We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Payslip Tax Payment Amounts Different?

Dave1UK

Posts: 36 Forumite

in Cutting tax

So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

0

Comments

-

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice0 -

From one of my payslips:Dazed_and_C0nfused said:

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice

Monthly payment period:

Tax Code: 1383M

Salary Gross: 2490.80

PAYE Tax: -267.60

National Insurance: -115.42

Student Loan: -36.00

Pension Contribution: -99.63

Net Pay: £1972.15

GOV.UK calculation:

Gross income: 2490.80

Personal Allowance: 1152.50

Pension Contributions: 99.63

Student loan: 28.00

Taxable Income: 1238.67

Income Tax at 20%: 247.58

National Insurance: 115.46

Take-home pay: £2000.13

My student loan repayment is plan 1 - should be 9% of monthly income threshold of anything above 2172, so 2490.80 - 2172 = 318.80 @ 9% is £28.69 basically the GOV.UK calculator figure not amount I'm paying right now.

My pension contributions are 4% (workplace pension). In terms of method it's deducted directly from payslip.

I don't think relief at source/salary sacrifice apply to me, done a quick Google on what they are and don't have any of those in place.0 -

If your pension contributions aren't made using the relief at source method and you haven't agreed a salary sacrifice arrangement then that just leaves net pay.Dave1UK said:

From one of my payslips:Dazed_and_C0nfused said:

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice

Monthly payment period:

Tax Code: 1383M

Salary Gross: 2490.80

PAYE Tax: -267.60

National Insurance: -115.42

Student Loan: -36.00

Pension Contribution: -99.63

Net Pay: £1972.15

GOV.UK calculation:

Gross income: 2490.80

Personal Allowance: 1152.50

Pension Contributions: 99.63

Student loan: 28.00

Taxable Income: 1238.67

Income Tax at 20%: 247.58

National Insurance: 115.46

Take-home pay: £2000.13

My student loan repayment is plan 1 - should be 9% of monthly income threshold of anything above 2172, so 2490.80 - 2172 = 318.80 @ 9% is £28.69 basically the GOV.UK calculator figure not amount I'm paying right now.

My pension contributions are 4% (workplace pension). In terms of method it's deducted directly from payslip.

I don't think relief at source/salary sacrifice apply to me, done a quick Google on what they are and don't have any of those in place.

But if you are in auto-enrolment pension then 4% is less than the minimum employee contribution.

But 4% in a RAS scheme is 5% with the tax relief added on.

You need to check your pension contribution method. If you look at your pension account you need to check if 25% is being added to your contribution (which is equivalent to 20% of the gross contribution). If you are seeing £24.90 being added each month then it is a relief at source scheme.0 -

So looking at my pension contribution account.Dazed_and_C0nfused said:

If your pension contributions aren't made using the relief at source method and you haven't agreed a salary sacrifice arrangement then that just leaves net pay.Dave1UK said:

From one of my payslips:Dazed_and_C0nfused said:

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice

Monthly payment period:

Tax Code: 1383M

Salary Gross: 2490.80

PAYE Tax: -267.60

National Insurance: -115.42

Student Loan: -36.00

Pension Contribution: -99.63

Net Pay: £1972.15

GOV.UK calculation:

Gross income: 2490.80

Personal Allowance: 1152.50

Pension Contributions: 99.63

Student loan: 28.00

Taxable Income: 1238.67

Income Tax at 20%: 247.58

National Insurance: 115.46

Take-home pay: £2000.13

My student loan repayment is plan 1 - should be 9% of monthly income threshold of anything above 2172, so 2490.80 - 2172 = 318.80 @ 9% is £28.69 basically the GOV.UK calculator figure not amount I'm paying right now.

My pension contributions are 4% (workplace pension). In terms of method it's deducted directly from payslip.

I don't think relief at source/salary sacrifice apply to me, done a quick Google on what they are and don't have any of those in place.

But if you are in auto-enrolment pension then 4% is less than the minimum employee contribution.

But 4% in a RAS scheme is 5% with the tax relief added on.

You need to check your pension contribution method. If you look at your pension account you need to check if 25% is being added to your contribution (which is equivalent to 20% of the gross contribution). If you are seeing £24.90 being added each month then it is a relief at source scheme.

Summary does show tax relief and an amount but can only view the total since inception (1958.51) or past year etc (369.23).

Specific to the date the payslip which I mentioned/quoted above for my pension plan account:

Your payments: NET£99.63 GROSS£124.54.

Employer payments: NET£74.72 GROSS£74.72.

I've been at the same company since workplace pensions came into force via automatic enrolment if that helps?0 -

So you cannot deduct those contributions when working out your PAYE tax (or NI).Dave1UK said:

So looking at my pension contribution account.Dazed_and_C0nfused said:

If your pension contributions aren't made using the relief at source method and you haven't agreed a salary sacrifice arrangement then that just leaves net pay.Dave1UK said:

From one of my payslips:Dazed_and_C0nfused said:

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice

Monthly payment period:

Tax Code: 1383M

Salary Gross: 2490.80

PAYE Tax: -267.60

National Insurance: -115.42

Student Loan: -36.00

Pension Contribution: -99.63

Net Pay: £1972.15

GOV.UK calculation:

Gross income: 2490.80

Personal Allowance: 1152.50

Pension Contributions: 99.63

Student loan: 28.00

Taxable Income: 1238.67

Income Tax at 20%: 247.58

National Insurance: 115.46

Take-home pay: £2000.13

My student loan repayment is plan 1 - should be 9% of monthly income threshold of anything above 2172, so 2490.80 - 2172 = 318.80 @ 9% is £28.69 basically the GOV.UK calculator figure not amount I'm paying right now.

My pension contributions are 4% (workplace pension). In terms of method it's deducted directly from payslip.

I don't think relief at source/salary sacrifice apply to me, done a quick Google on what they are and don't have any of those in place.

But if you are in auto-enrolment pension then 4% is less than the minimum employee contribution.

But 4% in a RAS scheme is 5% with the tax relief added on.

You need to check your pension contribution method. If you look at your pension account you need to check if 25% is being added to your contribution (which is equivalent to 20% of the gross contribution). If you are seeing £24.90 being added each month then it is a relief at source scheme.

Summary does show tax relief and an amount but can only view the total since inception (1958.51) or past year etc (369.23).

Specific to the date the payslip which I mentioned/quoted above for my pension plan account:

Your payments: NET£99.63 GROSS£124.54.

Employer payments: NET£74.72 GROSS£74.72.

I've been at the same company since workplace pensions came into force via automatic enrolment if that helps?

You are getting tax relief added within your pension fund instead.0 -

You are not, in the calculator, using the same methodology for pension contributions as your employer uses.Dave1UK said:

From one of my payslips:Dazed_and_C0nfused said:

You need to provide some actual details really for anyone to help muchDave1UK said:So I have been offered a new role at work with increased pay and I am trying to figure out whether it would be worth it to accept or stay in my current role.

I'm using the GOV.UK Income Tax calculator - "Estimate your Income Tax for the current year".

I have all my payslips to hand (several years). My tax code is 1383M and has been for a while. My pension contributions are 4% (monthly) and on Student loan repayment plan 1.

The only figure which is consistent and makes sense is my pension contribution of 4% which is correct throughout. Otherwise my Student loan repayment should be 9% but I have been paying 19% of gross. I have also been paying a slightly higher Income tax + NI? Overall month to month its lower by about £80-100 than estimate?

Anyone have any advice as to why this could be or what I should be looking at?

What method is used to make the pension contributions?

Relief at source

Net pay

Salary sacrifice

Monthly payment period:

Tax Code: 1383M

Salary Gross: 2490.80

PAYE Tax: -267.60

National Insurance: -115.42

Student Loan: -36.00

Pension Contribution: -99.63

Net Pay: £1972.15

GOV.UK calculation:

Gross income: 2490.80

Personal Allowance: 1152.50

Pension Contributions: 99.63

Student loan: 28.00

Taxable Income: 1238.67

Income Tax at 20%: 247.58

National Insurance: 115.46

Take-home pay: £2000.13

My student loan repayment is plan 1 - should be 9% of monthly income threshold of anything above 2172, so 2490.80 - 2172 = 318.80 @ 9% is £28.69 basically the GOV.UK calculator figure not amount I'm paying right now.

My pension contributions are 4% (workplace pension). In terms of method it's deducted directly from payslip.

I don't think relief at source/salary sacrifice apply to me, done a quick Google on what they are and don't have any of those in place.The difference in tax, for example, is £20.02 which is almost exactly 20% of your pension contribution.1 -

Not sure where you are getting "Overall month to month its lower by about £80-100 than estimate?" The figures you later quote are £27.98 different. Some is accounted for by the different pension system as advised; to get an accurate net value you need to add the extra pension that is added to what you pay on your pension account. Also small differences due to the method used by GOV.UK and PAYE to calculate the wages being different.

It does seem that the figure for student loan is higher assuming you have only one loan and that is plan 1. You need to query that with your payroll dept to see why that is.0 -

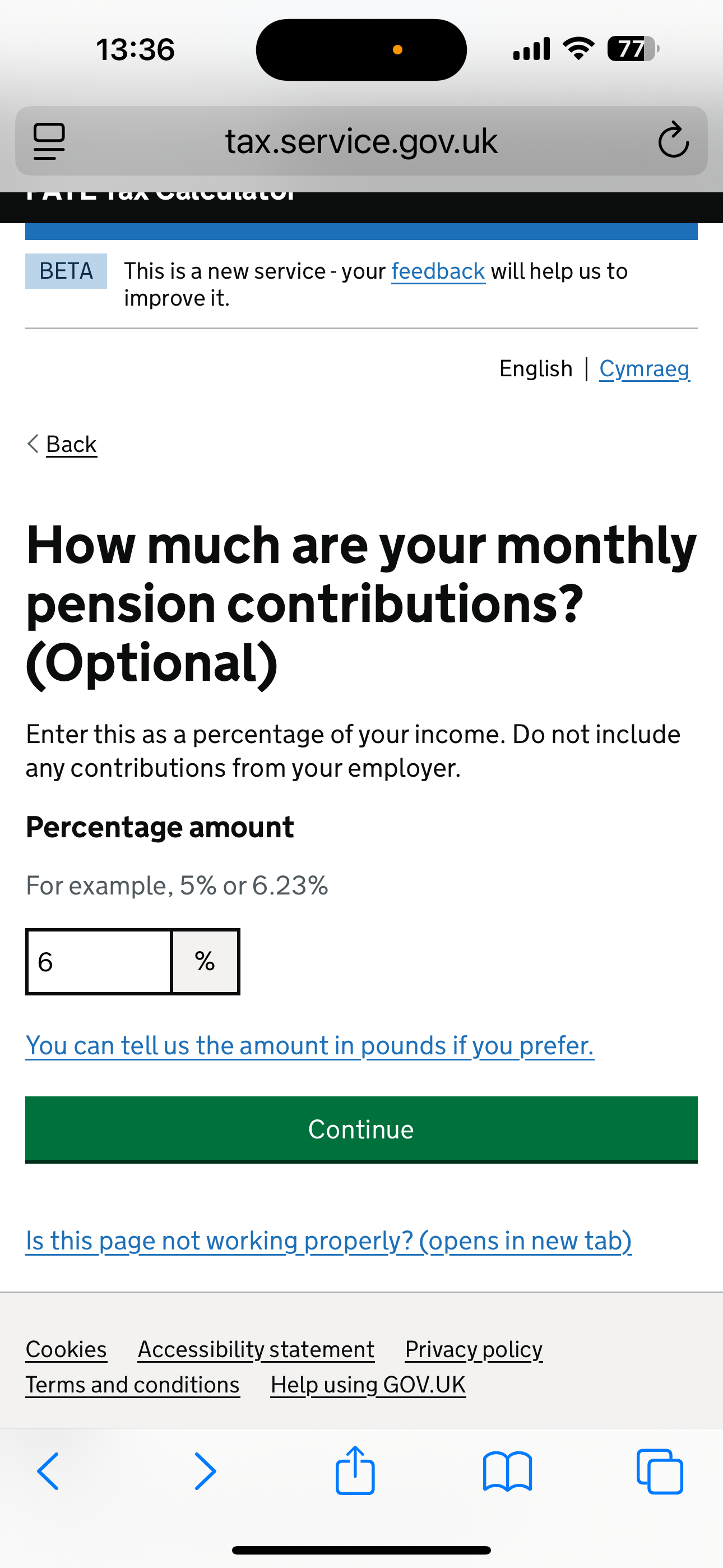

To be fair to the op one doesn’t appear to be given much option with the pension question!

1

1 -

I should of made it clearer, in regards to that statement (£80-100) I am referring to most recent months whereby I have been doing overtime and being paid extra thereby the difference being greater i.e. Income tax + NI + student finance higher than 9% repayment combined if that makes sense. The payslip used here as an example is without overtime in order to establish a base figure.chrisbur said:Not sure where you are getting "Overall month to month its lower by about £80-100 than estimate?" The figures you later quote are £27.98 different. Some is accounted for by the different pension system as advised; to get an accurate net value you need to add the extra pension that is added to what you pay on your pension account. Also small differences due to the method used by GOV.UK and PAYE to calculate the wages being different.

It does seem that the figure for student loan is higher assuming you have only one loan and that is plan 1. You need to query that with your payroll dept to see why that is.0 -

OK do you have one of these payslips as that does seem a rather large difference Have you queried the student loan with payroll?.Dave1UK said:

I should of made it clearer, in regards to that statement (£80-100) I am referring to most recent months whereby I have been doing overtime and being paid extra thereby the difference being greater i.e. Income tax + NI + student finance higher than 9% repayment combined if that makes sense. The payslip used here as an example is without overtime in order to establish a base figure.chrisbur said:Not sure where you are getting "Overall month to month its lower by about £80-100 than estimate?" The figures you later quote are £27.98 different. Some is accounted for by the different pension system as advised; to get an accurate net value you need to add the extra pension that is added to what you pay on your pension account. Also small differences due to the method used by GOV.UK and PAYE to calculate the wages being different.

It does seem that the figure for student loan is higher assuming you have only one loan and that is plan 1. You need to query that with your payroll dept to see why that is.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.3K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards