We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Higher rate relief calculations

Unclefoobar

Posts: 72 Forumite

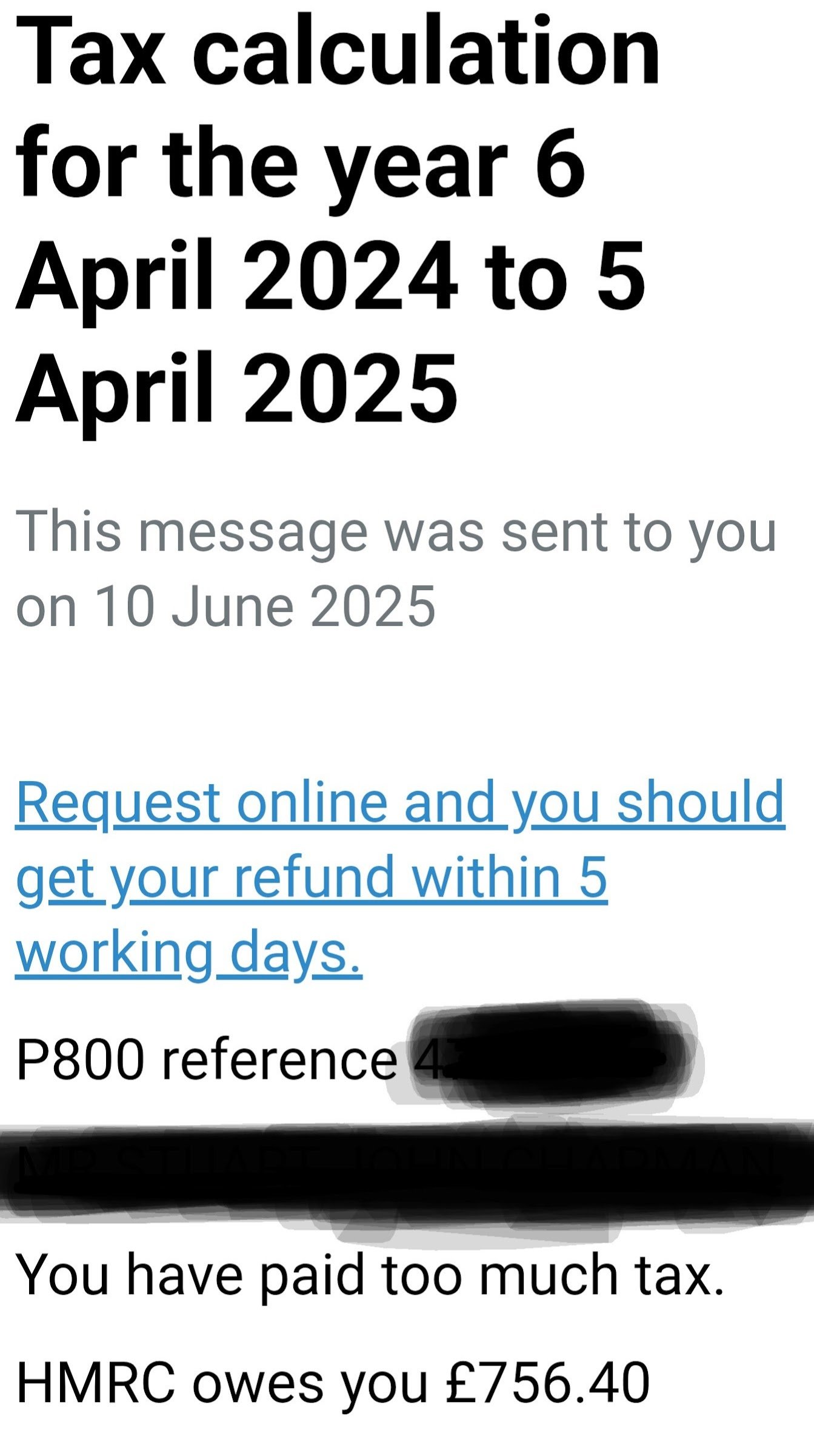

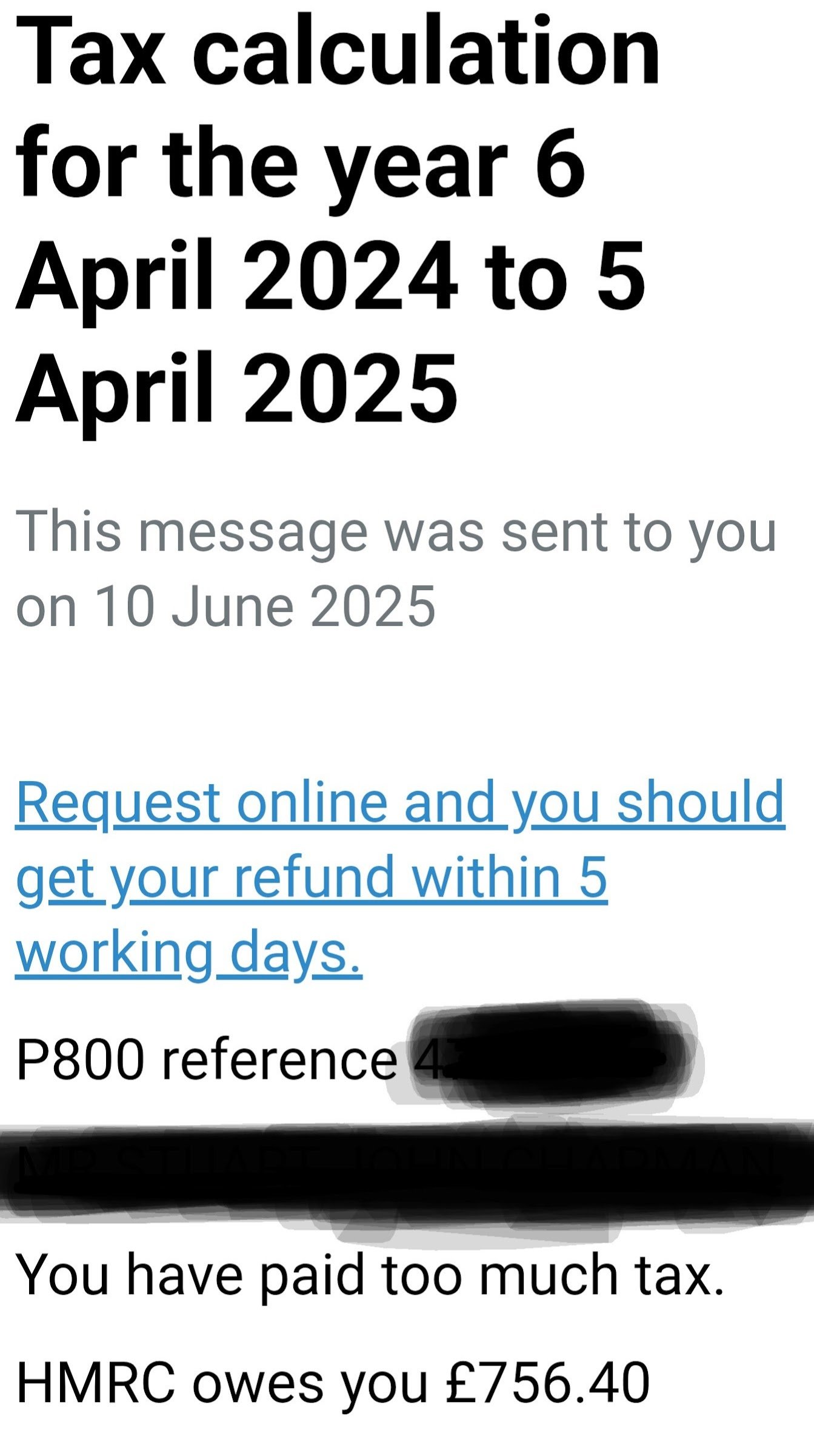

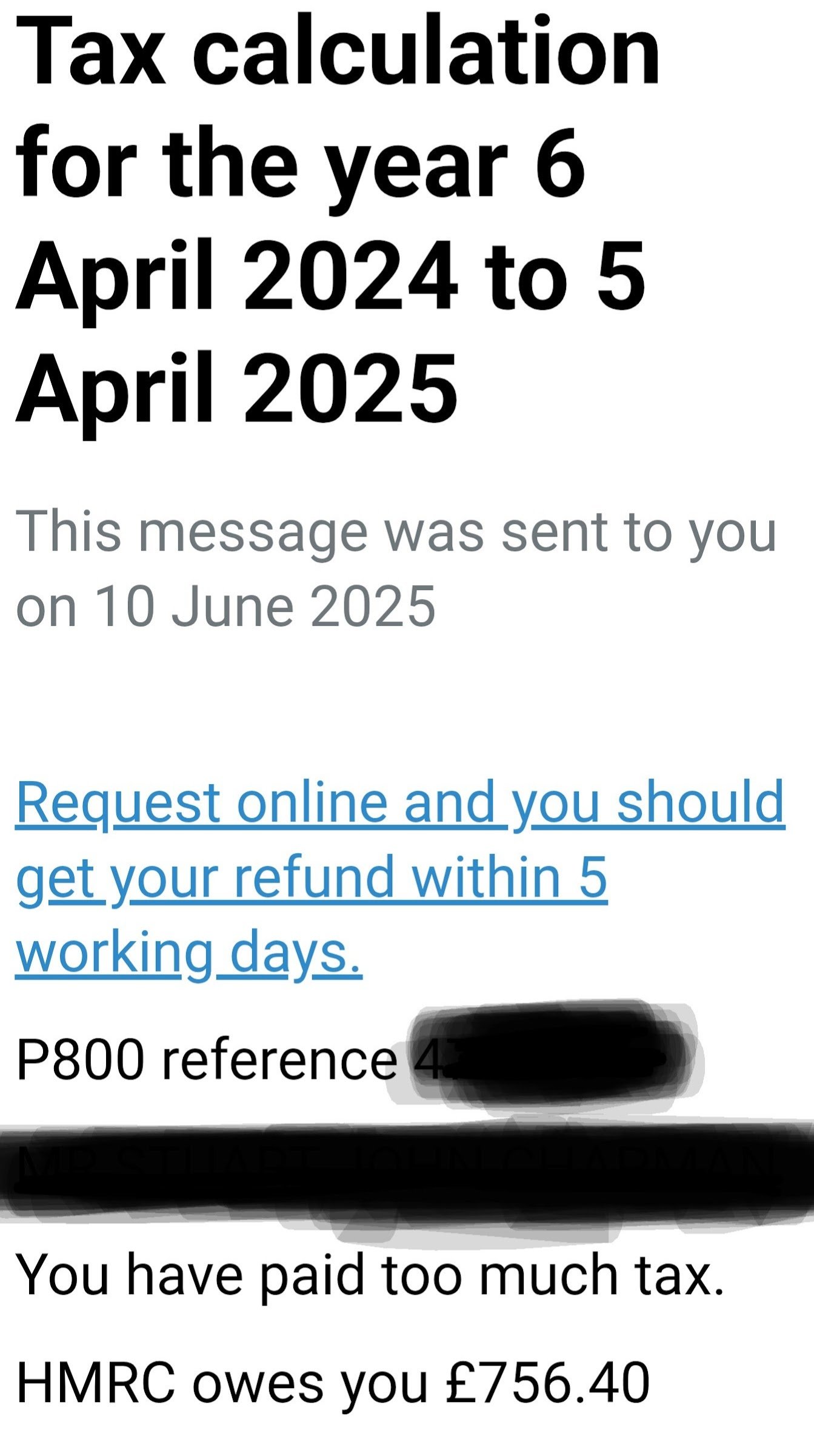

I recently informed HMRC via the online chat of my SIPP payments for 2024/2025 and wonder if anyone can check / confirm their calculations are correct?

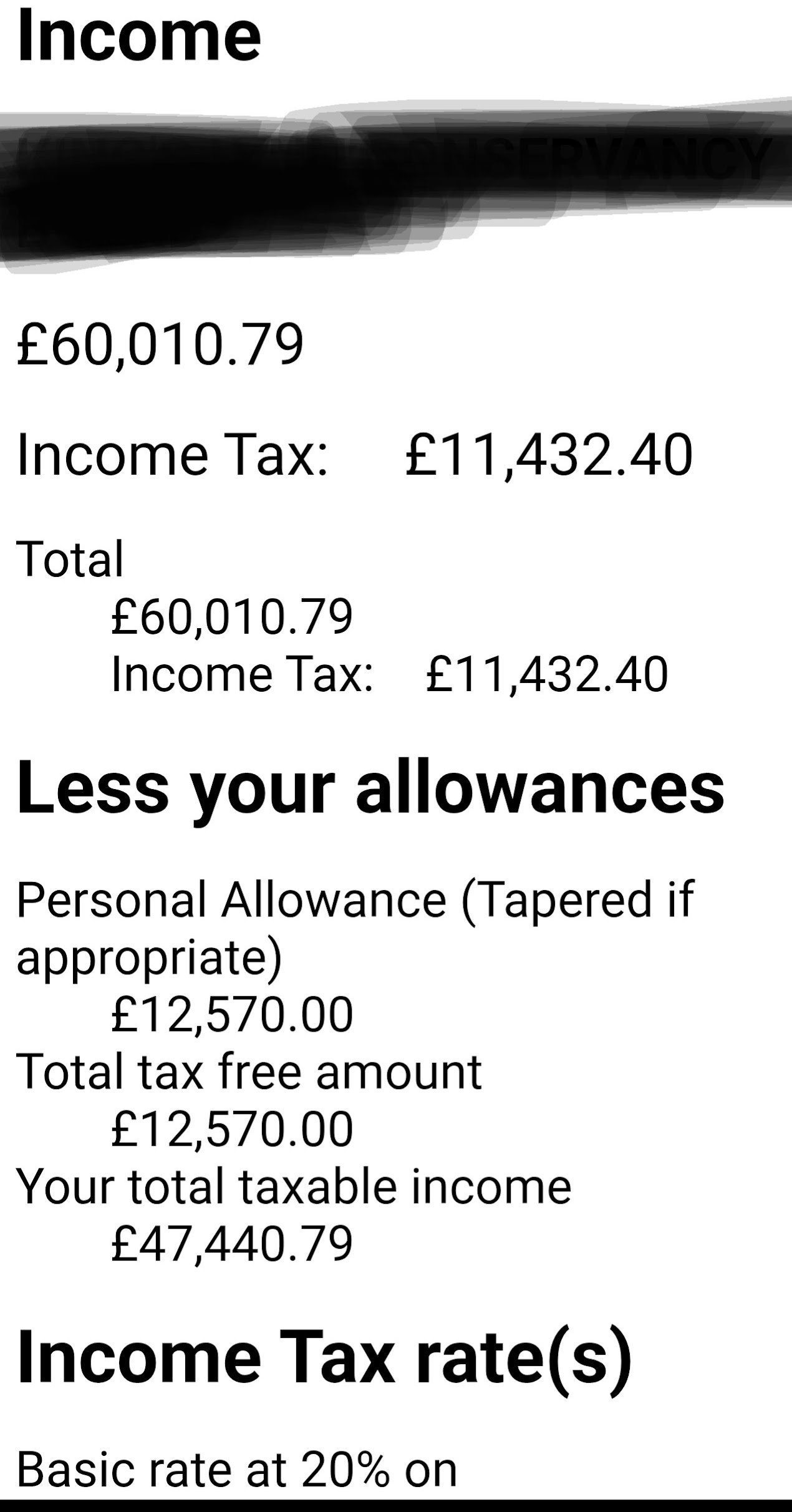

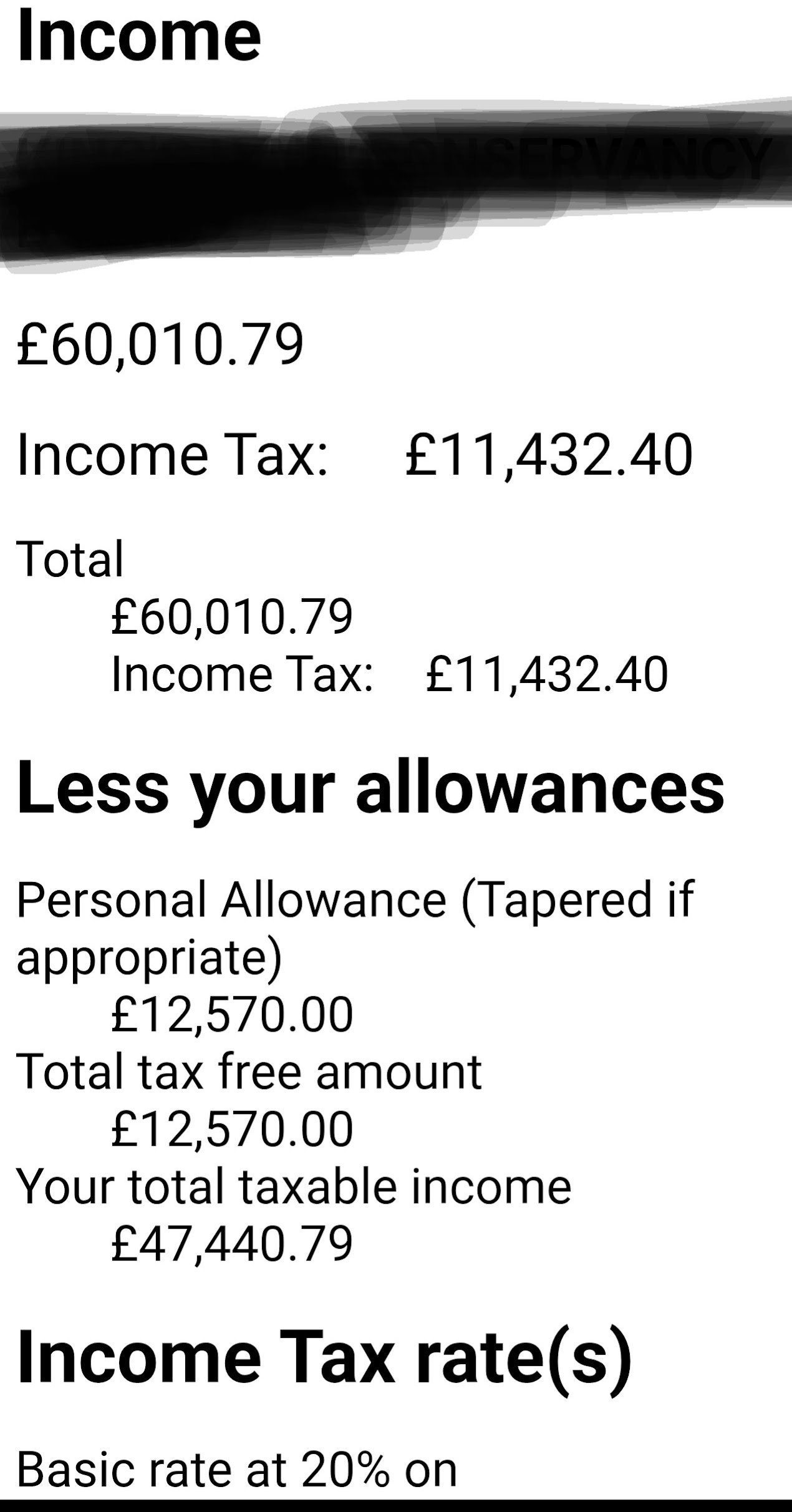

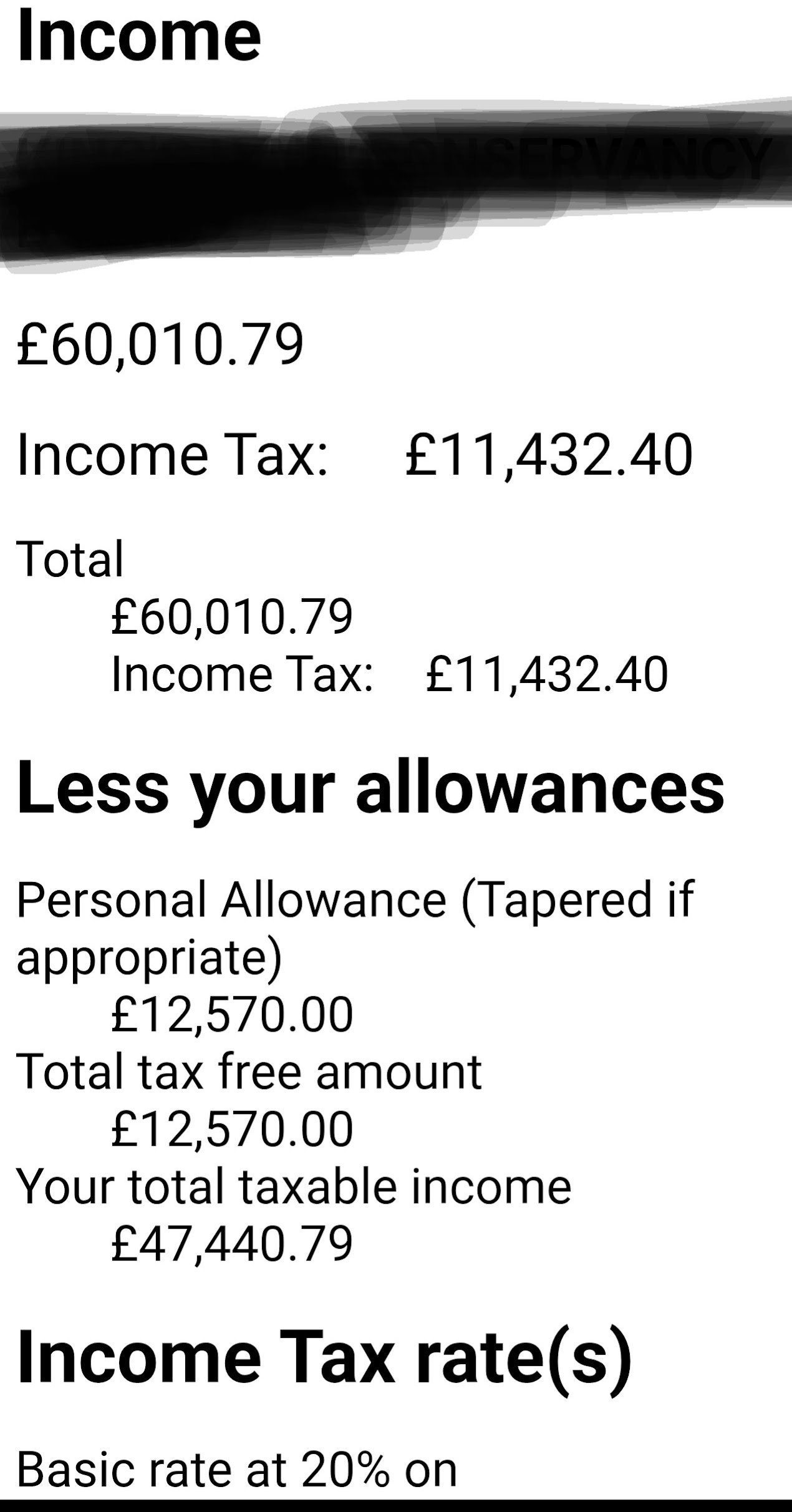

In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

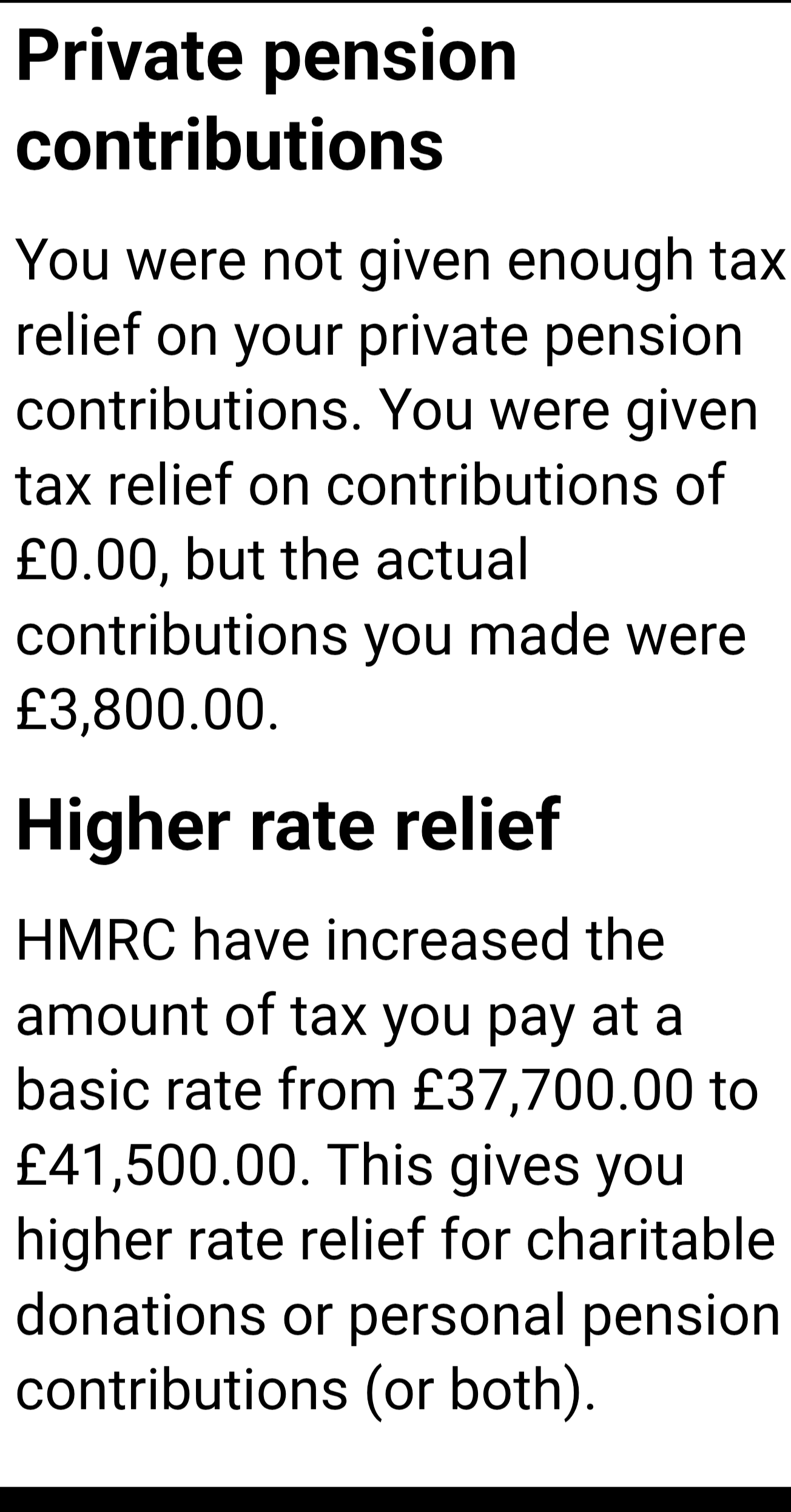

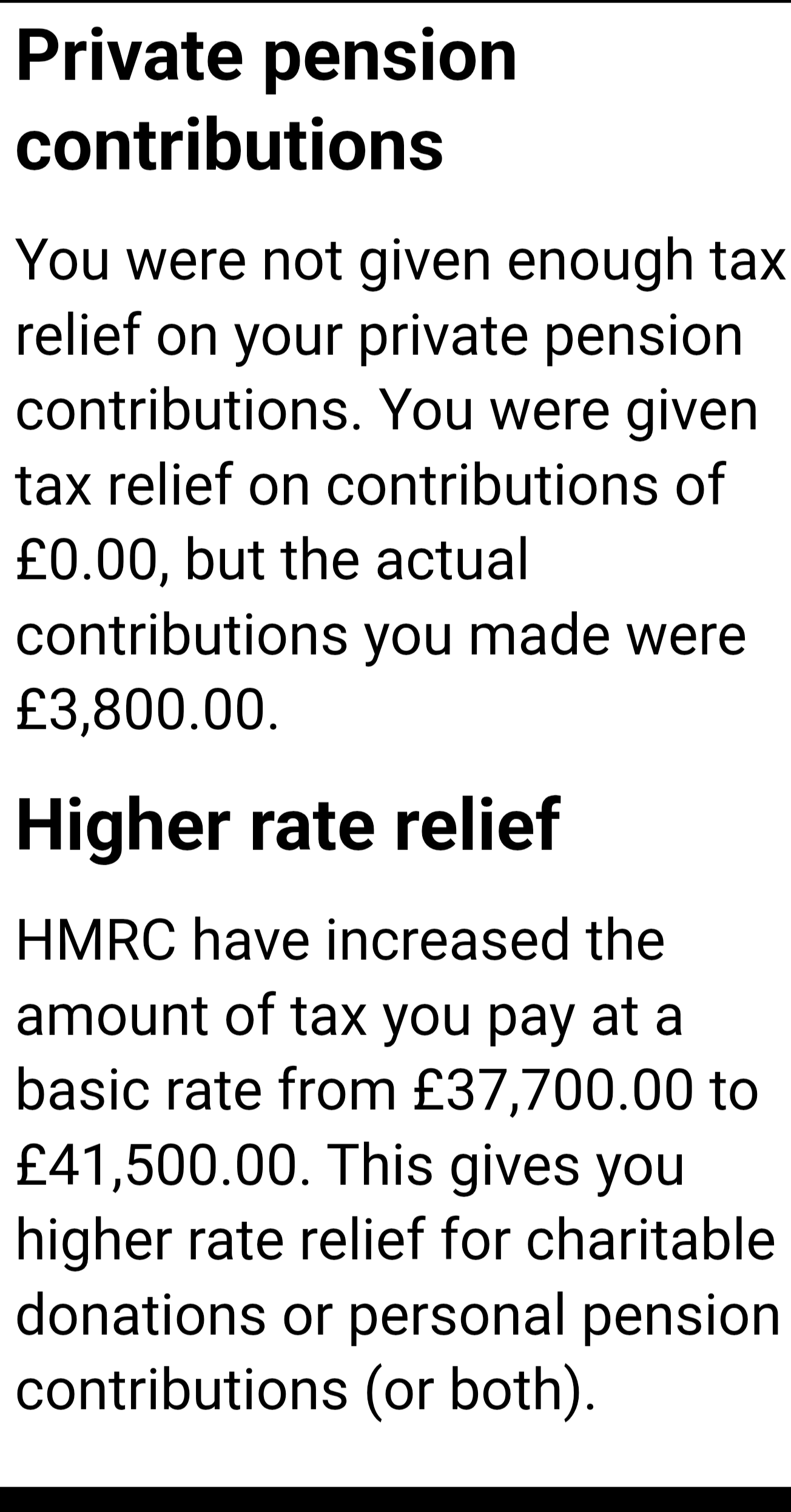

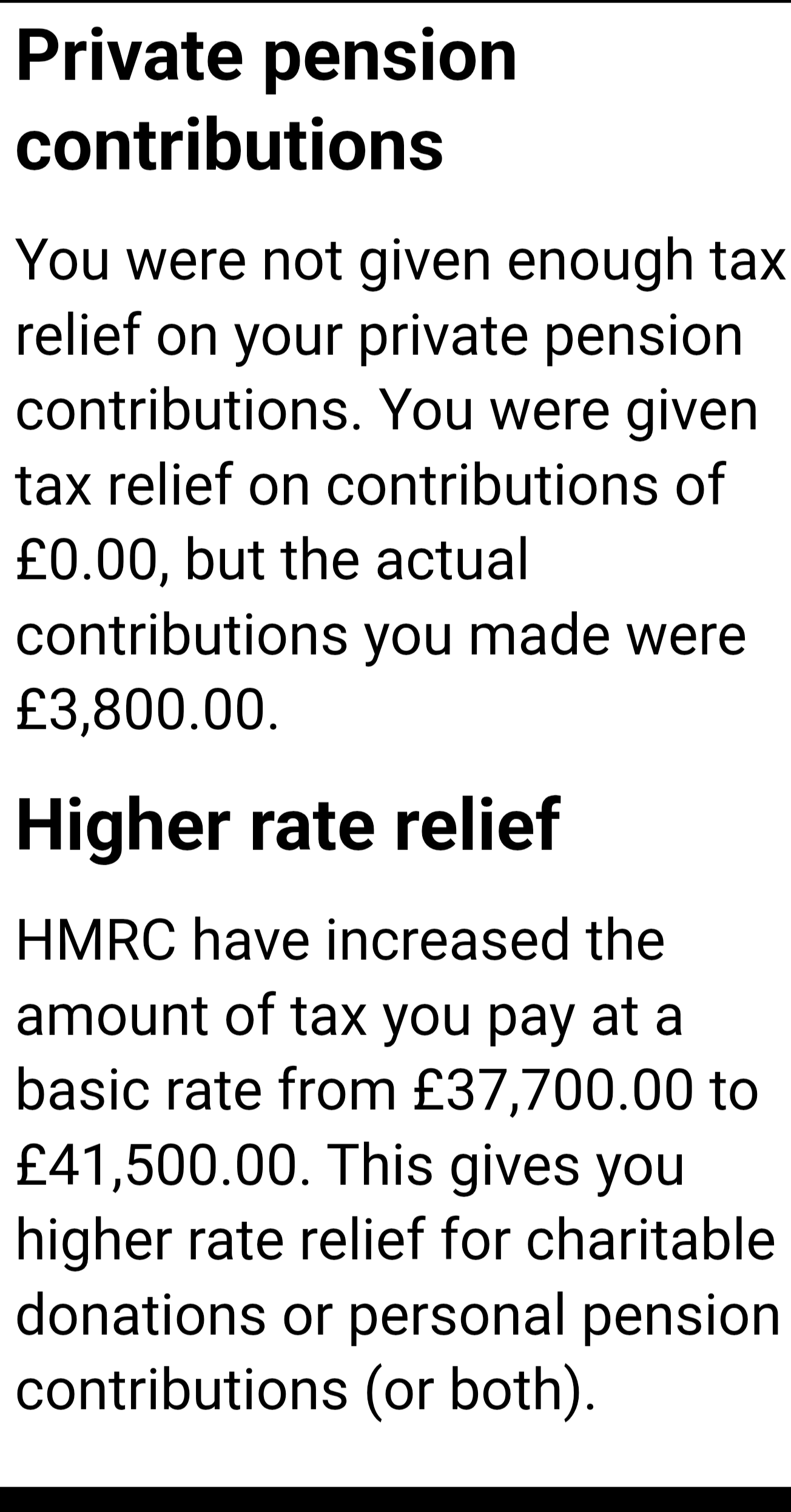

My SIPP contributions for 2024/25 were £3040 net, £3800 gross (£3800 is the figure I gave HMRC)

I have already claimed the figure HMRC have quoted, so probably too late if the figure is incorrect, but I'm looking to double my contributions this year.

In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

My SIPP contributions for 2024/25 were £3040 net, £3800 gross (£3800 is the figure I gave HMRC)

I have already claimed the figure HMRC have quoted, so probably too late if the figure is incorrect, but I'm looking to double my contributions this year.

0

Comments

-

Doubling your contributions in the current tax year won't necessarily mean you get double the tax refund.Unclefoobar said:I recently informed HMRC via the online chat of my SIPP payments for 2024/2025 and wonder if anyone can check / confirm their calculations are correct?

In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

My SIPP contributions for 2024/25 were £3040 net, £3800 gross (£3800 is the figure I gave HMRC)

I have already claimed the figure HMRC have quoted, so probably too late if the figure is incorrect, but I'm looking to double my contributions this year.

Without knowing the method used to get the normal 10% into your pension it's impossible to know of the calculation is correct or not. But assuming they weren't relief at source (the same method as your SIPP contributions) then it looks to be what you would expect.

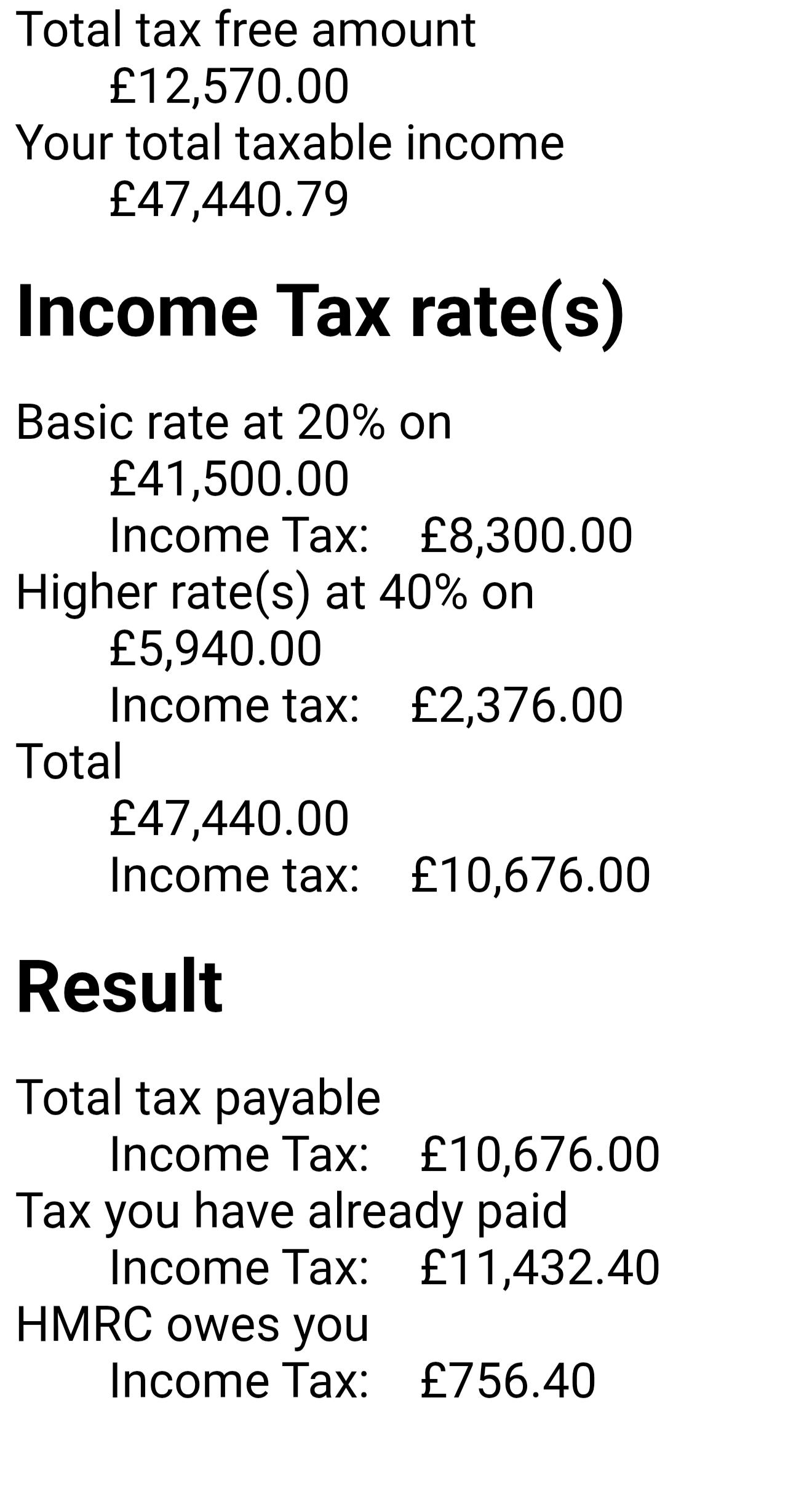

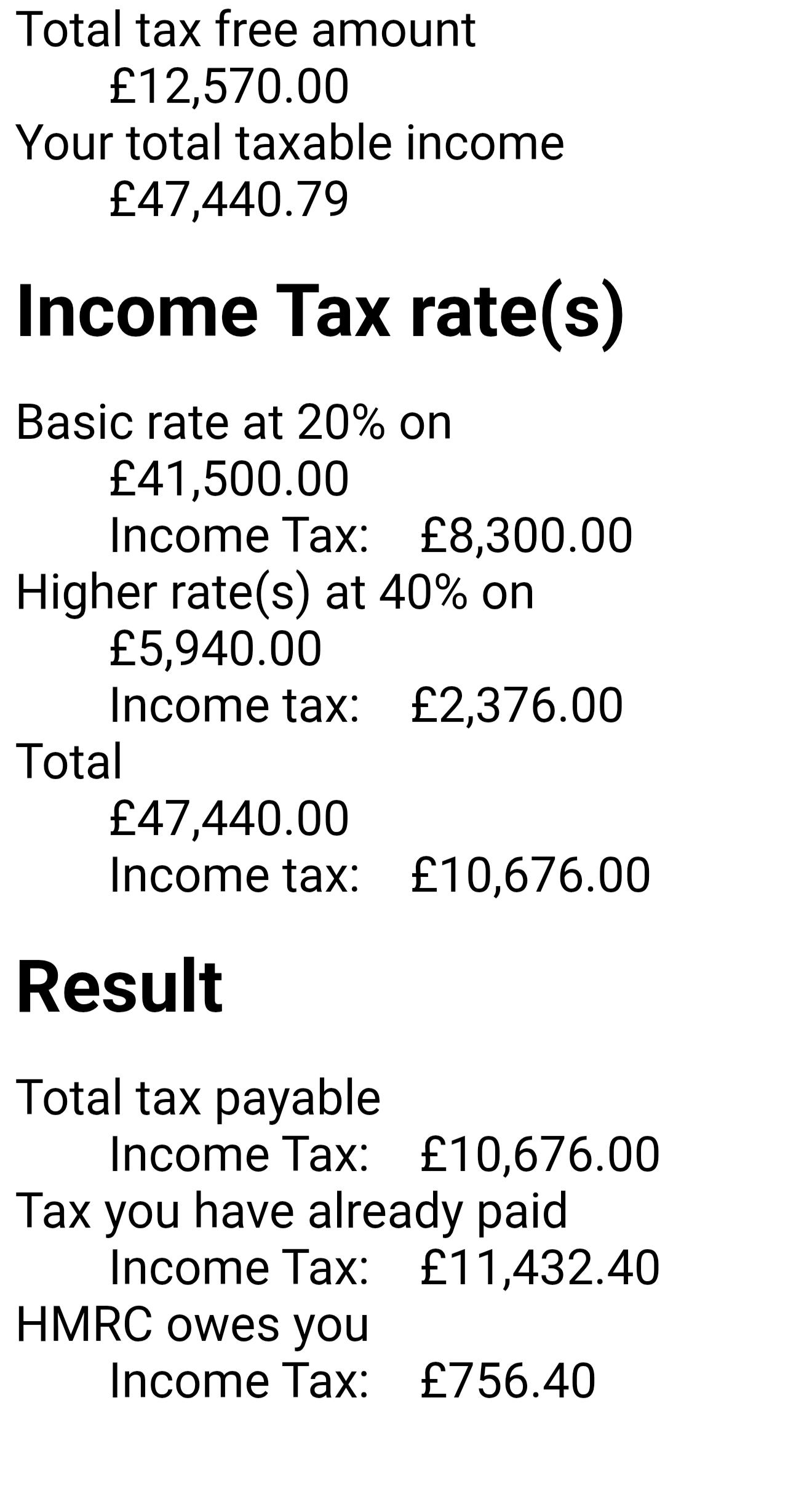

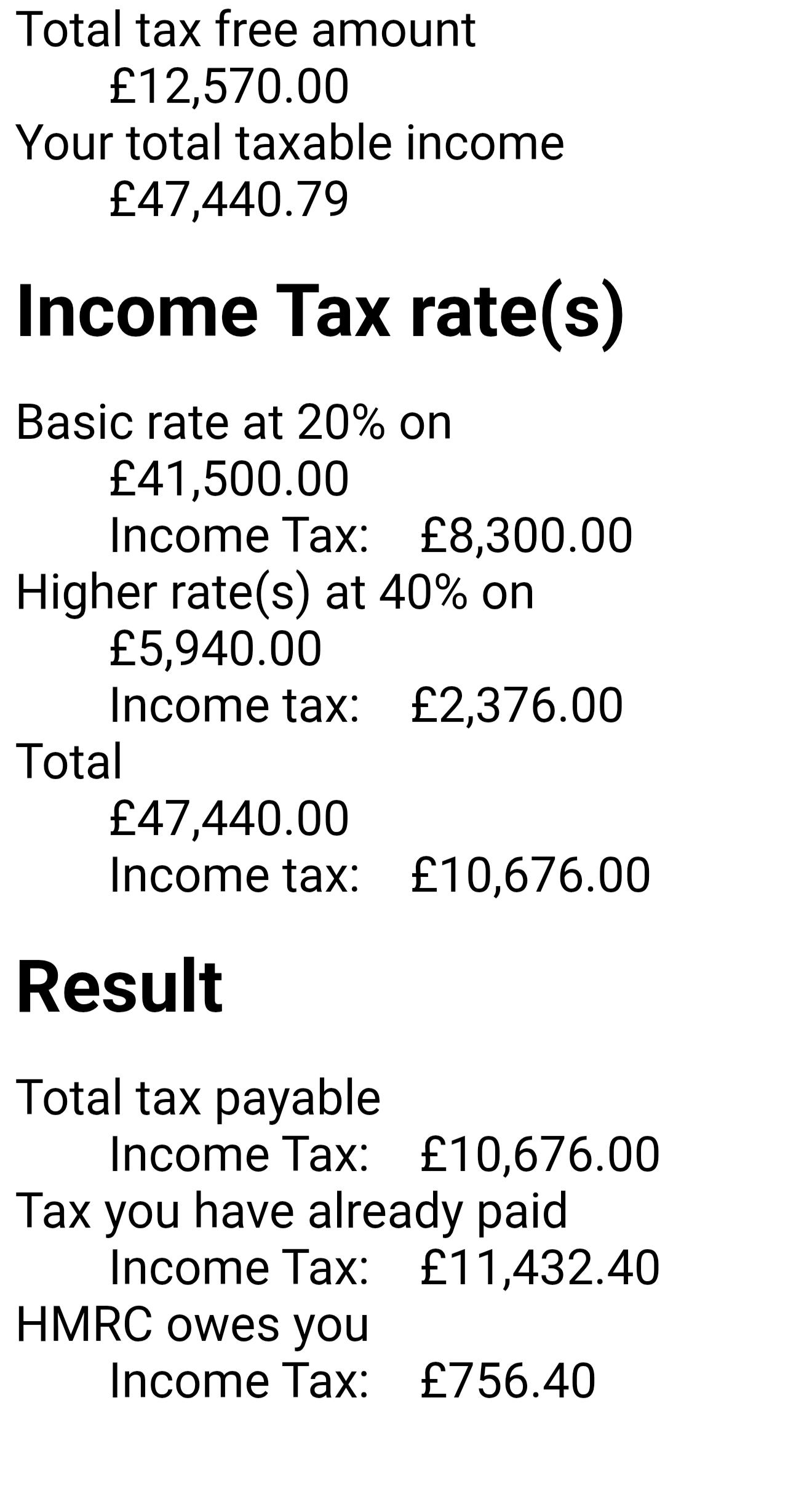

You owed £3.60 at the end of the tax year and received higher rate tax savings of £760, the net result being a refund of £756.40.

If you have any unexpected income from untaxed interest (more than £500) then HMRC will write to you again and tell you how much of the refund you need to pay back.0 -

In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

So do you agree or disagree with their £60010 figure?

Otherwise it looks like they added the right amount to your basic rate band and I assume their maths is correct.0 -

Given the I pay 10% ish..... comment it looks like a net pay scheme but hopefully the op will clarify.DRS1 said:In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

So do you agree or disagree with their £60010 figure?

Otherwise it looks like they added the right amount to your basic rate band and I assume their maths is correct.0 -

You are probably right. I asked because I got £60072.30 but I was using a straight 10%.Dazed_and_C0nfused said:

Given the I pay 10% ish..... comment it looks like a net pay scheme but hopefully the op will clarify.DRS1 said:In addition to the screenshots, my gross salary is £65,547 + approx £1200 in O/T, I pay 10% ish towards my work pension.

So do you agree or disagree with their £60010 figure?

Otherwise it looks like they added the right amount to your basic rate band and I assume their maths is correct.0 -

Thanks for the responses, I only stated my works pension contributions of 10% to clarify the difference between my gross salary and my taxable salary or 'income' as shown on my screenshot. I assumed the higher rate relief applied to my taxable salary?0

-

If your normal contributions are made using the net pay method, which does seem to be the case, then HMRC will only know about the taxable earnings, your "salary" is not relevant when it comes to your tax liability.Unclefoobar said:Thanks for the responses, I only stated my works pension contributions of 10% to clarify the difference between my gross salary and my taxable salary or 'income' as shown on my screenshot. I assumed the higher rate relief applied to my taxable salary?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards