We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Nest triggered MPAA on a pot less than £10,000

Comments

-

Did she specifically say she wanted to invoke one of her 3 "small pot" opportunities?gettoo27 said:Earlier in the year my wife took her whole NEST pension of £4,000. It should have been under the small pot rules. After numerous letters we have now found out that they triggered the MPAA without informing her. They should have written to her within 31 days. It was not a flexible draw down so should not be classed as ufpls, yet is seems that is what they have done. Despite numerous requests for a statement, they have not provided it. Equally as the account is closed my wife can no longer access any documents in the account. Any suggestions?

If so what evidence do you have of this?2 -

https://www.moneyhelper.org.uk/en/pensions-and-retirement/tax-and-pensions/money-purchase-annual-allowance-mpaaWhat triggers the MPAA?

The MPAA is triggered if you take 'taxable' money out of a defined contribution pension using a flexible payment option.

This usually means converting your pension money into income when you need it, and leaving the rest invested. Just taking up to 25% as a tax-free lump sum usually does not trigger the MPAA.

The MPAA will normally be triggered if you:

- start to take your pension as a series of lump sums

- take a regular income using pension drawdown or from an investment-linked or flexible annuity, where the income isn’t guaranteed

- take your entire pension in one go – unless it’s worth under £10,000 and you ask your pension provider to use small pot lump sum rules

- exceed the cap on capped drawdown started before April 2015.

The MPAA is usually not triggered if you:

- take up to 25% of your pension as a tax-free cash lump sum and leave the rest invested, or use it to buy a guaranteed income from a lifetime annuity

- take money from a defined benefit pension.

If you have an additional voluntary contribution (AVC) scheme, ask your provider or the trustees whether it counts as a defined contribution or defined benefit scheme before taking money. If it’s defined contribution, the withdrawal might trigger the MPAA.

Understand your pension options before taking money

There are many ways you can take money from your defined contribution pension scheme. Before taking money, it’s important to make sure you’ve considered which is best for you.

Our guide explains your options for using your defined contribution pension pot.

If you’re 50 or over, you can also get a free Pension Wise appointment. This will help you understand the different ways you can take your pension.

Remember, if your choices trigger the MPAA and you want to continue saving into your pension, you’ll only get tax relief up to £10,000 a year.

What you need to do if you trigger the MPAA

Your pension provider must tell you if you’ve triggered the MPAA. They’ll send you a flexible access statement within 31 days, or 91 days if you have an overseas pension.

If you have multiple active defined contribution pension schemes (where money is still being paid in), you must tell all your pension providers that the MPAA has been triggered. To avoid a fine, you must do this within 91 days of:

- receiving your flexible access statement or

- joining a new defined contribution scheme.

The MPAA starts the day after it’s triggered and resets at the start of each tax year (6 April). This means only future payments into your pension(s) are counted against the £10,000 limit.

What happens if you go over the MPAA

If you go over the MPAA, you won’t be entitled to tax relief on all your pension savings. This means you’ll need to pay Income Tax on the money that’s higher than the limit. This is called an annual allowance tax charge.

You can use the calculator on GOV.UK to check if you have an annual allowance tax chargeOpens in a new window

The carry forward rules do not apply to the MPAA, so you cannot use unused annual allowance to reduce or cancel out the charge.

How to pay the annual allowance tax charge

There are two ways to pay the annual allowance tax charge:

- Ask your pension provider to pay on your behalf. This is called ‘scheme pays’ and means your pension benefits will be reduced.

But your provider doesn’t always have to do this, including if the tax charge is less than £2,000. See Who must pay the pensions annual allowance tax chargeOpens in a new window on GOV.UK for the rules. - Pay the tax charge yourself.

Either way, you need to complete a Self Assessment tax returnOpens in a new window – this calculates how much you need to pay or tells HMRC your provider has already paid.

See our guide How to fill in a Self Assessment tax return for help with the process.

Consider advice from a financial adviser

If you think you might be affected by the MPAA, consider getting advice from a regulated financial adviser.

An adviser can help you understand:

- how much your annual allowance is

- your options to reduce the tax you might need to pay

- how to pay any tax charges.

Our tool can help you find a retirement adviser or see our guide Choosing a financial adviser for more information.

Need more information on pensions?

Call our helpline free on 0800 011 3797 or use our webchat. One of our pension specialists will be happy to answer your questions.

Our help is impartial and free to use, whether that’s online or over the phone.

Opening times: Monday to Friday, 9am to 5pm. Closed on bank holidays.

0 -

Not sure that helps at all. The point is that if this payment had been taken as a small pot it doesn't trigger the MPAA.

2 -

Except it makes the point that YOU have to ask the provider to apply the small pot rules. You can't just assume that they will do so because the pot is under £10k.GrumpyDil said:Not sure that helps at all. The point is that if this payment had been taken as a small pot it doesn't trigger the MPAA.

To be fair you'd have thought if she didn't specify it that they would have asked her if she wanted to.1 -

Fair point as I'd assumes the OP had made it clear they wanted a small pots payment.DRS1 said:

Except it makes the point that YOU have to ask the provider to apply the small pot rules. You can't just assume that they will do so because the pot is under £10k.GrumpyDil said:Not sure that helps at all. The point is that if this payment had been taken as a small pot it doesn't trigger the MPAA.

To be fair you'd have thought if she didn't specify it that they would have asked her if she wanted to.

Interestingly the Nest brochures implies they do small pots where they say:"You may not be subject to this annual limit if your Nest pot is under £10,000 and you take it all in one go. For more information on tax and pension contributions, visit moneyhelper.org.uk/en/pensions-and-retirement/tax-and-pensions"

But don't explicitly explain how you request this.0 -

I do not know but I imagine there is some sort of form you have to fill in. Maybe a box to tick?0

-

After numerous letters we have now found out that they triggered the MPAA without informing her.I have seen the Nest documentation on UFPLS and they do warn you.It was not a flexible draw down so should not be classed as ufpls, yet is seems that is what they have done.With most providers, you have to explicitly state you wish to draw on the small pots rule. It is not automatic.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

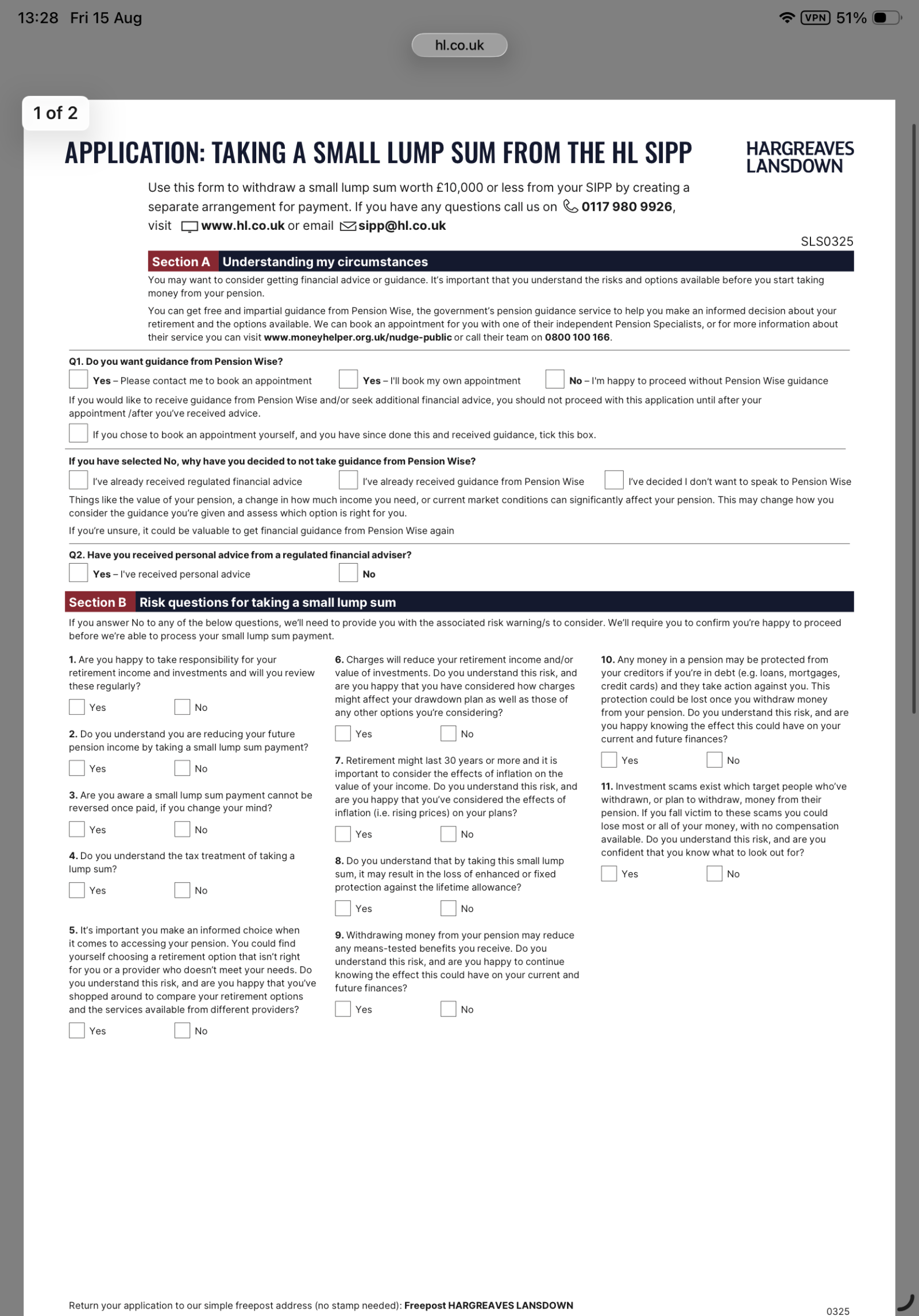

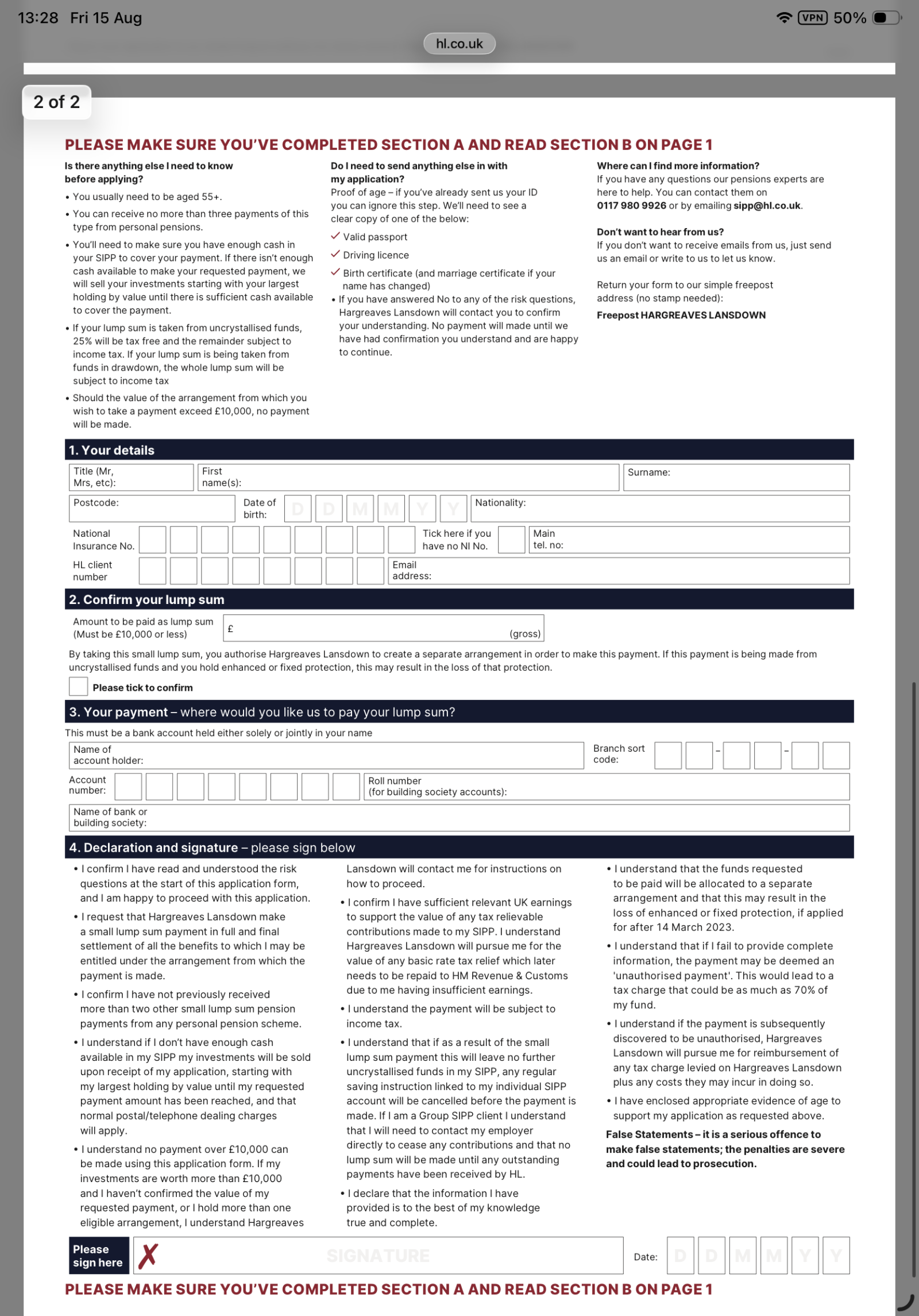

I took one from both Aj Bell and HL. In both cases I messaged them in advance to say I wanted to withdraw the pension pot ( both just under £10K) under the Small Pots Rule.DRS1 said:I do not know but I imagine there is some sort of form you have to fill in. Maybe a box to tick?

In both cases I had to fill in a specific form ( one by hard copy and one digitally) to confirm the requests.1 -

Hargreaves have a specific form to fill in for a small pot of £10,000 or less.Albermarle said:

I took one from both Aj Bell and HL. In both cases I messaged them in advance to say I wanted to withdraw the pension pot ( both just under £10K) under the Small Pots Rule.DRS1 said:I do not know but I imagine there is some sort of form you have to fill in. Maybe a box to tick?

In both cases I had to fill in a specific form ( one by hard copy and one digitally) to confirm the requests.

2

2 -

OK More than the one box to tick.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards