We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Credit freeze

thecatlady1963

Posts: 2 Newbie

Can anyone advise if it is possible in the UK to be able to freeze any application for credit to include pay day loans.

I know it is possible in the US but I am having difficulty finding the same here.

Surely it must be possible.

Any advice would be amazing.

Thank you

I know it is possible in the US but I am having difficulty finding the same here.

Surely it must be possible.

Any advice would be amazing.

Thank you

0

Comments

-

You mean blocking yourself from taking out credit?0

-

Essentially yes for any credit cards, payday loans etc. in the US you can freeze your credit but I cannot see that we have the ability in the UK0

-

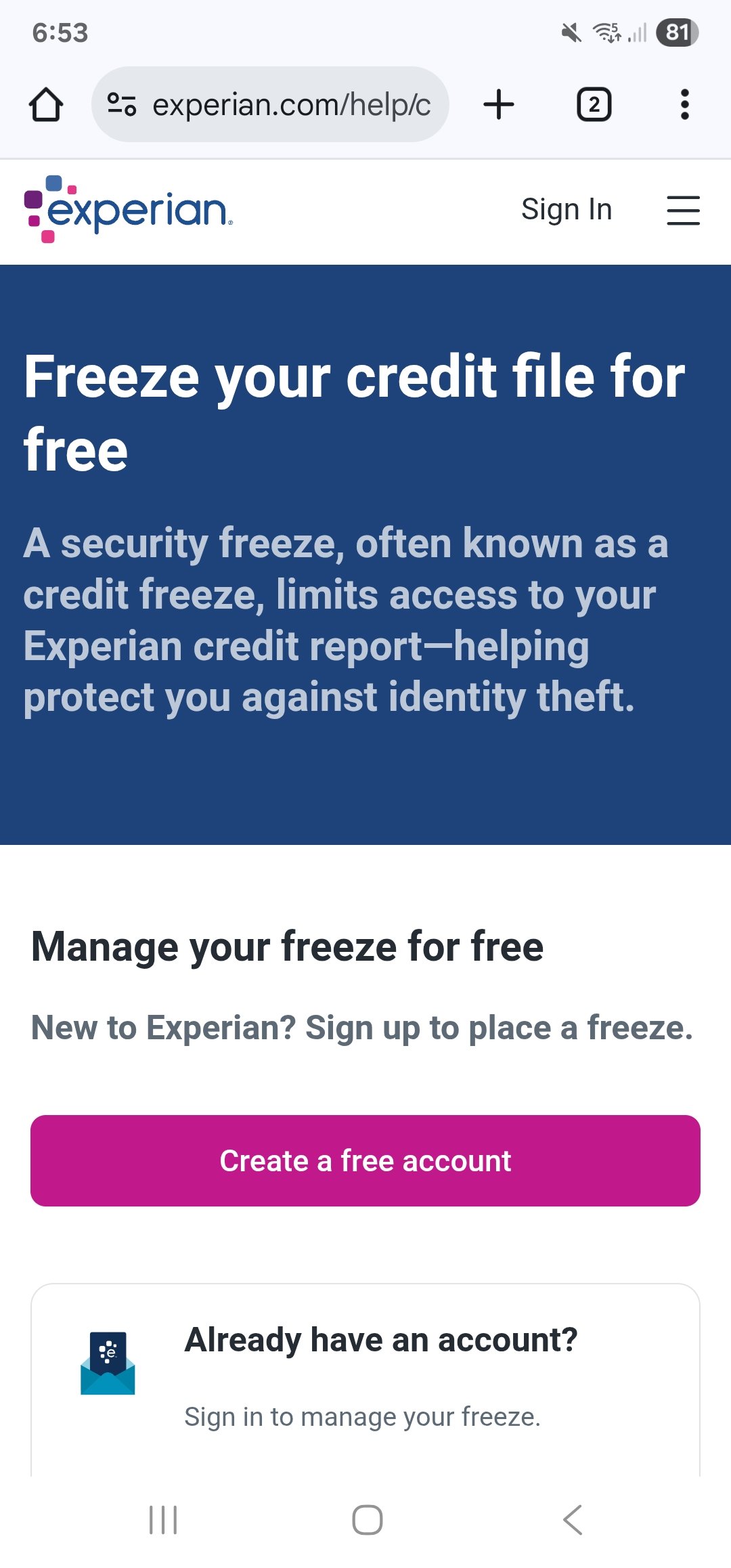

You can on Experian. Basically it blocks you being able to take out credit as they dont have access to the credit file.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001 -

A security freeze limits access to your Experian credit report without your permission. Freezing your credit can help protect against identity theft and fraud. Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your credit report or credit file. When you freeze your credit, you are still able to submit a loan or credit application to a potential lender, however the lender will be unable to pull your credit file to assess your creditworthiness and make a decision on your application. If you would like for the lender to assess your credit, simply unfreeze your credit file or schedule a thaw in advance for the dates you plan to process a credit application.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001 -

@BlueJ94

Thanks for the info (i didn't know that was possible).

Anyone had any long term experience of freezing their credit file and experiencing any negative effects i.e. renewal quotes on existing insurance policies have vastly increased because they couldn't access your file for example?

Also is this possible with Equifax/ClearScore and TransUnion/CreditKarma?I have a tendency to mute most posts so if your expecting me to respond you might be waiting along time!1 -

Most folk find out that defaulting on a few credit accounts works industry wide, lasts for 6 years, with few side effects, except perhaps the ability to obtain further credit, that is.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter2

-

But that freeze wouldn't apply to the other referencing agencies, so if a provider of credit uses TransUnion (for example) then the OP will be able to obtain credit.BlueJ94 said:A security freeze limits access to your Experian credit report without your permission. Freezing your credit can help protect against identity theft and fraud. Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your credit report or credit file. When you freeze your credit, you are still able to submit a loan or credit application to a potential lender, however the lender will be unable to pull your credit file to assess your creditworthiness and make a decision on your application. If you would like for the lender to assess your credit, simply unfreeze your credit file or schedule a thaw in advance for the dates you plan to process a credit application.

2 -

Yes I know, thats why I didn't say it would freeze all. I was just stating that you can do it on ExperianEmmia said:

But that freeze wouldn't apply to the other referencing agencies, so if a provider of credit uses TransUnion (for example) then the OP will be able to obtain credit.BlueJ94 said:A security freeze limits access to your Experian credit report without your permission. Freezing your credit can help protect against identity theft and fraud. Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your credit report or credit file. When you freeze your credit, you are still able to submit a loan or credit application to a potential lender, however the lender will be unable to pull your credit file to assess your creditworthiness and make a decision on your application. If you would like for the lender to assess your credit, simply unfreeze your credit file or schedule a thaw in advance for the dates you plan to process a credit application. I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe boards and spending & discounts boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Debt owed;Admiral - £0/£8000

DFW Challenges!

PAD #

365 Day 1p Challenge 2026 #8 £31.65

Pay off all your debts by Christmas 2026! #14 £74.77/£8000

Make £2026 in 2026! £390.05/£2026

Savings goal £91.50/£10001 -

Your post gave the impression (or at least that's how I read it) that freezing on Experian would give the OP what they wanted - but that's not actually the case as there are multiple referencing agencies (I'm not sure if people are necessarily aware of that)BlueJ94 said:

Yes I know, thats why I didn't say it would freeze all. I was just stating that you can do it on ExperianEmmia said:

But that freeze wouldn't apply to the other referencing agencies, so if a provider of credit uses TransUnion (for example) then the OP will be able to obtain credit.BlueJ94 said:A security freeze limits access to your Experian credit report without your permission. Freezing your credit can help protect against identity theft and fraud. Having a freeze on your credit report will not affect your credit scores, but it may prevent your credit report from being accessed until you unfreeze your credit report or credit file. When you freeze your credit, you are still able to submit a loan or credit application to a potential lender, however the lender will be unable to pull your credit file to assess your creditworthiness and make a decision on your application. If you would like for the lender to assess your credit, simply unfreeze your credit file or schedule a thaw in advance for the dates you plan to process a credit application.

I don't know why the OP wants to freeze - financial abuse fears, gambling/shopping addiction. Reduce risk of fraud? As sourcrates points out really only trashing your rating will have a "freezing effect" in that no one will give you credit. But given the implications I'm not sure this is advisable.2 -

Well it all depends what the OP is trying to achieve here, if they are fearful of obtaining unaffordable credit and feel there spending is out of control, then no amount of card freezing will work for them, as they will likely be resourceful and obtain credit elsewhere, by taking on new credit card accounts etc.Emmia said:

I don't know why the OP wants to freeze - financial abuse fears, gambling/shopping addiction. Reduce risk of fraud? As sourcrates points out really only trashing your rating will have a "freezing effect" in that no one will give you credit. But given the implications I'm not sure this is advisable.

The one sure way to stop this domino effect is to have such negative information on your credit file that lenders will say no, and stop lending to you.

Like I said, it depends on exactly why they want to freeze the card, as my example may not be the case here.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards