We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Poll: Pre vs post retirement disposable income (actual or planned)

Comments

-

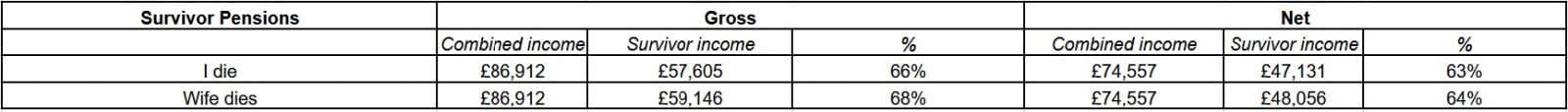

Just one thing to ask of you number crunchers - have you ensured that when life happens, and one of you is left alone (usually the wife) will she still have enough income to be comfortable?Something I monitor closely - the tax impact of moving from 2 sets of allowances to a single allowance is significant, as it means both of us are basic rate taxpayers when alive, but the survivor will be a higher rate taxpayer,I might delay my wife's DB or State Pension slightly to equalise the figures in the future if we have more than we need, but more for the satisfaction of symmetry than any genuine need.

1

1 -

That's easy from my perspective as I have a DC pot my wife is the beneficiary so will inherit the remainder of the pot. I will get about 8k per year from her DB pensions.Silvertabby said:

Just one thing to ask of you number crunchers - have you ensured that when life happens, and one of you is left alone (usually the wife) will she still have enough income to be comfortable?It's just my opinion and not advice.1 -

Interesting point about the individual tax allowances. Unbelievable to think that as recently as 1990 a wife's income was deemed to be her husband's for tax purposes!

We, too, would pay a substantial amount of higher rate tax on our combined pensions.

Hmmm - maybe I shouldn't be putting ideas into a certain person's head......1 -

Silvertabby said:Interesting point about the individual tax allowances. Unbelievable to think that as recently as 1990 a wife's income was deemed to be her husband's for tax purposes!

We, too, would pay a substantial amount of higher rate tax on our combined pensions.

Hmmm - maybe I shouldn't be putting ideas into a certain person's head......

Although there was the Married Man's Tax Allowance - larger than a single person's and was set against the couple's combined income.

0 -

Yes, 1.5 times the single rate. I dare say that married couples with non working wives weren't happy if they had to pay more tax, but a big boost for working couples.LHW99 said:Silvertabby said:Interesting point about the individual tax allowances. Unbelievable to think that as recently as 1990 a wife's income was deemed to be her husband's for tax purposes!

We, too, would pay a substantial amount of higher rate tax on our combined pensions.

Hmmm - maybe I shouldn't be putting ideas into a certain person's head......

Although there was the Married Man's Tax Allowance - larger than a single person's and was set against the couple's combined income.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards