We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

High risk, high reward: A pauper's dream of early retirement.

Comments

-

The point is that if you buy every month, sometimes it will be up and sometimes it will be down, but in the long run it will most probably all work out in your favour. So, average in this context doesn't mean it will be mathematically average after x number of years.Tassie_Devil said:

Untrue. When you make regular monthly investments you buy at the ruling market price.ali_bear said:Your strategy is a sound one. When you make regular (monthly) investments you average out the ups and downs of markets at the time of purchase.How does buying monthly average out the price?Think first of your goal, then make it happen!4 -

Sorry for my imprecise language, I'm sure Iain would have phrased it better.A little FIRE lights the cigar0

-

On the contrary, I thought your point was well made.ali_bear said:Sorry for my imprecise language, I'm sure Iain would have phrased it better.Think first of your goal, then make it happen!1 -

I admire those of conviction, "once sanity prevails in the US" is a conviction I'll not hang extra risk by piling in to US at low prices. Bon courage!barnstar2077 said:

I was previously in globally diversified funds, I have just gone all in on the US to try and take advantage of the current volatility. Once sanity prevails in the US I will go back to the previous funds and remain that way into retirement unless another potential opportunity* pops up.

*Full disclosure, opportunities can also backfire : )

I have had converastions with 2 people these past few weeks, they both accumulate VWRL monthly and should know better but are worried and made fairly reasoned arguments about how it might be different this time. I know I cannot know, I buy almost every month and have no plans to change too much. I might have found a few bargains or picked dogs on the way down but only with a few percent of the portfolio.1 -

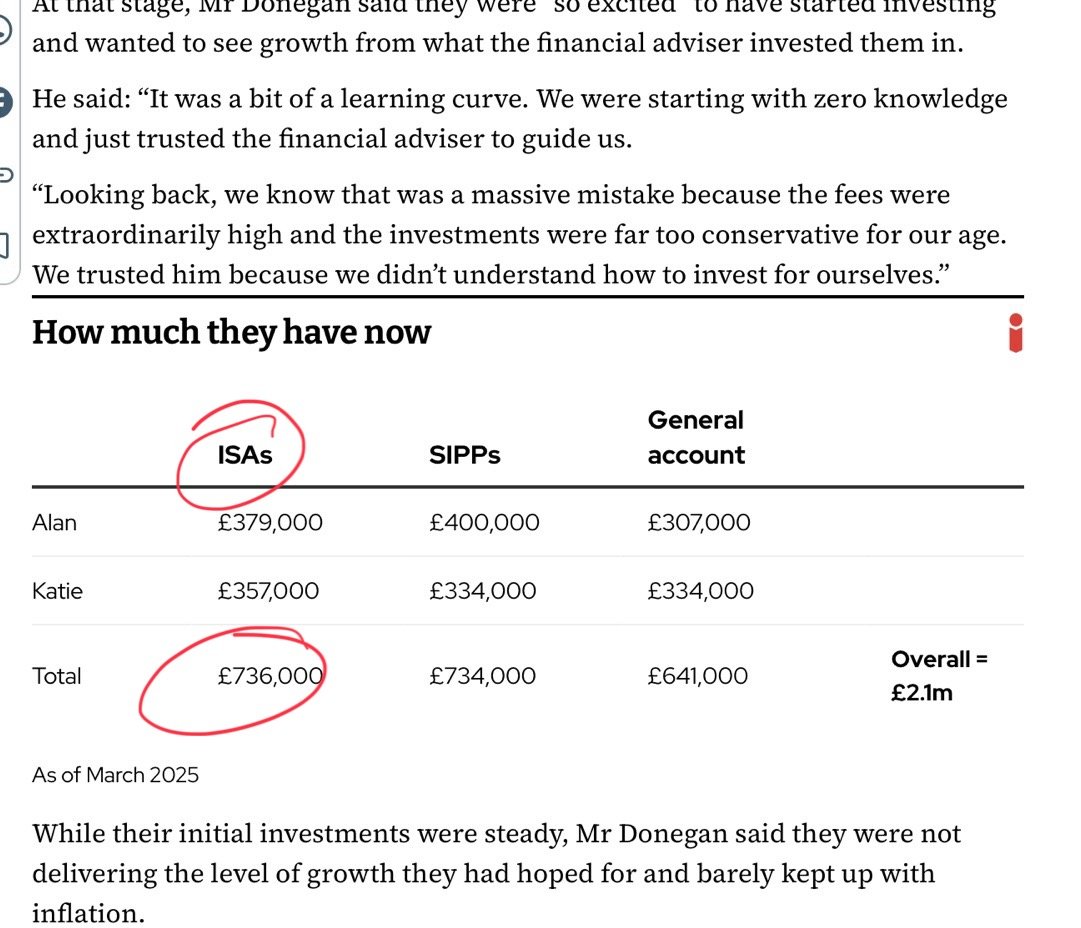

@barnstar2077 good luck with your all-in plan.I am still very conservative, and not blinded by stories like this one, out a couple of days ago: https://inews.co.uk/inews-lifestyle/money/isa-millionaires-retired-early-by-40s-3635283?utm_source=firefox-newtab-en-gbIn this stories it seems the couple invested their 1 million ISAs in global equity fund and doubled it in 5 years "In the five years since retiring, their investments have more than doubled to £2.1m" (a few lines under Retiring Early section). It doesn't sound right to me.

1 -

They don't mention how much they were earning, or the exact numbers that they were able to save, but clearly they weren't short of a few bob as they do say that they started to max out their ISAs every year. That's not easy to do on minimum wage! : )LL_USS said:@barnstar2077 good luck with your all-in plan.I am still very conservative, and not blinded by stories like this one, out a couple of days ago: https://inews.co.uk/inews-lifestyle/money/isa-millionaires-retired-early-by-40s-3635283?utm_source=firefox-newtab-en-gbIn this stories it seems the couple invested their 1 million ISAs in global equity fund and doubled it in 5 years "In the five years since retiring, their investments have more than doubled to £2.1m" (a few lines under Retiring Early section). It doesn't sound right to me.Think first of your goal, then make it happen!2 -

Buying into US share markets now would be a bold move. With the dollar predicted to decline in value and the economic damage already caused by the orange loony set to play out in the coming years. I don't think many would be in a rush to pile in.A little FIRE lights the cigar0

-

They aren’t ISA millionaires so the headline is misleading.barnstar2077 said:

They don't mention how much they were earning, or the exact numbers that they were able to save, but clearly they weren't short of a few bob as they do say that they started to max out their ISAs every year. That's not easy to do on minimum wage! : )LL_USS said:@barnstar2077 good luck with your all-in plan.I am still very conservative, and not blinded by stories like this one, out a couple of days ago: https://inews.co.uk/inews-lifestyle/money/isa-millionaires-retired-early-by-40s-3635283?utm_source=firefox-newtab-en-gbIn this stories it seems the couple invested their 1 million ISAs in global equity fund and doubled it in 5 years "In the five years since retiring, their investments have more than doubled to £2.1m" (a few lines under Retiring Early section). It doesn't sound right to me.

1 -

@FIREDreamer indeed - I find that article very dubious in many ways. Google knows what I am reading these days so it was just on the first page when open a new Firefox page :-).barnstar2077 regarding investmen, if you don't mind me asking, I feel if the spare money is not in ISAs or some type of pension account, it's difficult to plan for early retirement as any earnings will be too heavily taxed. I am late to the ISAs, having only accumulated for the last few years. Spare money is now stuck in an additional property, which I don't want to keep for much longer, yet I find difficult to bring the proceeds into a tax-wrapper. How to stretch that sum over the years in early retirement when it's not in ISAs yet is another issue. I have no choice but to only drip the cash in S&S gradually over the years, after selling, right? I am still torn between the use of the money really (having thought about giving my kids this sum for them to get on the property ladder too)1

-

I am not sure what the best thing to do would be if you should find yourself with a great deal of money outside of a tax wrapper. I am a pauper after all : )LL_USS said:@FIREDreamer indeed - I find that article very dubious in many ways. Google knows what I am reading these days so it was just on the first page when open a new Firefox page :-).barnstar2077 regarding investmen, if you don't mind me asking, I feel if the spare money is not in ISAs or some type of pension account, it's difficult to plan for early retirement as any earnings will be too heavily taxed. I am late to the ISAs, having only accumulated for the last few years. Spare money is now stuck in an additional property, which I don't want to keep for much longer, yet I find difficult to bring the proceeds into a tax-wrapper. How to stretch that sum over the years in early retirement when it's not in ISAs yet is another issue. I have no choice but to only drip the cash in S&S gradually over the years, after selling, right? I am still torn between the use of the money really (having thought about giving my kids this sum for them to get on the property ladder too)

My first thought would be that maybe you could max out your ISA, while increasing your pension payments to the point where you are practically on minimum wage (while making up the rest of living costs from the money outside of the tax wrapper.)

I have no idea how practical that would be however, nor do I know anything about capital gains tax etc, so my only real advice to you would be to start a new thread with your question to see what others come back with.Think first of your goal, then make it happen!2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards