We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Carry forward's calculation

Hi all,

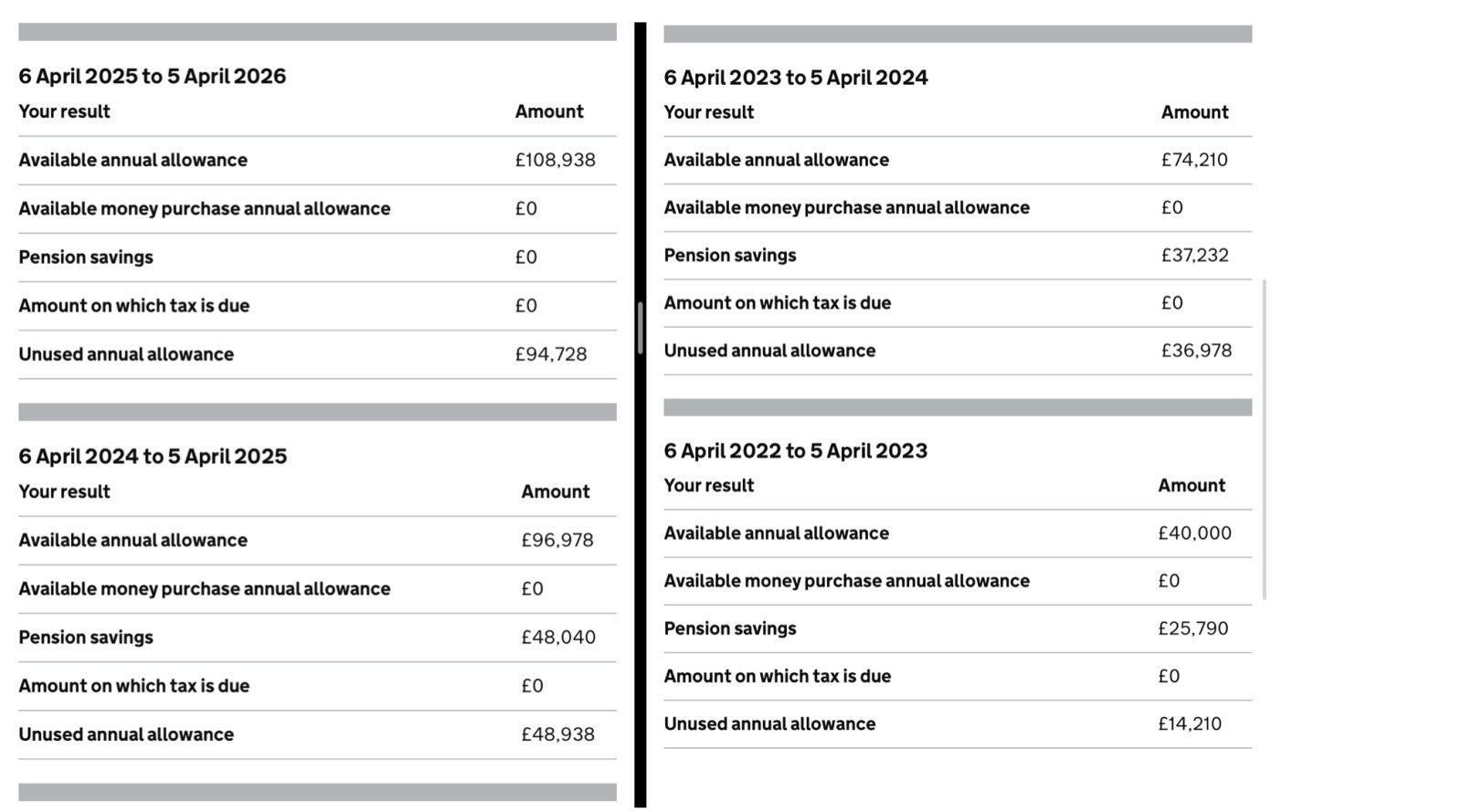

Intending to use my carry forwards allowances this year and I would be grateful if someone knowledgeable would be willing to double check my calculations:

Current annual salary £82.6k; Bonus £14k; 25-26 Available Annual Allowance: £108,938:

25-26 Pension payments to date: Salary Sacrifice £8,156; Bonus Sacrifice £14,011; AVC £9,000

Total Pension 25-26 to date: £31,167

Expected further pension payments via Salary Sacrifice: £8,262

The plan:

Increase my monthly AVC's for the rest of the year (6 months) from £1500 to £5000 per month. Total: £30,000. This will bring total 25-26 annual pension contributions to (31167+8262+30000) : £69,429

It will also reduce my taxable salary to (82600-9000-30000) £43,600 putting me back into the 20% tax bracket.

National Minimum Wage for a 34 hour week is approximately £1,800 per month. Gross monthly pay is £6,821, Net before Tax and NI will be £6,821-£5,000 AVC =£1,821

I can then opt to pay about another £12-£13k (82,600-69,429) into a SIPP before the end of the tax year (need to work out my actual gross salary as April-May was slightly less as before pay increase).

Are there any flaws in this plan, are my figures correct?

Comments

-

Are all of your contributions, over the entire four-year period, by salary sacrifice?Any relief-at-source contributions will need grossed-up before you include them in your calculations.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.0 -

So I have three types of contribution:QrizB said:Are all of your contributions, over the entire four-year period, by salary sacrifice?Any relief-at-source contributions will need grossed-up before you include them in your calculations.

Salary sacrifice - reducing my salary down to the £86k

Bonus sacrifice

AVC's

As per the company pension documentation for the AVC's "All of the contributions are made to the scheme before wages get taxed giving immediate tax relief"

Does that answer the question?

0 -

Yep, sounds like they're all gross contributions so no tax relief to add (since they were paid "before wages get taxed").

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.1 -

I can then opt to pay about another £12-£13k (82,600-69,429) into a SIPP before the end of the tax year (need to work out my actual gross salary as April-May was slightly less as before pay increase).Are there any flaws in this plan, are my figures correct?

I am being slow but if all the 69429 is paid by way of salary sacrifice (not really sure about the AVCs on that - could be net pay?) then you should not be deducting that to work out what your tax relievable contributions to the SIPP could be. Nor should you be using 82600 as your salary figure. I think you should use the 43600 figure with no deduction for the tax relief calculation. Of course you would then need to do the annual allowance calculation to see if you were going over that.

I confess I do not think annual allowance calculations are done the way you show them though it looks very neat that way. And the end result is probably the same as long as next year you remember that 22/3 falls out of the equation.1 -

Are you absolutely certain you won't be a higher rate tax payer in retirement? If you do end up paying 40% then it would be a really bad idea to put anything in with only 20% relief.0

-

This is where I start talking myself round in circles trying to work it all out........ but yes I think you are right and I'm understating what I can put into the SIPPDRS1 said:I can then opt to pay about another £12-£13k (82,600-69,429) into a SIPP before the end of the tax year (need to work out my actual gross salary as April-May was slightly less as before pay increase).Are there any flaws in this plan, are my figures correct?

I am being slow but if all the 69429 is paid by way of salary sacrifice (not really sure about the AVCs on that - could be net pay?) then you should not be deducting that to work out what your tax relievable contributions to the SIPP could be. Nor should you be using 82600 as your salary figure. I think you should use the 43600 figure with no deduction for the tax relief calculation. Of course you would then need to do the annual allowance calculation to see if you were going over that.

I confess I do not think annual allowance calculations are done the way you show them though it looks very neat that way. And the end result is probably the same as long as next year you remember that 22/3 falls out of the equation.

The salary sacrifice is counted as employer contributions so never comes near the payslip but I need to include in the allowance used figures.

The bonus sacrifice (I will double check) I think never shows up in Gross pay on the payslip either - so as above?

The AVC's do show up as a deduction against Gross pay on the payslip.

In which case the total employer contributions would be £30,429 and the most I could pay into the pension myself would be £82,600 (my relevant earnings) totalling £113,029, but I then have to reduce that down to the available annual allowance of £108,938. Does that sound better?

EDIT: My actual net payment into a SIPP would be: available annual allowance 108,938; minus employer contributions 30,429; minus 9000 current AVC's; minus 30000 future AVCs =39,509

0 -

The plan is to retire next year so putting virtually everything I have into the pension in the last months of employment. Have already maxed out ISA for the year. I'm planning on flying just below the higher rate band with my withdrawals when in retirement.Triumph13 said:Are you absolutely certain you won't be a higher rate tax payer in retirement? If you do end up paying 40% then it would be a really bad idea to put anything in with only 20% relief.

2 -

In round numbers, you are talking about putting roughly £20k gross, £16k net of basic rate pay into SIPP and AVCs and then 'flying just below the higher rate band'. If you do manage to stay below the threshold you end up making a £1,000 profit after tax. If your investments grow well and/or thresholds are lowered, and you end up taking it out at 40%, then you make a £2,000 loss. Is it really worth it?GenX0212 said:

The plan is to retire next year so putting virtually everything I have into the pension in the last months of employment. Have already maxed out ISA for the year. I'm planning on flying just below the higher rate band with my withdrawals when in retirement.Triumph13 said:Are you absolutely certain you won't be a higher rate tax payer in retirement? If you do end up paying 40% then it would be a really bad idea to put anything in with only 20% relief.1 -

Triumph13 said:

In round numbers, you are talking about putting roughly £20k gross, £16k net of basic rate pay into SIPP and AVCs and then 'flying just below the higher rate band'. If you do manage to stay below the threshold you end up making a £1,000 profit after tax. If your investments grow well and/or thresholds are lowered, and you end up taking it out at 40%, then you make a £2,000 loss. Is it really worth it?GenX0212 said:

The plan is to retire next year so putting virtually everything I have into the pension in the last months of employment. Have already maxed out ISA for the year. I'm planning on flying just below the higher rate band with my withdrawals when in retirement.Triumph13 said:Are you absolutely certain you won't be a higher rate tax payer in retirement? If you do end up paying 40% then it would be a really bad idea to put anything in with only 20% relief.At the moment my forecast stays below higher rate tax and the total pot has roughly £200k more growth before hitting the LSA.But as I am planning on retiring soon then it is only a max gain of £1k. I suppose when you look at it like that it's a good question.Thanks.

EDIT: actual net payment into a SIPP would be 39509 so £2k gain vs possible £4K loss if I did stray into 40% bracket.0 -

In which case the total employer contributions would be £30,429 and the most I could pay into the pension myself would be £82,600 (my relevant earnings) totalling £113,029, but I then have to reduce that down to the available annual allowance of £108,938. Does that sound better?EDIT: My actual net payment into a SIPP would be: available annual allowance 108,938; minus employer contributions 30,429; minus 9000 current AVC's; minus 30000 future AVCs =39,509

I really shouldn't be commenting because I don't follow the figures. I thought £82600 was your salary before any salary sacrifice and taken with the bonus gets your earnings for the year up to £96600 but that figure is then reduced by what you have salary/bonus sacrificed which from post 1 is £22167. I am not sure where £30429 comes from but maybe that includes some employer contributions which are not salary sacrificed amounts.

So I think that gets your relevant earnings down to £74433 (96600 - 22167)

If you then deduct £39000 of AVCs from that you have £35433 left to contribute to the SIPP (remember to multiply by 0.8 to get the actual net contribution). That will be well short of the net £39509 figure.

There are others on here way better at the figures than me. I hope they will be along soon0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards