We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Zopa Loan default

Fluffykittens_me

Posts: 44 Forumite

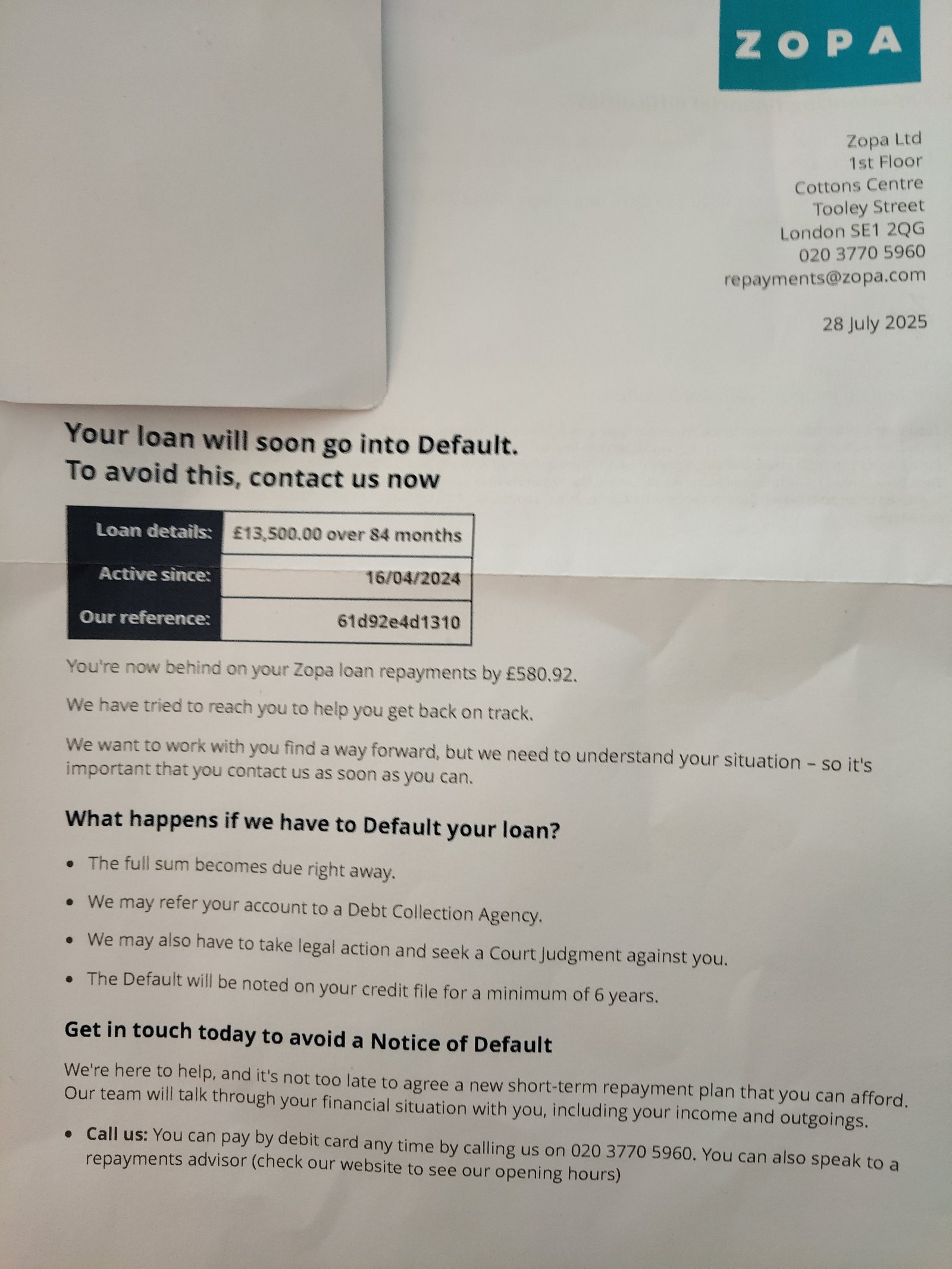

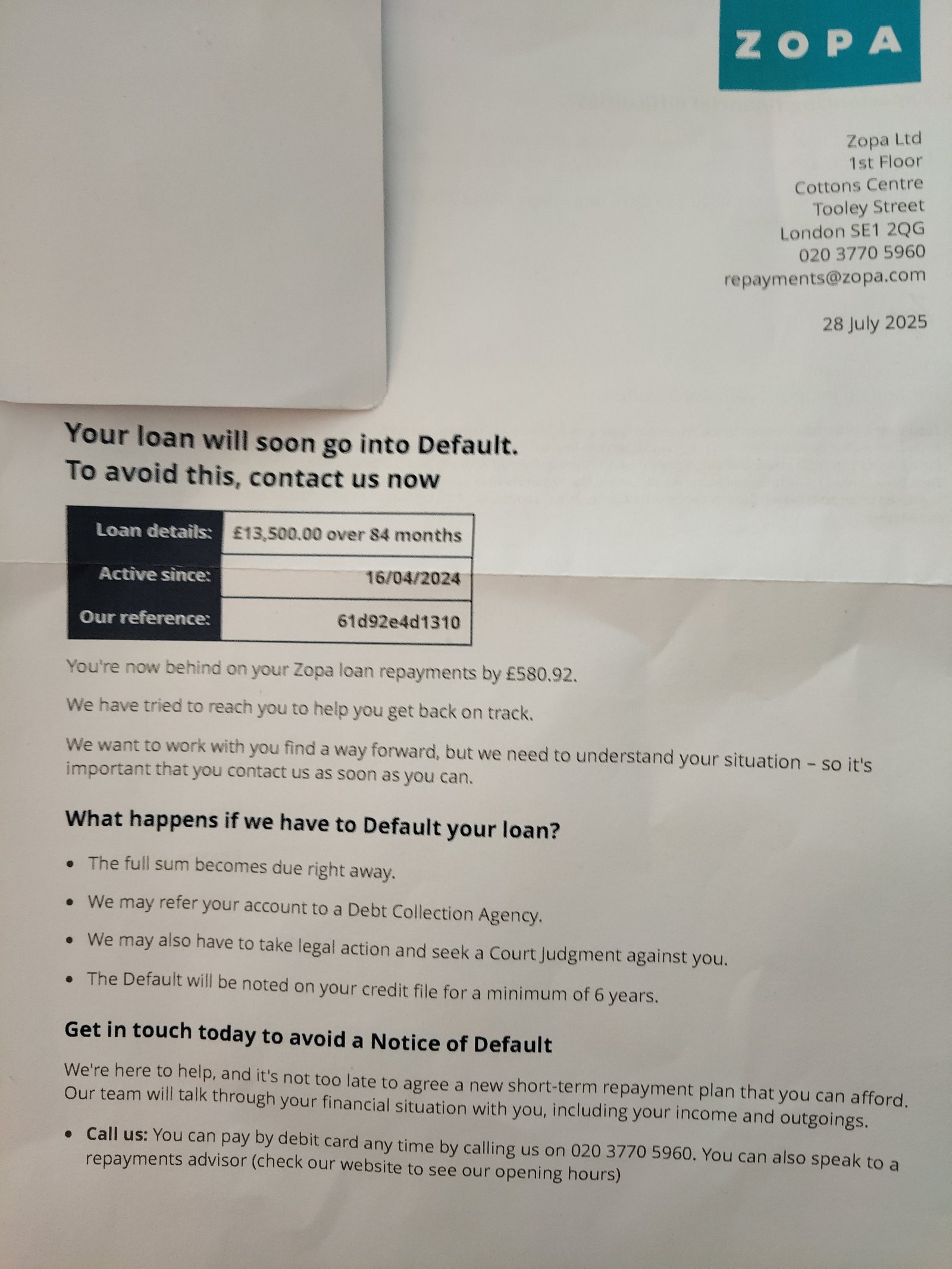

Hi, could you please advise if this is anything to worry about before I start a self managed Dmp? At what point do I contact them to set up a payment please? See attached letters. This is after 2 missed payment rather than the 3 to 6 that it says they usually start defaulting. Donr want to end up with a Ccj 😞. Thanks for any help.

edited to remove OP`s address.

edited to remove OP`s address.

0

Comments

-

I am also about to send an affordability complaint to them.0

-

I won an affordability complaint recently, you’ll see my post if you do a search. Zopa rejected it, but FOS upheld.

I haven’t paid anything since November 2024…defaulted in May, but as part of the complaint they have to remove the default and have taken the interest off my balance.

my next payment is showing as 01/01/1901, so I’m hoping I fall through the cracks for next 4.5 years (wishful thinking - I know) but not heard anything from them…I’m in Scotland2 -

Your address was visible in the letter, so I have removed the picture.

This is just a notice of arrears, a standard letter sent under the terms of the consumer credit act.

Before the account defaults, you will be sent a default notice, sent under sec 87(1) CCA.

That letter will give you 14 days to clear the breach to your agreement, or a default will be registered with the credit reference agencies.

After the time limit expires, the default will normally be registered within a month of that deadline.

Check your credit file to confirm.

Now this debt is quite large, 20k plus, and as far as I am aware Zopa`s debt collection process mimics normal industry standards, but if you do receive a "letter before action" from them after the debt defaults, please do post back for advice.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Thanks Sourcrates for the advice and taking the screenshot down. I am hoping this amount comes doen significantly if I can get the affordability complaint agreed, I will post back if I receive that. Is that something to be more concerned about? Thanks allystar I will have a look at the thread 😊.0

-

Lenders do not normally take legal action themselves to recover bad debts, they simply pass them to debt collection agencies, or they sell the debt to a 3rd party, that`s what happens 99% of the time.Fluffykittens_me said:Thanks Sourcrates for the advice and taking the screenshot down. I am hoping this amount comes doen significantly if I can get the affordability complaint agreed, I will post back if I receive that. Is that something to be more concerned about? Thanks allystar I will have a look at the thread 😊.

But there are occasions when they do, if you owe a lot of money, or there policy dictates as such.

An LBA (letter before action) is the first step in the legal process, so if you get one, it will clearly state what it is, you must respond to it to prevent the matter progressing to court.

I must stress the idea behind an LBA is to come to an agreement with your lender without the need to go to court, so its important that should you get one, you do respond to it.

I will also add that they must default you first, before any recovery action can take place, so for now, your strategy is a good one.

I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter0 -

Also, if you do an affordability complaint do they carry on defaulting you and going through the normal channels until its been upheld? Sorry for all the questions but just to put my mind at rest 😳0

-

Each case is different, and redress is decided on an individual basis.Fluffykittens_me said:Also, if you do an affordability complaint do they carry on defaulting you and going through the normal channels until its been upheld? Sorry for all the questions but just to put my mind at rest 😳

It can result in a refund of interest, all credit file reporting removed, there are various types of redress in these matters.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1 -

Thanks so much, I'm so glad I found this forum. Your advise and information is an absolute godsend!0

-

Just one last thing for now, does anyone know where I can get a copy of my credit report from 2024?0

-

Credit reports update on average on a monthly basis, so its constantly changing.

If an account has been open since before 2024, you can see its payment history on your report.

That`s about the best you can do.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards