We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

TAX ON FULL STATE PENSION APRIL 2027

Comments

-

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:

I think there is a good case to raise the basic rate. Something like 29m pay it, and it is currently just too low and out of keeping with our European neighbours.kinger101 said:

The 60/65 percent tax band also raises very little as people do everything in their power to avoid it.BlackKnightMonty said:Personally I would prefer they lowered the 45% band or pumped it up a bit, to remove the £100k-125k loss of personal allowance. (Which makes for a marginal tax rate of 60% Income tax [65% in Scotland]). It’s encouraging reduced productivity for the high income earners like doctors and other professionals.

If we're going to fill the gap with income tax....

Raising basic rate by 1 p brings in 8 billion

Raising higher rate by 1 p, 2 billion

Additional rate by 1 p,, 0.25 billion

The problem isn't solved by (only) taxing higher earners more.

However there is also a desperate need to reduce spending. PIP, motability, winter fuel allowance, triple locks. There is so much that needs to be addressed.0 -

I think the personal allowance already is too generous, so I would lower it, to say £5k a year.FIREDreamer said:

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:

I think there is a good case to raise the basic rate. Something like 29m pay it, and it is currently just too low and out of keeping with our European neighbours.kinger101 said:

The 60/65 percent tax band also raises very little as people do everything in their power to avoid it.BlackKnightMonty said:Personally I would prefer they lowered the 45% band or pumped it up a bit, to remove the £100k-125k loss of personal allowance. (Which makes for a marginal tax rate of 60% Income tax [65% in Scotland]). It’s encouraging reduced productivity for the high income earners like doctors and other professionals.

If we're going to fill the gap with income tax....

Raising basic rate by 1 p brings in 8 billion

Raising higher rate by 1 p, 2 billion

Additional rate by 1 p,, 0.25 billion

The problem isn't solved by (only) taxing higher earners more.

However there is also a desperate need to reduce spending. PIP, motability, winter fuel allowance, triple locks. There is so much that needs to be addressed.0 -

So what do you think is a reasonable amount of income tax to expect a pensioner, living on just the state pension, to be paying?BlackKnightMonty said:

I think the personal allowance already is too generous, so I would lower it, to say £5k a year.FIREDreamer said:

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:

I think there is a good case to raise the basic rate. Something like 29m pay it, and it is currently just too low and out of keeping with our European neighbours.kinger101 said:

The 60/65 percent tax band also raises very little as people do everything in their power to avoid it.BlackKnightMonty said:Personally I would prefer they lowered the 45% band or pumped it up a bit, to remove the £100k-125k loss of personal allowance. (Which makes for a marginal tax rate of 60% Income tax [65% in Scotland]). It’s encouraging reduced productivity for the high income earners like doctors and other professionals.

If we're going to fill the gap with income tax....

Raising basic rate by 1 p brings in 8 billion

Raising higher rate by 1 p, 2 billion

Additional rate by 1 p,, 0.25 billion

The problem isn't solved by (only) taxing higher earners more.

However there is also a desperate need to reduce spending. PIP, motability, winter fuel allowance, triple locks. There is so much that needs to be addressed.0 -

The same as everyone else.MK62 said:

So what do you think is a reasonable amount of income tax to expect a pensioner, living on just the state pension, to be paying?BlackKnightMonty said:

I think the personal allowance already is too generous, so I would lower it, to say £5k a year.FIREDreamer said:

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:

I think there is a good case to raise the basic rate. Something like 29m pay it, and it is currently just too low and out of keeping with our European neighbours.kinger101 said:

The 60/65 percent tax band also raises very little as people do everything in their power to avoid it.BlackKnightMonty said:Personally I would prefer they lowered the 45% band or pumped it up a bit, to remove the £100k-125k loss of personal allowance. (Which makes for a marginal tax rate of 60% Income tax [65% in Scotland]). It’s encouraging reduced productivity for the high income earners like doctors and other professionals.

If we're going to fill the gap with income tax....

Raising basic rate by 1 p brings in 8 billion

Raising higher rate by 1 p, 2 billion

Additional rate by 1 p,, 0.25 billion

The problem isn't solved by (only) taxing higher earners more.

However there is also a desperate need to reduce spending. PIP, motability, winter fuel allowance, triple locks. There is so much that needs to be addressed.

As for living just on the state pension. That’s their choice. They had a lifetime to make better provision. The state pension is not meant to be generous.0 -

Think you're being just a tad unrealistic there...BlackKnightMonty said:

I think the personal allowance already is too generous, so I would lower it, to say £5k a year.FIREDreamer said:

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:

I think there is a good case to raise the basic rate. Something like 29m pay it, and it is currently just too low and out of keeping with our European neighbours.kinger101 said:

The 60/65 percent tax band also raises very little as people do everything in their power to avoid it.BlackKnightMonty said:Personally I would prefer they lowered the 45% band or pumped it up a bit, to remove the £100k-125k loss of personal allowance. (Which makes for a marginal tax rate of 60% Income tax [65% in Scotland]). It’s encouraging reduced productivity for the high income earners like doctors and other professionals.

If we're going to fill the gap with income tax....

Raising basic rate by 1 p brings in 8 billion

Raising higher rate by 1 p, 2 billion

Additional rate by 1 p,, 0.25 billion

The problem isn't solved by (only) taxing higher earners more.

However there is also a desperate need to reduce spending. PIP, motability, winter fuel allowance, triple locks. There is so much that needs to be addressed.......Gettin' There, Wherever There is......

I have a dodgy "i" key, so ignore spelling errors due to "i" issues, ...I blame Apple 0

0 -

MK62 said:Is there any good reason why a pensioner on £13k a couple of years from now shouldn't pay tax but a low paid part time worker should ?

So what do you think is a reasonable amount of income tax to expect a pensioner, living on just the state pension, to be paying?

At the moment, they pay zero. Even after a few years of further above-inflation rises, it will still be a fairly trivial amount, because you only pay tax on the excess over the tax free allowance. ( When the pension hits £14k and if the allowance hasn't risen, a pensioner will be paying £5.72 per week in income tax.)FIREDreamer said:With those thresholds and rates, everyone earning more than £12570 but less than £50k would be paying less tax, so it's going the wrong direction for balancing government finances. Basically a big Liz Truss style unfunded tax cut.

Basic rate up to 25%, personal allowance up to £20k? How about that?BlackKnightMonty said:With no changes to rates, that's a £1500 tax rise on *everyone* earning above £12570. "A brave choice, minister.", as Sir Humphrey put it.

I think the personal allowance already is too generous, so I would lower it, to say £5k a year.

Combining it with a cut to a 15% basic rate would benefit higher earners above £36k, but people on around £11k to £15k would still be about £1k worse off. That's all the pensioners, among others. Even "braver".

If there were easy answers here, chancellors ( of any party) would be on them like a shot.

1 -

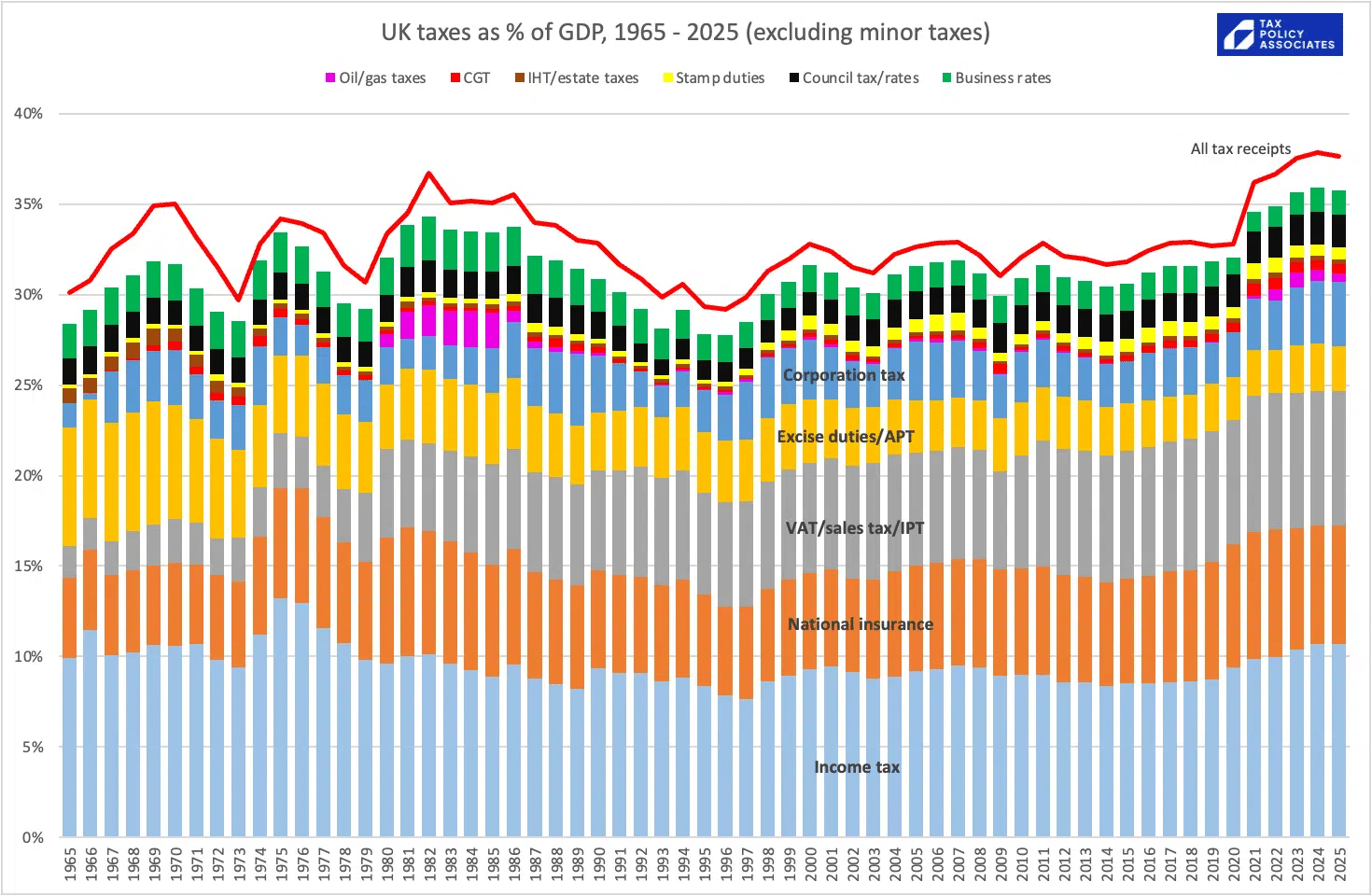

The total UK tax % of GDP is lower than most European nations. Even if Reeves increased the tax burden by another £50bn, we wouldn't be particularly high up the table.

They have a tough choice on where to take more tax and keep a prosperous economy, which we ultimately are.

I do believe though that the benefit system needs a major re-think. I know perfectly able people who just don't need to work with the various handouts given (even in my family). Ok so they aren't wealthy or maybe can't afford a higher lifestyle, but this can't make sense.

It seems virtually every public service is in crisis. It needs a monumental review into everything, an impossible task.

1 -

It is quite interesting to look at the September 2024 Office for Budget Responsibility's long-term expenditure forecast: (all categories accounting for 5% of GDP in any of next 50 years shown, remaining categories grouped)

The big increases in spending as a percentage of GDP are:

The big increases in spending as a percentage of GDP are:- Debt repayments (8.0 percentage points of GDP increase over the next 50 years).

- Health (6.6pp )

- State Pension (3.0pp)

Other areas of increase are:- Adult social care (1.1pp)

- Other pensioner benefits (0.3pp)

The areas that are declining as a share of GDP are:- Other capital spending (-1.5pp)

- Education (-0.8pp)

- Public service pensions (-0.5pp)

- Other spending (-0.5pp)

- Non-pensioner benefits (-0.1pp)

It is stark how much extra expenditure is going to be directed at the elderly in years to come, as things stand. There are very significant age-related spending challenges ahead - as bad as things might seem now, this is very likely to be as good as it gets for many years. Serious changes to tax and spending policies will need to happen, one way or another. They can probably be kicked down the road for a while yet, maybe even the next 20 years, but doing that will just mean greater change at some future point will be needed.3 -

In my opinion all income, state benefits and working and anything that is classed as income should be taxed equally so that it is a level playing field. That would also include child benefit - no exceptions.

I get Sp and very small work pension built up of part time (due to disability it was the maximum I could manage), school hours (TA) work over 25 years. I did my best to be independent and my children are productive, contributing members of society with a high work ethic - i also am special guardian to a child with medical needs who also has a high work ethic.

I am sure there are other pensioners who are like me though agree in a small minority - who have tried their best with what they had. Just a voice pointing out that to ‘pensioners had a life time to sort out good pensions, it is their fault they didn’t’ ‘pensioners have all the money’ posters/thinkers, circumstances sometimes got in the way but they still tried their best.4 -

Perhaps increased property tax is the solution. With so much wealth tied into property. I thought the following chart helpful and illuminating:

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.4K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.2K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards