We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Maxed out TFC what to do with small uncrystallised pot

Comments

-

Not sure where you got that information from, but taking a small pot via the small pots rules does not trigger MPAA even although you will be taking taxable income from it.DavidT67 said:

Small pots are outside and above the Lump Sum Allowance. Taking a small pot includes taking taxable income, so they do trigger Money Purchase Annual Allowance restriction.Marcon said:

You can't - maximum of 3 from personal pensions, + an unlimited number from true occupational schemes (which in practice is rarely more than one per person per lifetime!).NickPoole said:

Blimey - that sounds like straightforward and obvious tax avoidance! probably means it's perfectly legal! What's the point of a small pot rule if you can just make all your pension into small pots?DavidT67 said:A decent pension provider will carve out three £10K pots for you from the whole in order to utilise the small pots option.

Where does tax avoidance come into it? OP has only said they have taken 25% from their SIPP, not that they have hit the Lump Sum Allowance, so using the small pots rule wouldn't help them in that respect - they could take 25% from this tiddler pot regardless.

The small pot route would only be use if they wanted to pay in more than £10K a year to a DC scheme in future years, and didn't want to trigger the MPAA.

E.g. see https://www.standardlife.co.uk/articles/article-page/small-pots-questions-answered4 -

Small pot does NOT trigger MPAA.DavidT67 said:

Small pots are outside and above the Lump Sum Allowance. Taking a small pot includes taking taxable income, so they do trigger Money Purchase Annual Allowance restriction.Marcon said:

You can't - maximum of 3 from personal pensions, + an unlimited number from true occupational schemes (which in practice is rarely more than one per person per lifetime!).NickPoole said:

Blimey - that sounds like straightforward and obvious tax avoidance! probably means it's perfectly legal! What's the point of a small pot rule if you can just make all your pension into small pots?DavidT67 said:A decent pension provider will carve out three £10K pots for you from the whole in order to utilise the small pots option.

Where does tax avoidance come into it? OP has only said they have taken 25% from their SIPP, not that they have hit the Lump Sum Allowance, so using the small pots rule wouldn't help them in that respect - they could take 25% from this tiddler pot regardless.

The small pot route would only be use if they wanted to pay in more than £10K a year to a DC scheme in future years, and didn't want to trigger the MPAA.2 -

Notepad_Phil said:

Not sure where you got that information from, but taking a small pot via the small pots rules does not trigger MPAA even although you will be taking taxable income from it.DavidT67 said:

Small pots are outside and above the Lump Sum Allowance. Taking a small pot includes taking taxable income, so they do trigger Money Purchase Annual Allowance restriction.Marcon said:

You can't - maximum of 3 from personal pensions, + an unlimited number from true occupational schemes (which in practice is rarely more than one per person per lifetime!).NickPoole said:

Blimey - that sounds like straightforward and obvious tax avoidance! probably means it's perfectly legal! What's the point of a small pot rule if you can just make all your pension into small pots?DavidT67 said:A decent pension provider will carve out three £10K pots for you from the whole in order to utilise the small pots option.

Where does tax avoidance come into it? OP has only said they have taken 25% from their SIPP, not that they have hit the Lump Sum Allowance, so using the small pots rule wouldn't help them in that respect - they could take 25% from this tiddler pot regardless.

The small pot route would only be use if they wanted to pay in more than £10K a year to a DC scheme in future years, and didn't want to trigger the MPAA.

E.g. see https://www.standardlife.co.uk/articles/article-page/small-pots-questions-answered

HL... Thanks for the link.0 -

I think your confusion might have arisen because so many people (entirely understandably) refer to having a 'small pot' when they simply mean it is - in their eyes anyway - quite a modest amount.DavidT67 said:

Small pots are outside and above the Lump Sum Allowance. Taking a small pot includes taking taxable income, so they do trigger Money Purchase Annual Allowance restriction.Marcon said:

You can't - maximum of 3 from personal pensions, + an unlimited number from true occupational schemes (which in practice is rarely more than one per person per lifetime!).NickPoole said:

Blimey - that sounds like straightforward and obvious tax avoidance! probably means it's perfectly legal! What's the point of a small pot rule if you can just make all your pension into small pots?DavidT67 said:A decent pension provider will carve out three £10K pots for you from the whole in order to utilise the small pots option.

Where does tax avoidance come into it? OP has only said they have taken 25% from their SIPP, not that they have hit the Lump Sum Allowance, so using the small pots rule wouldn't help them in that respect - they could take 25% from this tiddler pot regardless.

The small pot route would only be use if they wanted to pay in more than £10K a year to a DC scheme in future years, and didn't want to trigger the MPAA.

Only if the pot qualifies for, and is withdrawn with the pot owner specifically asking to take it under the 'small pots' regime (and their provider offers it - not all do), is it a 'small pot' within the definition of the legislation. Otherwise it's just a little pension pot and yes - that will trigger the MPAA.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

I think your confusion might have arisen because so many people (entirely understandably) refer to having a 'small pot' when they simply mean it is - in their eyes anyway - quite a modest amount.

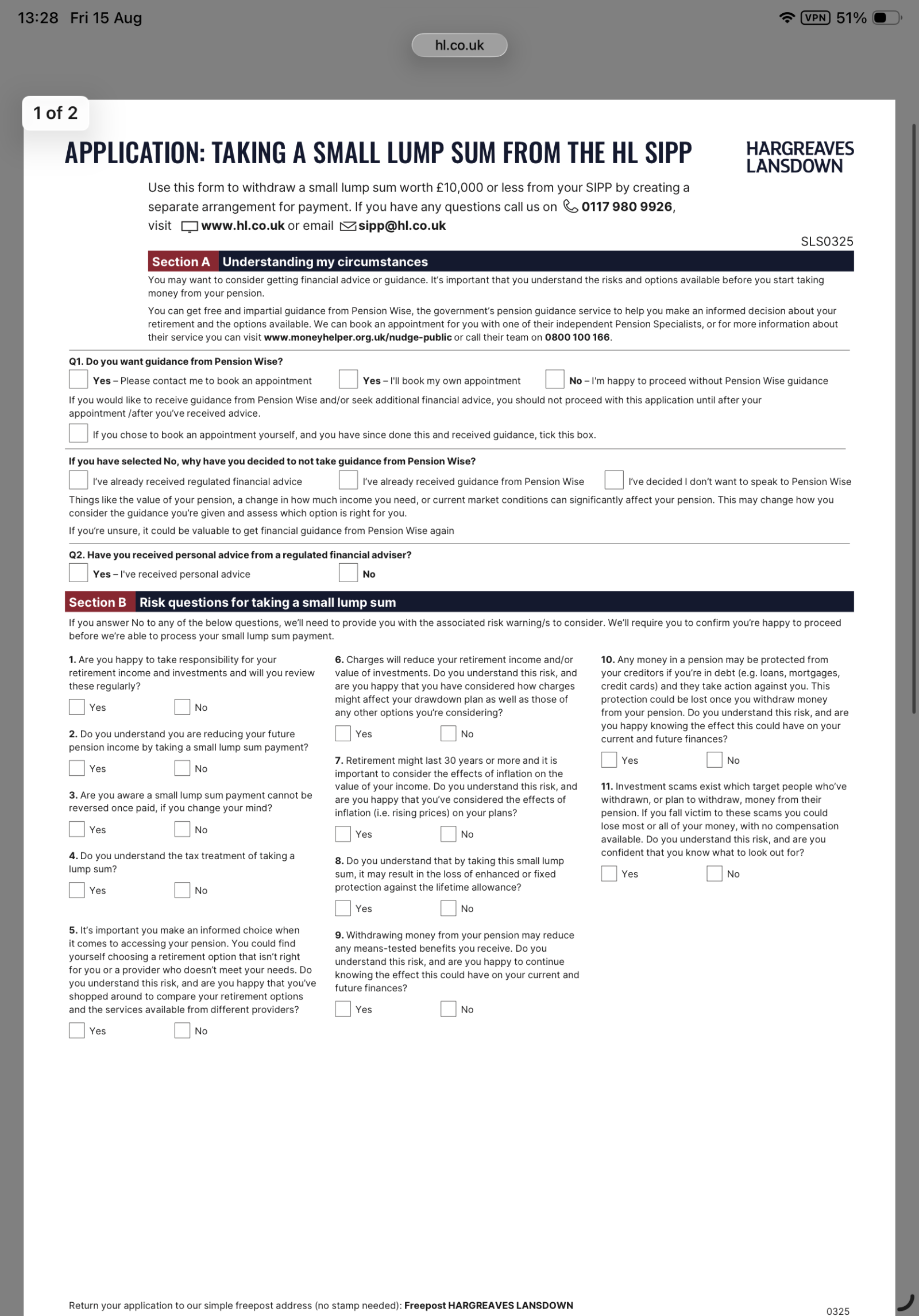

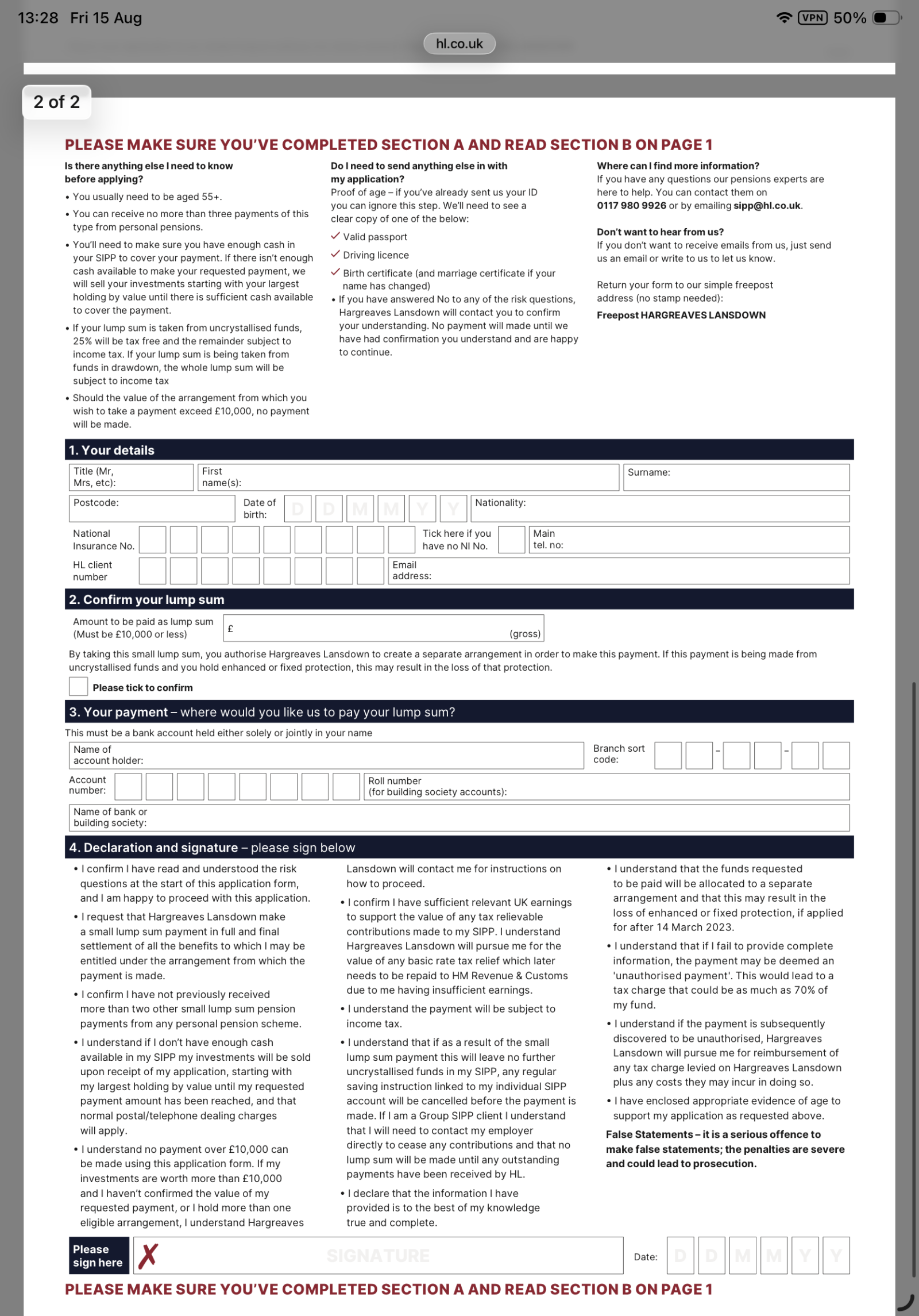

Only if the pot qualifies for, and is withdrawn with the pot owner specifically asking to take it under the 'small pots' regime (and their provider offers it - not all do), is it a 'small pot' within the definition of the legislation. Otherwise it's just a little pension pot and yes - that will trigger the MPAA.The confusion will have been with the HL CS rep who gave erroneous information to me.I've now seen someone else post an image of the HL form for slicing a small lump sum from their SIPP, so will know that's the form required when the time comes.

0 -

Presumably that was me, here it is again for future reference.DavidT67 said:I think your confusion might have arisen because so many people (entirely understandably) refer to having a 'small pot' when they simply mean it is - in their eyes anyway - quite a modest amount.

Only if the pot qualifies for, and is withdrawn with the pot owner specifically asking to take it under the 'small pots' regime (and their provider offers it - not all do), is it a 'small pot' within the definition of the legislation. Otherwise it's just a little pension pot and yes - that will trigger the MPAA.The confusion will have been with the HL CS rep who gave erroneous information to me.I've now seen someone else post an image of the HL form for slicing a small lump sum from their SIPP, so will know that's the form required when the time comes.

2 -

Happy to complete section 3 for you1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards