We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

As a sub contractor can I rent labour off a company.

Liamevans21

Posts: 7 Forumite

I'm a self employed sub contract roofer, I get all of my work through one company. The company i sub too also supplies labour at a cost of £250 a week towards the labourers wage. When I do my tax return amateur I able to put this through my return? I've spoken to my accountant and they said I'm not able too. Can somebody help please?

Many thanks

Many thanks

0

Comments

-

I am not sure that I read the question clearly.Liamevans21 said:I'm a self employed sub contract roofer, I get all of my work through one company. The company i sub too also supplies labour at a cost of £250 a week towards the labourers wage. When I do my tax return amateur I able to put this through my return? I've spoken to my accountant and they said I'm not able too. Can somebody help please?

Many thanks

You work on sole-trader basis as a Roofer for "A".

You need a second person to do the job, so get a mate to assist.

You charge "A" for the second person to do the job.

But you source the second person from "A".

For that to work, your would have to pay "A" £250 for the second person and then sell the person back to "A" for £300 to do the job.

That is illogical.0 -

As this is your first post, can you try to explain this more clearly, please?Liamevans21 said:I'm a self employed sub contract roofer, I get all of my work through one company. The company i sub too also supplies labour at a cost of £250 a week towards the labourers wage. When I do my tax return amateur I able to put this through my return? I've spoken to my accountant and they said I'm not able too. Can somebody help please?

Many thanks

Is it the case that the company pays whatever you charge for your own services plus £250 towards the cost of what you pay the labourer?

Or does the company supply the services of a labourer and charge you £250 towards the cost of the labourer's wages which effectively reduces how much you receive for the job?0 -

So I sub work to a company and the company employs a labourer. They then give the labourer to me but charge me £250 a week, the company then tops up the labourers wage. So I was wondering the £250 a week i pay can go through my tax return as it comes off my net payment. I hope that's more clear.0

-

As I see it you would have to put your receipts up by £250 per week (Would this increase your profits and therefore tax?) if you were allowed to do this.

So would you be any better off - indeed would the company alter its paperwork to suit you?0 -

What figures does your payment advice show?

It seems that your accountant considers the charge is already deducted so cannot be deducted again.

1 -

So on my pay slip I get the price of the job. Then the price after they take 20% tax off then at the bottom of the slip under deductions is the £250. So it looks like it comes off after I've payed the 20% tax0

-

But what figure is used for your gross earnings in your return?

Is it the net figure after deducting the £250?

0 -

My payslip says my net earnings (what ive earned after tax is taken for the week) then the £250 is deducted and then what goes in to my bank is at the bottom of the pay slip0

-

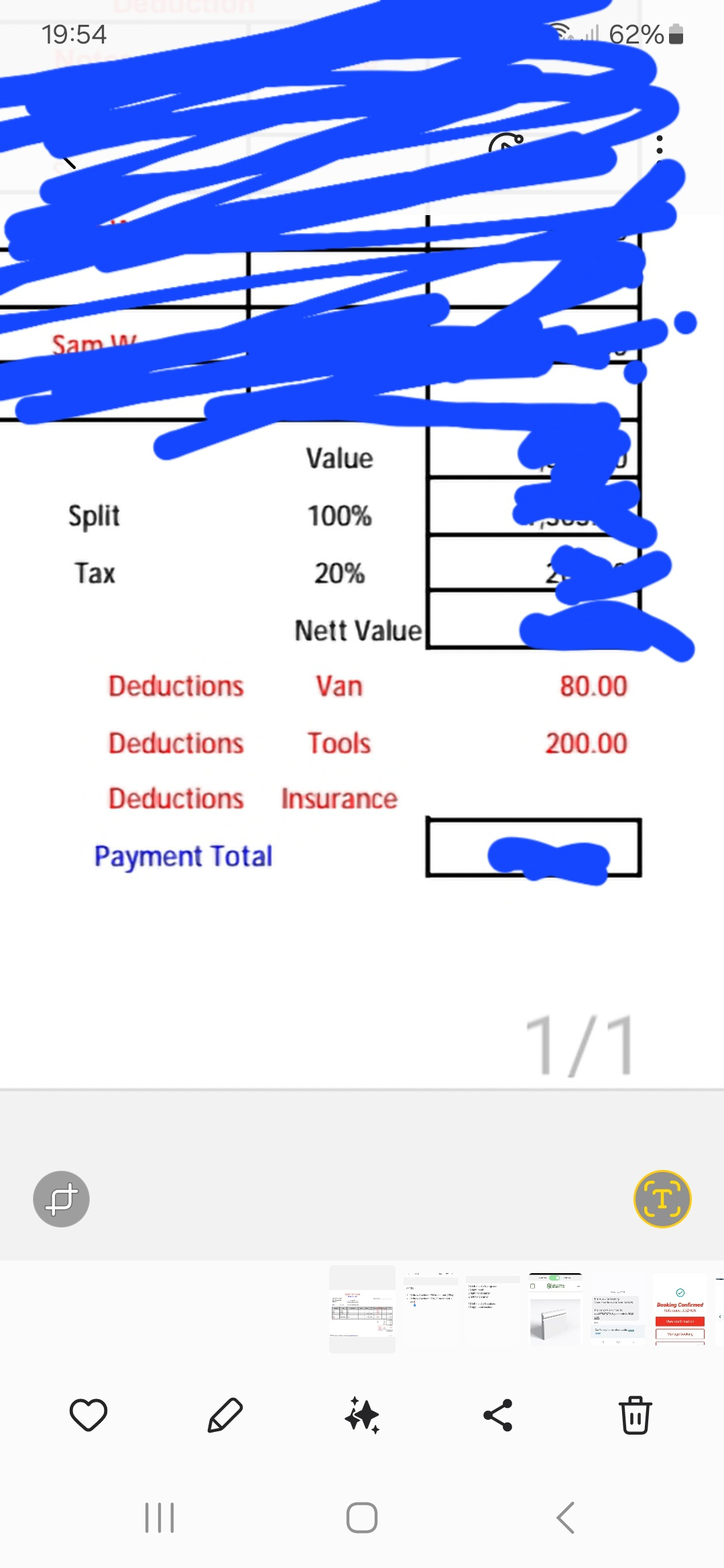

So it looks like this. I know it says £200 but its usually £250.

0 -

You have probably redacted too much for that payslip to be much help.

Are you sole trader or Owner-Director of own Ltd Co?

Is the 20% tax deducted that you refer to CIS tax?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards