We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Considering annuities

Comments

-

I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

If you are concerned about ‘money down the drain’ either draw down from the pot or buy something with belt and braces. The fact is that once you are dead you won’t be concerned either way.2 -

The tax free cash can be paid by the existing scheme or the receiving scheme depending on the chosen transfer method. The remaining 75% element buys the annuity.Mr_Benn said:On the subject of Annuities , and hope Im not diverting from the posters question..When you purchase an Annuity, you can get a tax-free lump sum as well as the regular amount. How does the tax free elemnt work , if you use money from your SIIP to buy the annuity ? Thank you.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

When people are concerned with losing capital should they die young then they are comfortably off.Cobbler_tone said:I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

If you are concerned about ‘money down the drain’ either draw down from the pot or buy something with belt and braces. The fact is that once you are dead you won’t be concerned either way.0 -

Buying annuities reminds me of a old phrase used by Clint Eastwood in a few films back in the day.

Clint was a police officer and when trying to arrest a villan who was resisting arrest, Clint would just ask them if they were feeling lucky & by reviewing their situations they made their choices.

My view on annuities is if I buy one and expire very quickly, that's my luck, however if I expire late that's also my luck.

But, if I don't buy an annuity(if needed) and expire late, this will be potentially bad for me or call it unlucky.

1 -

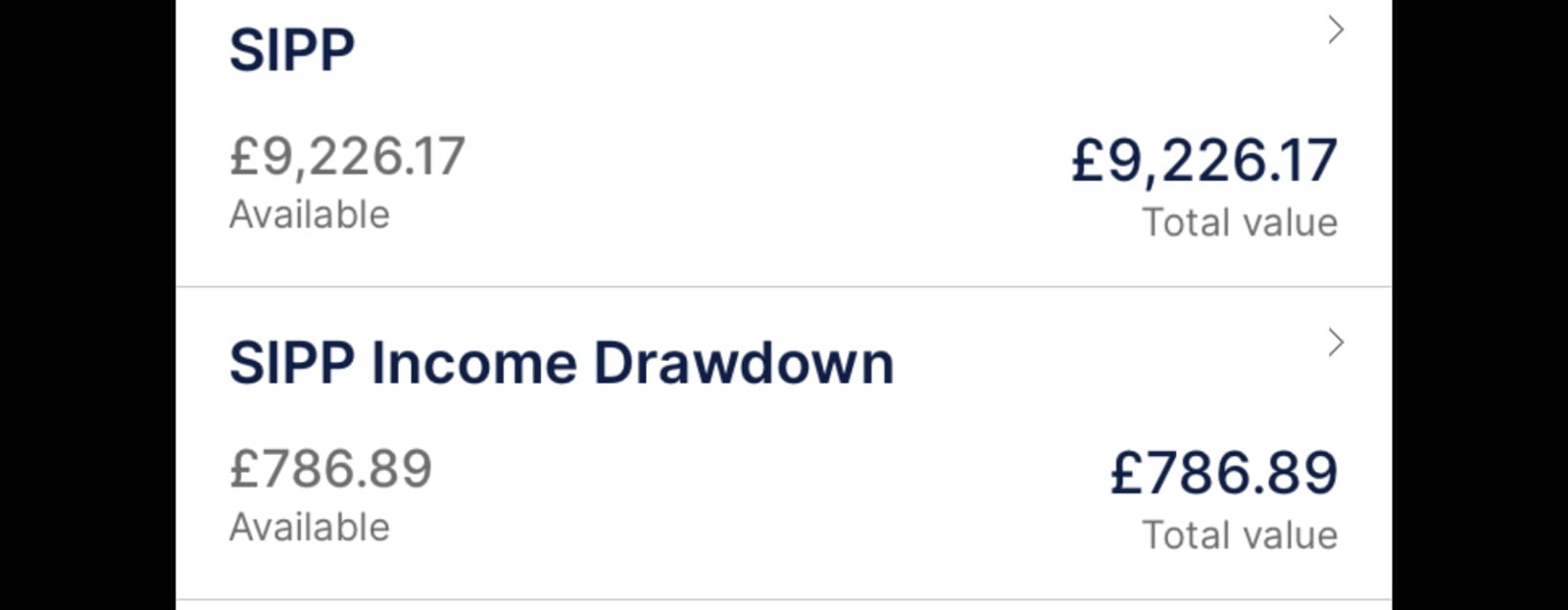

I have now traded in the rest of my drawdown pot for an annuity. I have about £10,000 uncrystallised.

If the annuity is too much it can go into an ISA. And £2,880 net back into pension each year regardless.

Now that I have more than enough guaranteed income, stress levels are very much reduced.

Also massively reduced future inheritance tax liability so yah boo sucks to you Rachel. 🤣🤣🤣 7

7 -

Um .....really? I'm concerned about maintaining a consistently good life style into the future. I'm not badly off - I know many people who are really struggling - but if I just drew down everything as quickly as possible then I would be struggling a bit. So it's just ensuring there's a good balance, having enough money to enjoy ourselves while we can and getting back what I've put into my pension over a number of years.Hoenir said:

When people are concerned with losing capital should they die young then they are comfortably off.Cobbler_tone said:I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

If you are concerned about ‘money down the drain’ either draw down from the pot or buy something with belt and braces. The fact is that once you are dead you won’t be concerned either way.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅0 -

How much risk can you personally afford to take? An investment portfolio needs to tailored to one's own appetite. Do you want to sleep easy at night? Stopped clocks are right twice a day. Over a long term horizon there's going to be extreme volatility and periods of investment return disappointment. The post GFC era has created an air of complancencey in many investors. With an exceptional period of market returns. What lies ahead over the next decade or so may well be very different.Brie said:

Um .....really? I'm concerned about maintaining a consistently good life style into the future. I'm not badly off - I know many people who are really struggling - but if I just drew down everything as quickly as possible then I would be struggling a bit. So it's just ensuring there's a good balance, having enough money to enjoy ourselves while we can and getting back what I've put into my pension over a number of years.Hoenir said:

When people are concerned with losing capital should they die young then they are comfortably off.Cobbler_tone said:I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

If you are concerned about ‘money down the drain’ either draw down from the pot or buy something with belt and braces. The fact is that once you are dead you won’t be concerned either way.3 -

The risks to income and legacy of annuities and portfolio withdrawals are different and, to some extent, complementary.

To take an example for a retirement at 67yo.

Assuming a historical safe withdrawal rate of 3.5% over a 30 year retirement (i.e., to 97yo) then portfolio withdrawals

1) Will probably provide an excellent legacy after an early death

2) Could run out of income before death

3) In the event of long life, may not provide much legacy (possibly zero), or in very good retirements a lot of legacy.

A single life RPI lifetime annuity with a 5 year guarantee currently has a payout rate of about 5.5%, so just over 60% of the pot is needed to provide the 3.5% (i.e., 3.5/5.5) income to match the portfolio withdrawals (leaving just under 40% invested)

1) Will provide some legacy after an early death (for an immediate death, roughly 40% of the initial pot plus 5 years of payments equivalent to about 25% of the initial pot)

2) Will not run out of income before death (except under very extreme circumstances)

3) Assuming zero or limited withdrawals from the residual portfolio, then it could provide a good legacy after a long life.

For a joint life 100% beneficiary annuity the payout rates are currently about 4.7% (i.e., about 75% of the portfolio would be needed, i.e., 3.5/4.7). A longer guarantee period will reduce the loss in the event of an immediate death but at the expense of reduced income and a higher proportion of the pot needed. I note that for joint life 100% annuities even a 20 year guarantee doesn't make that much difference to the payout rate.

Of course, one approach is to combine these two methods to incorporate the advantages (and disadvantages) of both.

I also note that while all(?) retirees will be interested in income, not all retirees will be interested in legacy. The above example assumes an interest in providing both.5 -

I think I better understand you now. If I wasn't financially comfortable then I'd be maxing my monthly payments. The fact that I can do without £400 a month over the long term does show comfort.Hoenir said:

How much risk can you personally afford to take? An investment portfolio needs to tailored to one's own appetite. Do you want to sleep easy at night? Stopped clocks are right twice a day. Over a long term horizon there's going to be extreme volatility and periods of investment return disappointment. The post GFC era has created an air of complacency in many investors. With an exceptional period of market returns. What lies ahead over the next decade or so may well be very different.Brie said:

Um .....really? I'm concerned about maintaining a consistently good life style into the future. I'm not badly off - I know many people who are really struggling - but if I just drew down everything as quickly as possible then I would be struggling a bit. So it's just ensuring there's a good balance, having enough money to enjoy ourselves while we can and getting back what I've put into my pension over a number of years.Hoenir said:

When people are concerned with losing capital should they die young then they are comfortably off.Cobbler_tone said:I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

If you are concerned about ‘money down the drain’ either draw down from the pot or buy something with belt and braces. The fact is that once you are dead you won’t be concerned either way.

I am happy with financial risk and understand this with other investments - I won't disinvest when the market is in a slump and will wait til things are on the up so I get the most bang for my buck. But this is part of what has led me to think that an annuity of some sort is a good thing to provide a solid base for my investment income to sit on.

Still trying to think things through and make a decision. Leaning towards Aviva as a provider if only because they are high up in every quote I've seen. Not the top but some of those are names I've never heard before.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

No, it is a form of insurance, not just ostensibly so.dunroving said:

I understand it is ostensibly a form of insurance, and the concept of pooled risk. The add-on of a guaranteed period is also a form of insurance or risk mitigation - so clearly the insurance companies recognise the concern of some potential customers of dropping dead within months of an annuity starting.Hoenir said:

The pooled risk enhances the return for those that live on. Cake and eat it. Alternatively buy shares in the annuity providers thmselves.dunroving said:

Personally, for a life annuity it would really annoy me to think of the annuity company being quids-in if I died early in the annuity period.

More people spend their lifetimes insuring their property against the risk of fire.

Guarantee is just a product feature that you can choose to have or not, like if you want accidental damage cover on your Home insurance or not.

Anyone who writes annuities will be in the bulk annuity market, but not everyone who does bulk annuities offers individual annuities. As the pensioner cannot be disadvantaged by their pension scheme going through the regular buy-out process annuity providers need to be able to mirror the features that pension schemes offered such as guarantee periods. If you've built the tech to be able to do it with Bulks you may as well offer it to your individual annuitants too and maximise your portfolio.

Well you could look at other non-compulsory insurance like Home or Pet or Travel?Cobbler_tone said:I wonder how many people wouldn’t choose to insure their car (and those around them) if it wasn’t the law?

According to various research 65-75% of people have home insurance of some form so somewhere between a third and a quarter dont for whatever reason. Look at Travel insurance and its more like 50/50

I've always found it a little odd that people feel that money spent on insurance is "wasted" whereas they dont feel the same way about a fire extinguisher or blanket etc which are equally there for emergency only1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards