We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

2 year fixes now cheaper than 5 - what does it mean?

Nailer99

Posts: 147 Forumite

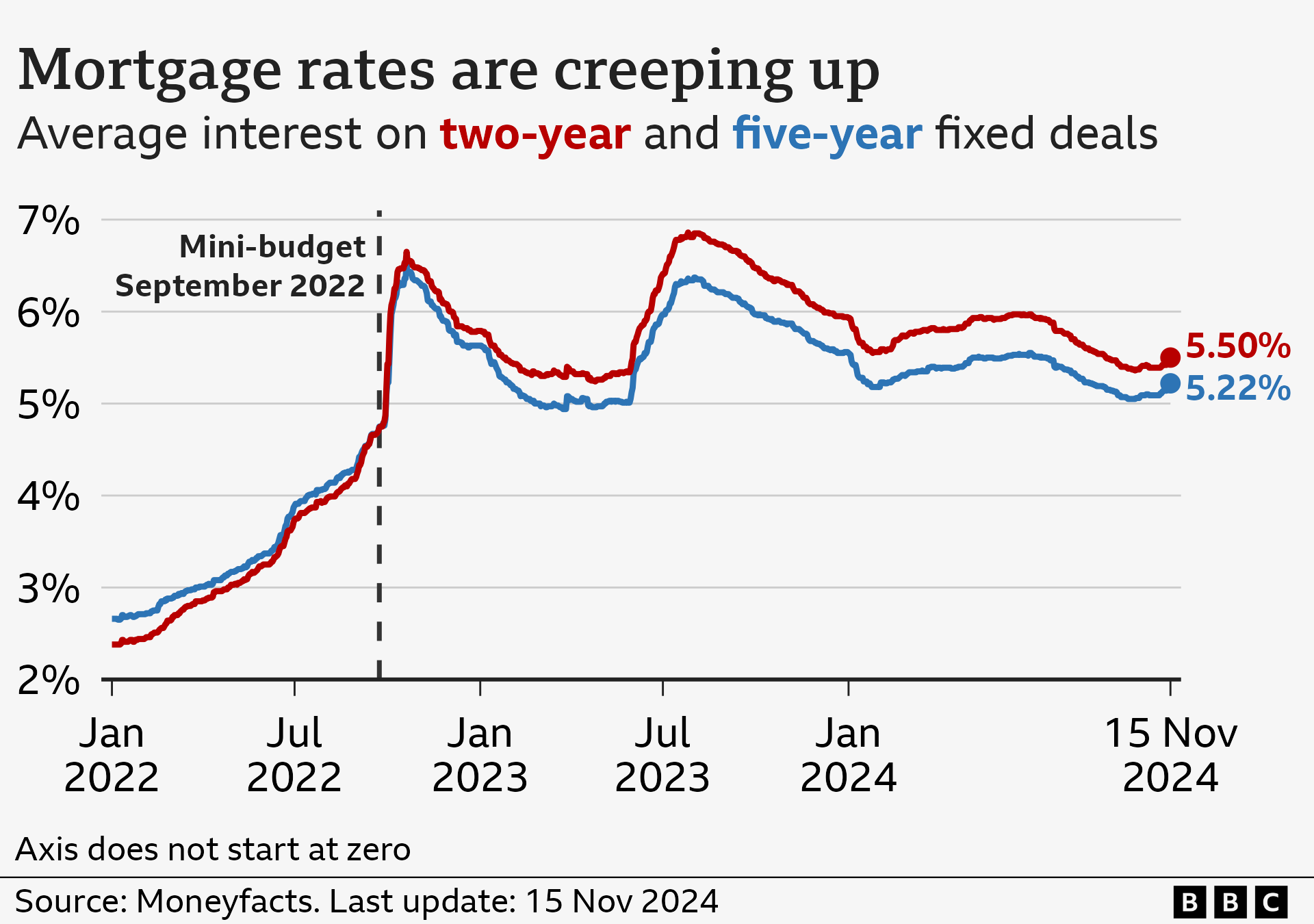

Ever since Liz Truss, many banks have offered 5-year rates significantly lower than their best 2-year. My interpretation of this was that the banks were predicting that interest rates would fall.

In the last few weeks, though, banks have started prices 2-years below 5-tears again. Eg Yorkshire’s current best 2-year remortgage is at 3.98 while the best 5-year is 4.14.

How should we interpret this? That interest rates are now as low as they are going to get and are expected to rise?

0

Comments

-

You should not, as you lack sufficient data.Nailer99 said:Ever since Liz Truss, many banks have offered 5-year rates significantly lower than their best 2-year. My interpretation of this was that the banks were predicting that interest rates would fall.In the last few weeks, though, banks have started prices 2-years below 5-tears again. Eg Yorkshire’s current best 2-year remortgage is at 3.98 while the best 5-year is 4.14.How should we interpret this? That interest rates are now as low as they are going to get and are expected to rise?

It could be because they expect interest rates to fall slightly in the short term, then rise again, it could be because they re-priced the two year mortgages but have not yet re-priced the five year mortgages, it could be because the two year mortgage market is more competitive than the five year mortgage market, it could just be a temporary anomaly. Without knowing why the difference exists it means that any attempt at interpreting it is just a blind guess.1 -

Could simply be in that in the current world of huge uncertainty there's a huge amount of liquidity sloshing around the financial system. While people attempt to figure out what's going to happen next.0

-

What's it got to do with Liz Truss? The cost of servicing gvnt debt is higher now than 2023, fwiw.

Domestically at least, expectations have changed as there are only headwinds for inflation. Lots of new legislation is ramping up business costs, unions are flexing their muscles. That's just two of them. The market also looks like it will reject any significant increases in gvnt borrowing.

This of course feeds into central rate policy, and significant rate cuts now look a long way off. In fact it's likely going to be very difficult to argue against raising.

My opinion is that we are wedded to what happens in the US re central rates. The administration is determined to get them lowered there. It will be very interesting to see if the BoE actually diverges from the Fed if they get what they want.

My own personal fixed rate only ends in late 2028, but I'd be looking to lock in as long as possible at the prevailing market rates if I was renewing this year.0 -

Prior to Liz Truss’s 5 minutes of prime ministership, 5-year mortgages were always more expensive than 2 as you were paying a fee to lock your rate in for longer. The chaos of the mini budget tipped this on its head.Altior said:What's it got to do with Liz Truss? .So perhaps what we are seeing is just the end of the post mini budget anomaly and the beginning of a new normal.1 -

Kwasi Kwarteng's 'fiscal event' was never passed into law. Not that the law controls retail mortgage rates.Nailer99 said:

Prior to Liz Truss’s 5 minutes of prime ministership, 5-year mortgages were always more expensive than 2 as you were paying a fee to lock your rate in for longer. The chaos of the mini budget tipped this on its head.Altior said:What's it got to do with Liz Truss? .So perhaps what we are seeing is just the end of the post mini budget anomaly and the beginning of a new normal.

You alluded to the answer in your OP, inflation spiked worldwide, QE ended worldwide, the oil tanker did an abrupt u turn and suddenly financial markets expected short term borrowing costs to spike, and then quickly fall medium/longer term once inflation was brought under control. But obviously world events are world events and expectation changes with them.

This chart clearly shows that mortgage rates were already spiking, and the longer term rates were converging with short term rates anyway. The domestic mortgage market would be in the same place it is now, whether KK had delivered his fiscal even or not. I'd agree that the massive wobble spiked the rates for a few months, but we were always headed for 5%+. And it will be a very very long time before we see sub 3% again. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards