We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

What counts as income when talking about gifts from excess income?

Comments

-

I think you may be asking why some gifts are taken into account in the calculation of surplus income, but not others. That's because it's enough to show that those specific gifts were made out of income, while the others can be assumed to have been made out of capital. Therefore no gifts need to be included on page 8 other than those for which you're claiming NEOOI exemption.

However, I am puzzled that you use regular £500 birthday presents as examples of non-exempt gifts, since they are the very of kind of gift for which the NEOOI exemption is designed. I assume you know about all the other exemptions available. In your example, if you apply the NEOOI exemption to £12k of gifts, the remaining £1k would fall under the £3,000 annual exemption and wouldn't even need to be declared.

https://www.gov.uk/inheritance-tax/gifts

Also, I presume you know about the test for "normality", implying a commitment to make approximately regular (though not necessarily equal) gifts to the same donee. The clearest guidance we have is the manual from IHTM14231 onwards:

https://www.gov.uk/hmrc-internal-manuals/inheritance-tax-manual/ihtm14231

I don't see any need to analyse your income and expenditure for any year earlier than 2024/25 unless you want to claim the NEOOI exemption in that year, and are not expecting to survive beyond April 2031.

On your final point, it's up to you which categories you allocate expenditure to. Clearly they are not mutually exclusive. Hairdressing could be Household bills or Other, I suppose.

0 -

Right got it now. Thank you. Would it matter if those gifts were being paid from an everyday current account and not a savings accounts. Can it still be classed as coming from capital?probate_slave said:I think you may be asking why some gifts are taken into account in the calculation of surplus income, but not others. That's because it's enough to show that those specific gifts were made out of income, while the others can be assumed to have been made out of capital. Therefore no gifts need to be included on page 8 other than those for which you're claiming NEOOI exemption.

Sorry - probably unhelpful examples as smaller gifts totalling more than £3,000 have been made each year (children, grandchildren, anniversaries, Xmas, etc). But yes, I'm fairly familiar with the exemptions available and I know about the £3,000 annual exemption.probate_slave said:However, I am puzzled that you use regular £500 birthday presents as examples of non-exempt gifts, since they are the very of kind of gift for which the NEOOI exemption is designed. I assume you know about all the other exemptions available. In your example, if you apply the NEOOI exemption to £12k of gifts, the remaining £1k would fall under the £3,000 annual exemption and wouldn't even need to be declared.

https://www.gov.uk/inheritance-tax/gifts

Also, I presume you know about the test for "normality", implying a commitment to make approximately regular (though not necessarily equal) gifts to the same donee. The clearest guidance we have is the manual from IHTM14231 onwards:

https://www.gov.uk/hmrc-internal-manuals/inheritance-tax-manual/ihtm14231

However, are you saying that the regular (annual) birthday, anniversary, Xmas gifts can form part of the 'regular' gifts being taken from any excess income and should therefore just ALL be included on page 8 (presuming there is enough excess income to do so)?

It was intended that say, £400 would now start being paid to child 1 and £400 to child 2 each month. Could say £500 also still be paid each birthday (to various family members) within the NEOOI exemptions (and therefore be included on page 3-4 and 8)?

That's a relief. Although my questions are on behalf of my mother (who is elderly) who has asked me to look into all of this. NEOOI exemption would be claimed from the 2025/26 year onwards as she would like to start giving regular and fairly equal gifts to myself and my brother from now onwards (or as soon as we have all got our heads completely clear on the rules and record keeping so we don't fall foal of anything in the future.probate_slave said:I don't see any need to analyse your income and expenditure for any year earlier than 2024/25 unless you want to claim the NEOOI exemption in that year, and are not expecting to survive beyond April 2031.

Excellent - that saves agonising over each decision. We'll just keep the categorisations consistent year on year.probate_slave said:On your final point, it's up to you which categories you allocate expenditure to. Clearly they are not mutually exclusive. Hairdressing could be Household bills or Other, I suppose.

Thank you again so much for your advice.0 -

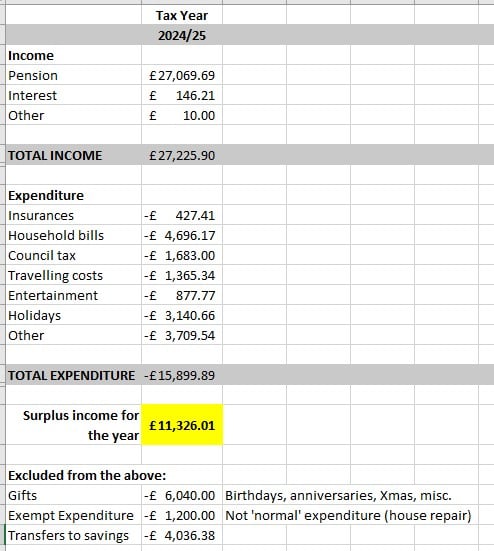

Is this along the right lines? (This is prior to any commitment to make regular gifts from excess income). Are we saying that £3,000 of the £6,040 Gifts figure doesn't need to go anywhere and potentially £3,040 of it could be included in Box 22 under 'Gifts made' IF those gifts are regular (i.e. every year) and 'normal' and paid to the same person/people?? Or am I still far off the mark!?0 -

Yes, your table looks fine. I would round figures up or down to the nearest pound. However, I'm not sure that any expenses can be discounted, and certainly not house repair. The "normal" in normal expenditure refers to the gifts rather than the living expenses.

If most of the £6,040 gifts are regular annual gifts to family members, there is an ideal pattern for NEOOI. You can make a table totalling gifts per year per donee, and just enter the annual grand total on page 3 with details on a separate schedule. Anything left over can be ignored if under £3,000. And you might find it worthwhile to go back before 24/25 if that allows you to exempt more gifts under NEOOI, as well as confirming the pattern. (Of course, page 8 is a bore to complete and all of this would be pointless if your mother's estate wasn't chargeable, as KP already mentioned.)

Once your mother starts giving you and your brother regular sums, that will form an additional pattern also exempt under NEOOI.

To answer your first question in the previous message, it's not required that the non-NEOOI gifts should come from capital, only that the NEOOI gifts should come from income. In any case, the source of gifts is surely unconnected to the question of whether there's sufficient surplus income to cover the NEOOI gifts. Any account will do for any gift.

1 -

So you need to be able to pay for things like one-off house repairs from your income and not from your savings that you have accumulated previously? i.e. in order to retain your usual standard of living? I thought I'd read something that contradicted this for things like big repairs or car purchases, but no idea where now!probate_slave said:However, I'm not sure that any expenses can be discounted, and certainly not house repair. The "normal" in normal expenditure refers to the gifts rather than the living expenses.

I presume 'transfer to savings' is not expenditure as it's just a transfer to another account and still belongs to my mother. I've just included it on my schedule for reconciliation purposes so it matches the bank statement totals.

My mother's estate is most likely in IHT territory as her property is worth about £625k (my question about whether Pension Credit income would be included was more in relation to my father, but that's a whole other question!)...probate_slave said:If most of the £6,040 gifts are regular annual gifts to family members, there is an ideal pattern for NEOOI. You can make a table totalling gifts per year per donee, and just enter the annual grand total on page 3 with details on a separate schedule. Anything left over can be ignored if under £3,000. And you might find it worthwhile to go back before 24/25 if that allows you to exempt more gifts under NEOOI, as well as confirming the pattern. (Of course, page 8 is a bore to complete and all of this would be pointless if your mother's estate wasn't chargeable, as KP already mentioned.)

I don't think I can face going any further back than 24/25 but perhaps I will if I can muster up the enthusiasm.

but perhaps I will if I can muster up the enthusiasm.

Any good templates/wording out there for the letter of intent? I've tried Googling it, but the examples don't seem quite right.

I think I am gradually getting my head around this now. Thank you yet again!0 -

Something like this, or is anything missing?

Letter of Intent

…………………………………… (insert your name)

. ....................................................... (insert address)

. .......................................................

. .......................................................

. .......................................................

. ....................................................... (insert date)

Dear ……………. (insert name of person you are making the gift to)

I am making a gift to you with a value of £ ………. (insert amount). I have considered my financial circumstances and consider that it is a gift out of my surplus income.

It is my intention to continue making such gifts to you each...................(insert frequency), taking into account my income from one year to the next, for as long as I am able to do so without affecting my current standard of living.

Yours sincerely

……………….. (insert signature)

0 -

I'm afraid I have no experience of how HMRC view large capital purchases. You may be thinking of this recent thread:

https://forums.moneysavingexpert.com/discussion/6602742/gifting-from-excess-income

For a letter of intent surely plain English would suffice. But after the first couple of years the intention is clear from the gifts themselves, and normality is a matter of fact.

For entertainment, you might enjoy STEP solicitors arguing whether gifts paid by a grandmother to her children can be regarded as income in the children's hands. AA is also mentioned. It shows how hard the legislation around NEOOI is to interpret.

https://trustsdiscussionforum.co.uk/t/gifts-out-of-income-are-regular-gifts-received-income/26882

0 -

Our posts crossed for some reason, but your letter looks good enough to me.

There is a mismatch between the conscientiousness we are both taking here and the fact that in most cases it's not in HMRC's interest even to look at the details of IHT403. IHT is already so expensive for them to process relative to the tax generated and they are so understaffed, particularly in compliance around gifts, that they will generally only glance at it and probably not even correct obvious errors (eg misapplication of the small gifts exemption). This from a friend high in the HMRC staff hierarchy.

0 -

I did wonder about this as it seems to be an absolutely enormous task that I suspect most executors don’t even realise will be required of them (although obviously as you said not all estates will be subject to IHT).probate_slave said:Our posts crossed for some reason, but your letter looks good enough to me.

There is a mismatch between the conscientiousness we are both taking here and the fact that in most cases it's not in HMRC's interest even to look at the details of IHT403. IHT is already so expensive for them to process relative to the tax generated and they are so understaffed, particularly in compliance around gifts, that they will generally only glance at it and probably not even correct obvious errors (eg misapplication of the small gifts exemption). This from a friend high in the HMRC staff hierarchy.

I quite like learning about new things and (simple) excel spreadsheet don’t scare me. And I particularly feel that if you are going to take advantage of the exemptions that are in place it is vitally important to understand the rules.As you said, I can’t imagine that most people are as conscientious about this as we are being (particularly posting on here about it at past midnight)!!! Plus staffing being stretched at HMRC…but I would still hate to rely on that!0 -

Sorry - coming back to this again!...

Just to double check - any large one-off gifts (such as £10k) would go on page 3-4 and subject to the usual IHT rules, but obviously not on page 8 as NEOOI exemption would not be applied to it. However, would the £10k 'expenditure' need to be included under 'Other' on Q21 on page 8? Because if that was included, it makes quite a difference to the Surplus income for the year Q22.

Similarly, should 'Gifts made' on Q22 just be for those for which we are claiming NEOOI exemption and not one-off gifts?

Also, with the question of my mother starting to make regular payments out of income to myself and my brother, we're trying to help her to calculate an amount that would allow her to comfortably retain the same standard of living. So lets say she usually gifts a total of £4,000 for birthdays, Xmas, etc (ignoring the small gift exemption as each gift tends to be over £250 anyway).

If £3,000 of that could be exempt under the annual exemption rules, then we would only need to claim NEOOI exemption on £1,000 of it. Therefore allowing scope for higher value monthly payments to be made.

So would it be better to list it that way round? Or am I barking up the wrong tree?

[EDITED TO SAY - probate_slave - I can see you have actually answered some of these questions already. I realise now I just didn't fully understand them at the time, but now I've read back it is making more sense to me - although I'd appreciate you or anyone confirming my understanding]!

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards