We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

5% or RPI increases - any crystal balls?

Comments

-

That is interesting. For some reason I thought that only caught certain types of annuity.ukdw said:Not sure if this is changing with the new pension IHT rules - but currently some guaranteed annuities can attract IHT I believe - based on a 'market value' - that gradually reduces as the guarantee period runs down.

market value calculator here

https://www.gov.uk/government/publications/inheritance-tax-guaranteed-annuity-calculator0 -

Told you!QrizB said:DRS1 said:One small point when you say "Unless someone knows something and isn't telling us, 5% protection looks pretty decent if quite a bit cheaper." 5% protection is currently more expensive because Mr Market is pricing inflation at just over 3%.There was a similar confusion in an earlier post:

I think the commenter had got it back-to-front for some reason.Cobbler_tone said:If buying something with RPI protection vs a 5% increase was significantly more, it would be a no brainer in my mind. 5% is a meaty increase. RPI traditionally runs well below that.

The maths still work but I’d go with RPI if a better starting annuity. You are protected and can’t lose really, unless your motivation is purely to growth it 5% each year regardless, which could be a part of your financial plan I guess.0 -

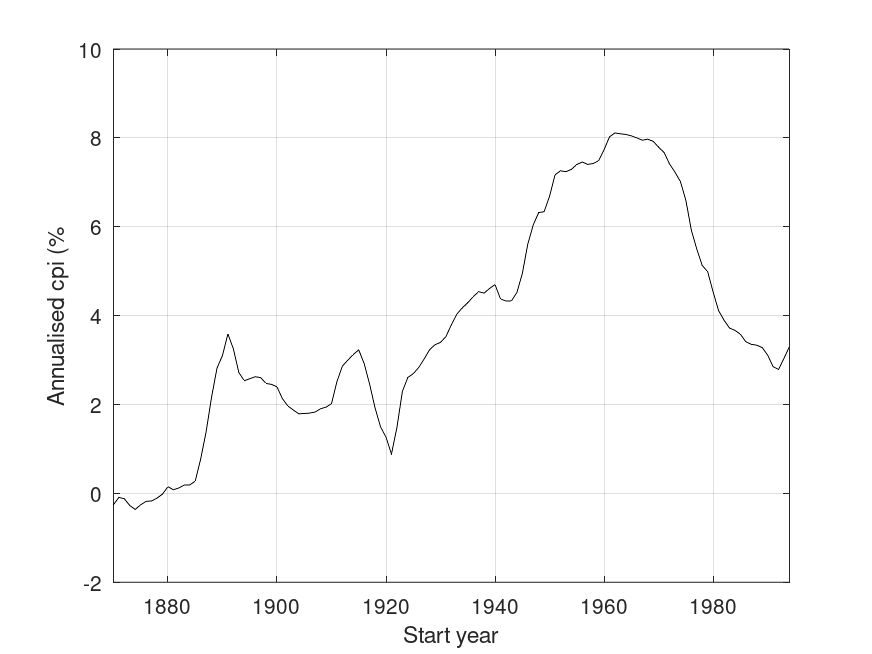

Just a slightly different take on the same theme, here is a graph of annualised inflation over rolling 30-year periods for the UK. Although I've included it, the period before 1930 when the UK was still on the gold standard (and there were periods of deflation) is less likely to be repeated and should probably be ignored.DRS1 said:

Those figures do surprise me and give me some comfort that I was not completely barking last year.m_c_s said:

UK Inflation (CPI) Averages10yr 3.01% 20yr 3.02% 30yr 2.90% 40yr 3.39% 50yr 5.23% 60yr 5.52% 70yr 5.17% 80yr 5.14%

Add 0.5 to 1% to the above to get approx RPI.

Recency bias is always something to be aware of. Recent inflation history falls significantly short of longer term averages. The recent 2 year period (2022 and 2023) of above 6% inflation impacts the average of the last 10 years by adding approx 1%. To feel real pain you need 10+ years of 7 to 15% like the 1970s and 1980s. The 1970s and early 1980s in particular are the main decades which skew most inflation data averages with many years above 8% inflation and several years hitting 15%+ inflation. That is brutal and arguably a once in a generation type global scenario.

I suppose that historic stories of hyperinflation (Germany in the 1920s/30s Zimbabwe and Venezuela more recently) make one more fearful of inflation that is justified by recent years in the UK.

Those retiring with nominal annuities (with or without escalations) in the 1960s and 1970s would have found the value of their income much reduced by the end of retirement.

It is interesting to note that 5% escalation annuities are currently not even priced at https://www.williamburrows.com/calculators/annuity-tables/ and that, as stated upthread the RPI annuity and 3% escalation are fairly similar (e.g., for a single life at 65yo, the payout rates are 5.2% and 5.7% for RPI and 3%, respectively).

If your starting points of £10k (5%esc) and £14k (RPI) are correct then the time required for the income of the escalation annuity to exceed that of the RPI annuity at the BoE target of 2% cpi is 11-12 years, at the best case cpi since the 1930s of 3% (see graph) is 17-18 years, and with a cpi of 4% is 35-36 years.

Since it is impossible to predict future inflation (i.e., no-one knows whether it will be 8% annualised over the next 30 years or 3%), you will only know which would have been the best purchase towards the end of retirement and therefore, IMV, trying to do so is asking the wrong question and a better question is "which annuity will give me the income I need/require?" As others have mentioned, consider what the consequences of the failure of this income stream would be if conditions are not favourable.

2 -

A few points pop in my head.

Recency bias, sequencing risk, FOMO, greed, sleepless nights and worry as we age.

The insurance companies can juggle and manage their risk over many years and policies, annuity holders can't really do this.

If I was to buy a annuity product, I think I may do a 50/50 split of RPI & 5% in the example.

If RPI was less than 5% I would try plonking the % difference of income on the 5% in to a ISA.

If RPI was more than 5% I would try plonked the % above 5% in to that ISA.

I'm very conservative in my views, but feel the plan above may be suitable for me.

I always plan for the worst and cut my cloth appropriately to provide me with a very reasonable margin of error.1 -

Thank you for the graph. I think I am more than ever inclined to go with the RPI increases. I will have to double check that the quotes are right - the gap was less last year so I wonder if there is an error in this years one.OldScientist said:

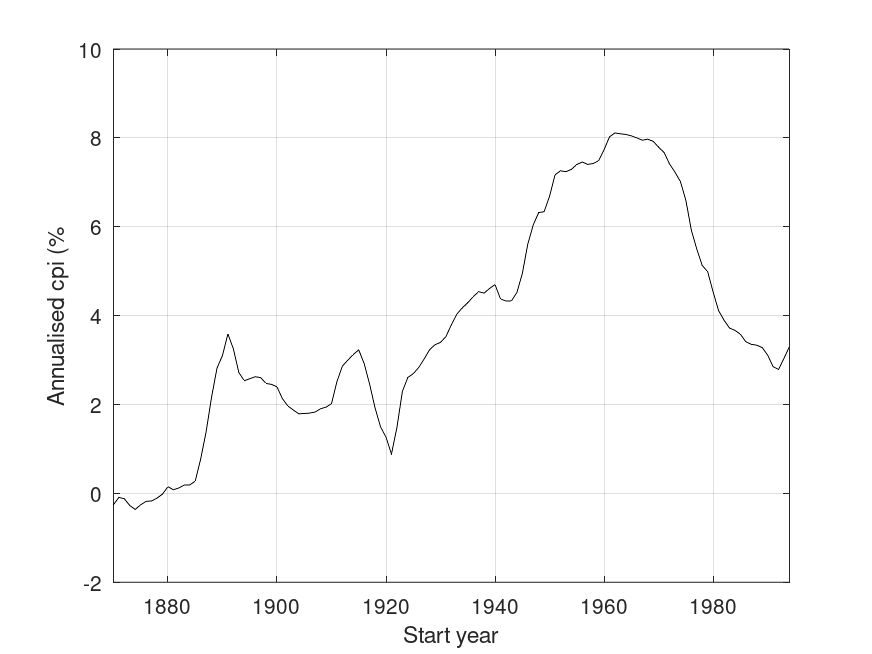

Just a slightly different take on the same theme, here is a graph of annualised inflation over rolling 30-year periods for the UK. Although I've included it, the period before 1930 when the UK was still on the gold standard (and there were periods of deflation) is less likely to be repeated and should probably be ignored.DRS1 said:

Those figures do surprise me and give me some comfort that I was not completely barking last year.m_c_s said:

UK Inflation (CPI) Averages10yr 3.01% 20yr 3.02% 30yr 2.90% 40yr 3.39% 50yr 5.23% 60yr 5.52% 70yr 5.17% 80yr 5.14%

Add 0.5 to 1% to the above to get approx RPI.

Recency bias is always something to be aware of. Recent inflation history falls significantly short of longer term averages. The recent 2 year period (2022 and 2023) of above 6% inflation impacts the average of the last 10 years by adding approx 1%. To feel real pain you need 10+ years of 7 to 15% like the 1970s and 1980s. The 1970s and early 1980s in particular are the main decades which skew most inflation data averages with many years above 8% inflation and several years hitting 15%+ inflation. That is brutal and arguably a once in a generation type global scenario.

I suppose that historic stories of hyperinflation (Germany in the 1920s/30s Zimbabwe and Venezuela more recently) make one more fearful of inflation that is justified by recent years in the UK.

Those retiring with nominal annuities (with or without escalations) in the 1960s and 1970s would have found the value of their income much reduced by the end of retirement.

It is interesting to note that 5% escalation annuities are currently not even priced at https://www.williamburrows.com/calculators/annuity-tables/ and that, as stated upthread the RPI annuity and 3% escalation are fairly similar (e.g., for a single life at 65yo, the payout rates are 5.2% and 5.7% for RPI and 3%, respectively).

If your starting points of £10k (5%esc) and £14k (RPI) are correct then the time required for the income of the escalation annuity to exceed that of the RPI annuity at the BoE target of 2% cpi is 11-12 years, at the best case cpi since the 1930s of 3% (see graph) is 17-18 years, and with a cpi of 4% is 35-36 years.

Since it is impossible to predict future inflation (i.e., no-one knows whether it will be 8% annualised over the next 30 years or 3%), you will only know which would have been the best purchase towards the end of retirement and therefore, IMV, trying to do so is asking the wrong question and a better question is "which annuity will give me the income I need/require?" As others have mentioned, consider what the consequences of the failure of this income stream would be if conditions are not favourable.

For what it is worth all the annuity providers were happy to quote for 5% increases last year so I don't think it is unusual. By contrast if you ask them to quote for LPI (RPI capped at 5%) then a number just won't quote.

As you say the key is guarding the income stream against future conditions and RPI increases are the nearest thing you can get to protection against inflation and the income falling behind expenditure. It may not be perfect but it is less of a gamble than doubling down on 5%.

As @RogerPensionGuy says splitting it 50/50 is a conservative approach and this is roughly what I will have ended up with. It will then be interesting to compare the pension increase statements every year (though hopefully not that interesting).0 -

The last time I got a quote from moneyhelper for an LPI annuity (a year or two ago?) it had a payout rate that was virtually identical to an RPI one which might explain why no-one will sell one!DRS1 said:

Thank you for the graph. I think I am more than ever inclined to go with the RPI increases. I will have to double check that the quotes are right - the gap was less last year so I wonder if there is an error in this years one.OldScientist said:

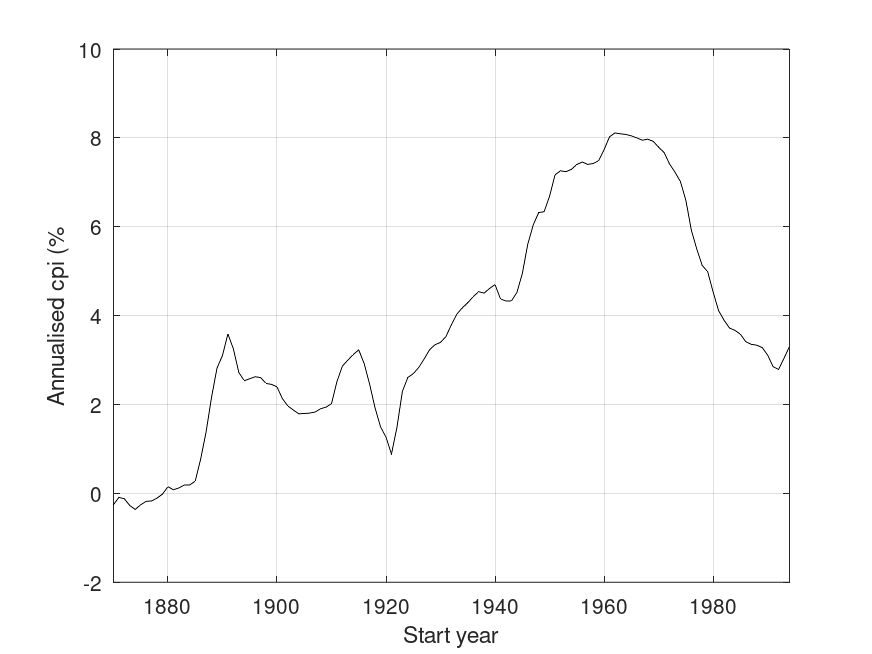

Just a slightly different take on the same theme, here is a graph of annualised inflation over rolling 30-year periods for the UK. Although I've included it, the period before 1930 when the UK was still on the gold standard (and there were periods of deflation) is less likely to be repeated and should probably be ignored.DRS1 said:

Those figures do surprise me and give me some comfort that I was not completely barking last year.m_c_s said:

UK Inflation (CPI) Averages10yr 3.01% 20yr 3.02% 30yr 2.90% 40yr 3.39% 50yr 5.23% 60yr 5.52% 70yr 5.17% 80yr 5.14%

Add 0.5 to 1% to the above to get approx RPI.

Recency bias is always something to be aware of. Recent inflation history falls significantly short of longer term averages. The recent 2 year period (2022 and 2023) of above 6% inflation impacts the average of the last 10 years by adding approx 1%. To feel real pain you need 10+ years of 7 to 15% like the 1970s and 1980s. The 1970s and early 1980s in particular are the main decades which skew most inflation data averages with many years above 8% inflation and several years hitting 15%+ inflation. That is brutal and arguably a once in a generation type global scenario.

I suppose that historic stories of hyperinflation (Germany in the 1920s/30s Zimbabwe and Venezuela more recently) make one more fearful of inflation that is justified by recent years in the UK.

Those retiring with nominal annuities (with or without escalations) in the 1960s and 1970s would have found the value of their income much reduced by the end of retirement.

It is interesting to note that 5% escalation annuities are currently not even priced at https://www.williamburrows.com/calculators/annuity-tables/ and that, as stated upthread the RPI annuity and 3% escalation are fairly similar (e.g., for a single life at 65yo, the payout rates are 5.2% and 5.7% for RPI and 3%, respectively).

If your starting points of £10k (5%esc) and £14k (RPI) are correct then the time required for the income of the escalation annuity to exceed that of the RPI annuity at the BoE target of 2% cpi is 11-12 years, at the best case cpi since the 1930s of 3% (see graph) is 17-18 years, and with a cpi of 4% is 35-36 years.

Since it is impossible to predict future inflation (i.e., no-one knows whether it will be 8% annualised over the next 30 years or 3%), you will only know which would have been the best purchase towards the end of retirement and therefore, IMV, trying to do so is asking the wrong question and a better question is "which annuity will give me the income I need/require?" As others have mentioned, consider what the consequences of the failure of this income stream would be if conditions are not favourable.

For what it is worth all the annuity providers were happy to quote for 5% increases last year so I don't think it is unusual. By contrast if you ask them to quote for LPI (RPI capped at 5%) then a number just won't quote.

As you say the key is guarding the income stream against future conditions and RPI increases are the nearest thing you can get to protection against inflation and the income falling behind expenditure. It may not be perfect but it is less of a gamble than doubling down on 5%.

As @RogerPensionGuy says splitting it 50/50 is a conservative approach and this is roughly what I will have ended up with. It will then be interesting to compare the pension increase statements every year (though hopefully not that interesting).

As I'm sure you've already found with your 5% annuity, having a regular income is useful particularly, if like me, the mental transition from saving to spending has not been easy.

0 -

What is more important?

If winning is the most important then go for the one you think will give you the most, which essentially is do you think we will have high inflation in the next 20-30 years, particularly in the early years of your retirement. A bet that nobody knows the answer until it happens.

If security and having enough to live on is the target, mix it up. A bit of 5% and a bit of RPI is a good bet. I have enough inflation linked DB if I do go for an annuity top up in the next 12 months I’ll go 3% as I get a higher starting amount and with my costs covered by DB, if I lose ground by 75 it probably isn’t the end of the world.

0 -

Or indeed buy one - who wouldn't want the full fat RPI version if it costs the same.OldScientist said:

The last time I got a quote from moneyhelper for an LPI annuity (a year or two ago?) it had a payout rate that was virtually identical to an RPI one which might explain why no-one will sell one!DRS1 said:

Thank you for the graph. I think I am more than ever inclined to go with the RPI increases. I will have to double check that the quotes are right - the gap was less last year so I wonder if there is an error in this years one.OldScientist said:

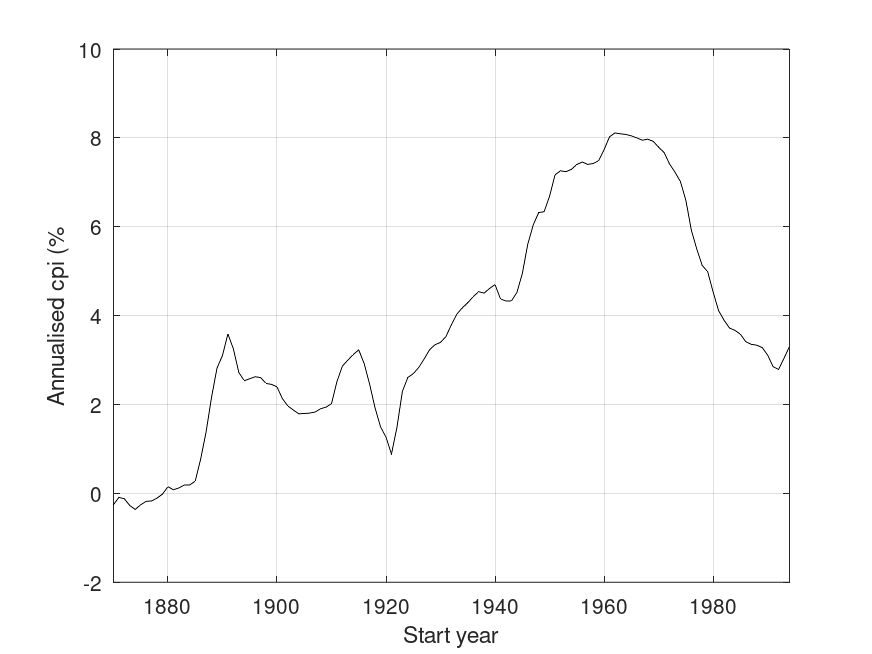

Just a slightly different take on the same theme, here is a graph of annualised inflation over rolling 30-year periods for the UK. Although I've included it, the period before 1930 when the UK was still on the gold standard (and there were periods of deflation) is less likely to be repeated and should probably be ignored.DRS1 said:

Those figures do surprise me and give me some comfort that I was not completely barking last year.m_c_s said:

UK Inflation (CPI) Averages10yr 3.01% 20yr 3.02% 30yr 2.90% 40yr 3.39% 50yr 5.23% 60yr 5.52% 70yr 5.17% 80yr 5.14%

Add 0.5 to 1% to the above to get approx RPI.

Recency bias is always something to be aware of. Recent inflation history falls significantly short of longer term averages. The recent 2 year period (2022 and 2023) of above 6% inflation impacts the average of the last 10 years by adding approx 1%. To feel real pain you need 10+ years of 7 to 15% like the 1970s and 1980s. The 1970s and early 1980s in particular are the main decades which skew most inflation data averages with many years above 8% inflation and several years hitting 15%+ inflation. That is brutal and arguably a once in a generation type global scenario.

I suppose that historic stories of hyperinflation (Germany in the 1920s/30s Zimbabwe and Venezuela more recently) make one more fearful of inflation that is justified by recent years in the UK.

Those retiring with nominal annuities (with or without escalations) in the 1960s and 1970s would have found the value of their income much reduced by the end of retirement.

It is interesting to note that 5% escalation annuities are currently not even priced at https://www.williamburrows.com/calculators/annuity-tables/ and that, as stated upthread the RPI annuity and 3% escalation are fairly similar (e.g., for a single life at 65yo, the payout rates are 5.2% and 5.7% for RPI and 3%, respectively).

If your starting points of £10k (5%esc) and £14k (RPI) are correct then the time required for the income of the escalation annuity to exceed that of the RPI annuity at the BoE target of 2% cpi is 11-12 years, at the best case cpi since the 1930s of 3% (see graph) is 17-18 years, and with a cpi of 4% is 35-36 years.

Since it is impossible to predict future inflation (i.e., no-one knows whether it will be 8% annualised over the next 30 years or 3%), you will only know which would have been the best purchase towards the end of retirement and therefore, IMV, trying to do so is asking the wrong question and a better question is "which annuity will give me the income I need/require?" As others have mentioned, consider what the consequences of the failure of this income stream would be if conditions are not favourable.

For what it is worth all the annuity providers were happy to quote for 5% increases last year so I don't think it is unusual. By contrast if you ask them to quote for LPI (RPI capped at 5%) then a number just won't quote.

As you say the key is guarding the income stream against future conditions and RPI increases are the nearest thing you can get to protection against inflation and the income falling behind expenditure. It may not be perfect but it is less of a gamble than doubling down on 5%.

As @RogerPensionGuy says splitting it 50/50 is a conservative approach and this is roughly what I will have ended up with. It will then be interesting to compare the pension increase statements every year (though hopefully not that interesting).

As I'm sure you've already found with your 5% annuity, having a regular income is useful particularly, if like me, the mental transition from saving to spending has not been easy.

Having a regular stream of monthly income is a bit like being back at work. I am not sure it helps with the spending though - the amount coming out of the account hasn't changed much. Still I have only been "retired" for about 20 years; I will get the hang of it sometime.1 -

Thanks. Security is key. And I have no crystal ball so my instinct that inflation will pick up is just a feeling.Moonwolf said:What is more important?

If winning is the most important then go for the one you think will give you the most, which essentially is do you think we will have high inflation in the next 20-30 years, particularly in the early years of your retirement. A bet that nobody knows the answer until it happens.

If security and having enough to live on is the target, mix it up. A bit of 5% and a bit of RPI is a good bet. I have enough inflation linked DB if I do go for an annuity top up in the next 12 months I’ll go 3% as I get a higher starting amount and with my costs covered by DB, if I lose ground by 75 it probably isn’t the end of the world.

One thought, you mention an inflation linked DB pension - a lot of them are LPI pensions so inflation increases but capped at 5% pa or 2.5% pa. If that applies then it may be useful to have an annuity with uncapped RPI increases (in case we have more years of 10%/8% RPI).

Of course the higher starting point is useful and the chances are 3% and RPI won't be much different.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards