We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

10 years retired - how come finances are so good?

Comments

-

For sure. My retirement plan is to have a retirement income in excess of my needs, same as my wages, say a 15% excess income above my wants. 10 years of that would of course ramp up the pot size. Ideally if we all live within our means the pot increases. Of course inflation erodes the real value of the pot even as/if the actual number grows though compounding is a well known bleeding miracle.green_man said:

Yes certainly true in my case, however with retiring early this was (in my mind) an essential process otherwise the risk of a long retirement would just be too high. In the years leading to retirement my planning was on a long pessimistic outlook, only when tools showed this as likely > 99% success rate did I feel confident enough to take the jump.Linton said:ISTM the core reason people are finding themselves unexpectedly rich after say 10 years retirement is that, reasonably enough, they plan pessimistically on all fronts. In reality life rarely turns out completely badly.0 -

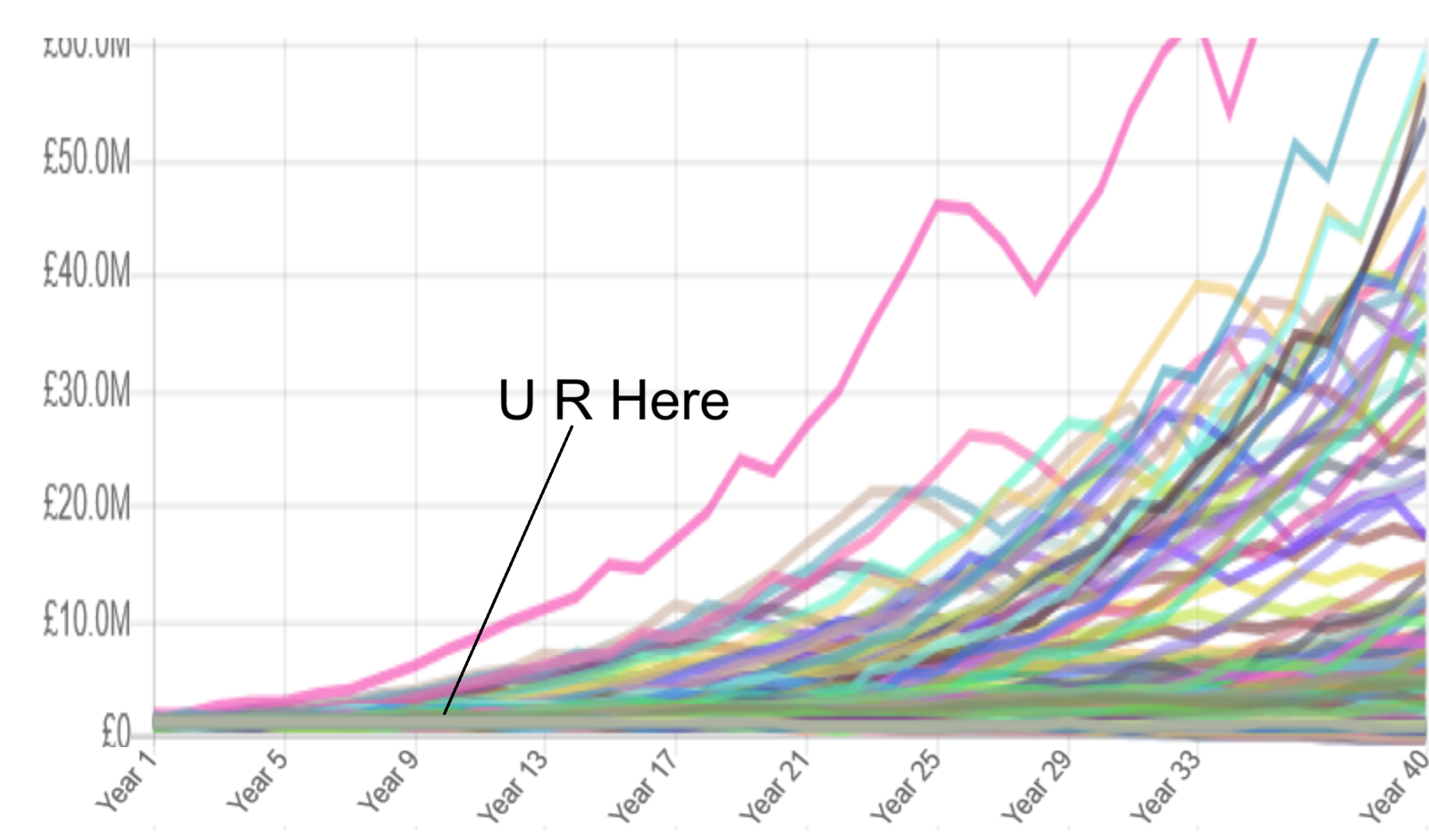

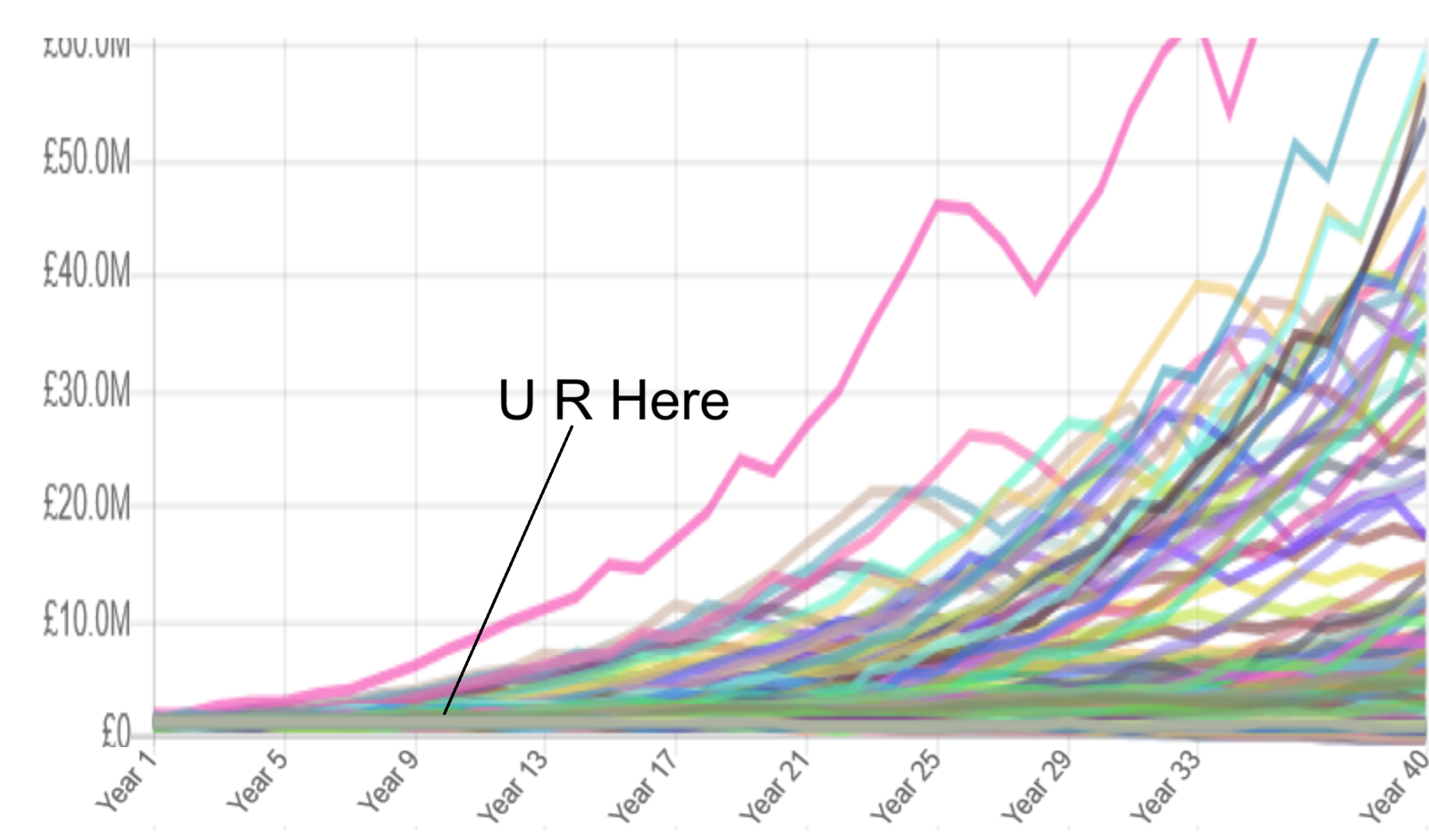

That's because this portfolio is in my opinion (on a 5 minute analysis) carrying too little "risk". 30% cash and then another 10% cash in the HSBC fund as well. Not enough info to look at the L&G fund.Secret2ndAccount said:Here are 125 simulations of a retirement like yours:

You are in the middle of the mass of lines. So just average. Incidentally, 5.6% of these simulations ran out of money! If stocks are at an unexpected high, and annuities are at an unexpected high, have you considered buying an annuity. Put 300k into an annuity, then go on with the million you started with.

Too me this feels like a situation where the "risk" level of the investments could (should?) be increased in order to reduce the bigger risk - inflation.

I am pretty sure that if you run that simulation with less cash and more equities the 5.6% of failures will disappear i.e. the level of risk aversion is actually causing the risk of long term failure.

Unfortunately in the finance investment world "risk" is seen mainly in the context of the risk for short or medium term nominal losses. Carrying 100% cash would come up as zero risk on your investment platform, but actually it's a big risk.0 -

I suspect you are correct, what the relatively low withdrawal rate does allow me to do though is increase my cash amount thus mitigating short term risk, however I can see this does increase long term risk to a degree. When I started out inflation was very low and my income from the cash exceeded inflation, hence the cash reduced my grown potential but did not add significant inflation risk. What I hadn’t allowed for was a couple of years where inflation exceeded cash return by a significant margin (> 5%). This has now stabilised somewhat and my cash income is within a few points of inflation (<0.5%).Pat38493 said:

That's because this portfolio is in my opinion (on a 5 minute analysis) carrying too little "risk". 30% cash and then another 10% cash in the HSBC fund as well. Not enough info to look at the L&G fund.Secret2ndAccount said:Here are 125 simulations of a retirement like yours:

You are in the middle of the mass of lines. So just average. Incidentally, 5.6% of these simulations ran out of money! If stocks are at an unexpected high, and annuities are at an unexpected high, have you considered buying an annuity. Put 300k into an annuity, then go on with the million you started with.

Too me this feels like a situation where the "risk" level of the investments could (should?) be increased in order to reduce the bigger risk - inflation.

I am pretty sure that if you run that simulation with less cash and more equities the 5.6% of failures will disappear i.e. the level of risk aversion is actually causing the risk of long term failure.

Unfortunately in the finance investment world "risk" is seen mainly in the context of the risk for short or medium term nominal losses. Carrying 100% cash would come up as zero risk on your investment platform, but actually it's a big risk.I will consider your response though, thanks.0 -

I think maybe this shows that large and prolonged market slumps are not usually the result of Global events like you describe, but stem from issues in the financial markets themselves. The two this century certainly were;green_man said:

Yes certainly true in my case, however with retiring early this was (in my mind) an essential process otherwise the risk of a long retirement would just be too high. In the years leading to retirement my planning was on a long pessimistic outlook, only when tools showed this as likely > 99% success rate did I feel confident enough to take the jump.Linton said:ISTM the core reason people are finding themselves unexpectedly rich after say 10 years retirement is that, reasonably enough, they plan pessimistically on all fronts. In reality life rarely turns out completely badly.

So based on that it’s probably no surprise that things seem ok. However in my mind it seems to have been a pretty rocky 10 years: stagnant growth in the UK; spiralling energy costs; war in Europe; inflation in double figures; high interest rates (compared with recent past); COVID; Trump lunacy. I know there’s nearly always something happening but other than actual world wars this seems like pretty big head winds to me.

Dot com crash of 2000- due to massive overexuberance/bubble in dot. com stocks.

GFC of 2008 - Reckless lending, subprime mortgages, exacerbated by debt derivatives etc0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards