We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Inheritance and Pension

Comments

-

Yes, you will be deferring that money until retirement but that is not so far away now. As a minimum you should probably sacrifice enough to take you out of 40% income tax. Going further you could take your taxable income down to the level of national minimum wage. Further still if you also pay into a personal pension.Kinclad said::

Does it make general economic sense to increase my pension % contributions to a point where I almost become reliable on my savings for month to month living expenses?

:

But there's the annual limit of gross contributions 60k. This can be brought forward from the previous three years if that was unused.

I'm not sure if this would affect your ability to get consumer credit, something perhaps to consider.A little FIRE lights the cigar1 -

Depends how much OP is earning in the tax year in which they wish to use carry forward.ali_bear said:

Yes, you will be deferring that money until retirement but that is not so far away now. As a minimum you should probably sacrifice enough to take you out of 40% income tax. Going further you could take your taxable income down to the level of national minimum wage. Further still if you also pay into a personal pension.Kinclad said::

Does it make general economic sense to increase my pension % contributions to a point where I almost become reliable on my savings for month to month living expenses?

:

But there's the annual limit of gross contributions 60k. This can be brought forward from the previous three years if that was unused.

I'm not sure if this would affect your ability to get consumer credit, something perhaps to consider.

Whether it impacts on the ability to get credit depends on the lender's approach. If they are satisfied OP has the means to repay, then all should be well - but you'd have to ask whether the cost of borrowing is a better option than paying lower pension contributions, especially if OP has sacrificed down to a point where they are only paying basic rate tax.Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1 -

Maybe it would affect you when taking out a lease on a new car?A little FIRE lights the cigar1

-

Hi,

Whether salary sacrifice affects your ability to get any form of credit is dependant on the way the sacrifice is evidenced to a lender and the lenders assessment of the extent to which you can vary that sacrifice in time of financial stress.ali_bear said:Maybe it would affect you when taking out a lease on a new car?

I've certainly never had an issue with mortgage lenders but (a) my "reference salary" (i.e. salary before sacrifice) and the extent of the sacrifice is clearly expressed on my payslips and (b) I only use salary sacrifice for pension contributions which I have been able to confirm to the lender can be varied quite quickly should it be necessary.

I've always stated my before sacrifice salary to lenders not requiring payslips as that is what I would earn if I did get to the point where missing payments was a risk.

1 -

Hi,

Just picking back up on my original thread, rather than creating a new one.

I’m aware that this isn’t necessarily the place to be looking for guidance on investment/retirement strategies.But im very interested in peoples’ thoughts as they can be very helpful.My situ…

56 years old with a desire to retire at 60.Full state pension at 67

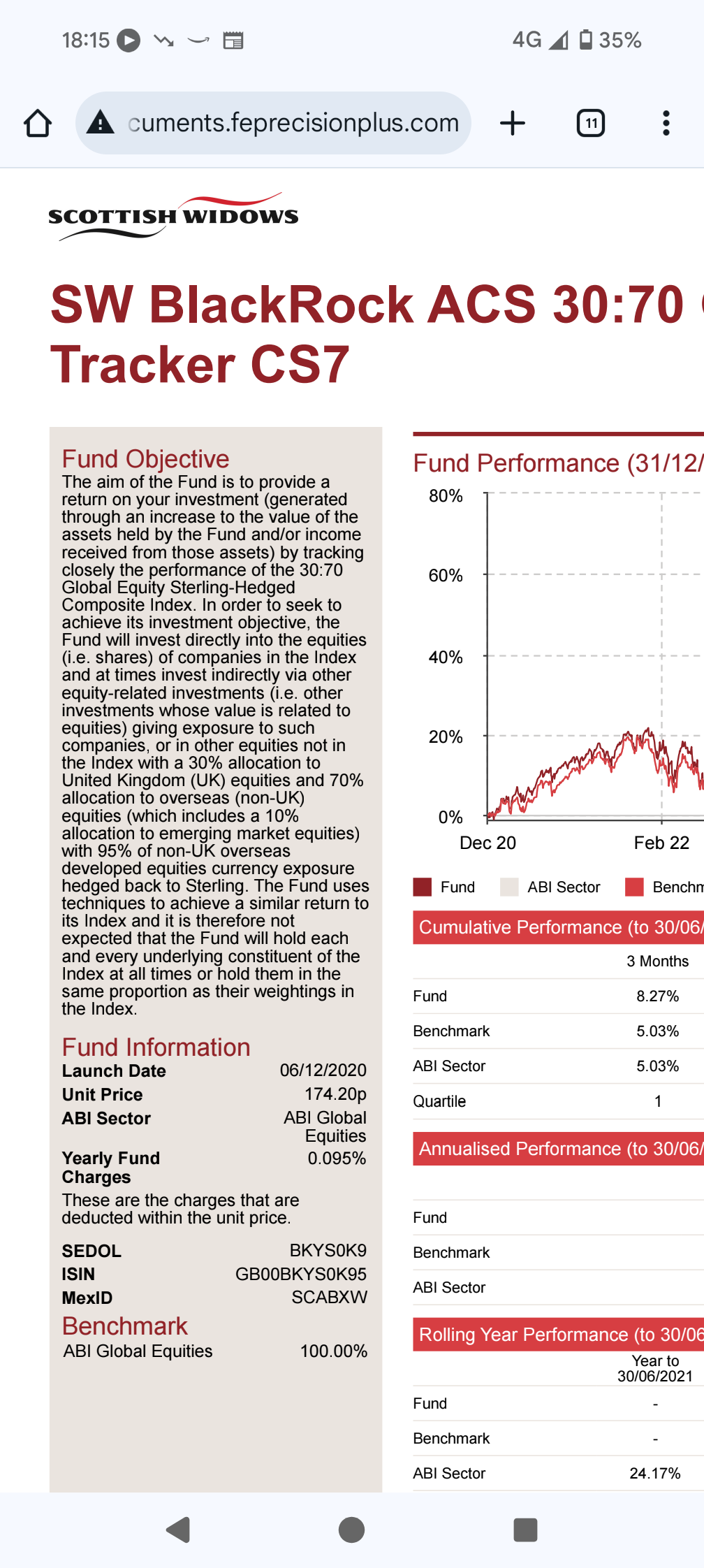

377K in Scottish Widows workplace DC pension (324K un crystalized, 53K crystalized), all in Blackrock 30:70 Global Equity Tracker CS7

Currently sacrificing 12.5%, Company 10.5% (max) - £1241 a month

75K outstanding on mortgage (1.29% fixed until 05/26)

3K in S&S ISA

My parents estate has just come through Probate and if we achieve a reasonable market price for the family home (I know the market is not the best atm), I should net 220K (no IHT due).

So I want to start working on a plan, but interested in people’s thoughts.

The following are what I believe as... givens…

Don’t pay off mortgage until renewal as I’m only paying 1.29%Dramatically increase my salary sacrifice pension contributions and live off cash (aware of restrictions on how much I can sacrifice as mentioned earlier in this thread)

What I’m looking for some guidance on is…

Is my current pension position too risky based on my age and it being 100% equities?, even though my plan is relatively long term and use drawdown and will have a reasonable amount of cash to fall back on if necessary, during bad equity periods.How best should I manage my cash inheritance?, im thinking initially 20K into an ISA and then 70K to pay off my mortgage in 05/26. But I then need to consider the remainder and the fact that I will need some available for a period of time whilst I up my salary sacrifice contributions (to avoid at least the 40%, but im presuming it makes sense to at the 20% level too).

Should I be setting out a plan of money I need on a monthly basis during the following periods?

Now to age 60 (my preferred retirement date).60 to 67 – period of no state pension

67 onwards….

Any thoughts or guidance would be appreciated.

Thanks,

Mark.

0 -

Is my current pension position too risky based on my age and it being 100% equities?

Blackrock 30:70 is only 70% equities.

Would still be too high for some, but not others.

As you are still working you can afford a bit more risk, as if it goes down you will be investing every month at a lower price.Should I be setting out a plan of money I need on a monthly basis during the following periods?

Now to age 60 (my preferred retirement date).60 to 67 – period of no state pension

68 onwards…

Yes

0 -

Thanks, ok this maybe where I'm being a bit naive with regards to understanding of these funds.Albermarle said:Is my current pension position too risky based on my age and it being 100% equities?

Blackrock 30:70 is only 70% equities.

Would still be too high for some, but not others.

As you are still working you can afford a bit more risk, as if it goes down you will be investing every month at a lower price.Should I be setting out a plan of money I need on a monthly basis during the following periods?

Now to age 60 (my preferred retirement date).60 to 67 – period of no state pension

68 onwards…

Yes

But my understanding of the 70/30 split in this was

30% UK Equities

70% non UK Equities0 -

If you could share the exact name of the fund,Kinclad said:

377K in Scottish Widows workplace DC pension (324K un crystalized, 53K crystalized), all in Blackrock 30:70 Global Equity Tracker CS7

This one?If so, then yes that's 100% equities, ~30% UK, and ~30% ROW.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.0 -

Yep, I'm pretty sure that's the oneQrizB said:If you could share the exact name of the fund,Kinclad said:377K in Scottish Widows workplace DC pension (324K un crystalized, 53K crystalized), all in Blackrock 30:70 Global Equity Tracker CS7

This one?If so, then yes that's 100% equities, ~30% UK, and ~30% ROW.

0 -

My mistake.

I googled it and found info on this very similar named investment.

blackrock 30/70 target allocation etf0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards