We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

0% Balance Transfer or Loan?

Troublesum1

Posts: 153 Forumite

Hi All,

I've been in debt for a while and honestly I've not managed it particularly well largely due to various external factors. I've been offered voluntary redundancy at work which would pay me out roughly £50k and I intend on taking it at the end of the year with the view of finding another job. My question for you all is for the non 0% debt I have right now, should I try to move it to 0% Balance Transfer or should I just go for another loan? One first thought the balance transfer sounds the obvious move but I have about £8k of non-zero interest unsecured debt, which I'm doubtful I'll get a card with enough limit to do the balance transfer. My credit score on Experian is 784 right now, I haven't really checked what is available to me but would be great to get some advice before taking my steps. Below is my SOA:

I've been in debt for a while and honestly I've not managed it particularly well largely due to various external factors. I've been offered voluntary redundancy at work which would pay me out roughly £50k and I intend on taking it at the end of the year with the view of finding another job. My question for you all is for the non 0% debt I have right now, should I try to move it to 0% Balance Transfer or should I just go for another loan? One first thought the balance transfer sounds the obvious move but I have about £8k of non-zero interest unsecured debt, which I'm doubtful I'll get a card with enough limit to do the balance transfer. My credit score on Experian is 784 right now, I haven't really checked what is available to me but would be great to get some advice before taking my steps. Below is my SOA:

[font=courier new][b]Statement of Affairs and Personal Balance Sheet[/b][b]

Household Information[/b]

Number of adults in household........... 2

Number of children in household......... 1

Number of cars owned.................... 1[b]

Monthly Income Details[/b]

Monthly income after tax................ 3500

Partners monthly income after tax....... 4000

Benefits................................ 0

Other income............................ 0[b]

Total monthly income.................... 7500[/b][b]

Monthly Expense Details[/b]

Mortgage................................ 0

Secured/HP loan repayments.............. 280

Rent.................................... 1525

Management charge (leasehold property).. 0

Council tax............................. 193

Electricity............................. 240

Gas..................................... 0

Oil..................................... 0

Water rates............................. 70

Telephone (land line)................... 0

Mobile phone............................ 60

TV Licence.............................. 15

Satellite/Cable TV...................... 18

Internet Services....................... 45

Groceries etc. ......................... 750

Clothing................................ 30

Petrol/diesel........................... 140

Road tax................................ 14

Car Insurance........................... 79

Car maintenance (including MOT)......... 0

Car parking............................. 20

Other travel............................ 100

Childcare/nursery....................... 1750

Other child related expenses............ 0

Medical (prescriptions, dentist etc).... 0

Pet insurance/vet bills................. 0

Buildings insurance..................... 0

Contents insurance...................... 0

Life assurance ......................... 30

Other insurance......................... 10

Presents (birthday, christmas etc)...... 42

Haircuts................................ 30

Entertainment........................... 67

Holiday................................. 0

Emergency fund.......................... 0

curr acc charge......................... 22

family.................................. 150

gym..................................... 266[b]

Total monthly expenses.................. 5946[/b]

[b]

Assets[/b]

Cash.................................... 0

House value (Gross)..................... 0

Shares and bonds........................ 0

Car(s).................................. 12000

Other assets............................ 0[b]

Total Assets............................ 12000[/b]

[b]

Secured & HP Debts[/b]

Description....................Debt......Monthly...APR

Mortgage...................... 0........(0)........0

Hire Purchase (HP) debt ...... 15000....(280)......0[b]

Total secured & HP debts...... 15000.....-.........- [/b]

[b]Unsecured Debts[/b]

Description....................Debt......Monthly...APR

virgin credit card.............6112......248.8.....24.9

paypal norm....................1883.96...74.28.....25.9

paypal zero....................289.......5.........0

abound loan....................10769.....264.3.....11.66

ccb loan.......................16295.....492.4.....17.89[b]

0

Comments

-

It's probably a bit radical, but...

With a £50k redundancy payment I think you should pay off your loan and credit card debts, and learn to live without credit, rather than trying to shift it to 0%

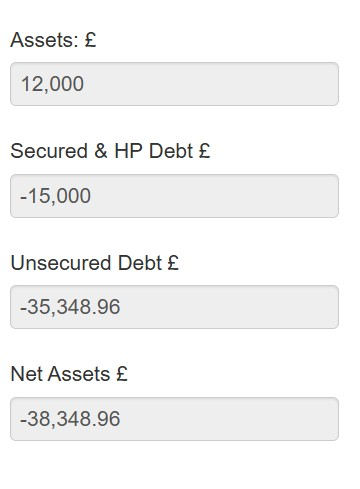

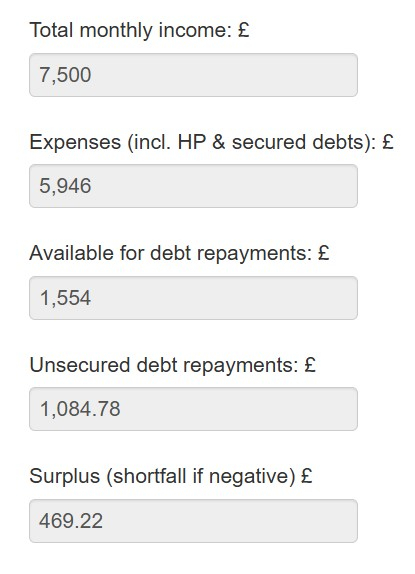

You appear to owe a bit over £35k in unsecured credit, rather than £8k, unless there are some decimal points missing? (I note the debt total isn't on your SOA).

1 -

Could you post the whole SOA please? There should be a totals bit at the bottom.Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.2

-

Your priority has to be getting a new job and that is what it is usually best to keep redundancy money for.

But with 50k, I suggest you get as much as possible moved to a 0% deal, then simply clear the rest. No more loans!

That CCB loan is very expensive, once you have found a new job I suggest also clearing that which will save you nearly 500 a month, which you can then use to clear the other debts fast.1 -

I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that.

Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

EDIT: On the SOA conversion to MSE format its not showing me a total for debt, I'm not sure what's going wrong with it. Here are images of the totals from the website

For more clarity, I believe with my redundancy payment I should be able to clear all my debt and of course that will be my intention, the question I'm asking here is how should I manage my current debt in the meantime while I wait for that payment. Thank you very much sorry for any confusion.0 -

Looking at your SOA, you do have areas where you seem to be spending a lot of money (more than necessary). One way of tackling your debts, and put you on a better footing financially for the future would be to review your spending in other areas now.Troublesum1 said:I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that. Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

For example £750 a month on groceries (you could probably reduce that by a third easily) £266 a month on the gym...

But you've got nothing for the MOT or car maintenance.1 -

Thanks for the response Emmia. I am literally on a crusade with the Mrs on the groceries - don't get me started. The gym, again, my Mrs had a baby and she's doing PT £180 a month, she needs it for her mental health. I have a 24h gym membership and I have a boxing membership which is £50. I can reduce my puregym membership to the standard which will give me an extra £10 - definitely will do that.Emmia said:

Looking at your SOA, you do have areas where you seem to be spending a lot of money (more than necessary). One way of tackling your debts, and put you on a better footing financially for the future would be to review your spending in other areas now.Troublesum1 said:I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that. Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

For example £750 a month on groceries (you could probably reduce that by a third easily) £266 a month on the gym...

But you've got nothing for the MOT or car maintenance.

My car situation is another can of worms. I have a new car from 2023 on a PCP. So I've not had to pay anything on MOT or maintenance really although that can (and will) all change now that the PCP contract is about to be over in September. I think its best to discuss one thing at a time.0 -

There's lots of good advice available on this board to reduce your expenditure - you've got a combined income currently of £7k a month (this is pretty high) but your SOA indicates you spend nothing on some things (no holidays or emergency fund?) but money drips away on things like a £22 a month current account charge, £150 on "family" (what does that cover?)Troublesum1 said:

Thanks for the response Emma. I am literally on a crusade with the Mrs on the groceries - don't get me started. The gym, again, my Mrs is had a baby and she's doing PT £180 a month, she needs it for her mental health. I have a 24h gym membership and I have a boxing membership which is £50. I can reduce my puregym membership to the standard which will give me an extra £10 - definitely will do that.Emmia said:

Looking at your SOA, you do have areas where you seem to be spending a lot of money (more than necessary). One way of tackling your debts, and put you on a better footing financially for the future would be to review your spending in other areas now.Troublesum1 said:I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that. Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

For example £750 a month on groceries (you could probably reduce that by a third easily) £266 a month on the gym...

But you've got nothing for the MOT or car maintenance.

My car situation is another can of worms. I have a new car from 2023 on a PCP. So I've not had to pay anything on MOT or maintenance really although that can (and will) all change now that the PCP contract is about to be over in September. I think its best to discuss one thing at a time.

You might want to redo your SOA by going through your bank/card statements over the last year to work out where you're spending your cash. Lemonfool has a SOA template that formats for MSE.

Ultimately though your wife needs to get on board with making changes (do you want to buy a property rather than rent?) for it to be successful.2 -

I try very hard to avoid holidays, I don't plan to be on any holiday this year, Mrs and baby will go but that will be financed by the inlaws. We rent and we're in debt to hard to have an emergency fund but of course in the event of an emergency we'd had to do something.. £22 a month on the current account gives us world travel insurance, phone insurance and rewards which we get £5 a month back on. Family £150 is money we give to my side of the family that helps the upkeep of my Mum and Dad.Emmia said:

There's lots of good advice available on this board to reduce your expenditure - you've got a combined income currently of £7k a month (this is pretty high) but your SOA indicates you spend nothing on some things (no holidays or emergency fund?) but money drips away on things like a £22 a month current account charge, £150 on "family" (what does that cover?)Troublesum1 said:

Thanks for the response Emma. I am literally on a crusade with the Mrs on the groceries - don't get me started. The gym, again, my Mrs is had a baby and she's doing PT £180 a month, she needs it for her mental health. I have a 24h gym membership and I have a boxing membership which is £50. I can reduce my puregym membership to the standard which will give me an extra £10 - definitely will do that.Emmia said:

Looking at your SOA, you do have areas where you seem to be spending a lot of money (more than necessary). One way of tackling your debts, and put you on a better footing financially for the future would be to review your spending in other areas now.Troublesum1 said:I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that. Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

For example £750 a month on groceries (you could probably reduce that by a third easily) £266 a month on the gym...

But you've got nothing for the MOT or car maintenance.

My car situation is another can of worms. I have a new car from 2023 on a PCP. So I've not had to pay anything on MOT or maintenance really although that can (and will) all change now that the PCP contract is about to be over in September. I think its best to discuss one thing at a time.

You might want to redo your SOA by going through your bank/card statements over the last year to work out where you're spending your cash. Lemonfool has a SOA template that formats for MSE.

Ultimately though your wife needs to get on board with making changes (do you want to buy a property rather than rent?) for it to be successful.

So I've actually got my own excel document which is even more detailed than the SOA and I've gone through many months of statements to get an appreciation of what we're spending on. It basically comes down to a disgusting amount of money on takeaway food and coffee and my grocery bill has been out of control for a while. All of which I am putting a lot of energy in to reducing (and also facing a lot of resistance).

Yes agree, you are very correct - apart from going to marriage counselling (another expense) I just have to keep banging my head against a brick wall there.

But now with the full context, what would you say to my original question? How should I deal with my current non-zero interest debt while I wait to get my redundancy payment? Many thanks Emmia (and anybody else that can help).0 -

Based on your first post I was concerned that you didn't understand how precarious your situation?

You and your wife are spending £6k on living expenses. If you accept redundancy, that's a £2k per shortfall, before even considering debt repayments, £3k with debt repayments.

Redundancy is intended to cover costs whilst you seek replacement employment. You need to use that money to cover costs until you've got employment and at least passed any probationary period. If your employer is shedding people, it's likely others in the same field are also doing so, so don't assume you'll get the same salary. So you need £3k per month to replace your salary?

Now you advise that you are expecting a second child soon. So your wife will be on mat leave when you become redundant? Depending on her workplace benefits, that could be half pay for 6 months or SMT. When she goes back to work, that's another £1750 per month(+) in childcare. At which point even if you were in both full-time employment, you can't cover your living costs.

OK if you don't get secure employment, you might be able to get income based JSA and maybe HB, apply for CB, depending on the mat pay. But you won't be able to afford the car, the gym, family (is that debt or gift), the current grocery costs or any other niceties. Wake up?

Sort out a 0% card now, and stuff everything spare to pay off the ccb loan.

Sit down with your wife and work out how you can cover your living costs once she passes the 6 week limit on full SMT? Cut everything you can now, do not wait six months. Use that to pay down the ccb loan.

Seriously consider whether this is the right time to accept redundancy, unless you are very sure that you can get new employment.

Also consider whether the cost of childcare is such that it would make sense for one of you to work part-time, possible you rather than your wife considering the salaries, and reconsider once childcare costs reduce? The other would need to earn enough to utilise their tax allowance.

You might fall lucky, get a good new job, then cover the mat leave and be able to pay a chunk off the debt using your remaining redundancy. But you will need to reduce your living costs substantially going forward, whatever happens.

I'm risk adverse but we've seen some much grief caused by not planning to cover mat leave and increased childcare costs. It leads to a lot of problems with mental health, debt and relationships. Work together now and you'll sort it.

If you've have not made a mistake, you've made nothing3 -

If you don't go on holiday why do you need world wide travel insurance? I'd personally buy a standalone policy if you needed it. You're spending £17 a month if you knock off the value of the rewards.Troublesum1 said:

I try very hard to avoid holidays, I don't plan to be on any holiday this year, Mrs and baby will go but that will be financed by the inlaws. We rent and we're in debt to hard to have an emergency fund but of course in the event of an emergency we'd had to do something.. £22 a month on the current account gives us world travel insurance, phone insurance and rewards which we get £5 a month back on. Family £150 is money we give to my side of the family that helps the upkeep of my Mum and Dad.Emmia said:

There's lots of good advice available on this board to reduce your expenditure - you've got a combined income currently of £7k a month (this is pretty high) but your SOA indicates you spend nothing on some things (no holidays or emergency fund?) but money drips away on things like a £22 a month current account charge, £150 on "family" (what does that cover?)Troublesum1 said:

Thanks for the response Emma. I am literally on a crusade with the Mrs on the groceries - don't get me started. The gym, again, my Mrs is had a baby and she's doing PT £180 a month, she needs it for her mental health. I have a 24h gym membership and I have a boxing membership which is £50. I can reduce my puregym membership to the standard which will give me an extra £10 - definitely will do that.Emmia said:

Looking at your SOA, you do have areas where you seem to be spending a lot of money (more than necessary). One way of tackling your debts, and put you on a better footing financially for the future would be to review your spending in other areas now.Troublesum1 said:I don't understand what is going wrong with my paste of my SOA sorry I will try to fix that. Something I think I need to clarify is I do not get that redundancy payment untill the end of the year earliest - in actual fact it will probably be Jan of next year. It is also only £30k tax free, the rest tax applies. Many thanks for all your replies!

For example £750 a month on groceries (you could probably reduce that by a third easily) £266 a month on the gym...

But you've got nothing for the MOT or car maintenance.

My car situation is another can of worms. I have a new car from 2023 on a PCP. So I've not had to pay anything on MOT or maintenance really although that can (and will) all change now that the PCP contract is about to be over in September. I think its best to discuss one thing at a time.

You might want to redo your SOA by going through your bank/card statements over the last year to work out where you're spending your cash. Lemonfool has a SOA template that formats for MSE.

Ultimately though your wife needs to get on board with making changes (do you want to buy a property rather than rent?) for it to be successful.

So I've actually got my own excel document which is even more detailed than the SOA and I've gone through many months of statements to get an appreciation of what we're spending on. It basically comes down to a disgusting amount of money on takeaway food and coffee and my grocery bill has been out of control for a while. All of which I am putting a lot of energy in to reducing (and also facing a lot of resistance).

Yes agree, you are very correct - apart from going to marriage counselling (another expense) I just have to keep banging my head against a brick wall there.

But now with the full context, what would you say to my original question? How should I deal with my current non-zero interest debt while I wait to get my redundancy payment? Many thanks Emmia (and anybody else that can help).

Cutting out takeaways is an easy move (and could lead to less time needed with the PT). You just decide to stop, delete the apps etc. ready meals are frankly just as quick as delivery and cheaper, if you really don't want to cook.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards