We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Percentage of LTA - NHS Pension

Moonwolf

Posts: 538 Forumite

I have already retired but I couldn’t claim my 1995 early as I left the scheme before 2008. All later payments were after a more than 5 year break and into the new scheme.

I’m now completing the AW8P to apply for my 1995 NHS pension (and possibly the others, still dither) at 60 later this year.

I have already accessed a DB pension flexibly.

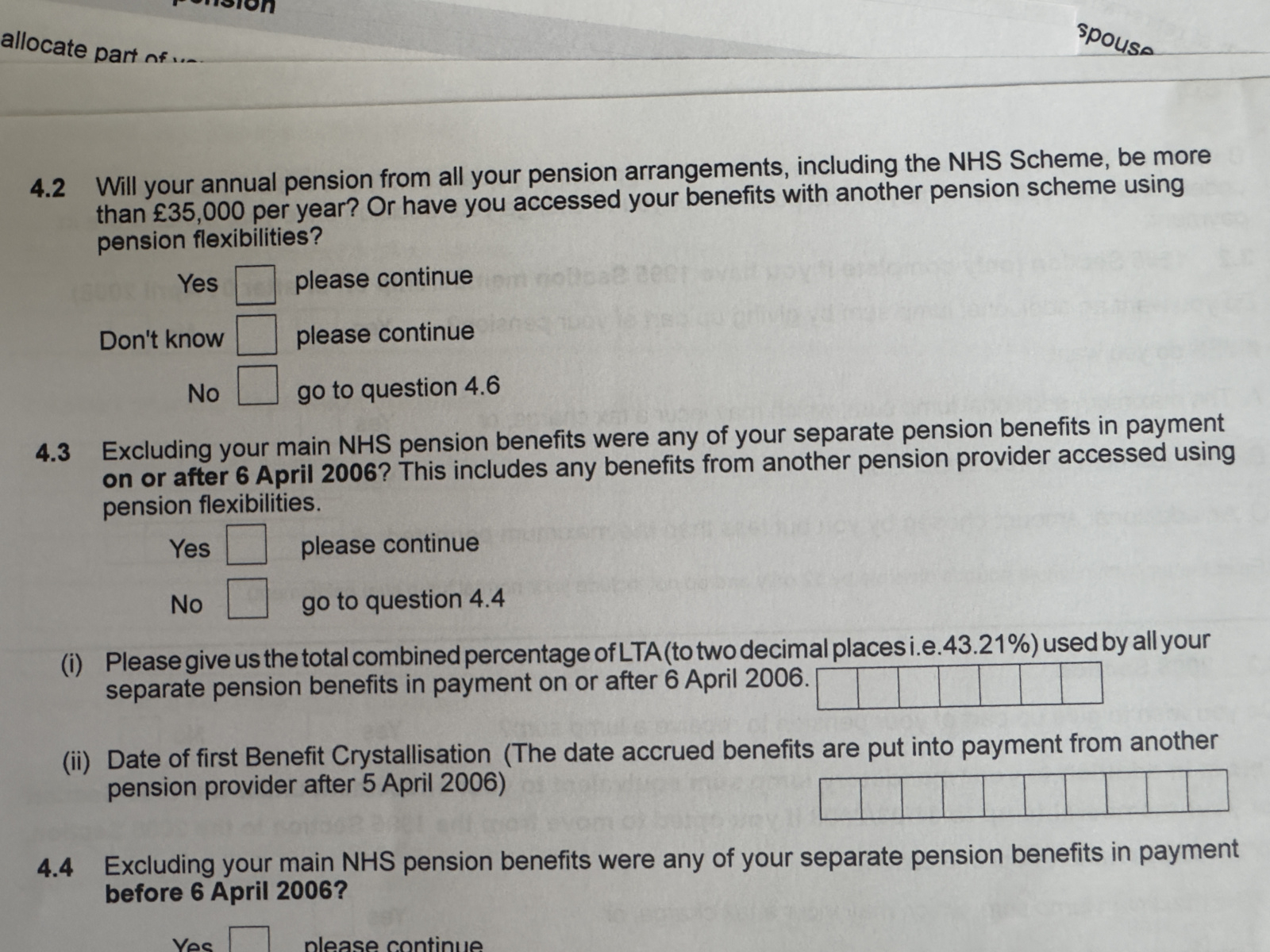

The following question is challenging me although I don’t think I will be bothering HMRC but I don’t want to get it wrong and delay the pension or have them treat me as breaching the LTA as they put it - as the form is the most current dated March this year, I assume the underlying issue is tax free lump sum limits, but given it is bureaucracy I’ll answer as asked.

4.2 I have accessed a pot so yes to that irrespective of the £35k per year. Technically, with flexible drawdown I’ll be over £35k in private pensions until I reach 67, then I won’t in today’s money.

4.3 After 2006 so yes to that.

but then the part of the question on percentage of LTA - the notes imply crystallised benefits only, so as I am doing this flexibly, so far I have drawdown £9,000 but there is another £10k in my drawdown pot and I expect to have drawn down closer to £27,000 by the time the NHS pension comes into payment. Or have I misread and I should quote my entire £384k DC pot.

As the NHS pensions will be less than 25k a year, I will be under the old and not relevant LTA and certainly under the TFLS £268,276. I’ll only take £16K tax free from my NHS pensions, the minimum.

do I put something like 3.35% or 35.78%?

Thanks

I’m now completing the AW8P to apply for my 1995 NHS pension (and possibly the others, still dither) at 60 later this year.

I have already accessed a DB pension flexibly.

The following question is challenging me although I don’t think I will be bothering HMRC but I don’t want to get it wrong and delay the pension or have them treat me as breaching the LTA as they put it - as the form is the most current dated March this year, I assume the underlying issue is tax free lump sum limits, but given it is bureaucracy I’ll answer as asked.

4.2 I have accessed a pot so yes to that irrespective of the £35k per year. Technically, with flexible drawdown I’ll be over £35k in private pensions until I reach 67, then I won’t in today’s money.

4.3 After 2006 so yes to that.

but then the part of the question on percentage of LTA - the notes imply crystallised benefits only, so as I am doing this flexibly, so far I have drawdown £9,000 but there is another £10k in my drawdown pot and I expect to have drawn down closer to £27,000 by the time the NHS pension comes into payment. Or have I misread and I should quote my entire £384k DC pot.

As the NHS pensions will be less than 25k a year, I will be under the old and not relevant LTA and certainly under the TFLS £268,276. I’ll only take £16K tax free from my NHS pensions, the minimum.

do I put something like 3.35% or 35.78%?

Thanks

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards