We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Pension planning advice before seeing an financial advisor

Skintsaver

Posts: 152 Forumite

Basically last couple of weeks I've been going over my finances like many I haven't given my pension much thought. After being divorced and getting my feet back on track, now is this time to look at this.

I'm 35, 1 dependent planning and intend to be mortgage free around 45.

I'm now getting a pay increase which I don't really need to cover day to day and mortgage costs ect..(I'm already overpaying)

My salary is increasing to 40500. Next year I expect my mortgage to increase by approx £100 to cover the additional interest rates.

So this leaves me with approx £250pm after tax extra new income to do something with. Which in thinking £150 extra each month into my pension as part of a salary sacrifice is what I need to do. Can you check over my figures and see what I'm missing where I'm going wrong?(All my figures are as today's money)

My current pot is 27k across 2 pots

I'd like to plan to retire at 60.

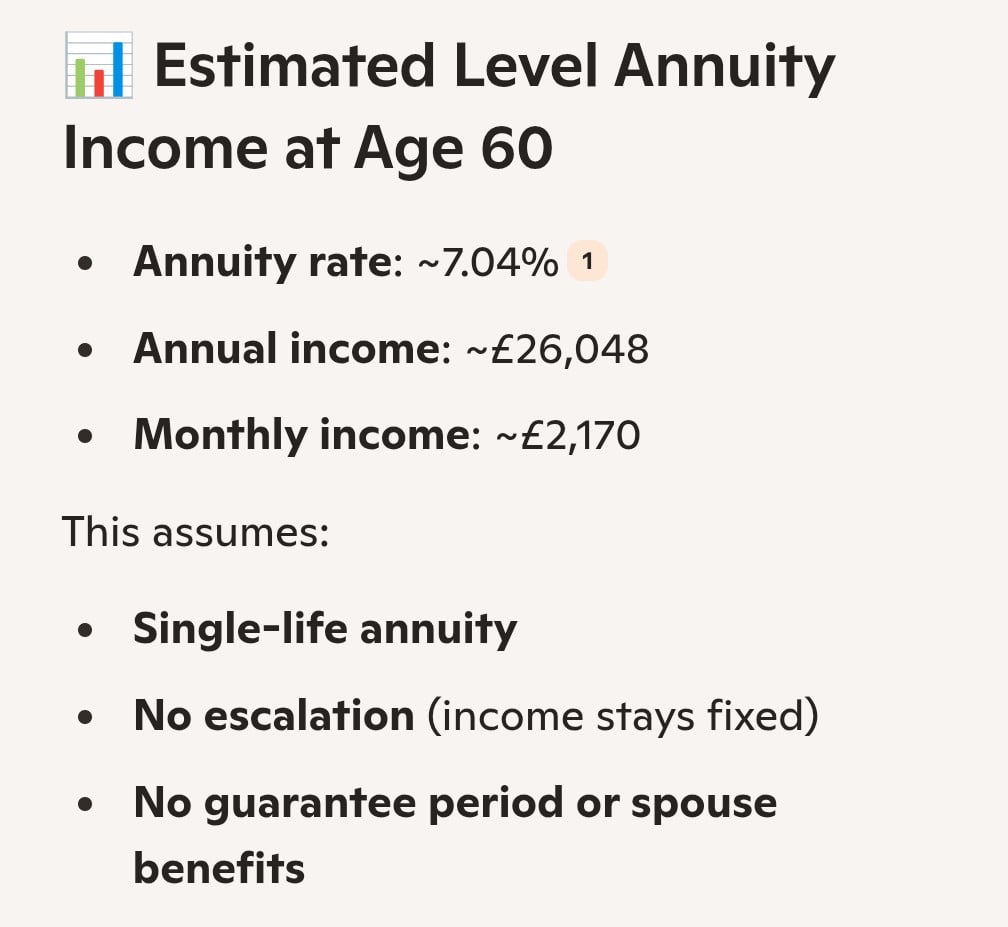

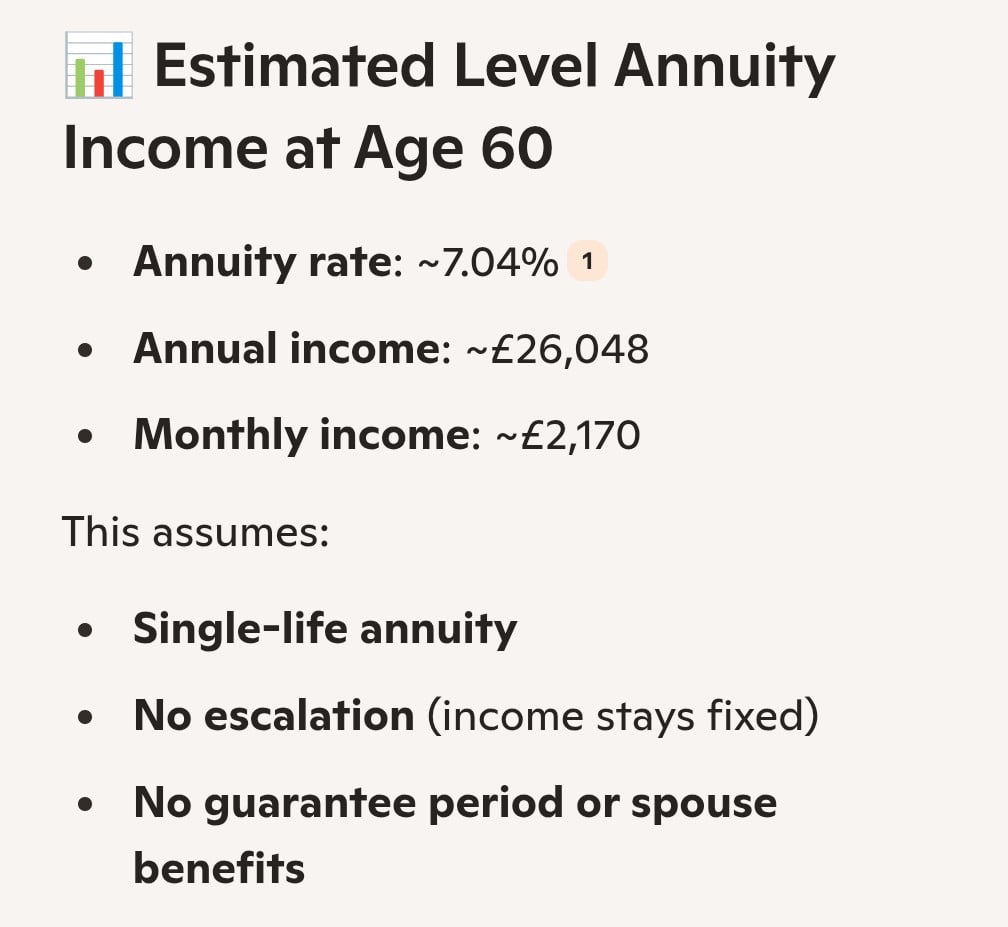

At 60 I'd definitely be mortgage free, hopefully my child will be financially dependent and my income protection won't be required. Which totals around 750-850pm. Taking this into account with state pension. I need around 20k each year from my own pension.

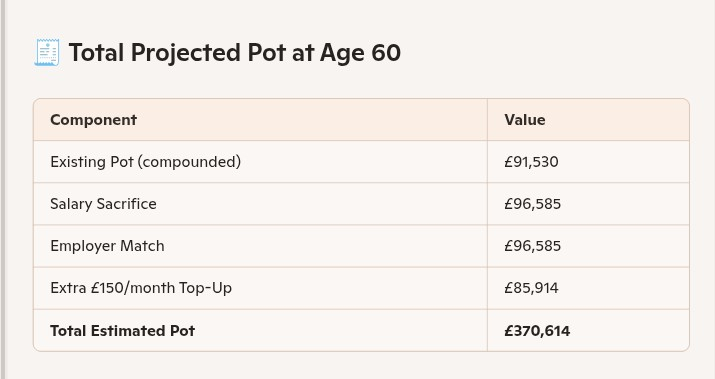

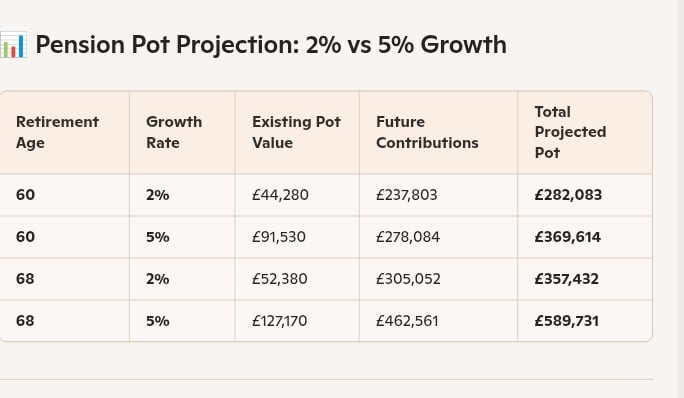

This is what my projected pot would be according to Ai - is this accurate?

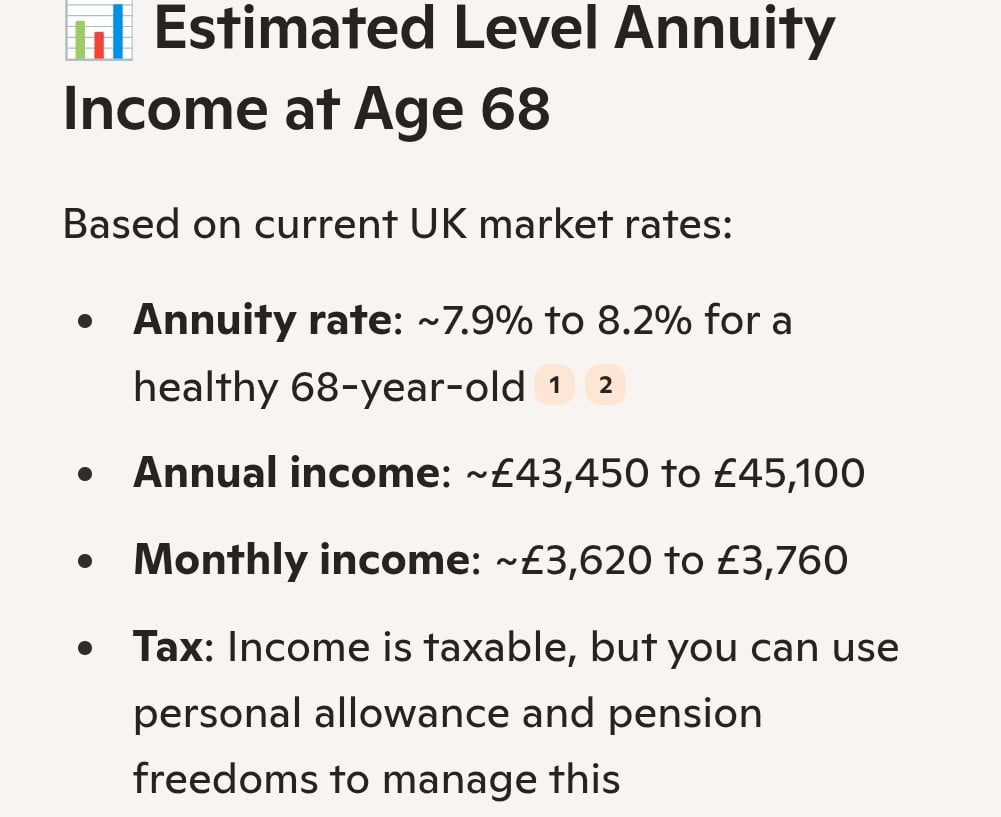

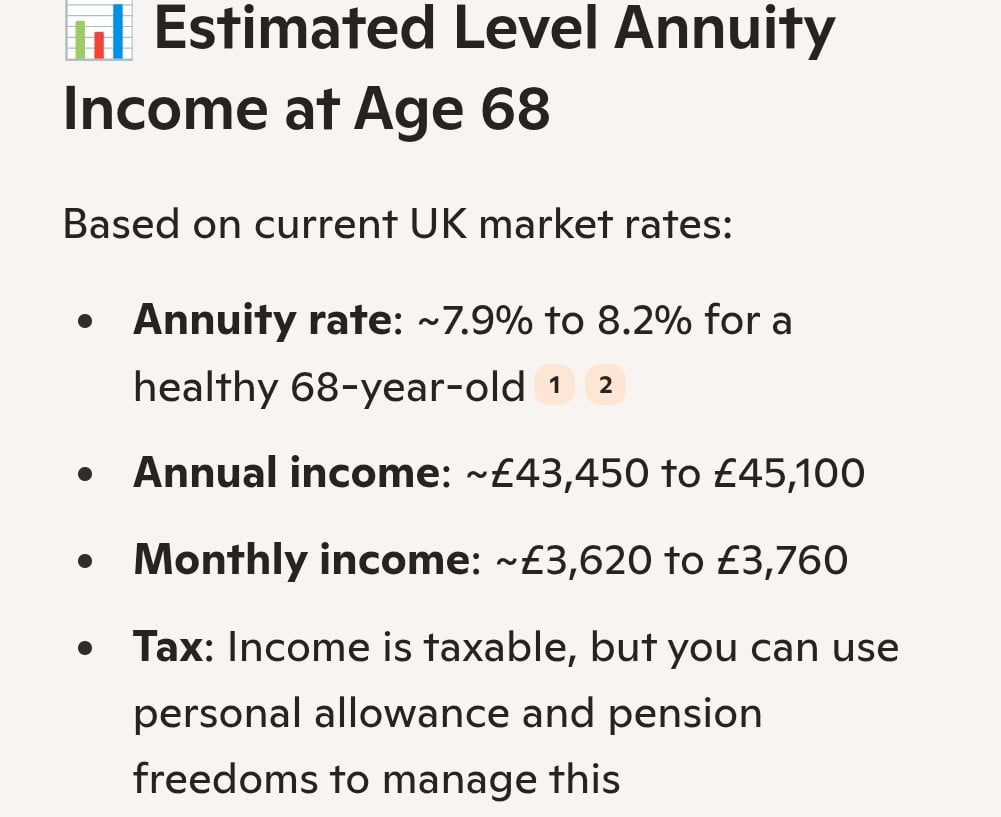

Top table projection at 68

Does this seem right?

Basically I'm seeing the older lads at work having the option to retire early due to their pensions and I'd like to be in the same boat. And want time to enjoy my retirement ect.. and not worry about money. So now seems the perfect time to look into this.

Thoughts on these figures and plans?

I'm 35, 1 dependent planning and intend to be mortgage free around 45.

I'm now getting a pay increase which I don't really need to cover day to day and mortgage costs ect..(I'm already overpaying)

My salary is increasing to 40500. Next year I expect my mortgage to increase by approx £100 to cover the additional interest rates.

So this leaves me with approx £250pm after tax extra new income to do something with. Which in thinking £150 extra each month into my pension as part of a salary sacrifice is what I need to do. Can you check over my figures and see what I'm missing where I'm going wrong?(All my figures are as today's money)

My current pot is 27k across 2 pots

I'd like to plan to retire at 60.

At 60 I'd definitely be mortgage free, hopefully my child will be financially dependent and my income protection won't be required. Which totals around 750-850pm. Taking this into account with state pension. I need around 20k each year from my own pension.

This is what my projected pot would be according to Ai - is this accurate?

Top table projection at 68

Does this seem right?

Basically I'm seeing the older lads at work having the option to retire early due to their pensions and I'd like to be in the same boat. And want time to enjoy my retirement ect.. and not worry about money. So now seems the perfect time to look into this.

Thoughts on these figures and plans?

0

Comments

-

You will doubtless get some feedback about whether paying extra to your mortgage over pension is the optimum choice.

But given your final thoughts why only £150?

As I presume you are aware you don't get any pension tax relief with salary sacrifice, you are giving up salary in return for additional employer contributions and as such are avoiding paying both tax and NI on the salary you no longer have.

So very tax/NI efficient but it's not really clear how much would go into your pension? If you are happy losing £150 then wouldn't that £208/month that you could sacrifice (if you are a basic rate payer)?

0 -

You are only 35 and have nailed the pension and finance planning. Good job on that. As for your numbers these are 25 years away and look to be based on some modest salary growth. If we were discussing this over a beer I would ask you what the future prospects are in your job. Upskilling or promotion in work will allow you to accelerate your financial goals well beyond this plan.0

-

I think that's a typo(!) but it could well turn out to be a prophecy...Skintsaver said:Basically last couple of weeks I've been going over my finances like many I haven't given my pension much thought. After being divorced and getting my feet back on track, now is this time to look at this.

I'm 35, 1 dependent planning and intend to be mortgage free around 45.

At 60 I'd definitely be mortgage free, hopefully my child will be financially dependent and my income protection won't be required. Which totals around 750-850pm. Taking this into account with state pension. I need around 20k each year from my own pension.

It's great that you are doing the planning well in advance, but never forget just how dramatically things can change - and having ready cash to ride out those rainy days is a lot cheaper than panic borrowing. Before lobbing everything into your pension (and effectively tying up the funds for 20+ years before you can access them, unless you are too ill to work again), think about how much of a cash buffer you have now and whether (say) an ISA might be a good home for some of your cash.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!2 -

100% I never expected to get married then divorced so soon. Nor did I expect to recover so soon after financially. Makes me realise that the solicitor which laughed and said I have nothing to worry about was 100% right in that and his advice and going with him may of been the right choice but ultimately didn't.Marcon said:

I think that's a typo(!) but it could well turn out to be a prophecy...Skintsaver said:Basically last couple of weeks I've been going over my finances like many I haven't given my pension much thought. After being divorced and getting my feet back on track, now is this time to look at this.

I'm 35, 1 dependent planning and intend to be mortgage free around 45.

At 60 I'd definitely be mortgage free, hopefully my child will be financially dependent and my income protection won't be required. Which totals around 750-850pm. Taking this into account with state pension. I need around 20k each year from my own pension.

It's great that you are doing the planning well in advance, but never forget just how dramatically things can change - and having ready cash to ride out those rainy days is a lot cheaper than panic borrowing. Before lobbing everything into your pension (and effectively tying up the funds for 20+ years before you can access them, unless you are too ill to work again), think about how much of a cash buffer you have now and whether (say) an ISA might be a good home for some of your cash.

I have around 25k in savings but yes I guess that's something which I should explore too, never thought about an isa

1 -

Looking at your projections and taking into account how much you are planning to pay into your pension your projections look very optimistic. Is the projection a nominal figure? Normally it is in today's money, not future money. After all £100 today will be able to buy you a lot more than £100 in 25 years time.

I agree with those who say that you should pay into a Stocks & Shares ISA, you never know when you might need money before you are old enough to access your pension. Also as alluded to, paying off your mortgage at 45 won't give you the best return. I would definitely pay it off before you retire, but if you put spare money into a S&S ISA rather than your mortgage the money should grow faster than your mortgage interest rate. You can then use some of your gains to pay into your mortgage when you retire (or sooner).0 -

They're in today's money, with a projection interest of 5% my current pots are growing by 17% but I have seen this in the red too

I agree with you there about the mortgage, but that's something which i wish to have paid off sooner than later. Personally the sooner it's paid off the better.

But I feel this pay increase would be better suited to be put towards later life...0 -

Fair enough about wanting to pay off your mortgage quickly. There are far worse things that money can be diverted towards. One bonus of being mortgage free relatively young is that once you have no mortgage payments to make you can put more money into investments.Skintsaver said:They're in today's money, with a projection interest of 5% my current pots are growing by 17% but I have seen this in the red too

I agree with you there about the mortgage, but that's something which i wish to have paid off sooner than later. Personally the sooner it's paid off the better.

But I feel this pay increase would be better suited to be put towards later life...

So your projection is 5% above inflation for the next 25 years? While that doesn't look too bad when looking at the last 25 years or so I think it is quite optimistic. Personally I project 2% above inflation per year on average. Some might say this is pessimistic, though there are people on this forum who are even more pessimistic than me.1 -

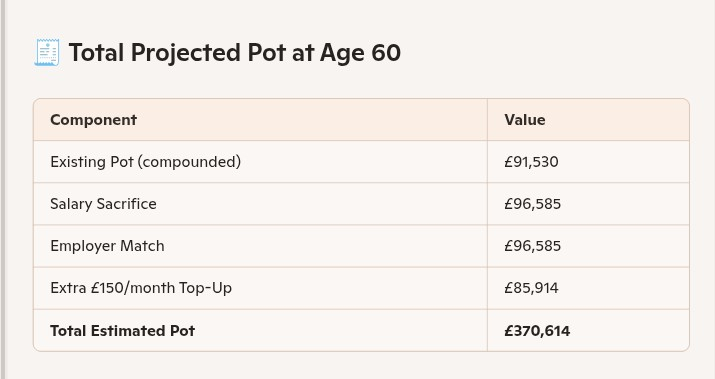

I just took the average of the last 33years. I have checked these as below as you suggested at 2%

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards