We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

ERC Skipton

diggingdude

Posts: 2,501 Forumite

Sorry to ask here but having spent 2 hours today on the phone/chat to Skipton without getting through I thought someone here might be able to answer my question.

Origional loan £117000 in 2019 5 year fix.

Renewed (product transfer) mortgage at £79000 march 2024 with Skipton 2 year fix.

ERC is 1.25% it says the original loan amount. Am I right in thinking that's the 117k not the 79k when I took out the new fix?

Any help would stop me screaming at the call centre if they ever answer. Affordability isn't the issue, I just like to know things. Thank you

Origional loan £117000 in 2019 5 year fix.

Renewed (product transfer) mortgage at £79000 march 2024 with Skipton 2 year fix.

ERC is 1.25% it says the original loan amount. Am I right in thinking that's the 117k not the 79k when I took out the new fix?

Any help would stop me screaming at the call centre if they ever answer. Affordability isn't the issue, I just like to know things. Thank you

An answer isn't spam just because you don't like it......

0

Comments

-

no it should be 1.25% of the balance when the new product was taken - that's what most do - although you need to check with Skipton ( sorry ) - did you get new mortgage doc when you changed product?1

-

Thanks for the reply. In all honesty I don't remember. It's strange for me as I'm a paperwork hoarder but for the life of me I don't remember/can't find it and there isn't anything I can see online.DE_612183 said:no it should be 1.25% of the balance when the new product was taken - that's what most do - although you need to check with Skipton ( sorry ) - did you get new mortgage doc when you changed product?

Well it will be a nice suprise if it's the lower amount anyway An answer isn't spam just because you don't like it......0

An answer isn't spam just because you don't like it......0 -

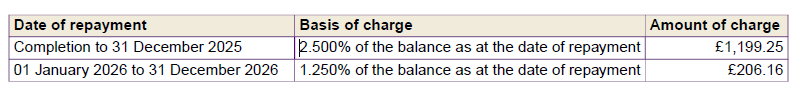

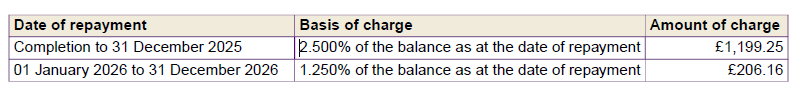

I'm looking at a Skipton offer and it says "1.25% of the balance at the date of repayment" in year two.I am a mortgage broker. You should note that this site doesn't check my status as a Mortgage Adviser, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice. Please do not send PMs asking for one-to-one-advice, or representation.1

-

I'm a bit rubbish at this so that would be 1.25% of the balance now?An answer isn't spam just because you don't like it......0

-

Yes, they cannot charge you 2.5% of debt that no longer exists.

It is 2.5% of the debt settled on the day you make the payment to settle some or all of the debtI am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.1 -

Thank you, saved me another call on MondayAn answer isn't spam just because you don't like it......0

-

Not all work this way - the penalty can be calculated on the debt at the start point - they could add this into the T&Cs as a amount but it's easier to say it's a % of the initial loan - Clydesdale do it this way.amnblog said:Yes, they cannot charge you 2.5% of debt that no longer exists.

It is 2.5% of the debt settled on the day you make the payment to settle some or all of the debt0 -

So do first direct (although they also allow unlimited overpayments)DE_612183 said:

Not all work this way - the penalty can be calculated on the debt at the start point - they could add this into the T&Cs as a amount but it's easier to say it's a % of the initial loan - Clydesdale do it this way.amnblog said:Yes, they cannot charge you 2.5% of debt that no longer exists.

It is 2.5% of the debt settled on the day you make the payment to settle some or all of the debt

https://mortgages.firstdirect.com/mortgage-rates-fees/fees

0 -

Some do, but we are talking about SkiptonMDMD said:

So do first direct (although they also allow unlimited overpayments)DE_612183 said:

Not all work this way - the penalty can be calculated on the debt at the start point - they could add this into the T&Cs as a amount but it's easier to say it's a % of the initial loan - Clydesdale do it this way.amnblog said:Yes, they cannot charge you 2.5% of debt that no longer exists.

It is 2.5% of the debt settled on the day you make the payment to settle some or all of the debt

https://mortgages.firstdirect.com/mortgage-rates-fees/fees I am a Mortgage Broker

I am a Mortgage Broker

You should note that this site doesn't check my status as a Mortgage Broker, so you need to take my word for it. This signature is here as I follow MSE's Mortgage Adviser Code of Conduct. Any posts on here are for information and discussion purposes only and shouldn't be seen as financial advice.0 -

Agreed - but I was replying to your statement that - "they cannot charge you 2.5% of debt that no longer exists." which implies that there is a legal or regulation that stops them doing this, which is not the case.amnblog said:

Some do, but we are talking about SkiptonMDMD said:

So do first direct (although they also allow unlimited overpayments)DE_612183 said:

Not all work this way - the penalty can be calculated on the debt at the start point - they could add this into the T&Cs as a amount but it's easier to say it's a % of the initial loan - Clydesdale do it this way.amnblog said:Yes, they cannot charge you 2.5% of debt that no longer exists.

It is 2.5% of the debt settled on the day you make the payment to settle some or all of the debt

https://mortgages.firstdirect.com/mortgage-rates-fees/fees 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards