies. I was charged duty and VAT. I don't really understand the margin scheme, but that looks like I have to sell the item on and be registered for VAT? The item is just for personal use and is not going to be sold.

I am pretty sure the item would be zero rated (or some other way exempt from VAT) if bought here. It's a part of a vintage guitar and is the same age - the vintage guitar itself was VAT exempt and was bought from a large VAT registered company. Sorry I don't know the technical language for any of this.

Of course parts of an item may be treated differently to a whole item for VAT.

I have now found the form to check and challenge the payment but this forum doesn't allow me to share a link here.

I'll try anyway.

Thanks0 -

cerddoriaeth said:Thanks for the replies. I was charged duty and VAT. I don't really understand the margin scheme, but that looks like I have to sell the item on and be registered for VAT? The item is just for personal use and is not going to be sold.

I am pretty sure the item would be zero rated (or some other way exempt from VAT) if bought here. It's a part of a vintage guitar and is the same age - the vintage guitar itself was VAT exempt and was bought from a large VAT registered company. Sorry I don't know the technical language for any of this.

Of course parts of an item may be treated differently to a whole item for VAT.

I have now found the form to check and challenge the payment but this forum doesn't allow me to share a link here.

I'll try anyway.

ThanksMy point is that second hand goods aren’t as exempt from VAT in Britain as people assume.

What was it classified as on the invoice the importer issued to you? There should be a code(s). You can Google the various duty and VAT rates due on import items and HMRC has a calculator.

https://www.gov.uk/trade-tariff

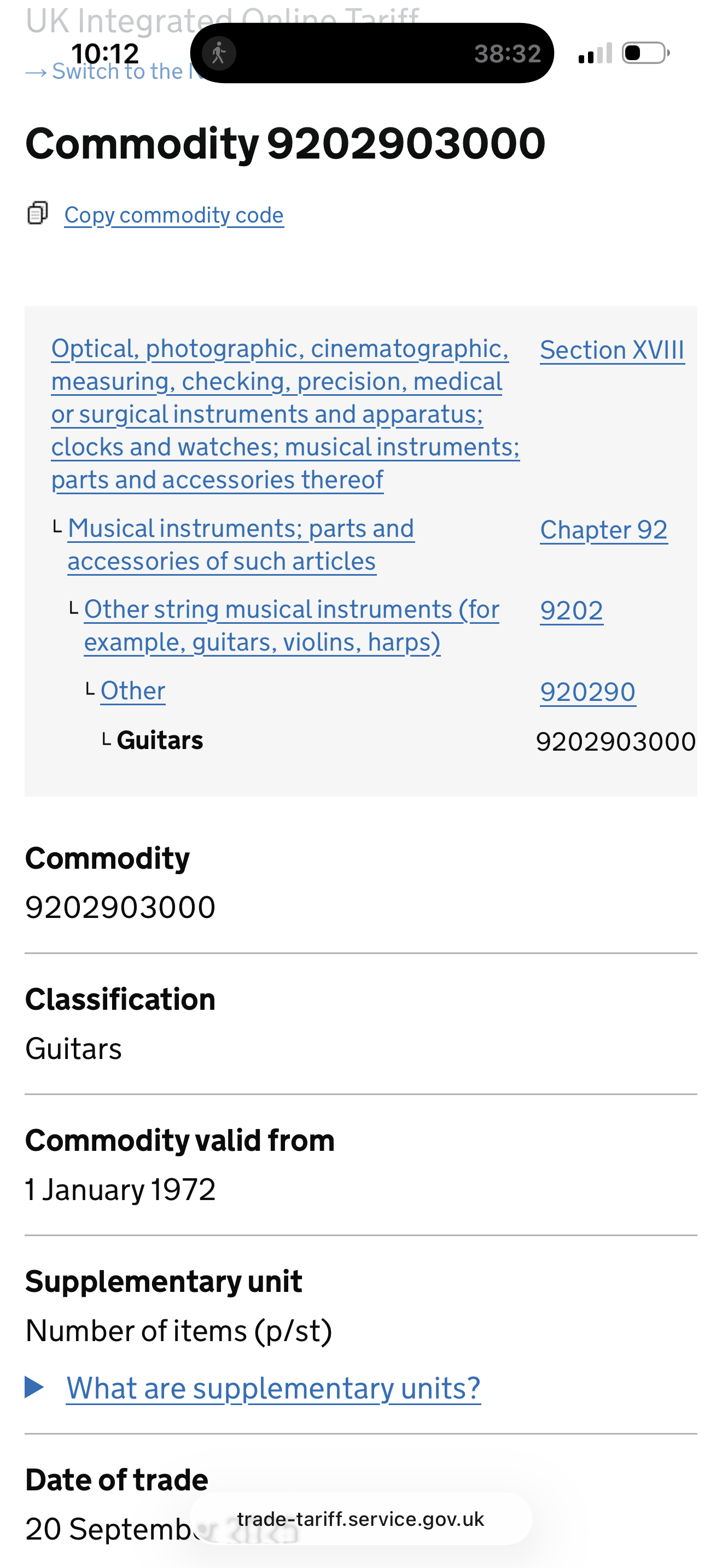

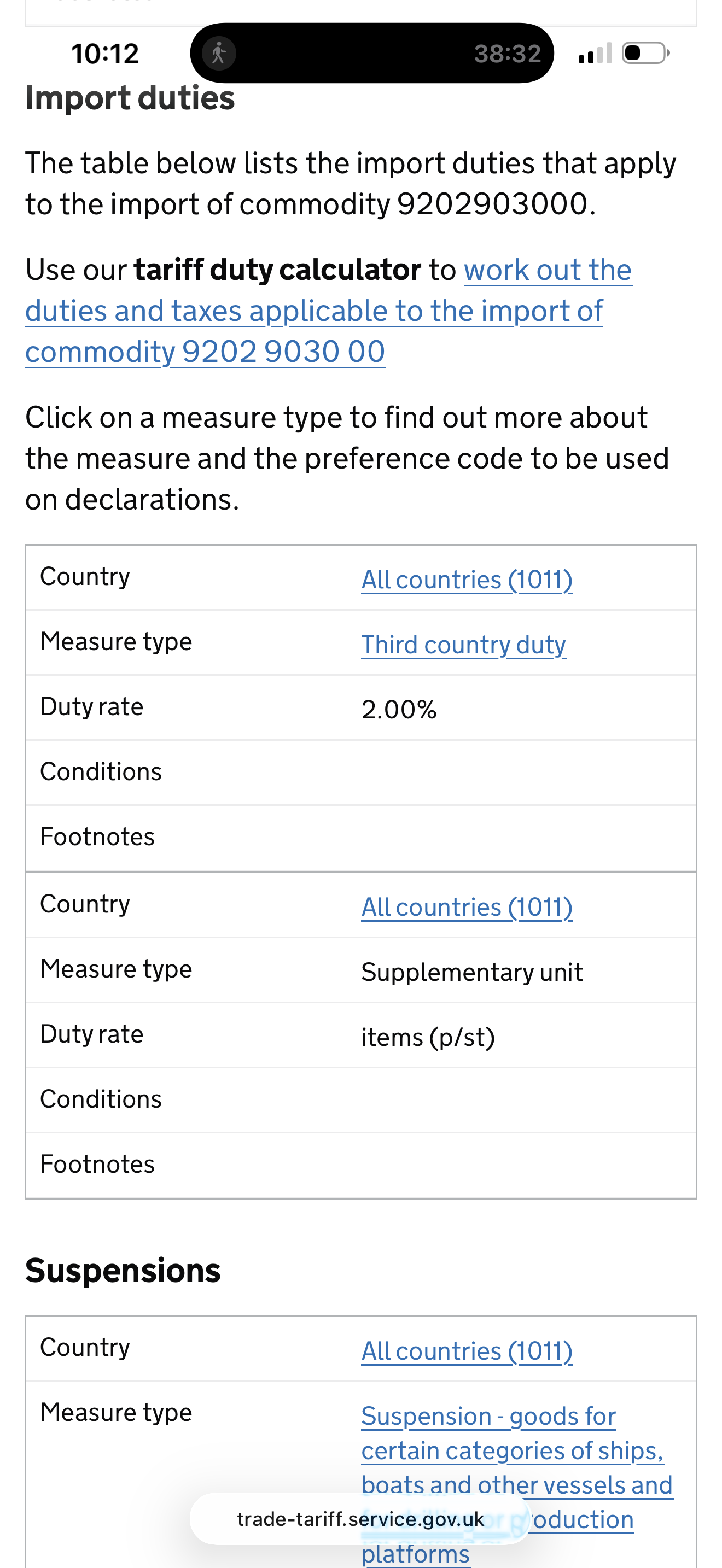

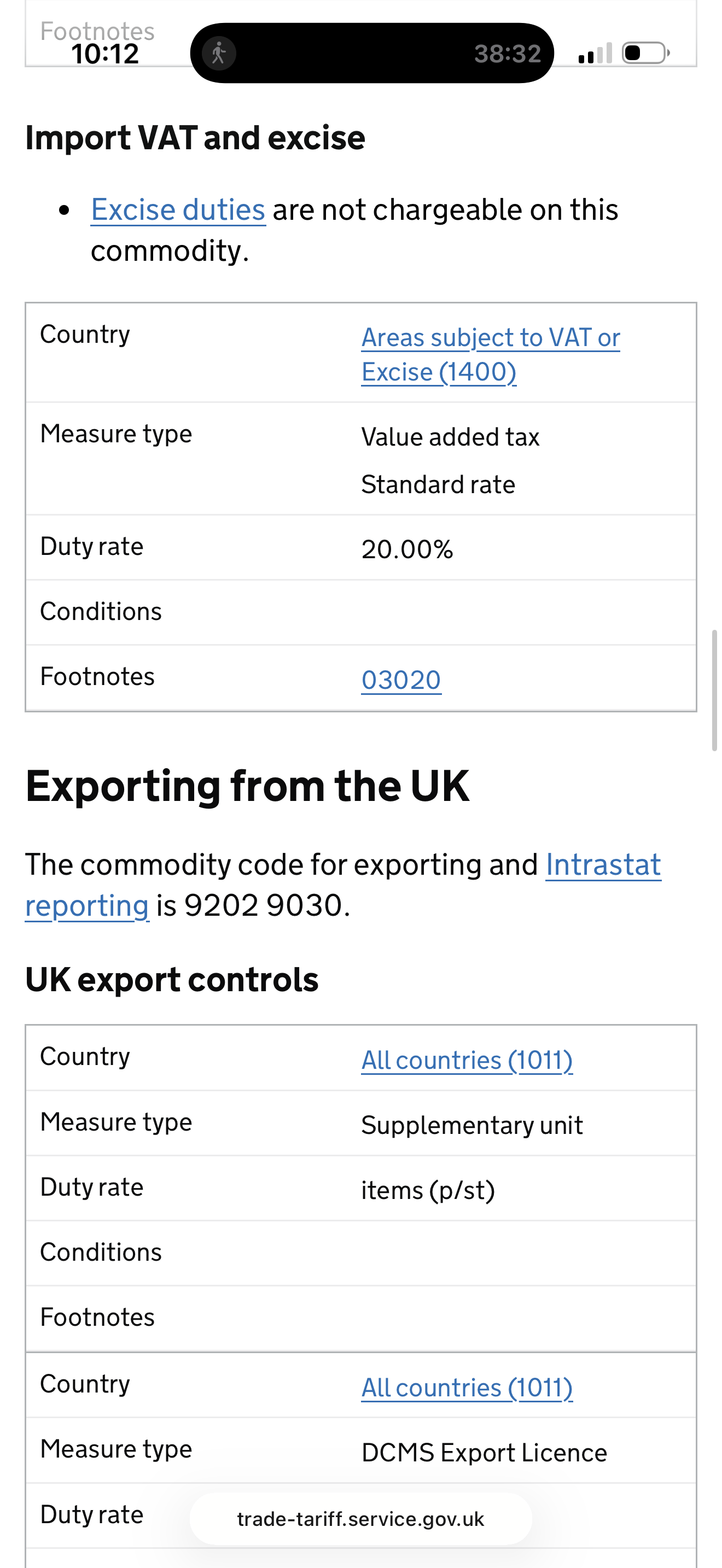

I used HMRC’s calculator to try to find the duty and VAT for electric guitar parts, 9209920000, from the USA and it shows an import duty rate of 2% and VAT of 20%.

1

1 -

So the item was given the code 920994. (Not quite correct as this seems to be instrument cases and stands?) Your suggestion above is electric guitar parts - I'm sure that this won't make a difference but my query is about parts for an acoustic guitar dating to 1938 - just a different code I guess. Obviously not new items.

Does this mean that all vintage guitars and guitar parts should have 20% VAT added regardless of whether they are bought from outside the UK or in the UK? Or does this just apply to sales from outside the UK?

I know the guitar itself was sold as VAT zero rated or VAT exempt. (And the business I bought it from is large, long established and definitely VAT registered.)

Very complicated I can see..

Thanks for the reply!0 -

9209940000 "Parts and accessories for the musical instruments of heading 9207" looks to be 2%/20% as well. That looks to be for amplified instruments but it probably doesn't make any difference: if you work through the different options it all looks to me to be 2%/20%:cerddoriaeth said:So the item was given the code 920994. (Not quite correct as this seems to be instrument cases and stands?) Your suggestion above is electric guitar parts - I'm sure that this won't make a difference but my query is about parts for an acoustic guitar dating to 1938 - just a different code I guess. Obviously not new items.

Does this mean that all vintage guitars and guitar parts should have 20% VAT added regardless of whether they are bought from outside the UK or in the UK? Or does this just apply to sales from outside the UK?

I know the guitar itself was sold as VAT zero rated or VAT exempt. (And the business I bought it from is large, long established and definitely VAT registered.)

Very complicated I can see..

Thanks for the reply!

https://www.trade-tariff.service.gov.uk/chapters/92?country=US&day=20&month=9&year=2025

https://www.trade-tariff.service.gov.uk/headings/9209?country=US&day=20&month=9&year=2025

The point of charging duties and VAT on imports is to persuade people to spend their money in Britain and to reduce the leakage of tax revenue abroad so the Treasury does't care whether or not it would have cost you less here or whether or not it would have attracted British VAT - that'll depend on who you buy it from.

https://www.fedex.com/en-gb/customer-support/faq/duties-taxes-imported-goods/when-do-duties-and-taxes-apply/import-duty-on-second-hand-goods.html

I imported something from Indonesia that was new old stock and don't think I was charged any Indonesian taxes by the shop that sold it but had to pay British duty and VAT. I think that's normal. It is/used to be normal that if you bought something out of state in the US you wouldn't be charged sales tax (US doesn't have VAT) but perhaps those parts are exempt from sales tax in the vendor's state anyway and not all US states/counties have sales tax.

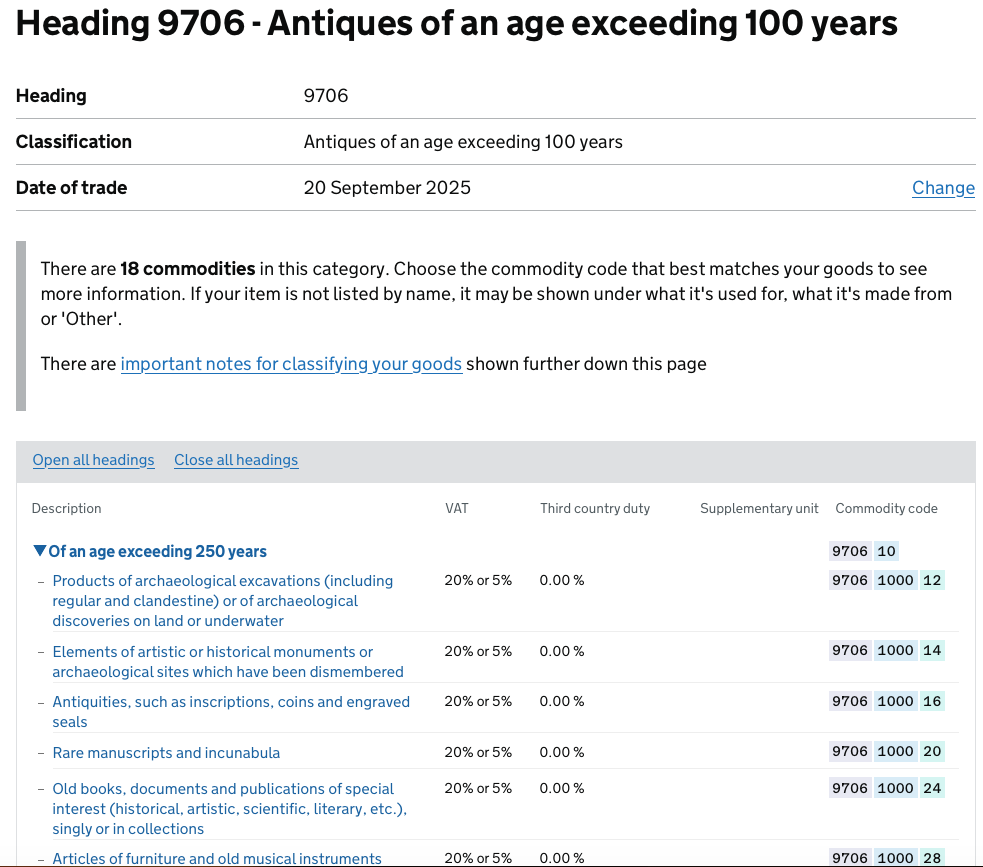

Almost by definition 100+ year old antiques will be second hand but it looks like VAT is still charged on imports:

https://www.trade-tariff.service.gov.uk/headings/9706

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards